- The next major demand zone for Bitcoin was around $56,000.

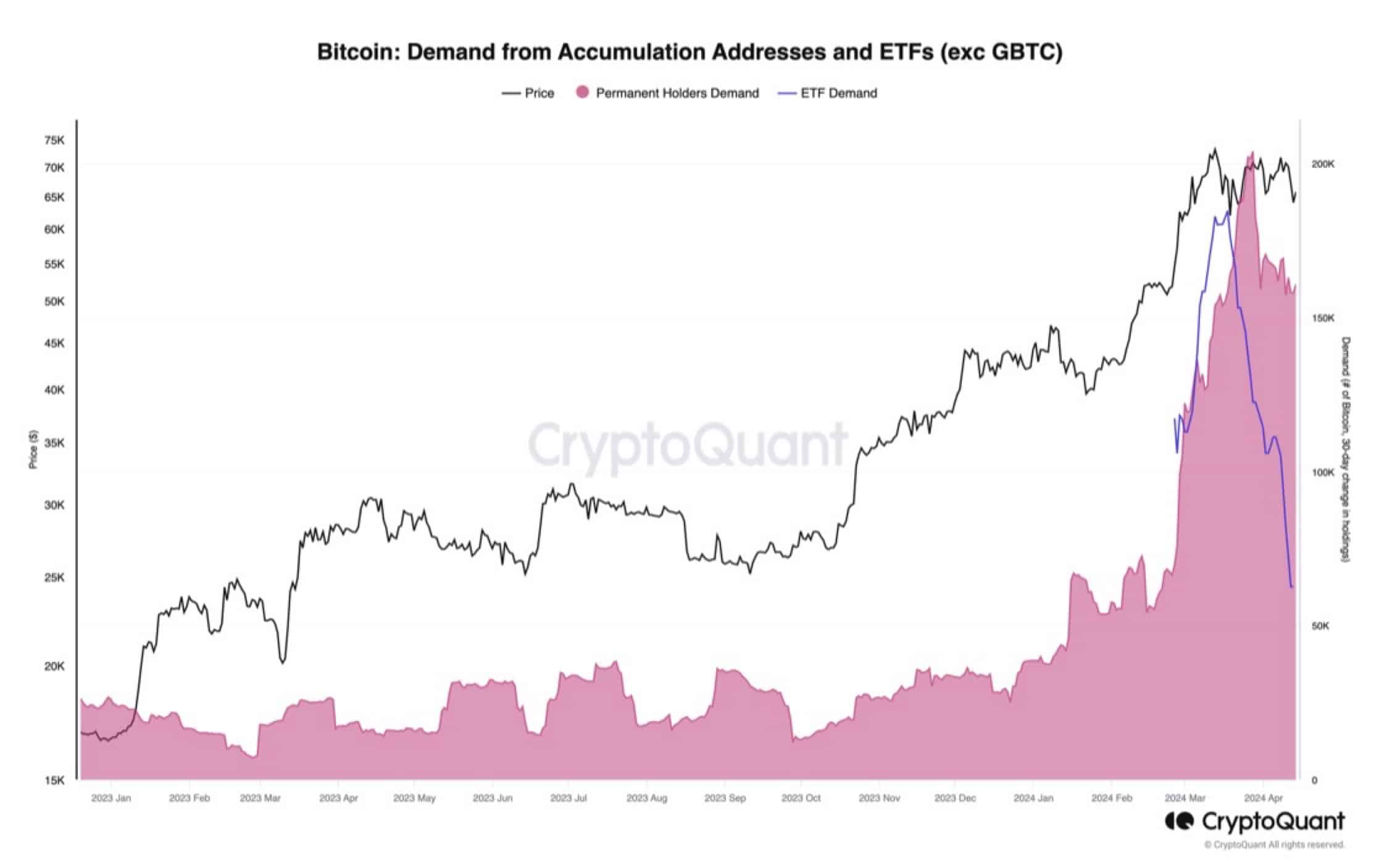

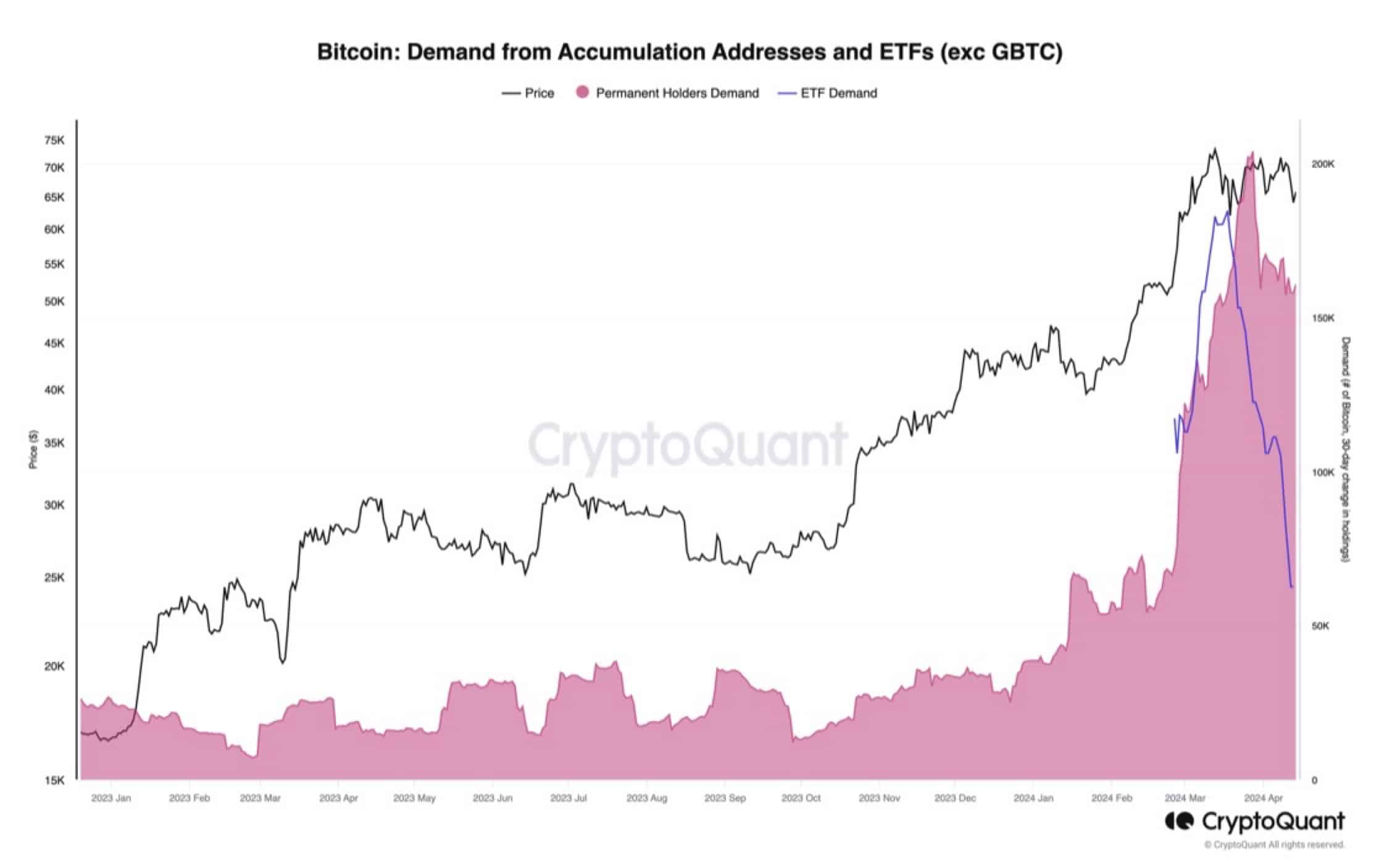

- Demand slowed, both from new ETFs and existing holders.

Bitcoin [BTC] continued to sell, falling more than 4% in the past 24 hours to trade in the $62,000 zone, according to CoinMarketCap. Trading volumes increased by almost 5% to $45 billion in the period, indicating high speculation from market participants.

Will the recession continue?

Interestingly, the latest dip came from an area of ”high demand,” according to an analytics firm in the chain InTheBlok. History showed that more than a million wallets had purchased BTC at an average price of $64,300, indicating that it served as a strong support.

But now that the bears have been able to break through this support, the next key demand zone was around $56,000. This meant that if accumulation does not gain momentum, BTC was at risk of plunging to the aforementioned level.

Was Bitcoin bought or…?

Well, a few smart investors used the downsides of the market to load their Bitcoin bags.

According to on-chain tracker Look at chain, a whale bought a whopping 244 Bitcoins in the last two days, worth a whopping $15 million at the time of writing. The wealthy player has acquired around 915 Bitcoins since December 2023, additional data shows.

But was there a broader market accumulation trend?

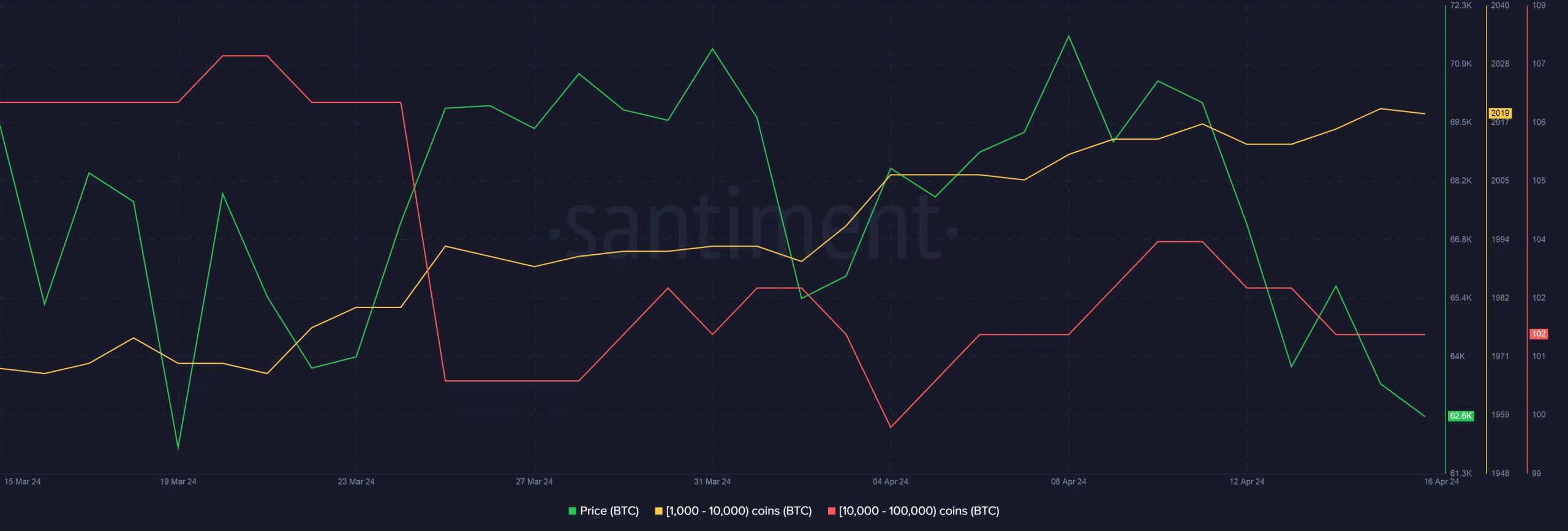

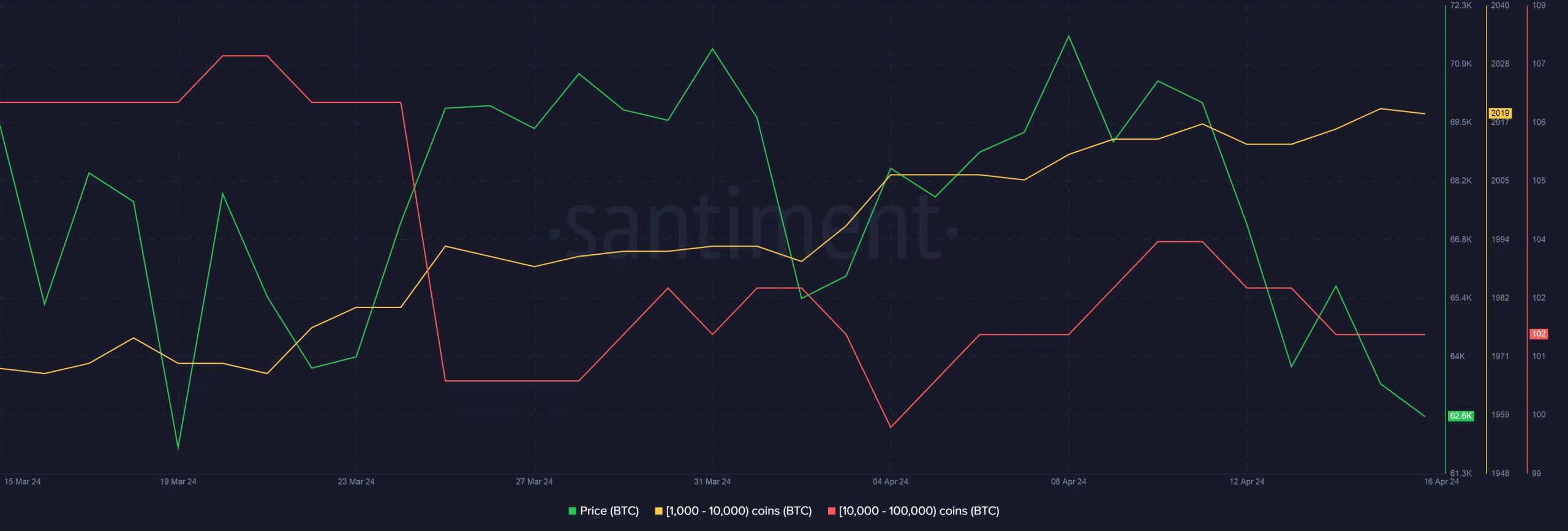

According to AMBCrypto’s analysis of Santiment’s data, there was a lack of urgency among whale cohorts to stock up on Bitcoins.

While portfolios holding between 1,000 and 10,000 coins showed little increase, the cohort holding 10,000 to 100,000 coins liquidated their holdings over the course of the week.

Source: Santiment

These findings were confirmed by Julio Moreno, head of research at CryptoQuant. Using data, he showed how demand for Bitcoin has slowed, both from new exchange-traded funds (ETFs) and existing holders.

Source: CryptoQuant

Is your portfolio green? Check out the BTC profit calculator

Derivatives markets are still bullish on BTC

These alarming developments raised concerns about further downsides to Bitcoin’s price in the coming days.

Interestingly, speculative traders did not believe this story. According to AMBCrypto’s analysis of Coinglass’s data, the Long/short ratio was still above 1, implying that the majority of futures traders were hopeful of a recovery.