This article is available in Spanish.

Since March, the price of BNB, formerly also known as Binance Coin, has barely dipped below $500, despite the broader crypto market recession. After heavy losses from major cryptocurrencies, BNB has impressively resisted the price drop, supported by strong demand.

Related reading

Despite this power, the latest BNB Price Prediction from CoinCodex still estimates that the coin could rise 25% and reach $650 by October 10, 2024. Meanwhile, investor sentiment is bearish and the Fear & Greed Index is also at 33, reflecting uncertainty in the market.

This mixed outlook raises questions about BNB’s near-term trajectory. While long-term growth may be possible, short-term conservatism is required, especially given the currencies’ recent volatility and broader market dynamics.

Lateral movement and strong demand from BNB

Since March, BNB has been moving in a sideways pattern with heavy ups and downs. But after every fall BNB has rebounded strongly above $500, meaning there is strong demand for the coin. For example, on September 6, the price fell to $470, but later recovered to trade at $520 at the time of writing.

This is also in line with rising expectations of an altseason, as a decline in Bitcoin dominance tends to boost altcoins like BNB. Investors appear confident that BNB could continue to benefit from this trend in the way it has historically done as stronger demand for alternative cryptocurrencies emerged.

On-Chain Data: Activity and Network Demand

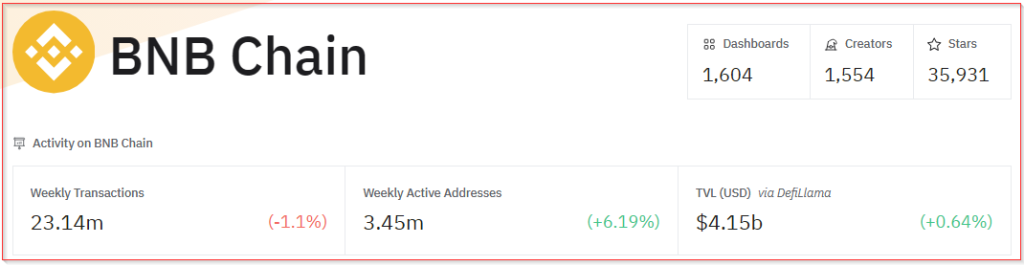

Recently data about the chain from Dune Analytics points out both some promising and concerning trends in BNB. The number of active addresses on the Binance Smart Chain has increased by 6% week over week, indicating that more people are interested in joining the network.

However, this increase in active addresses did not reflect a similar increase in transaction volume, which fell 1.1% over the week, indicating that increased participation has not yet translated into strong network activity.

The drop in network fees also reflects reduced activity, which could have an effect on the path the BNB price may take. To be sure, high network usage has historically always led to relatively high demand for the BNB, and its prolonged depressive activity may limit the coin’s upside potential.

A rally around the corner?

Some analysts think a run could happen despite the bearish sentiment and recent price swings, especially once the high season starts to heat up. When Bitcoin dominance weakens, other assets can usually capture the market’s attention and capital, and that’s where altcoins, especially BNB, often do well.

While CoinCodex’s projection of a 25% price increase could be something that suggests BNB will continue to rise, the short-term outlook for the token remains uncertain.

Related reading

Although the coin managed to post green days of 47% over the past month, its price volatility of 4.62% still showed risks. The bearish sentiment and market fear, along with mixed network activity, all imply that investors should be cautious for the foreseeable future.

It is entirely possible that BNB will maintain its resilience and likely grow further. This crypto asset is one to keep an eye on. But given the mixed signals from on-chain data and markets cautiously navigating their way, the risks need to be considered first before investors jump into digital assets.

While a rally is certainly possible, the market has not yet ended its swings and short-term volatility could still be an issue.

Featured image of Zipmex, chart from TradingView