- The SUI was already down more than 6% and the numbers were bearish.

- DYDX remained bullish and the indicators were in favor of the buyers.

After a long wait, the crypto market recorded an upswing in recent days, allowing several cryptos to increase their value. Amid these market conditions, Sui [SUI] and Dydx [DYDX] will unlock new tokens on October 3, which could negatively impact the prices of both tokens.

Read Suis [SUI] Price prediction 2023-24

SUI and DYDX are waiting to be unlocked

Token Unlocks’ recent tweet revealed that both SUI and DYDX were expecting a new round of token unlocks on October 3, 2023, which will inject new tokens into the market.

SUI will unlock nearly 4% of its total offering, which is worth more than $17 million. On the other hand, DYDX will release 1.2% of its total offering, which is worth more than $4.4 million.

$37.72M unlocked this week 🗓️🔓

10 tokens unlocked a cliff this week.$SUI 4% – $17.14 million$IMX 1.8% – $11 million$DYDX 1.2% – $4.44 million$NYM 2.3% – $1.41 million$HFT 1.8% – $1.13 million$LQTY 0.7% – $0.71 million$GLMR 0.4% – $0.70 million$TORTED 11.6% – $0.56 million$GAL 0.9% – $0.54 million#1 INCH 0.03% – $79,000

.

.

( % by… pic.twitter.com/WlqHli0G7n— Token Unlocks (@Token_Unlocks) October 2, 2023

In general, token unlocks are often followed by price drops due to supply-demand theory. As circulating supply increases, demand for an asset decreases, causing its value to decrease.

Therefore, a closer look at both tokens can provide a better insight into what to expect from them in the coming days.

SUI has challenges to address

According to CoinMarketCapthe price of SUI has already fallen by more than 6% in the last 24 hours. A look at the token’s stats suggests things could get worse.

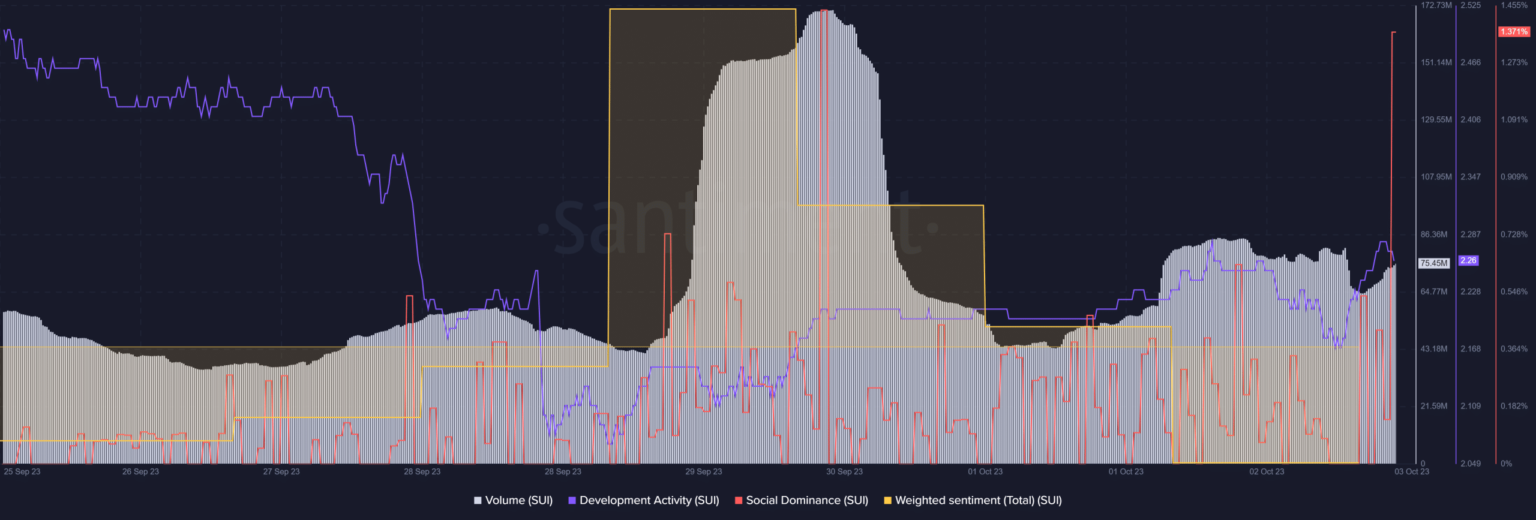

For example, trading volume has fallen in recent days. Development activity around SUI also plummeted last week. Sentiment around SUI remained negative, as reflected in the decline in weighted sentiment.

However, social dominance increased, reflecting popularity in the crypto market.

Source: Santiment

DYDX remains bullish

Although SUI statistics raised alarms, DYDX acted differently. From CoinMarketCapDYDX is up more than 2% in the past 24 hours. At the time of writing, the token was trading at $2.08 with a market cap of over $381 million, making it the 82nd largest crypto.

The good news was that DYDX trading volume also increased by more than 100% in the last 24 hours, which served as the basis for this increase.

It was interesting to note that as the price of DYDX rose, Spartan Group deposited 500,000 DYDX on Binance, which was worth over a million dollars. Spartan Group currently owns 737,623 DYDXs and its profits were $54.5 thousand.

Spartan Group has deposited 500,000 $DYDX($1.04 million) 10 minutes ago.

Spartan Group withdrew a total of 1.24 million $DYDX ($2.25 million) from #Binance from January 13 and June 13 at an average price of $2.04.

Spartan Group currently owns 737,623 $DYDX($1.53 million), and the profit is $54.5K. pic.twitter.com/v2ygMr7HPP

— Lookonchain (@lookonchain) October 2, 2023

Realistic or not, here it is DYDX market cap in BTC conditions

Apart from the recent deposits, quite a few market indicators remained in favor of buyers. The MACD showed a clear bullish upper hand on the market.

DYDXThe Relative Strength Index (RSI) gained momentum heading north, raising the likelihood of a price surge even after the upcoming token unlock. Nevertheless, the Chaikin Money Flow (CMF) was worrying as it recorded a slight decline.

Source: TradingView