- BONK has regained some of its July recovery gains

- The Fed’s rate decision could spark a relief rally, but there seemed to be an obstacle overhead

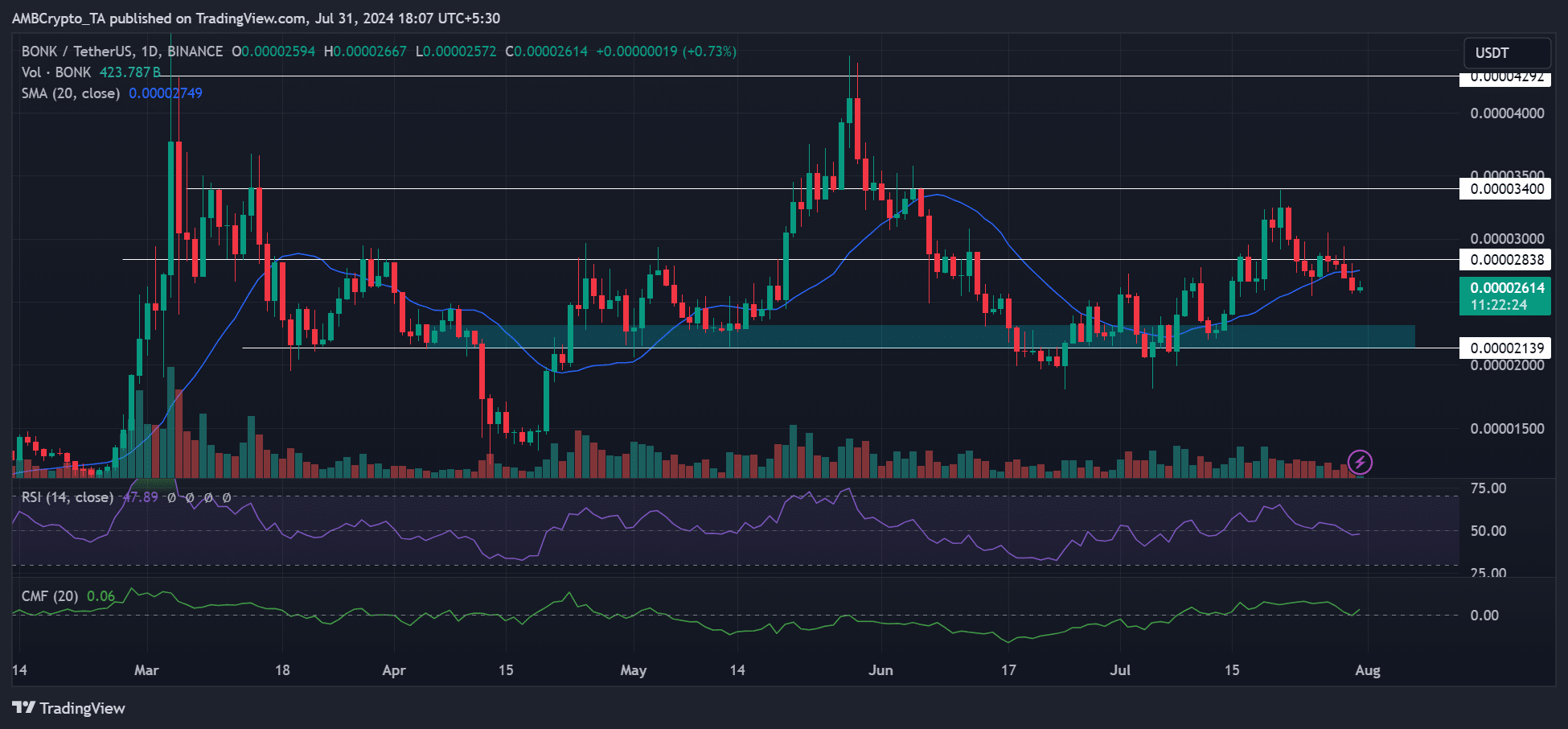

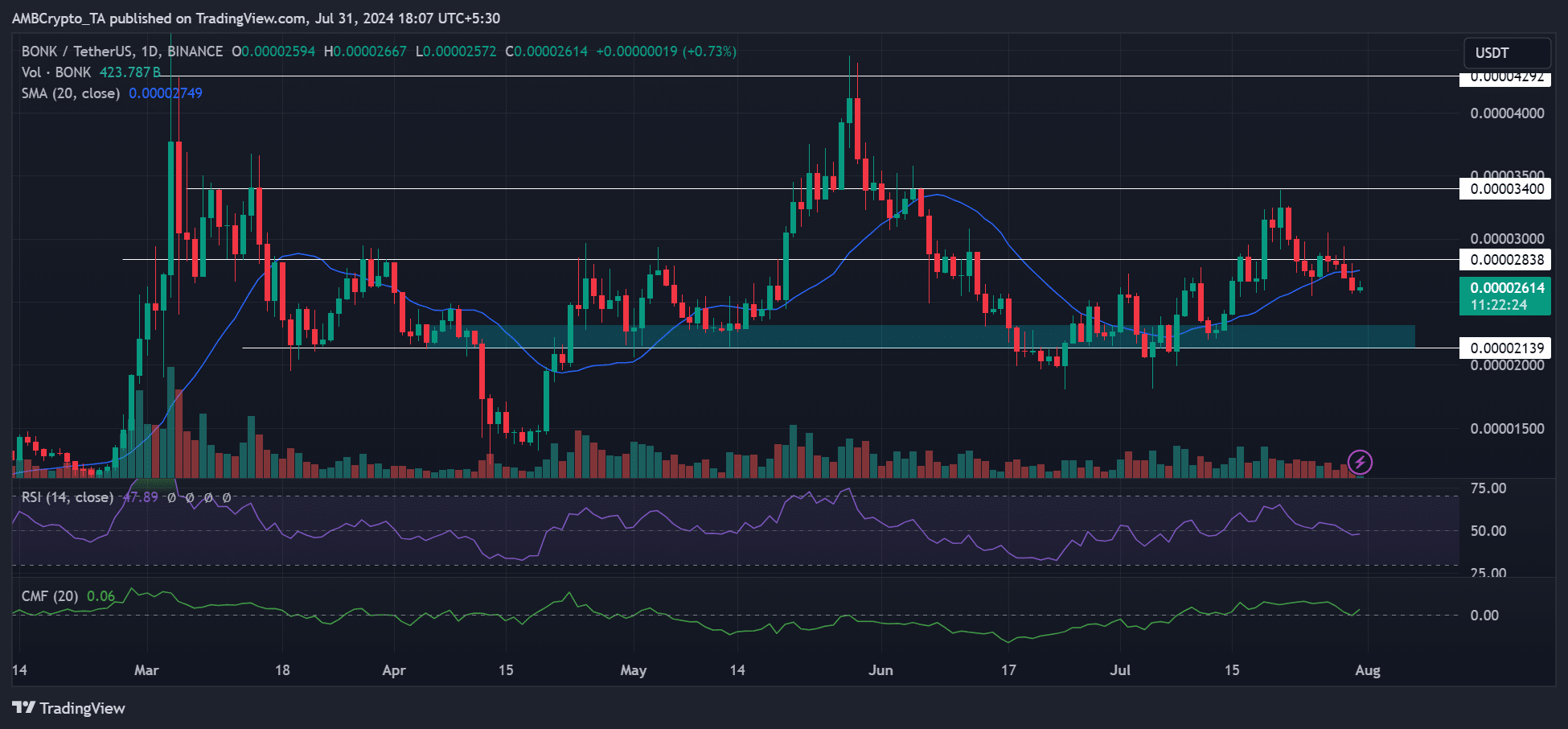

BONK had a mixed performance in July. It rose +50% in the first half, rising from $0.00002 to $0.000034. However, it later erased some of its monthly gains, with the retracement extending to $0.000026 at the time of writing.

The pullback cleared significant support, pushing the memecoin into its familiar second-quarter range. Interestingly, even the short-term price trend, the 20-day SMA (Simple Moving Average), was broken, indicating that sellers had the upper hand.

However, based on the FOMC (Federal Open Market Committee) announcement, volatility can be expected. Could the Fed’s interest rate decision provide relief?

Will FOMC boost BONK?

Source: BONK/USDT, TradingView

The market expected the Fed rate to remain unchanged in July, with high chances of a rate cut in September. A moderate FOMC could provide BONK bulls with an opportunity to move higher. In such a case, a 9% gain could be likely if BONK hits the immediate resistance at $0.000028.

However, any aggressive comments from the Fed chairman could have undermined expectations for the September rate cut and dragged BONK down even further. In such a hawkish scenario, a retest of the previous low and bullish order block (highlighted in cyan) above $0.000020 could have acted as support.

The demand zone could provide a nice discounted entry position for sidelined bulls looking for upside potential, especially if Bitcoin [BTC] is retargeting its range-high of $70k.

The neutral RSI (Relative Strength Index) and CMF (Chaikin Money Flow) figures further reinforced the ‘calm before the storm’ narrative – a sign that buying and capital flows were flat.

BONK market sentiment was positive

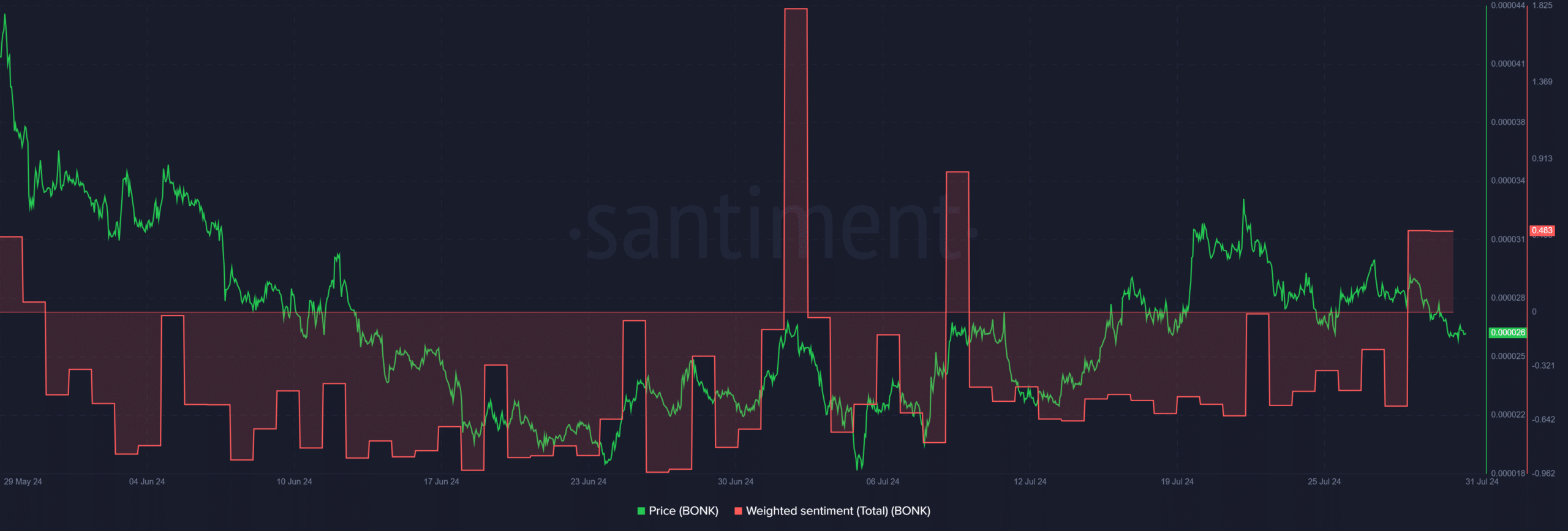

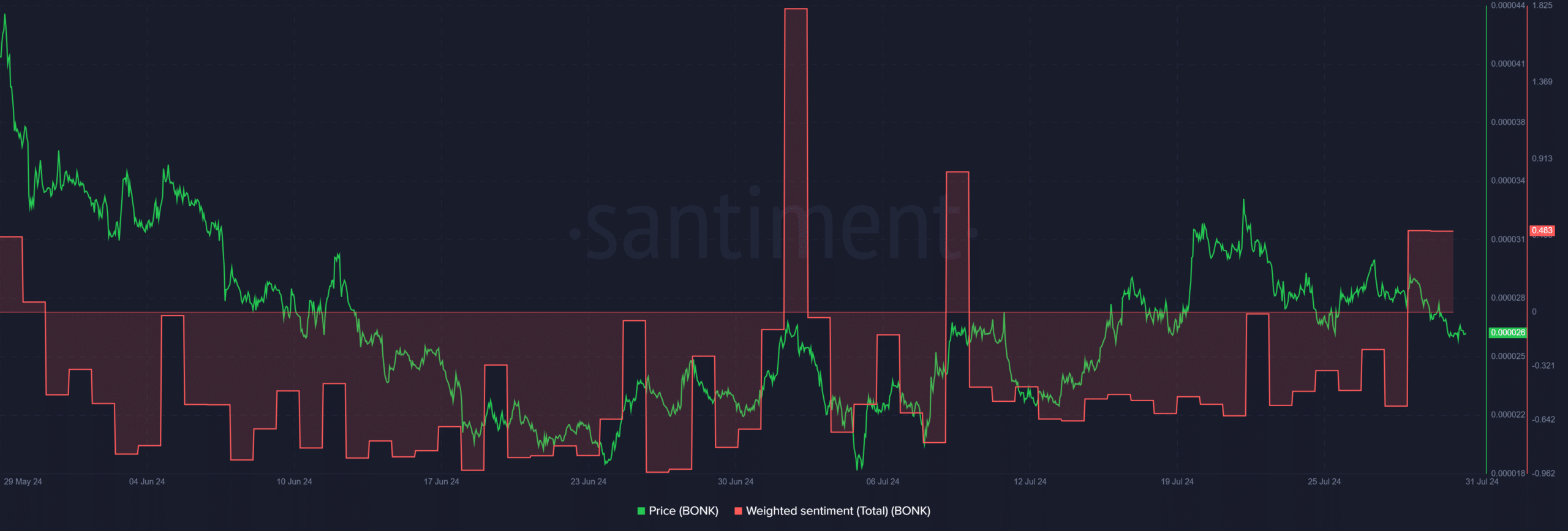

Source: Santiment

Interestingly, despite the price revision, market sentiment has been overly positive in recent days. This suggested that market players expected some upside potential for the memecoin.

Read BONK price prediction 2024-2025

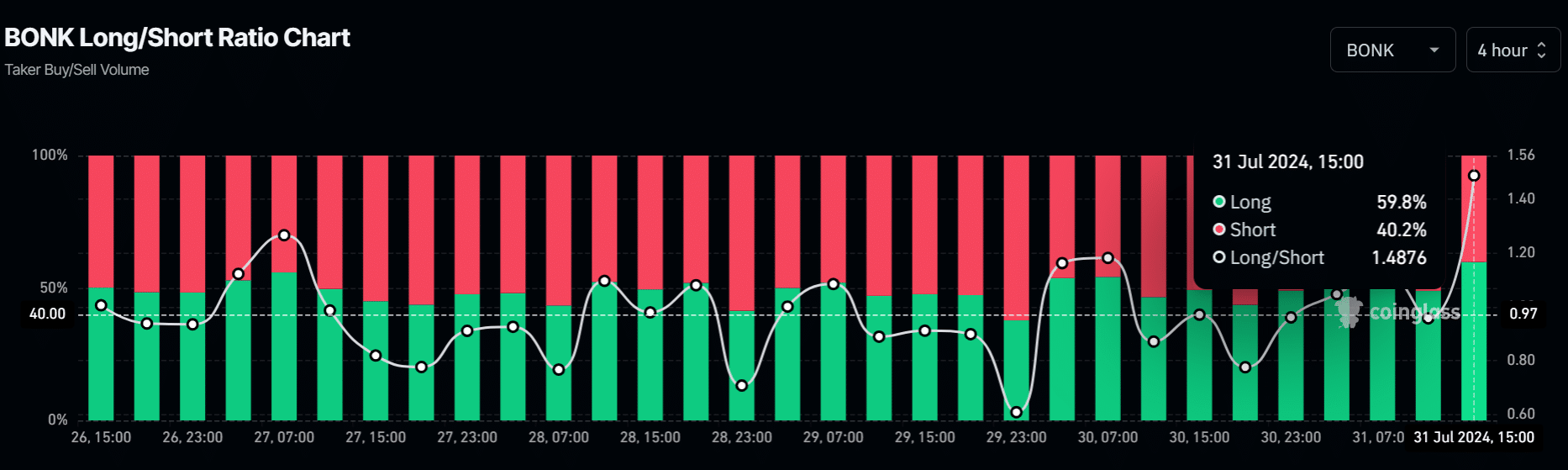

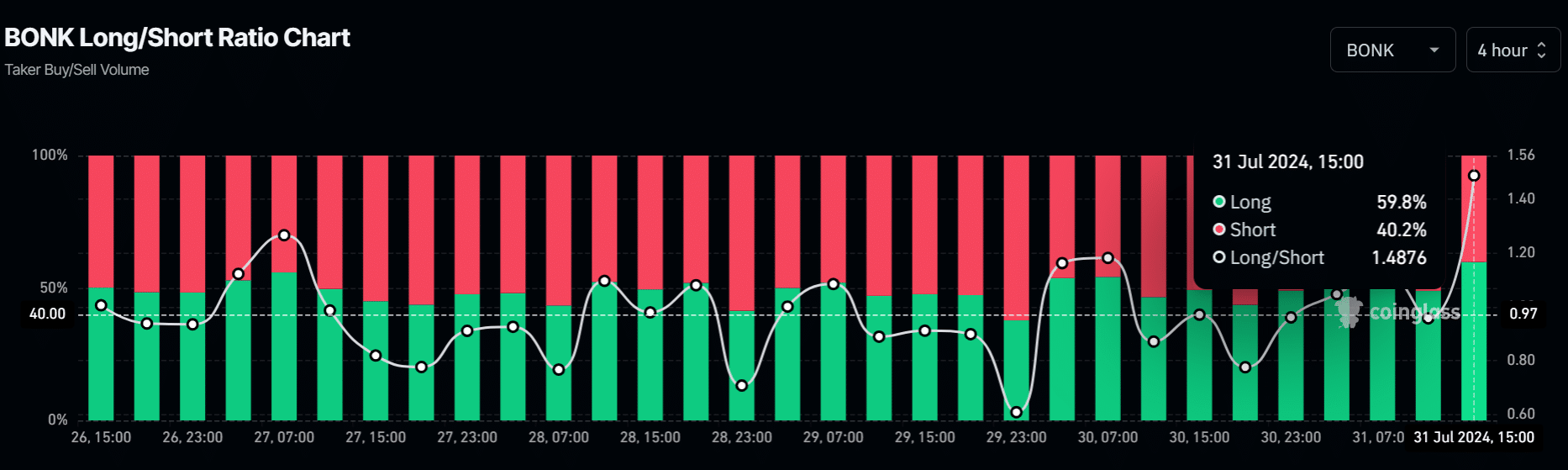

This outlook was further supported by traders’ positioning in the futures market. At the time of writing, 59% of BONK Futures positions were long positions, underscoring that more players were going long on the memecoin, perhaps to ride out an FOMC-induced rally.

Source: Coinglass

Nevertheless, the resistance at $0.000028 remains crucial. BONK could move lower if the expected recovery does not resolve this.

Disclaimer: The information presented does not constitute financial, investment, trading or other advice and is solely the opinion of the author.