- The price of Bitcoin has risen by more than 6% in 24 hours

- If the bulls maintain control of the market, a rally beyond $65,000 could be possible

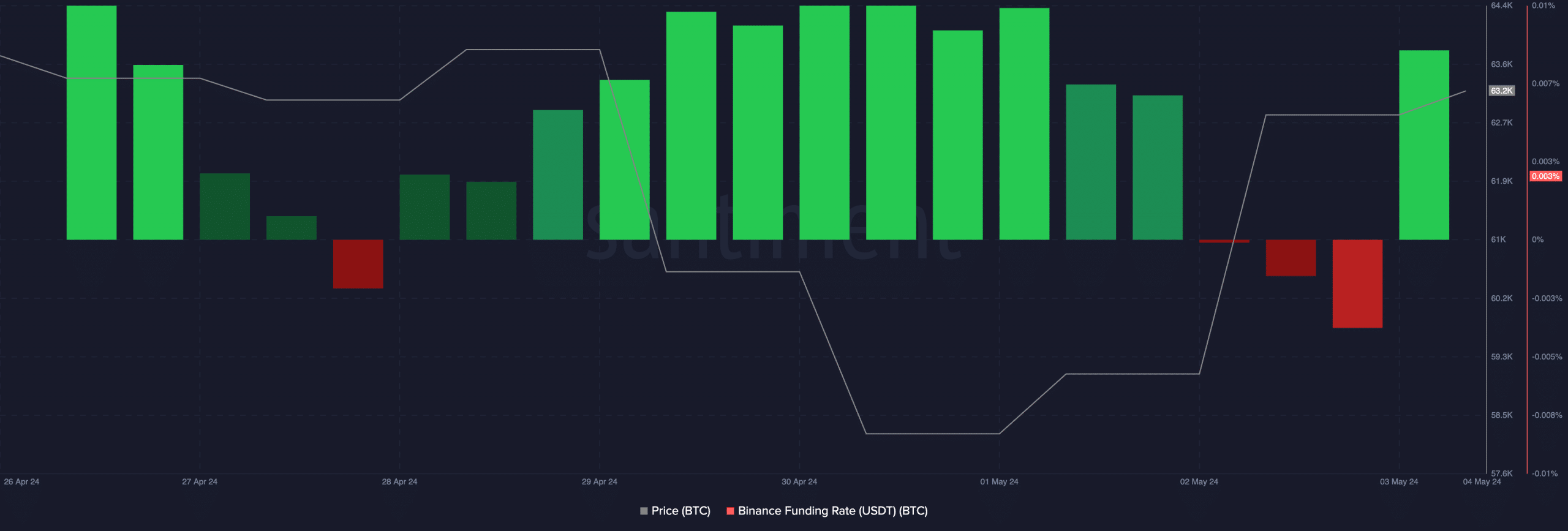

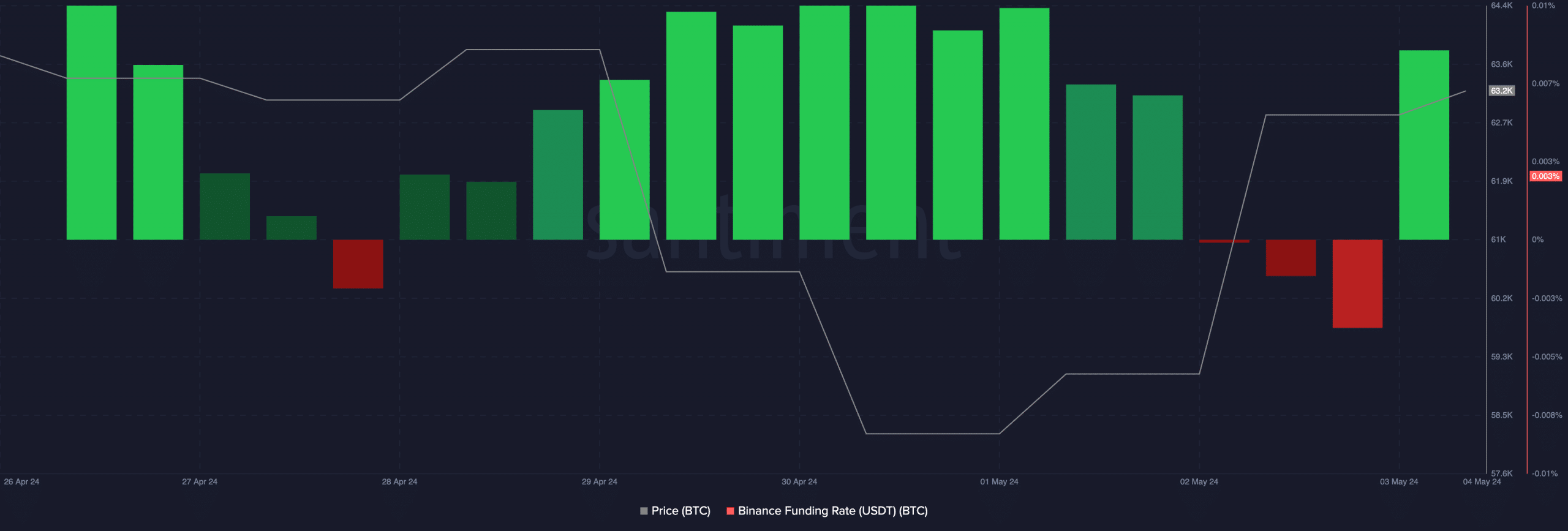

According to Santiment, Bitcoin rises by 6% [BTC] price in the last 24 hours has led to a notable change in the funding rate, from negative to positive on Binance.

📈 #Bitcoin has bounced on a #bullish On Friday, the market capitalization rose by +5.4% in 24 hours. The audience has had it all #flipflopped on their #Binance transactions ranging from liquidated #shorts Unpleasant #long after this jump. We do not want to see whether the rally will continue #FOMO also rising… pic.twitter.com/fY3lEX3REb

— Santiment (@santimentfeed) May 3, 2024

Financing rates are a mechanism used in perpetual futures contracts to ensure that the contract price remains close to the spot price. When the contract price of an asset is higher than the spot price, traders who hold long positions pay a fee to traders who short the asset. The funding rates return positive values when this happens.

Conversely, negative financing rates are recorded when the contract price of the asset is lower than the spot price. Here, short traders pay a fee to traders who take long positions.

When an asset witnesses a sudden shift from a negative to a positive funding rate, it indicates that there is strong demand for long positions. It is considered a bullish signal and a precursor to an asset’s continued price growth.

According to Santiment, Bitcoin funding rates on Binance closed at a year-to-date low of -0.008% on May 3. However, after the price started an upward trend to rise by more than 6% within 24 hours, the funding rate on the main exchange changed to positive.

At the time of writing, this stood at 0.0027%, indicating that there were more long than short positions in the coin’s derivatives market.

Source: Santiment

Is your portfolio green? Check out the BTC profit calculator

What do you have to pay attention to?

Bitcoin’s price rise over the past 24 hours has led to a rally in trading activity in the derivatives market. According to Mint glassFor example, trading volume on that market during that period totaled $78.05 billion, while the same volume increased by 30%.

Signaling that market participants are opening new trading positions, BTC open interest in futures also registered a 7% increase in 24 hours. At the time of writing, the coin’s open interest stood at $30 billion, while the crypto was valued at just over $63,000 on the charts.

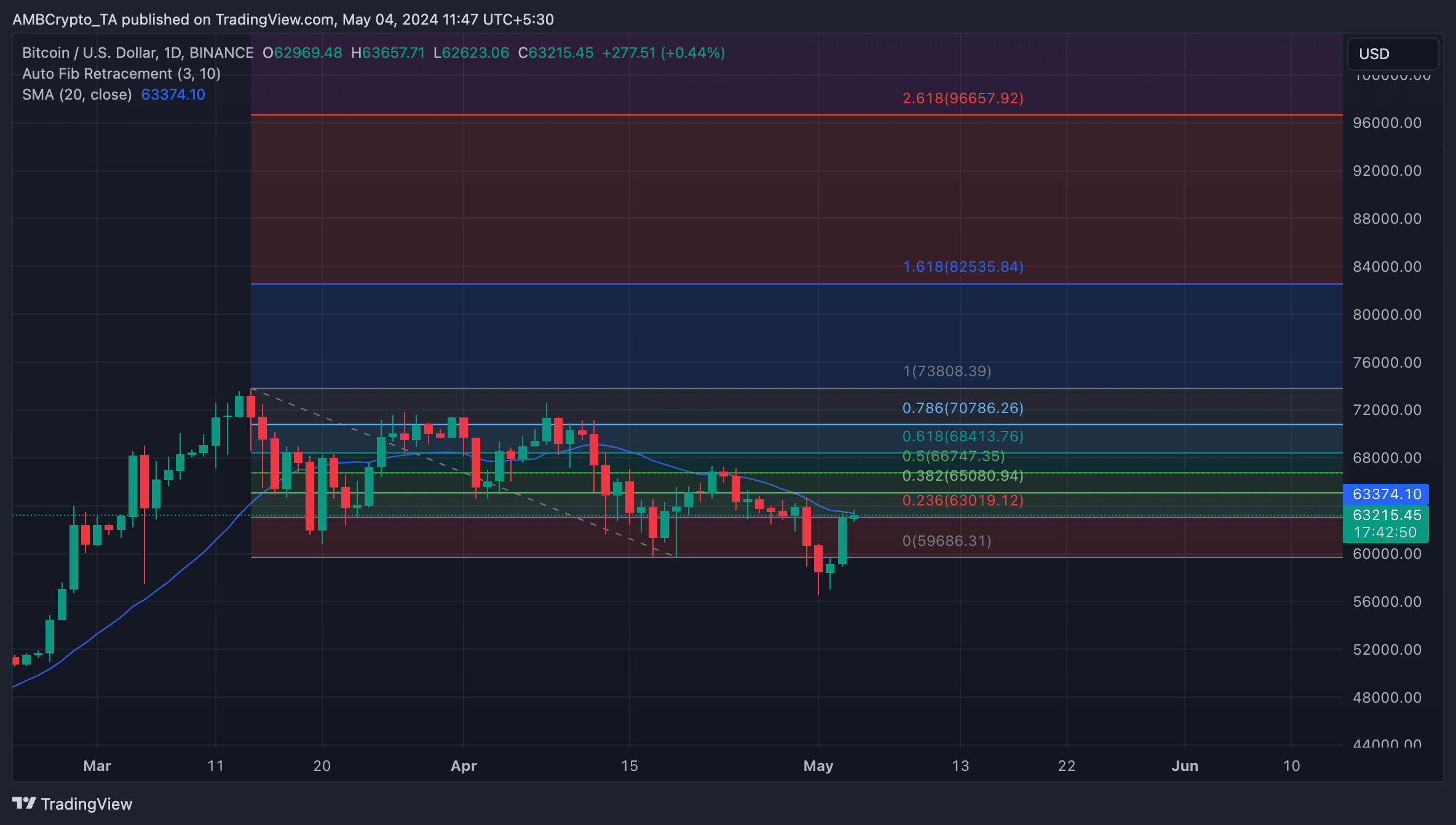

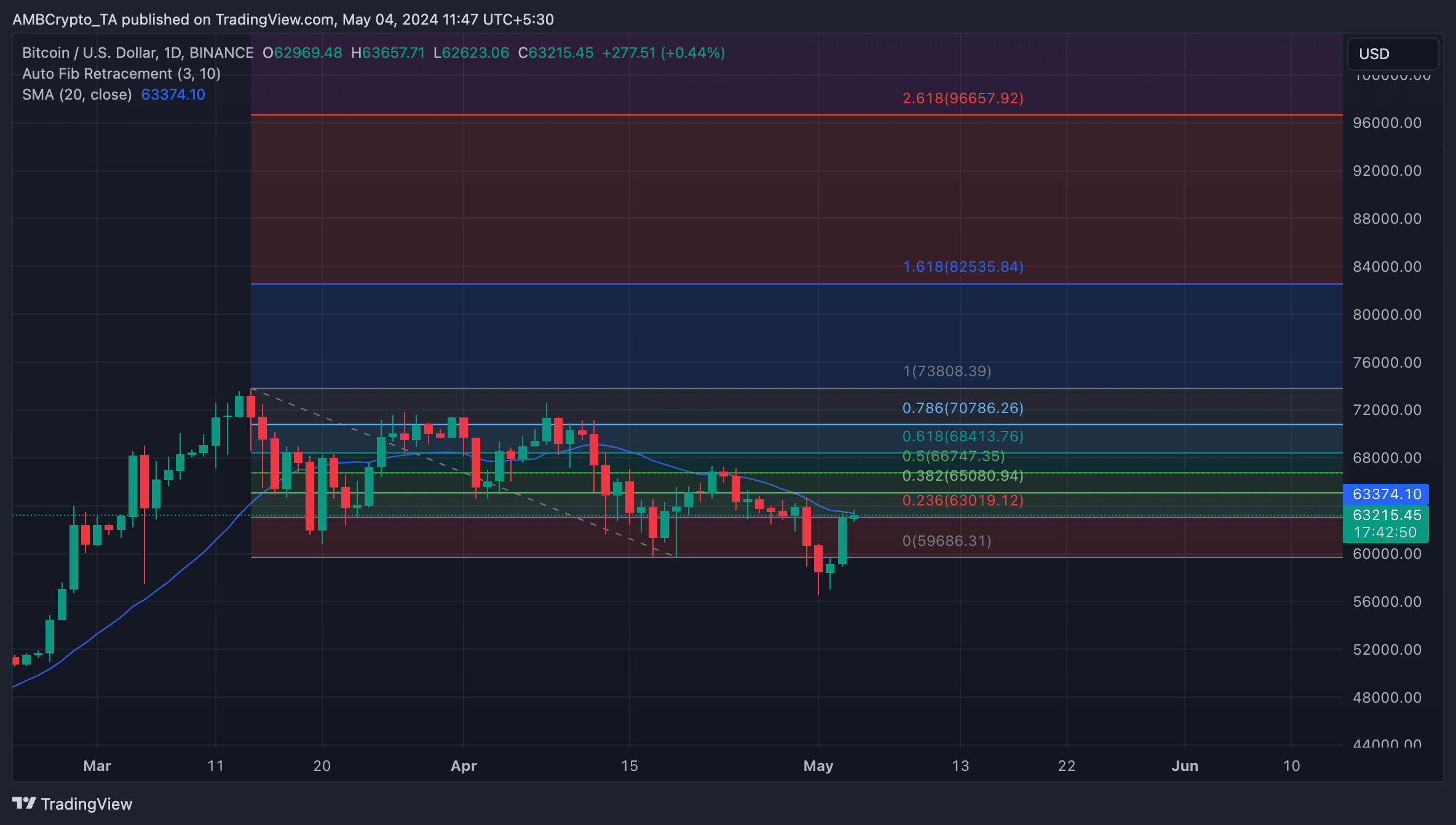

Furthermore, readings of BTC’s Fibonacci retracement levels on the 1-day chart showed that if this bullish momentum continues, the coin’s next price point will be $65,050.

Source: DOGE/USDT on TradingView

However, if the bears emerge again and put pressure on the price, the bullish projection will be invalidated. If that happens, the price of BTC will drop below $60,000 to change hands to $59,700.