- Bitcoin has fallen by more than 7% in the past seven days.

- Analysts believe a significant correction could be needed if BTC falls below $56,000

Bitcoin [BTC]The world’s largest cryptocurrency by market capitalization has seen a significant drop in value over the past week. In fact, at the time of writing, BTC had fallen more than 7% to trade on the charts at a value of $59,129.

Overall, August was quite volatile for the cryptocurrency. For example, BTC fell to $49,500 on the charts earlier this month before recovering shortly afterwards. In fact, it also later hit a local high above $65,000 before losing its gains again and falling below $60,000.

That is why many are still uncertain about the size of the next wave of corrections.

However, according to Cryptoquant analyst Julio Moreno, Bitcoin could register a sharp decline if the price falls below $56,000.

What does the market sentiment say?

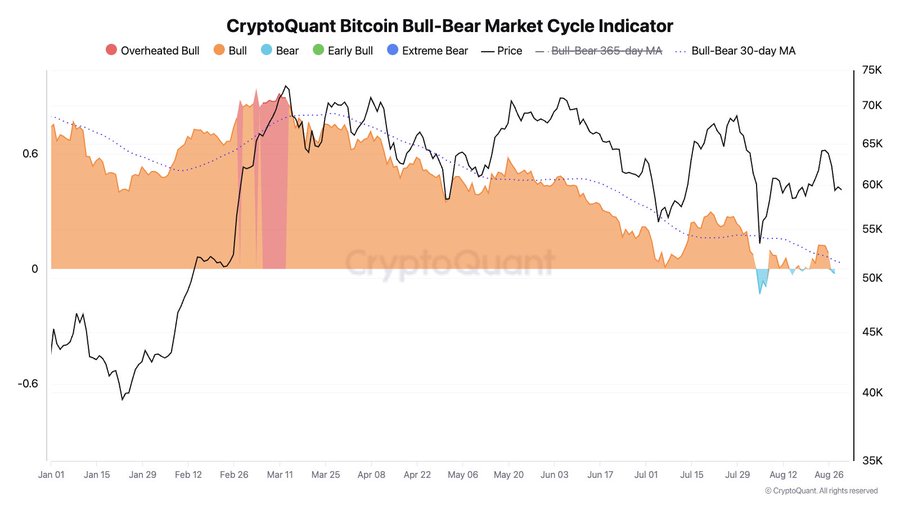

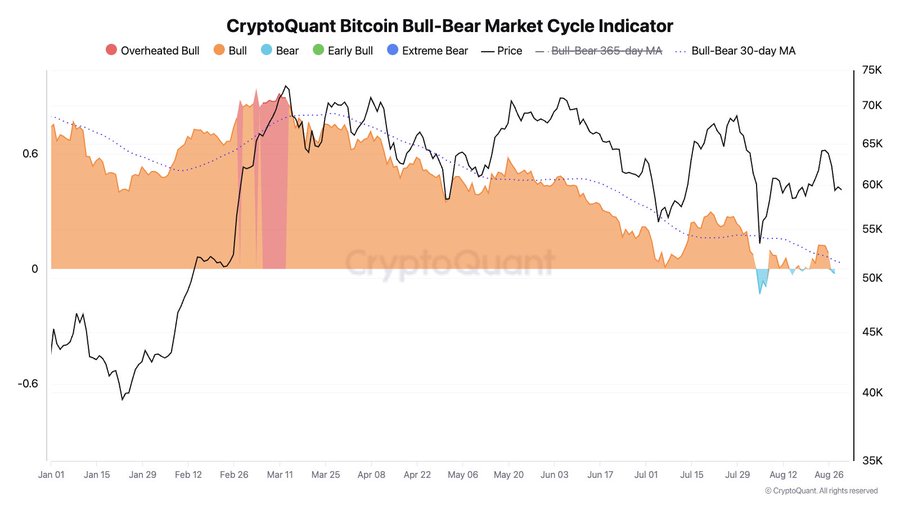

In his analysis states Moreno cited the market cycle indicator that suggests $56,000 is the most crucial support level. According to the analysts, the crypto will experience significant weakness if the price falls below this level. Since the Bitcoin market cycle indicator turned bearish again, the crypto risks a further correction below the demand zone.

The analyst shared the analysis on X and noted that:

“#Bitcoin market cycle indicator is again in the BEAR phase (light blue area). From a valuation perspective, if the price penetrates $56,000 lower, the risks of a larger correction increase.”

Source: Cryptoquant

Based on this analysis, the bear phase is well positioned to persist if the bulls do not recapture the market.

What do the BTC charts say?

While these metrics highlighted by Moreno offer possible future price movements, it is essential to see what other market indicators suggest.

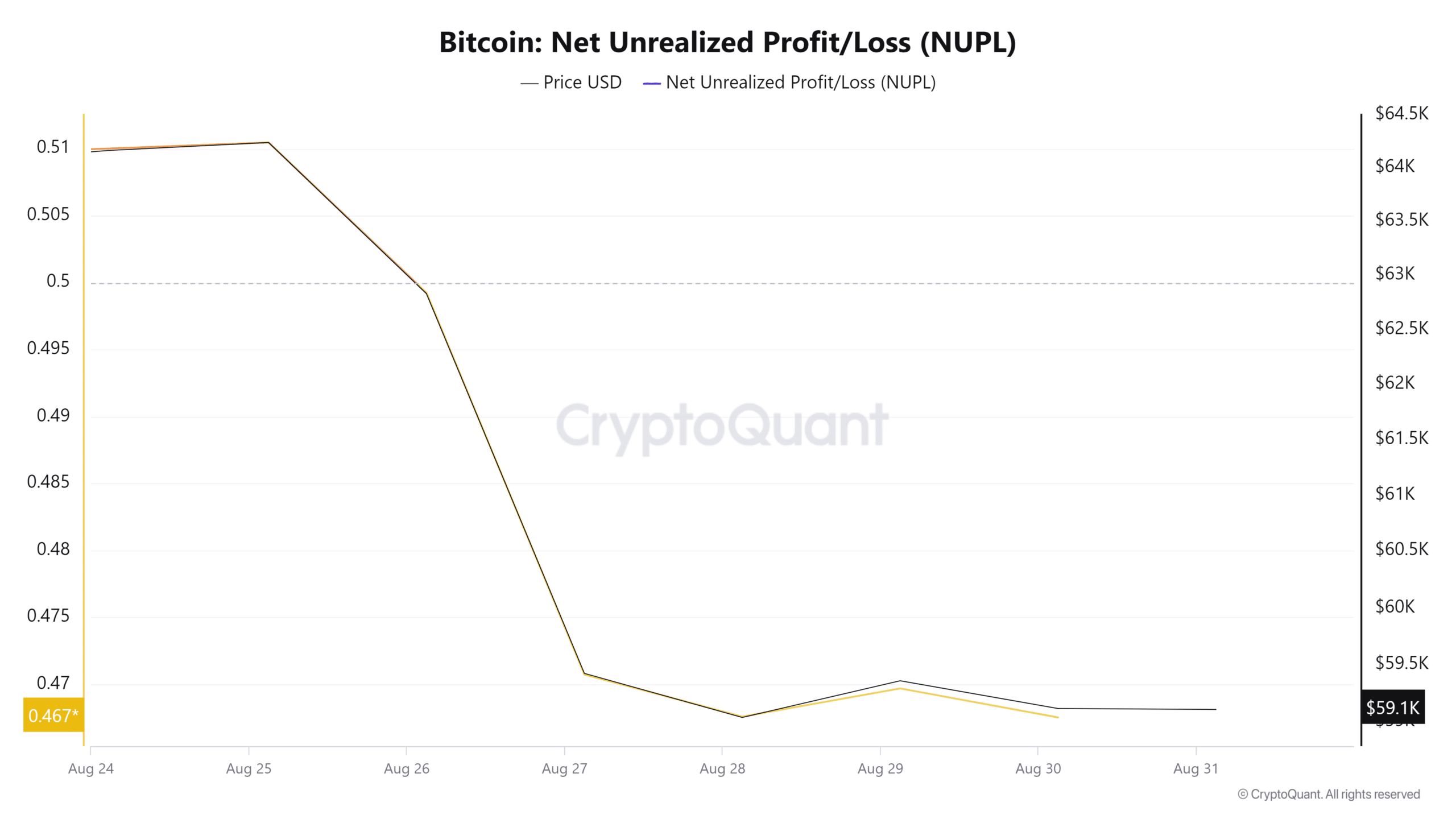

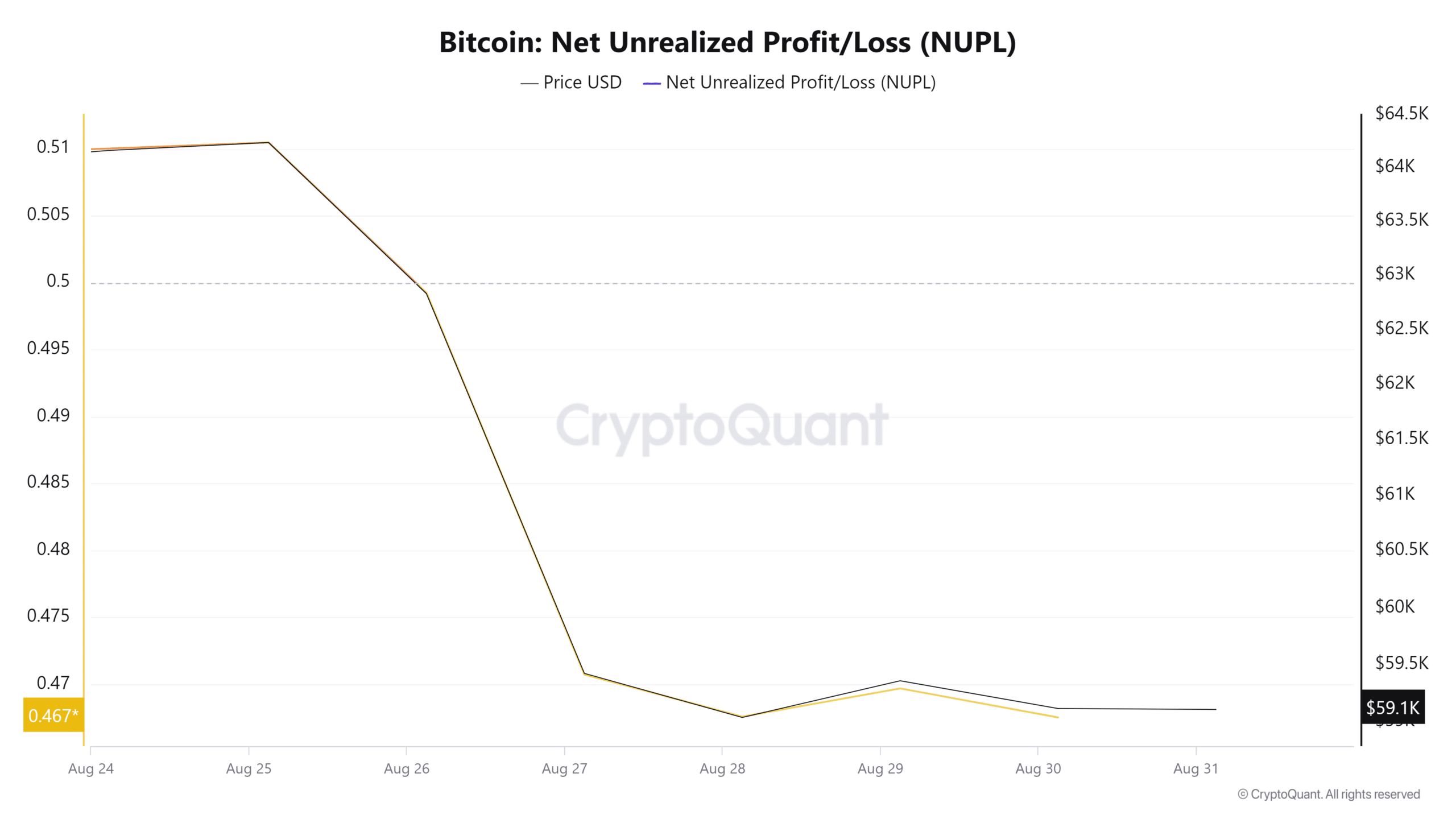

Source: Cryptoquant

For starters, Bitcoin’s NUPL has fallen over the past seven days. Net unrealized gain/loss decreased from 0.5 to 0.4, indicating that investors are switching from unrealized gains to unrealized losses.

This is a sign that the market may be bearish. By extension, this means that investors are concerned about the sustainability of current prices, which could lead to selling pressure.

Source: Santiment

Moreover, BTC reports a negative adjusted price-DAA divergence of -44.31.

This indicates a decrease in activity in the chain based on current prices. Such market conditions result in a correction as prices adjust to the lower level of activity in the chain.

Source: Cryptoquant

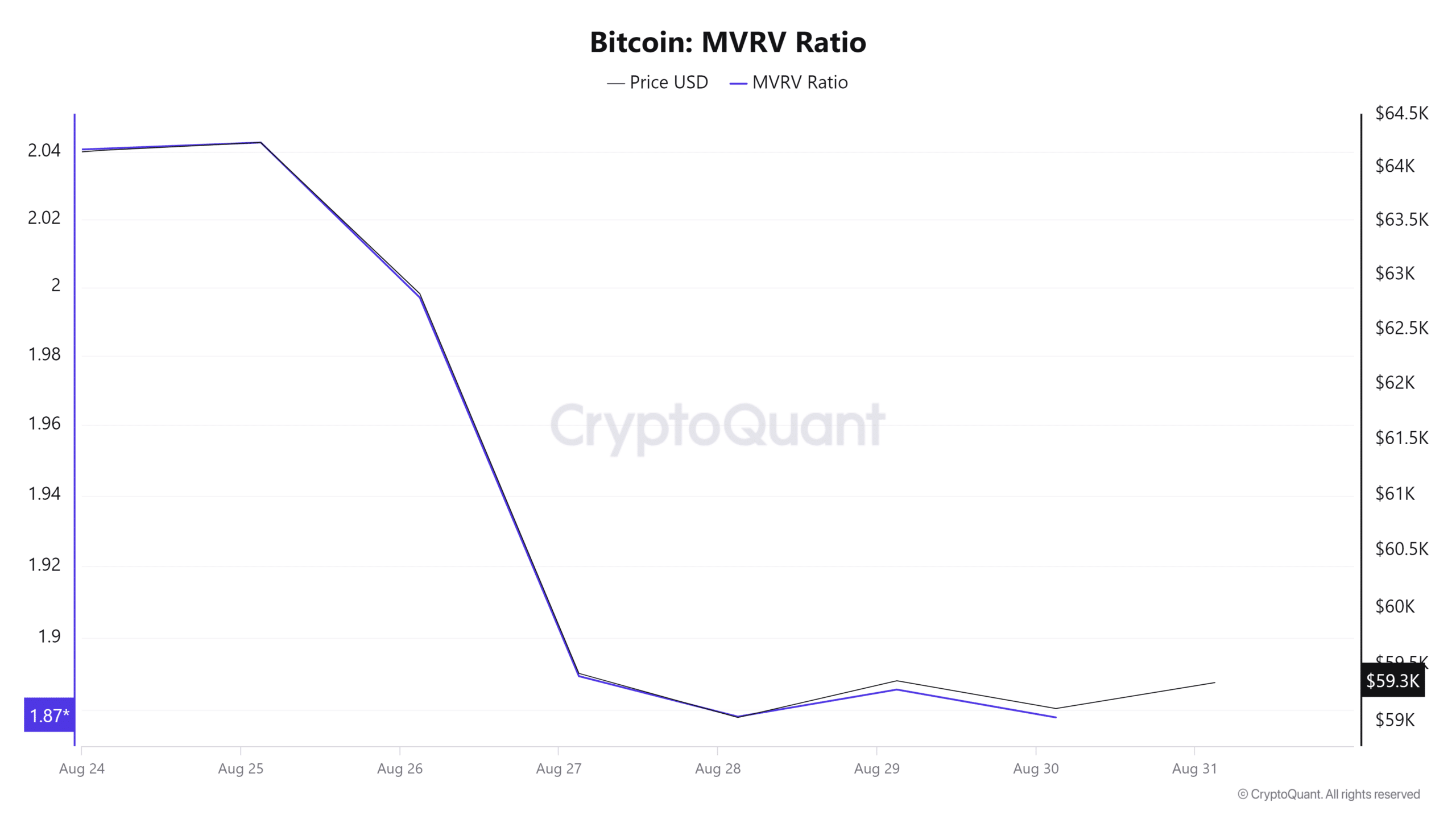

Likewise, the MVRV ratio for BTC has remained at 1.8 over the past week. This shows that participants are making profits, which could lead to selling pressure as they want to realize these profits. If BTC holders decide to sell at this rate to realize their profits, it would lead to further price corrections.

If selling pressure increases, the market will experience a pullback.

Therefore, as Cryptoquant analyst Julio suggests, BTC is in bear phase. If current market conditions persist, Bitcoin could be positioned for a bigger correction. A pullback below the $56 level will see BTC fall below $50,000 to the critical support at $49,000.