- If Bitcoin continues to correlate with stocks, the price may drop.

- HODLers are sticking to accumulation no matter the circumstances.

Bloomberg’s senior strategist Mike McGlone has explained that there is talk of a price reversal Bitcoin [BTC] could pose a major risk to the currency. Speaking of the king coin on Twitter, McGlone compared Bitcoin’s $26,000 value to its correlation to stocks.

Read Bitcoins [BTC] Price Prediction 2023-2024

According to the analyst, Bitcoin’s correlation to traditional assets was 0.40 — the highest level it had reached since the invention of the digital asset.

In addition, McGlone compared BTC’s performance to the season when Amazon.com peaked and said it was a huge increase drop in price could lead to another long period of time before BTC surpasses its ATH.

‘It Went Up So It Will Keep Going Up’ Risks in Bitcoin –

The lessons of well-performing, widely hyped assets show that price reversal can be the biggest risk once the masses get in. #Bitcoin at about $26,000 on August 28 is slightly less than at the end of 2020, comparable to… pic.twitter.com/3UdAbpLNLe— Mike McGlone (@mikemcglone11) August 28, 2023

One reason the analyst maintained this position was the endorsement of Bitcoin futures EFT. For McGlones, the ETF’s approval contributed to the drop in volatility. He also referred to 2021 and said:

“The arrival of futures-based Exchange Traded Funds in 2021 helped reduce volatility and increase cash-and-carry arbitrage.”

Remember that companies like it Black rock received SEC approval for a Bitcoin ETF. However, the coin’s price action since then has been disappointing, at the cost of an impressive first quarter. Regardless of the circumstances, many believe that an approval of a spot ETF would turn the tide for BTC for the better.

However, the SEC has been delayed on this aspect, pushing the filings of ARK Invest and 21Shares to undisclosed confirmation dates. But how did the affected BTC do this?

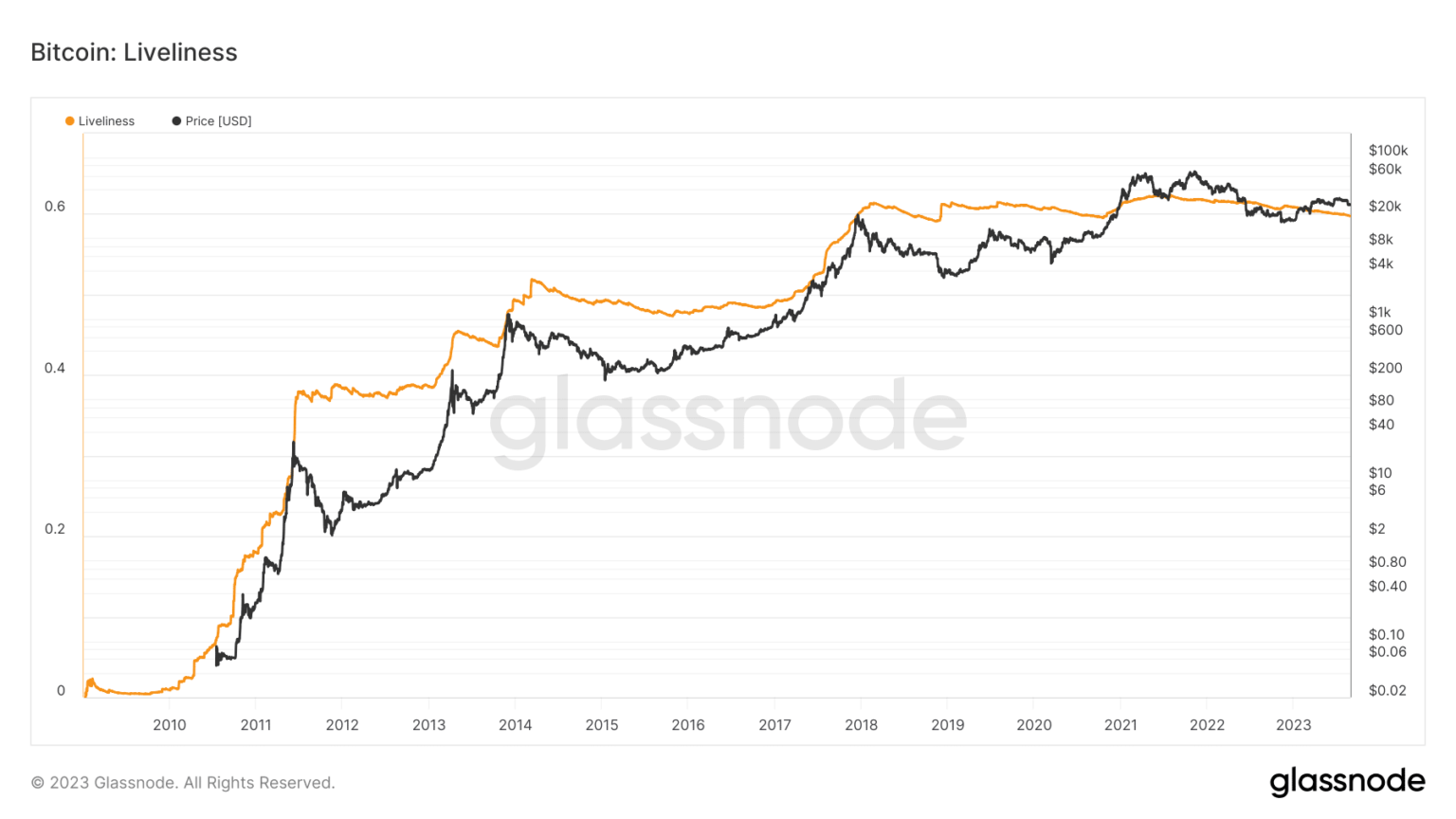

According to Glassnode, the current state of Bitcoin has not stopped investors from holding on to the coin, as the report shows. liveliness. Bitcoin vibrancy is defined as the ratio of Coin Days Destroyed (CDD) to Coin Days Created (CDC).

When the liveliness increases, it means HODLers are releasing their coins. However, a drop in the measure, as it was at the time of going to press, indicates increased accumulation and a desire to hold on.

Source: Glassnode

In addition, the supply of long-term holders (LTH) had increased to 14.53 million. The LTH offer is the total amount of circulating supply held by long-term holders.

How many Worth 1,10,100 BTC today?

The metric uses a logistic function centered on an age of 155 days and a transition width of 10 days on the average purchase data to weigh the sentiment around BTC.

Therefore, the rise in the benchmark suggested that investors might be conscious of the downside risks. However, the same group of holders consider Bitcoin an asset worth waiting for returns.

Source: Glassnode