- Analysis showed that fear has gripped the Bitcoin market.

- BTC continued to breach critical support levels.

The Recent Downtrend in Bitcoin [BTC] The prices have fueled negative sentiments among traders, resulting in significant liquidation volumes.

Despite these setbacks, buyers have continued to dominate the market and maintain their positions despite losses.

Fear dominates Bitcoin sentiment

Analysis of BTC’s fear and greed index on Mint glass indicated that the market was experiencing a high level of fear, with the index at around 29 at the time of writing.

This indicated a significant level of fear among traders and investors.

Furthermore, fear has maintained the upper hand in over 33% of observations, making it the dominant sentiment in the current market trend.

The dominance of fear is further underlined by the large number of liquidations. This partly explains why this cautious sentiment is so prominent.

More long positions are being liquidated

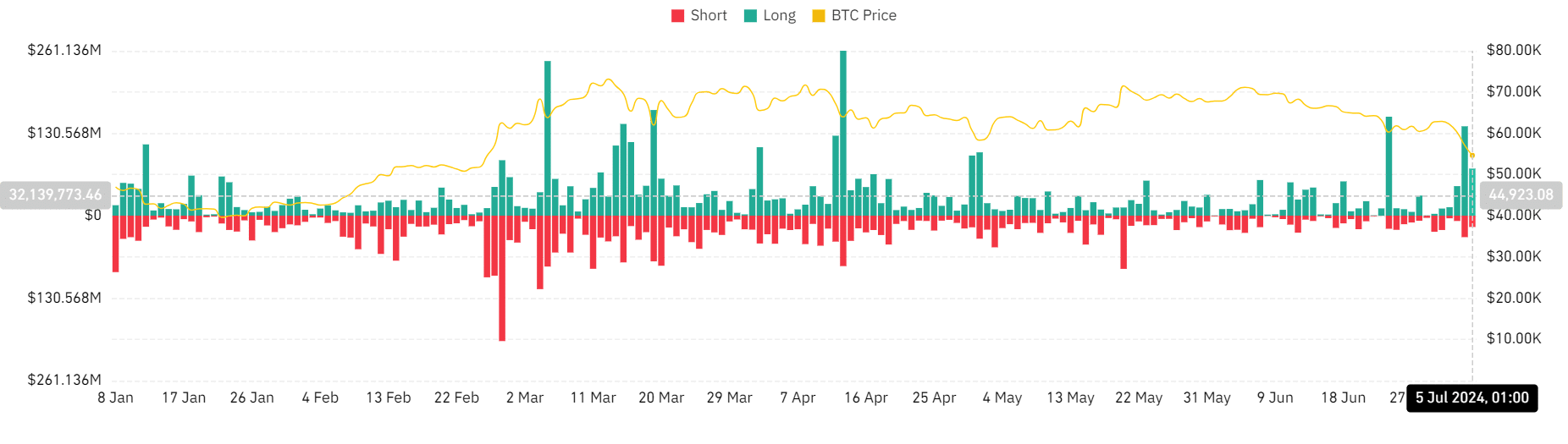

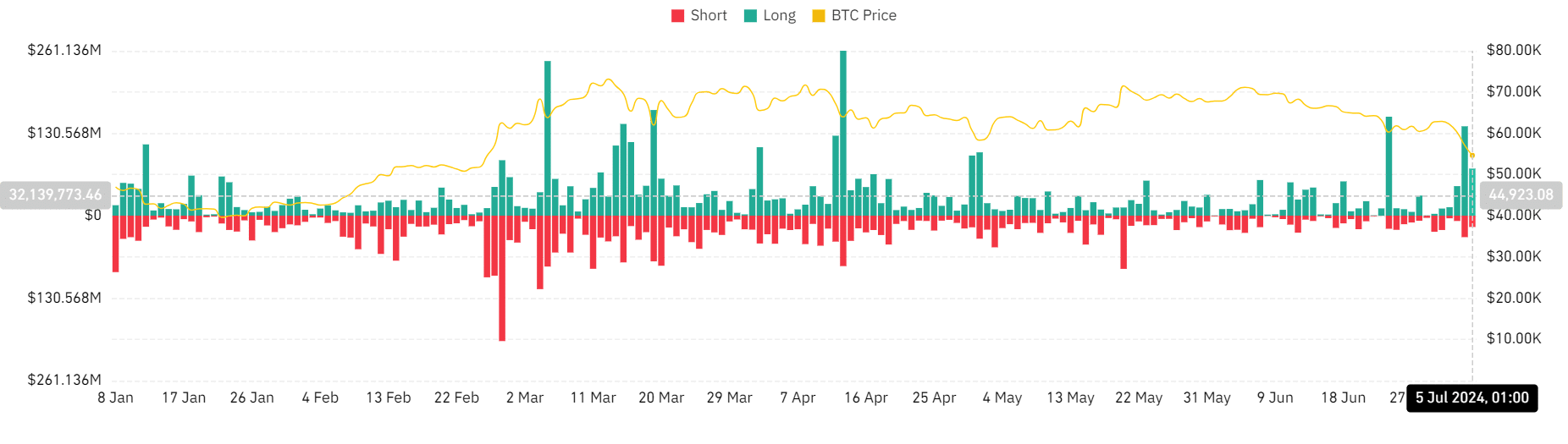

AMBCrypto’s analysis of Bitcoin liquidation volumes revealed that more than $256 million has been liquidated in the last 24 hours.

During this period, mainly long positions were liquidated, with the largest volume taking place.

Source: Coinglass

Specifically, long liquidations as of July 4 were almost $142 million, while short liquidations were approximately $34 million, totaling more than $170 million.

This amount represented the second highest liquidation volume in recent months. At the time of writing, long liquidation volume is over $73 million. Also, the short liquidation volume has exceeded $16 million.

There has also been a decline in derivatives volume for Bitcoin over the past 24 hours. At the time of writing, volume was approximately $29 billion, up from more than $31 billion on July 4.

This reduction in trading volume is a key factor contributing to the current position of the BTC Fear and Greed Index.

Bitcoin continues to fall

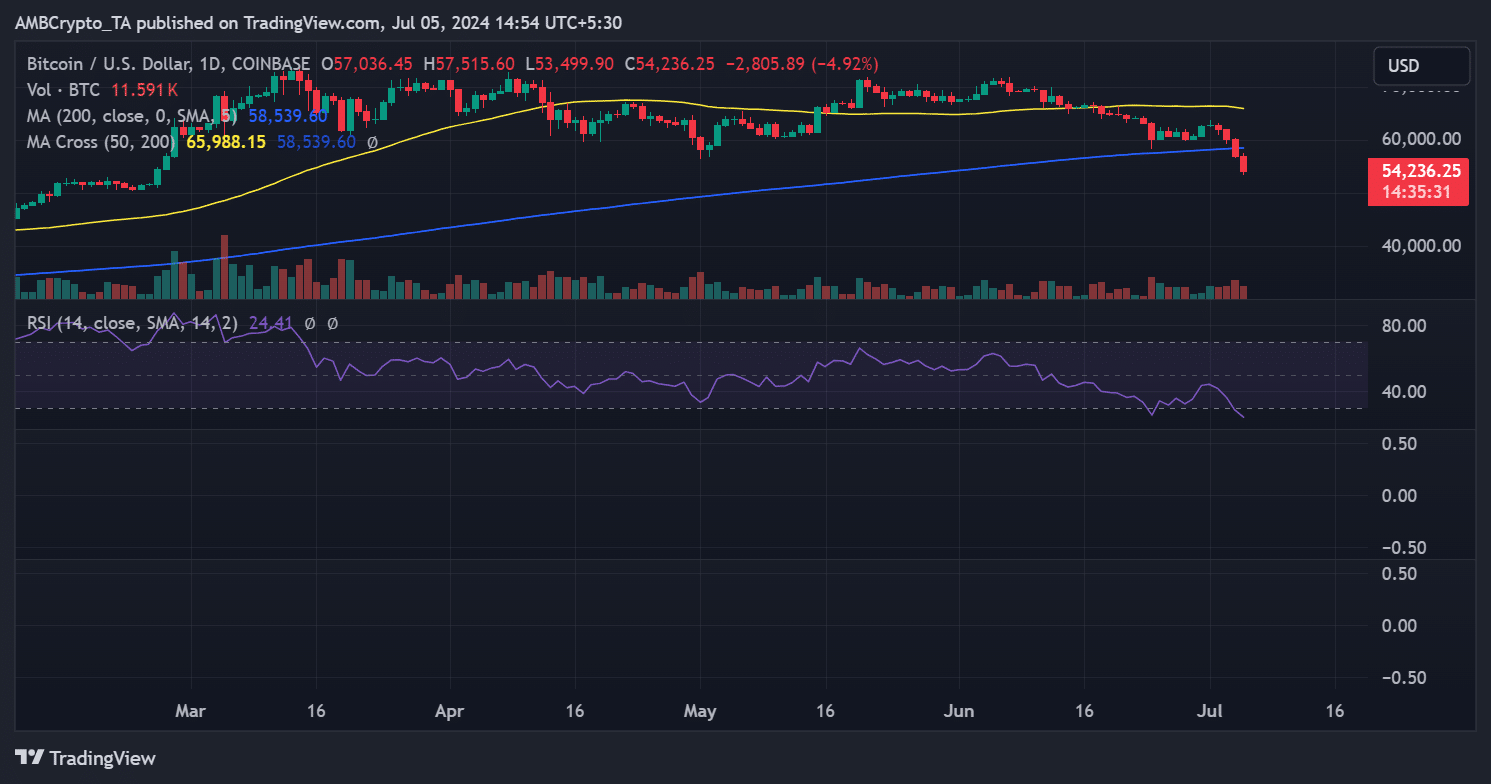

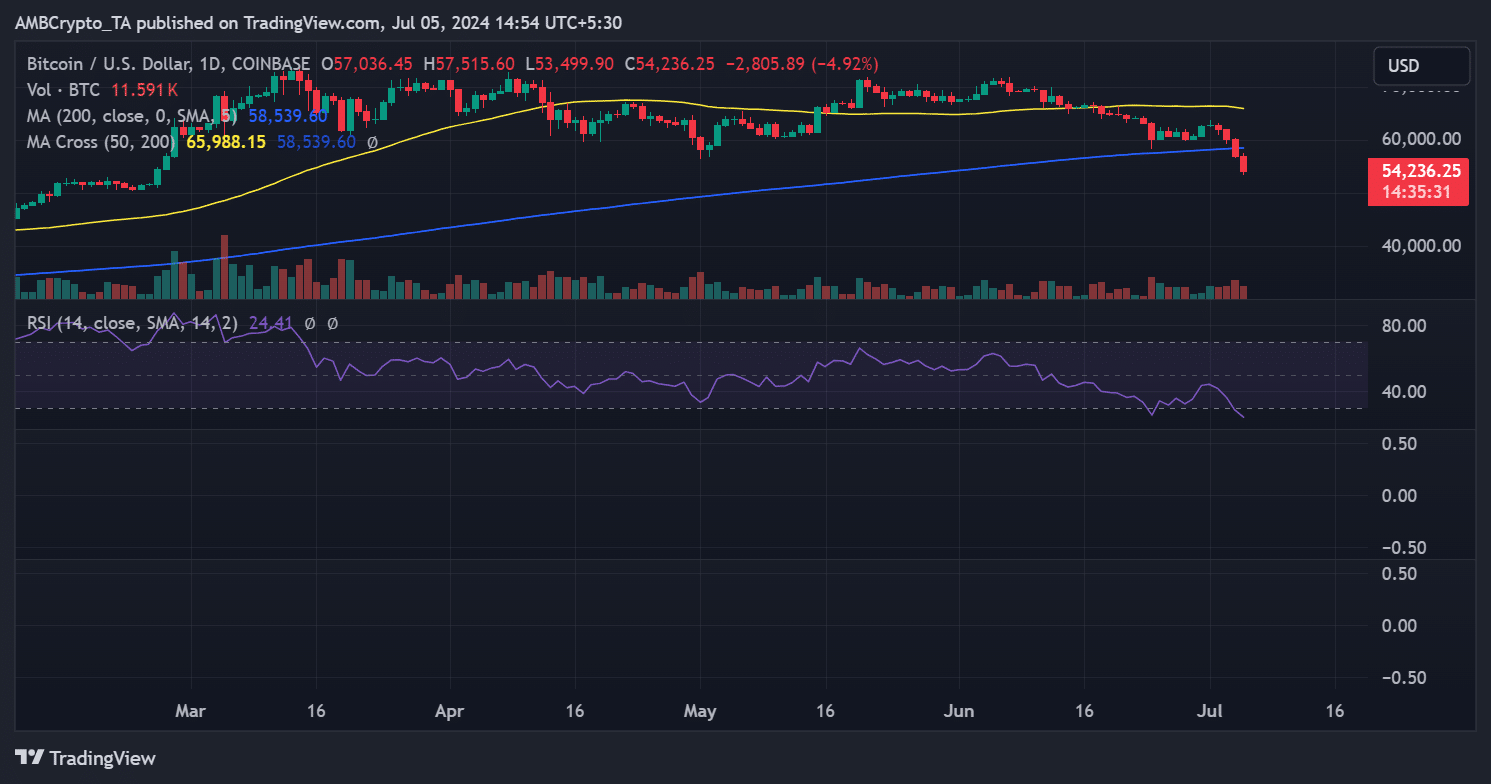

AMBCrypto’s analysis of Bitcoin on a daily time frame has highlighted why the BTC fear and greed index is currently dominated by fear.

Read Bitcoin’s [BTC] Price forecast 2024-25

We noted that BTC was trading down over 5%, with a price of around $54,240 at the time of writing. It ended the previous trading session with a similar decline of more than 5%.

Source: TradingView

This was the first instance in over six months where BTC has experienced consecutive daily declines of more than 5%. This has contributed significantly to the prevailing market fear.