- Bitcoin hit his historical peak due to widespread bullish investors expectations

- Cryptocurrency started a falling trend after touching his peak, settled under $ 85,000 at the moment

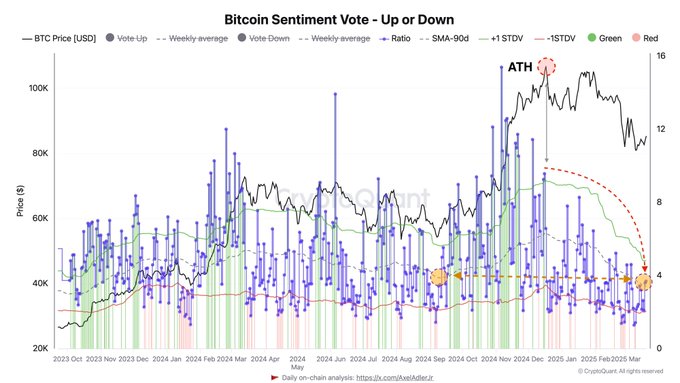

In 2024, Bitcoin reached his historical peak due to widespread bullish investors expectations that emerged via the Bitcoin sentiment Vote Chart. The price of Bitcoin even climbed above $ 100,000, while the mood sentiment became very strong.

After it reached its peak, the market sentiment began to fall quickly over its value. Market sentiment shifted to negative when traders started to vote alongside investors, which resulted in lower sentiment values.

Source: Cryptuquant

The rally started with the blinking of positive expectations, but was darkened with both anxiety, along with solders sold to reduce their participations after reaching the highest point. The prize of BTC started a downward trend after touching his peak, with the crypto setting under $ 85,000 in March 2025.

The difference in investor feeling is a sign of deepening of the market. Especially since the sentiment is equal to what it did in September 2024, just before the bullish period started.

Bitcoin’s sentiment levels mirror September 2024 trends

Bitcoin’s mood suggested that March 2025 marked the return of sentiment relationships that were identical to those in September 2024. The measurements in that period revealed neutral opinions when the relationship remained nearly 4 – indicative of uncertain feelings.

The newest market trend showed a large fall compared to the previous time high levels above 12 that Bitcoin reached during his peak. These indicators emphasized a neutral-to-hard prospect, because the “voting” sentiment continued to rise in the 90-day advancing average together with standard deviation.

The prevailing sentiment among traders corresponds to earlier market conditions before the rally, indicating that they hesitate on Bitcoin’s coming performance. The same situation as before Bitcoin’s previous large upward increase exists today when investors feel restraint.

Sales behavior of the long -term holders and the implications for their market

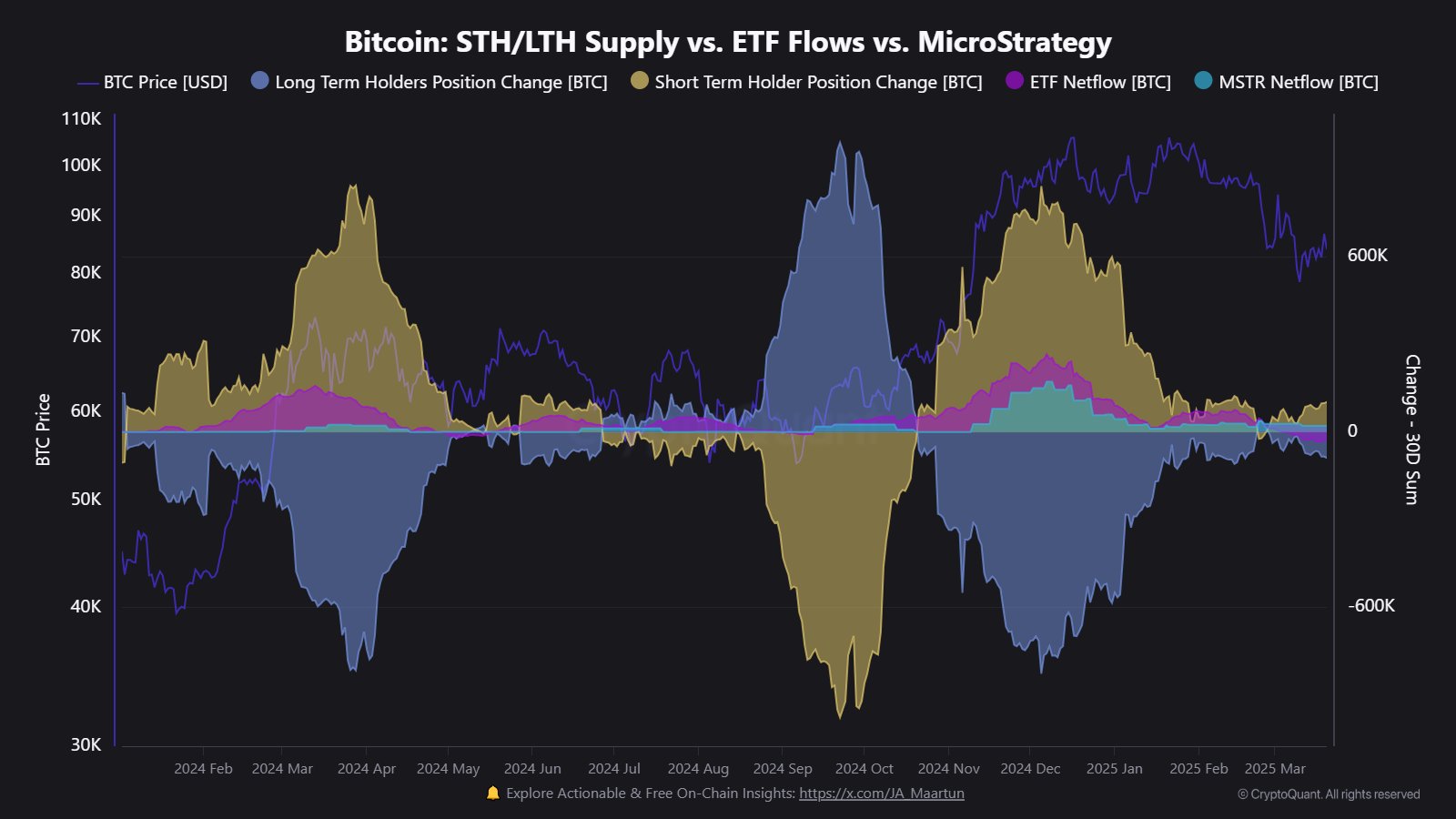

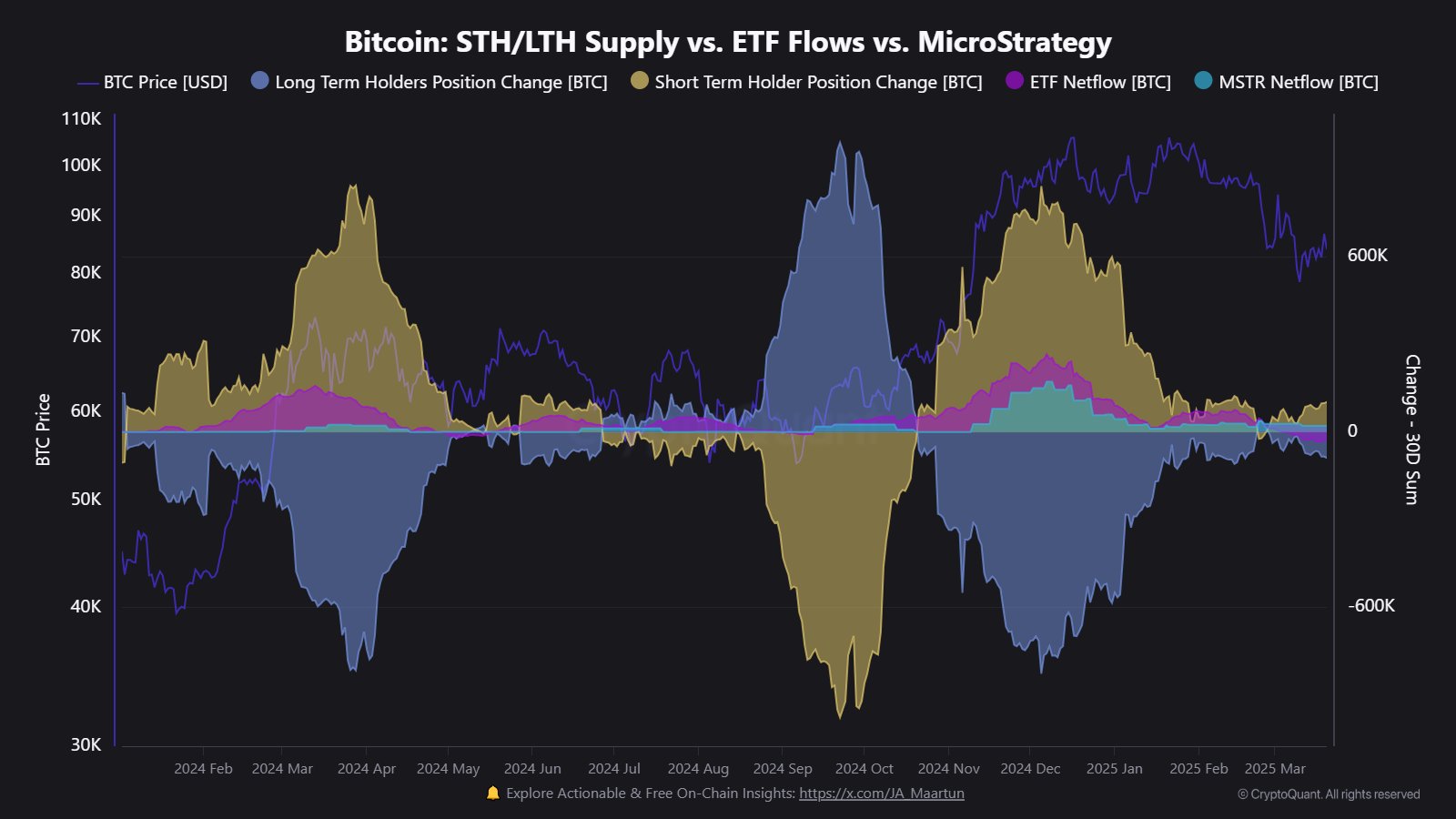

Finally, Bitcoin’s STH/LTH Supply versus ETF streams versus micro strategy Chart emphasized persistent long-term holders (LTH). Although the pace was delayed since Bitcoin $ 100,000 exceeded, a 30-day LTH offer reduction of 89,738 BTC could be a sign of continuous profit making.

Souce: Cryptuquant

The downward trend of the graph in LTH position can be a sign of risk-off behavior, in accordance with the bearish sentiment of the first graph. The persistence of the sale of LTH, albeit at a reduced pace, hinted with a lack of trust in the immediate recovery of Bitcoin.

This trend also supported the return from sentiment to levels of September 2024 and strengthened a cautious market forecast. While Bitcoin is struggling to regain an upward momentum, investor behavior will continue to reflect hesitation and uncertainty about its future trajectory.