- The Hedera network has achieved a significant increase in revenue from transaction fees and new addresses.

- However, HBAR has not responded to network growth as it continued to underperform.

Hedera [HBAR] has not been one of the top performers in the cryptocurrency market over the past year. In fact the altcoin has lost 39% of its value this year.

However, despite the bearish price outlook, the Hedera network has seen significant growth. According to a recent report from Messarithe network saw an increase in key metrics in the second quarter of 2024.

Hedera’s network growth

According to the report, transaction fee revenue on Hedera was $1.4 million in the second quarter of 2024. This was the second highest quarterly level and a quarter-on-quarter jump of 26%.

The average number of new addresses during the quarter also rose 31% to 11,000, while average daily transactions saw the biggest increase of 46% to 132.9 million.

Additionally, despite HBAR’s price showing signs of weakness this year, the report noted that the company’s market capitalization rose. This was largely due to an increase in circulating supply.

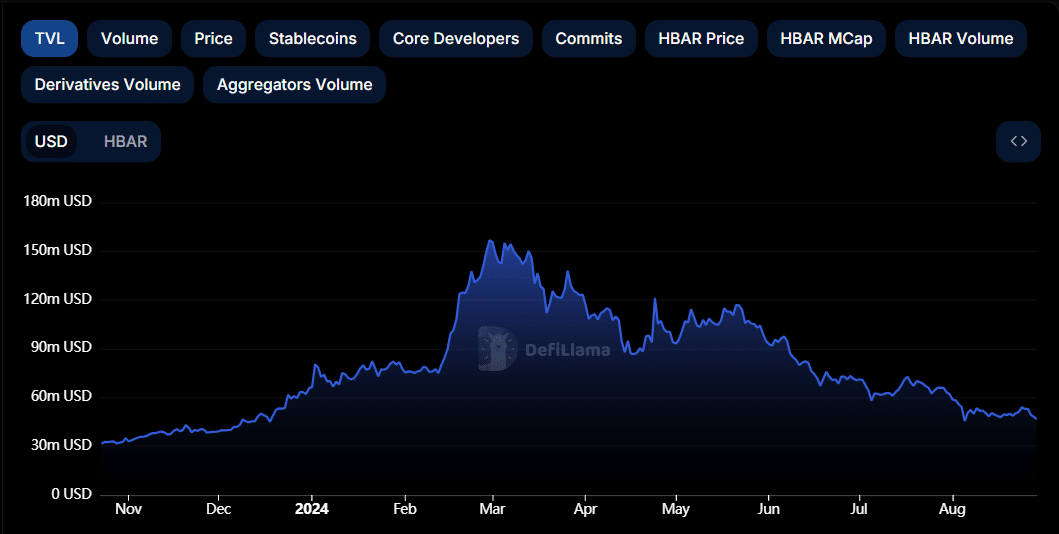

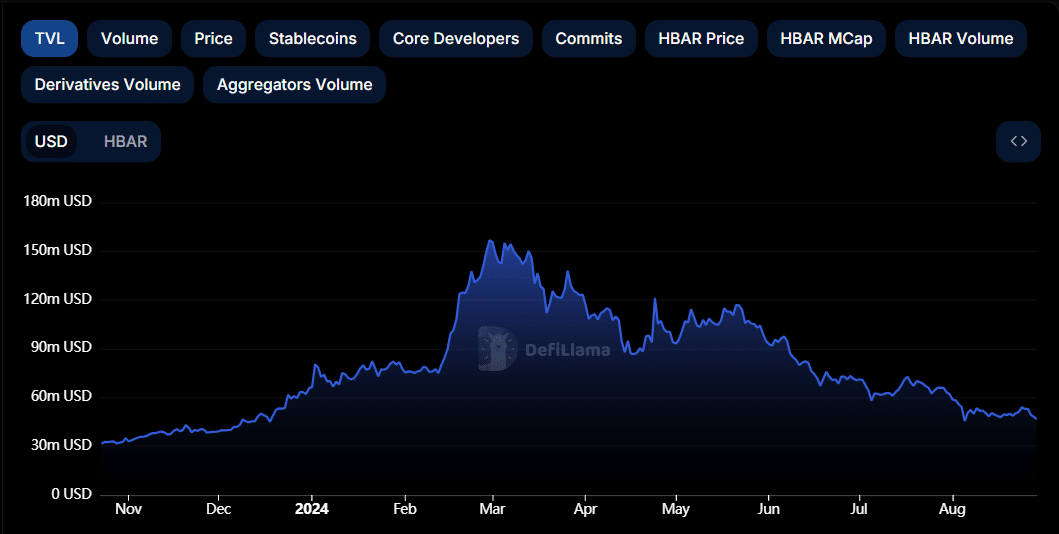

While this outlook paints a bullish picture, other on-chain metrics provide a contrasting picture. Hedera’s Total Value Locked (TVL) has fallen from an annual high of $156 million to the current $46 million as seen on DeFiLlama.

This showed a significant decline in activity from decentralized funding applications.

Source: DefiLlama

With on-chain data showing mixed signals, is HBAR poised for a breakout or will the bearish trend continue?

Will HBAR break the bearish trend?

Hedera was trading at $0.051 at the time of writing, having fallen 3.8%. A look at the daily chart showed that the token has consolidated within the range of $0.0514-$0.062 since early August.

$0.514 acted as a key support level for HBAR as it has held in recent weeks. If the price fails to hold this level, it will drop to gather liquidity at $0.0453, or even move lower.

Every time HBAR tested $0.514, the price rose. This indicated a high concentration of buy orders at this price.

Source: TradingView

The Relative Strength Index (RSI) at 40 showed bearish momentum. However, after price tested support again, the RSI recovered, indicating that this support could remain.

Over the past month, bears have controlled the price action. The Awesome Oscillator has been on a steady downward trend since early August.

The AO has also failed to turn positive for weeks, further indicating bearish momentum.

Read Hedera’s [HBAR] Price forecast 2024–2025

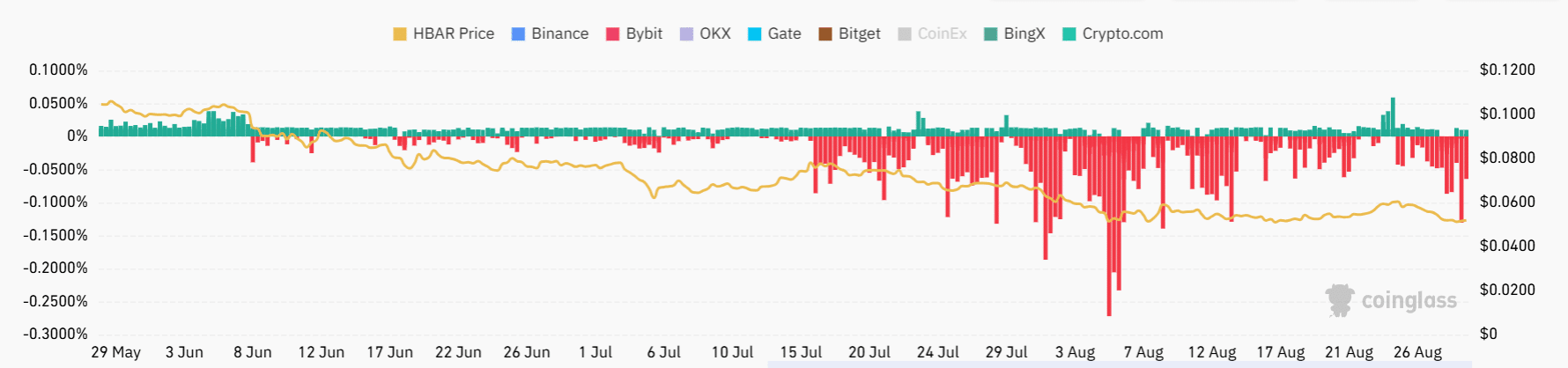

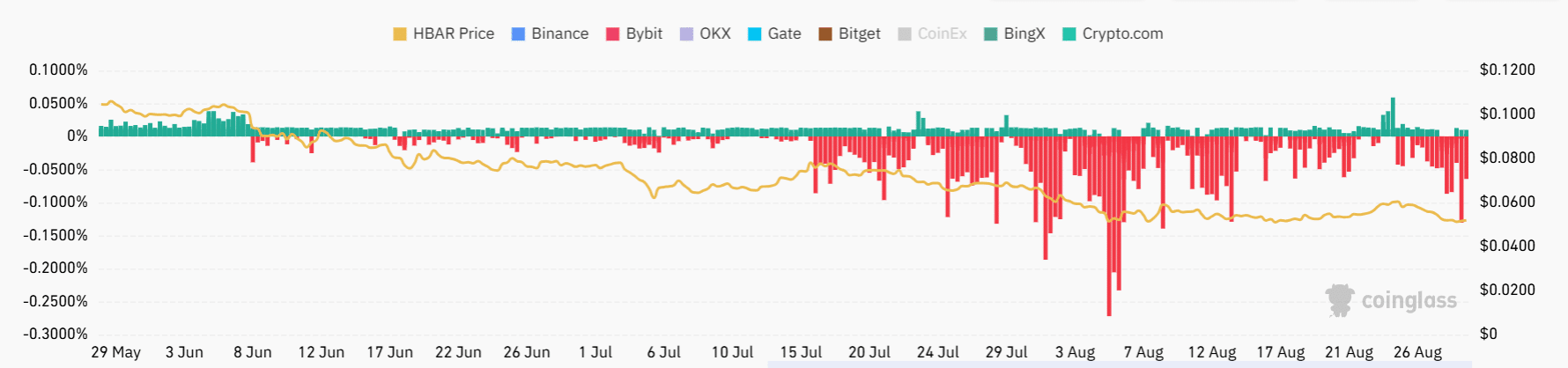

Coinglass data further showed that HBAR funding rates have been mostly negative over the past two months. This indicated prolonged bearish sentiment as traders took short positions.

Source: Coinglass

Therefore, for HBAR to break the bearish trend, it needs an increase in buyer interest and support from the broader market.

![By Will Hedera [HBAR] key $0.0514 hold or break support?](https://bitcoinplatform.com/wp-content/uploads/2024/08/hbar-webp-1000x600.webp)