In a new essay With the title ‘Group of Fools’, Arthur Hayes, the outspoken co-founder of crypto exchange BitMEX, takes a critical look at recent macroeconomic developments and their implications for the crypto market. Known for his direct and often provocative commentary, Hayes uses a mix of technical analysis, central bank criticism and currency market insights to build a case for what he believes is the return of a Bitcoin and crypto bull market .

A “group of fools”

He begins by emphasizing the significance of the dollar-yen exchange rate as a macroeconomic barometer. According to Hayes, this measure has a crucial impact on global financial stability and policy decisions. “The exchange rate between the dollar and the yen is the most important macroeconomic indicator,” he said.

Hayes is revising his earlier proposal for the US Federal Reserve (Fed) to enter into expanded dollar-for-yen swaps with the Bank of Japan (BOJ), a move he said would allow Japan’s Ministry of Finance to exchange the yen through targeted interventions on the forex markets. Despite the theoretical merits of this strategy, Hayes notes with a mix of irony and frustration that the G7 countries, which he calls the “Group of Fools,” have chosen a different route.

Related reading

The story then shifts to a critical examination of the G7’s central bank strategies. Hayes points to the wide disparity in interest rates between major economies, with Japan maintaining an interest rate near zero while other countries hover around 4-5%. He criticizes the conventional wisdom that supports interest rate cuts as a tool to control inflation, which universally targets a 2% rate among G7 countries despite their varying economic circumstances.

“The G7 central banks – with the exception of the BOJ – have all raised rates aggressively in response to inflation spikes,” Hayes writes. However, he highlights yesterday’s unexpected rate cuts by the Bank of Canada and the European Central Bank, despite prevailing inflation trends, suggesting a deeper, unspoken economic strategy aimed at strengthening the yen against a backdrop of geopolitical and economic tensions with China .

He describes the move as a halt to what he calls the “Kabuki theater of interest rate hikes,” a maneuver he says is intended to maintain the dominance of the Pax Americana-led global financial system.

Why the Bitcoin and Crypto Bull Run Are Returning

It is in this context that Hayes focuses on the implications for the crypto market. Looking ahead, Hayes sets his sights on the crypto markets, suggesting that these recent shifts point to a favorable environment for investing in digital assets. Hayes speculates that coordinated actions by central banks to adjust interest rates downward despite high inflation are paving the way for more liquidity in global markets, which traditionally benefits riskier assets like Bitcoin and subsequently altcoins.

Related reading

“The June central bank fireworks, kicked off this week by the BOC and ECB rate cuts, will catapult crypto out of the Northern Hemisphere summer doldrums. This was not my expected base case. I thought the fireworks would start in August, right around the time the Fed hosts its Jackson Hole symposium,” Hayes said.

He argues that these shifts in monetary policy are likely to create a bull market for Bitcoin and crypto, especially as central banks appear to be entering a cycle of interest rate easing. “We know how to play this game. It’s the same game we’ve been playing since 2009, when our Lord and Savior Satoshi gave us the weapon to defeat the TradFi devil. Go long on Bitcoin and then on shitcoins.” Hayes explains, referring to the pseudonymous creator of Bitcoin.

As the June 13-15 G7 meeting approaches, Hayes anticipates further developments that could impact global financial markets. He expects that the communiqué from this meeting will likely explicitly address manipulations of the currency and bond markets, or at least signal continued accommodative policies. Moreover, Hayes predicts that despite conventional caution against policy changes near major political events such as the U.S. presidential election, unusual circumstances could prompt unexpected moves.

Hayes concludes his essay by reinforcing his bullish stance on Bitcoin and crypto, driven by his analysis of the G7 monetary policies and their impact on global exchange rates and financial stability. His call to action for the crypto community is to take advantage of these developments and position themselves for what he believes will be a lucrative phase in the markets.

“For my excess liquid cryptocurrency in synthetic dollars, […] it’s time to bet it again on persuasion shitcoins. […] But suffice it to say that the crypto bull is awakening again and is about to pierce the hides of profligate central bankers,” concludes Hayes.

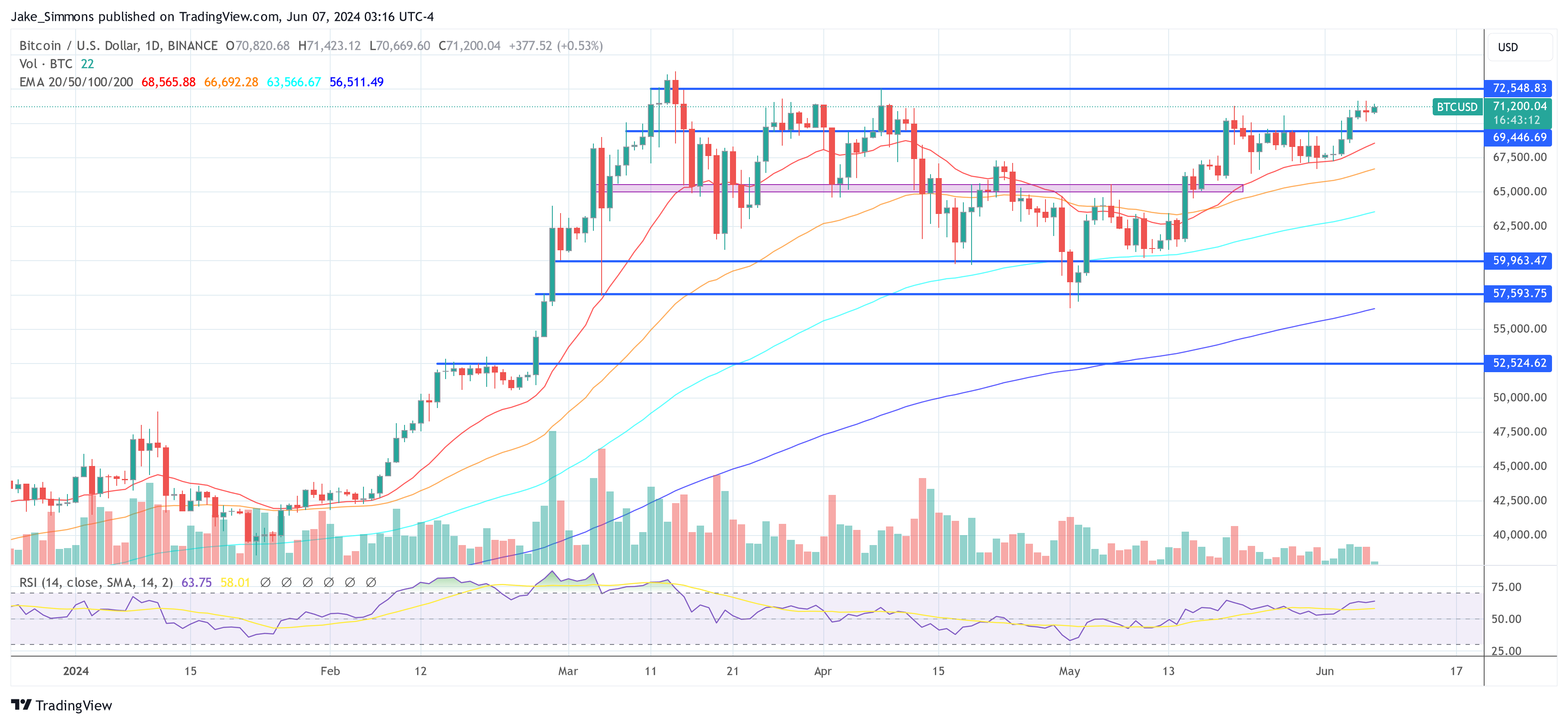

At the time of writing, BTC was trading at $71,200.

Featured image created with DALL·E, chart from TradingView.com