Bitcoin has been in a consolidation phase since hitting a new all-time high of $73,777 in mid-March. Since then, Bitcoin’s daily closing prices have shown significant restraint, never holding above $71,500 and maintaining a bottom above $54,000, although there has been a major intraday low of $49,000. This consolidation phase has pushed the Fear and Greed Index to a cautious “fear” score of 30, revealing an atmosphere of anxiety among traders who are often caught off guard by volatile market dynamics.

Is $60,000 the New $10,000 Bitcoin Price?

Despite prevailing market nerves, some market experts believe this is a potential buying opportunity, reminiscent of similar market conditions in 2019. Bloomberg ETF expert James Seyffart noted via

Related reading

He recognizes the complexity of comparing historical and current graphs, emphasizing that while historical patterns should not dictate future outcomes, comparative dynamics offer insightful parallels. “I know, of course, not to equate historical graphs with current graphs. I know all the differences of the current price dynamics etc. $10k was much further away from the $20k+ ATH which is 60K. But go ahead, make fun of me. I can handle it,” Seyffart added.

James “Checkmate” Check, a leading on-chain analyst and co-founder of Checkonchain, agreed with Seyffart’s observation. “The similarities between the 2024 chop consolidation and the 2019 one are strange and uncanny.”

In 2019, the market rose from $4,000 to $14,000 within three months, significantly driven by the PlusToken Ponzi scheme in China, which absorbed around 2% of Bitcoin’s total circulating supply at the time. This was followed by a massive sell-off of these acquired coins on Huobi by the Chinese CCP, contributing to the prolonged market turmoil until the sharp downturn in March 2020.

Check drew a parallel, noting that a similar sequence played out in 2024, when the market rose from $40,000 to $73,777, catalyzed by a substantial increase in spot bids from US spot ETFs, which absorbed around 5% of Bitcoin supply. This was followed by substantial selling activity from the US and German governments, involving approximately 70,000 BTC, contributing to a sustained market shock until the Yen Carry Trade came to a halt on August 5.

“Seriously, it’s crazy how similar these events are, and this is just based on the main events. There is even more evidence beneath the surface,” Check concluded. He shared several on-chain statistics that highlight the strong similarities.

Related reading

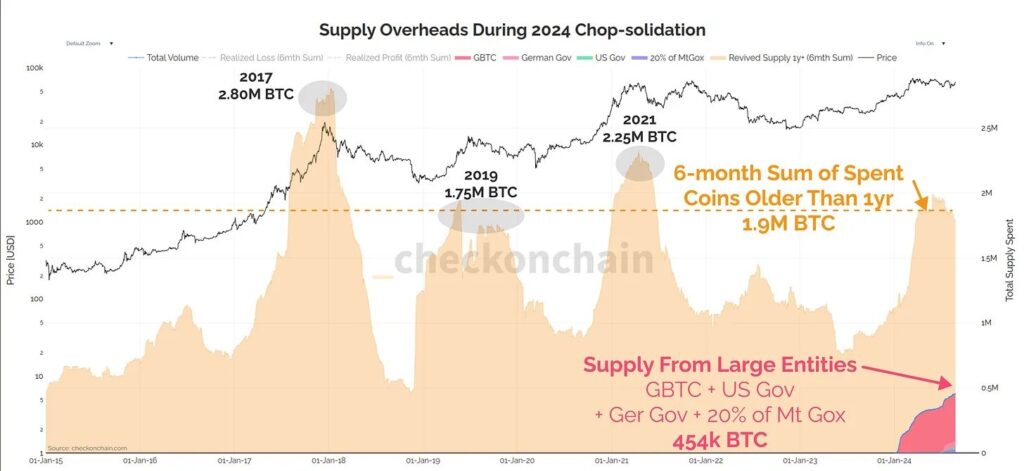

His chart ‘Supply Overheads During 2024 Chop-consolidation’ showed that the six-month sum of issued coins older than one year was quite similar to historical movements. In 2019, 1.75 million BTC was moved by this cohort; Similar: 1.9 million BTC have been mobilized so far in 2024. Notably, major entities including the Grayscale Bitcoin Trust (GBTC), the German government, and the US government accounted for approximately 454,000 BTC from this movement.

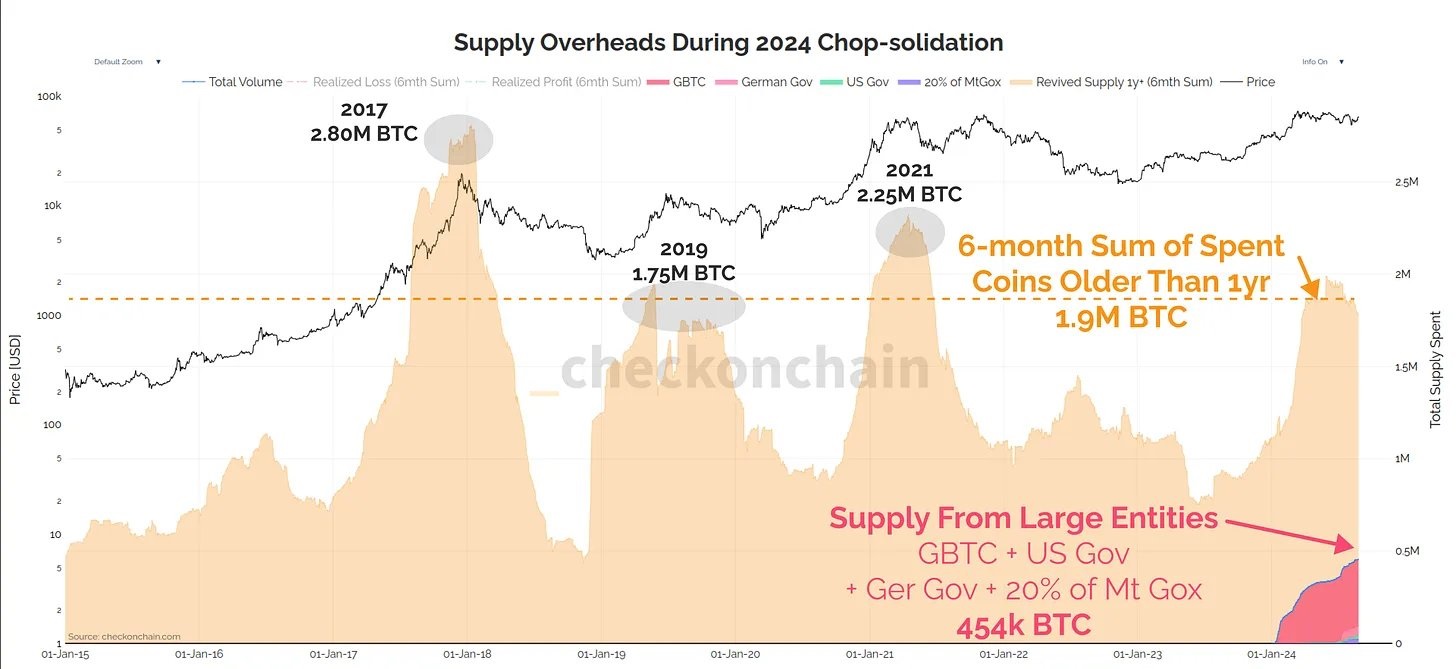

Additional data from Check’s analysis highlights the “realized gains” during these periods. In 2019, 3.4 million BTC were sold for profit over six months. In 2024, this figure will reach 3.33 million BTC.

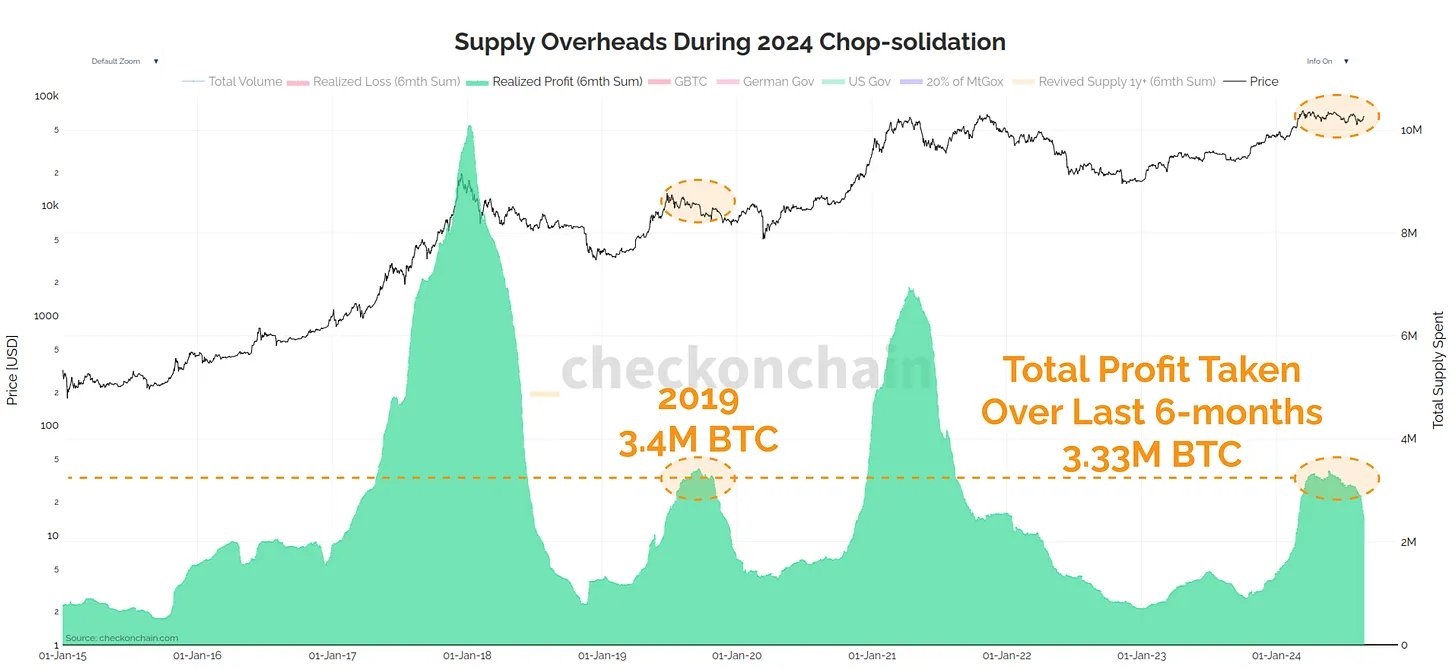

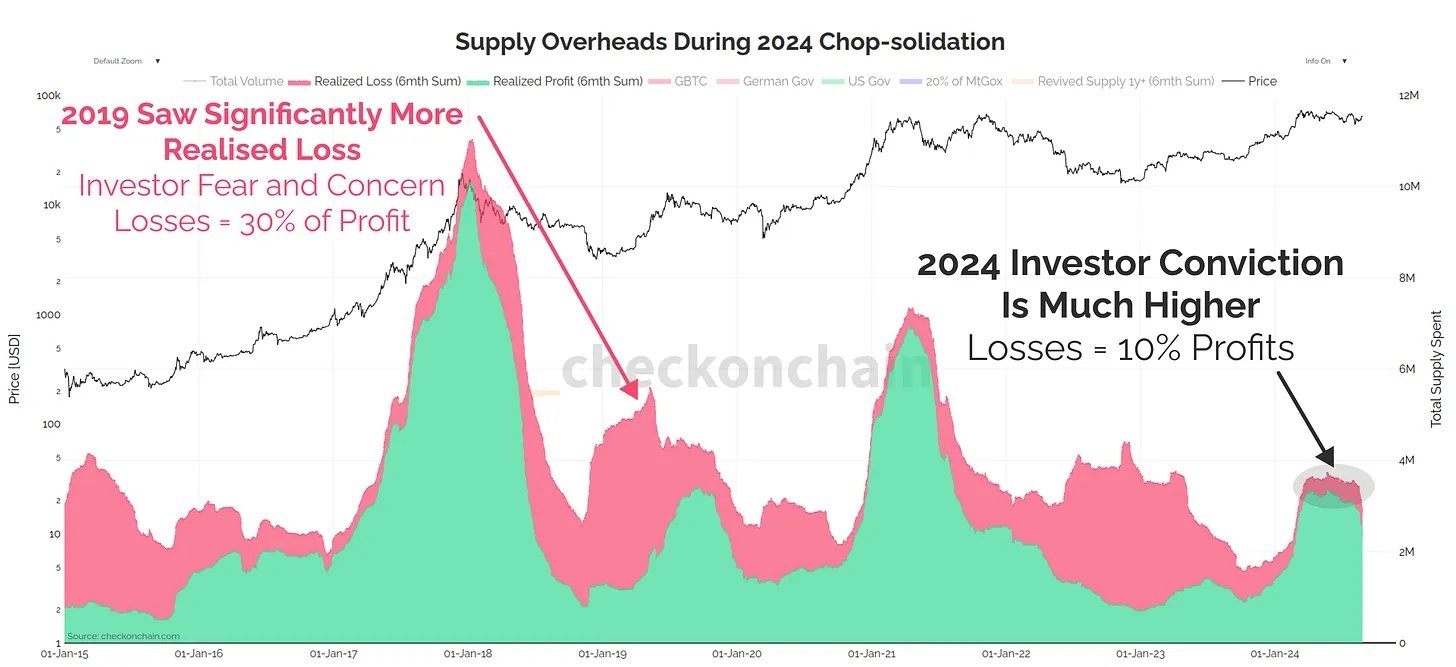

However, the analysis of realized losses provides a stark contrast between the two periods. In 2019, losses amounted to 30% of gains, indicating a market full of investor fear and a willingness to sell at a loss. Conversely, losses in 2024 will be only 10% of profits. This comparison shows how market sentiment has shifted between 2019 and 2024, with investors appearing more confident and less likely to panic sell in 2024.

At the time of writing, BTC was trading at $59,689.

Featured image created with DALL.E, chart from TradingView.com