Este Artículo También Está Disponible and Español.

In a message shared on X with his 700,000 followers, market veteran Cryptto₿irb (@Crypto_Birb) outlined which he believes that one of the last large Bitcoin pullbacks could be for a final increase in a price objective of six digits. In his own words: “BTC Dips dips for $ 273k? This is the reason: ‘He back up this claim with a series of concise bullet points about market trends, technical signals and historical data.

Last chance to buy Bitcoin cheaply?

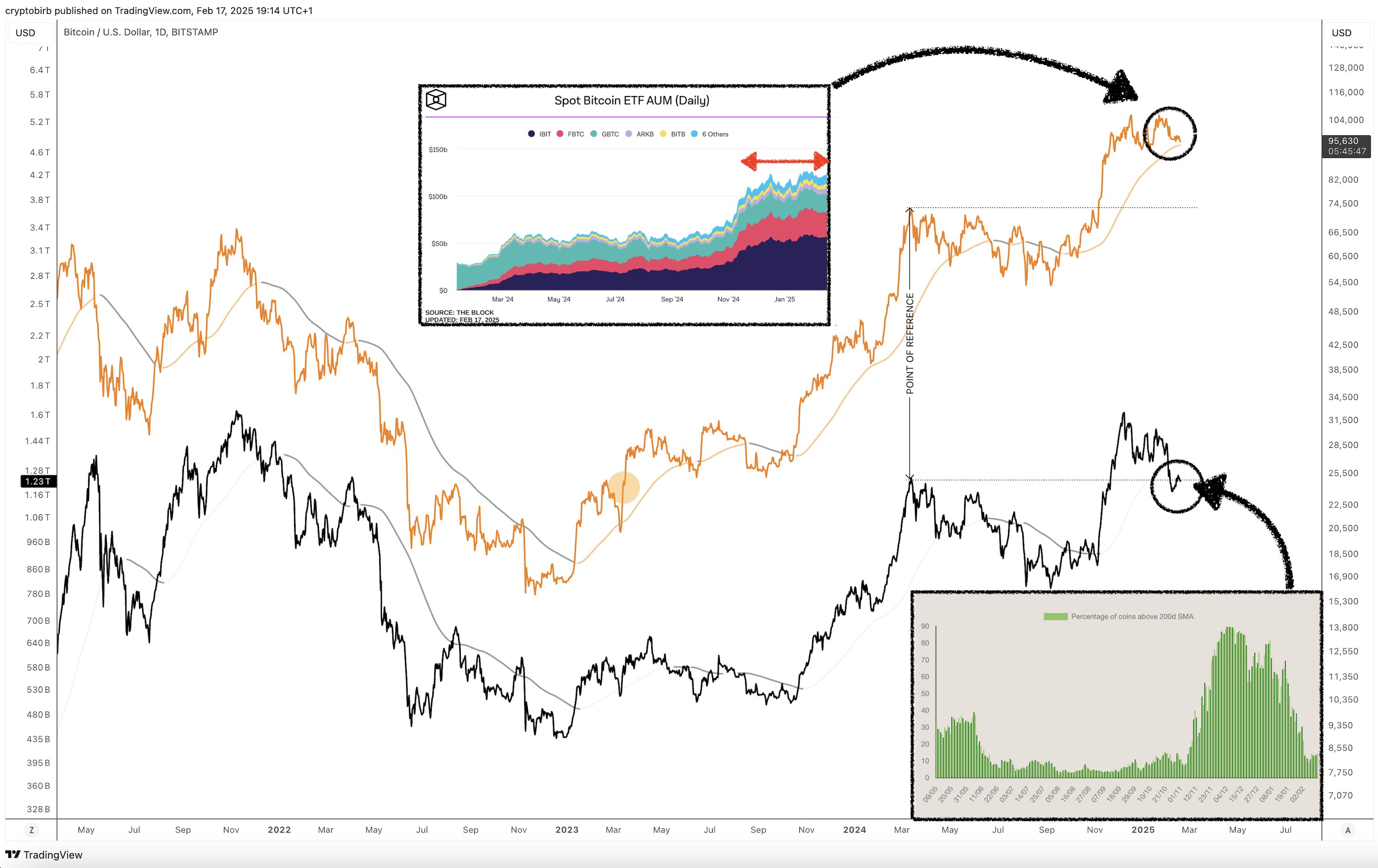

Crypto₿irb’s analysis Starts with a description of the “Bull Market” environment and notes that both the 200 -week and 50 -week progressing averages are rising. These long -term trends often reflect a wider shift in market sentiment.

He also refers to the latest data on Bitcoin-listed funds, pointing to total assets in control (AUM) of $ 121 billion, in addition to a substantial trade volume of $ 746 billion. Another important metric that is emphasized is the net not -realized profit and loss (NUPL), which he places at 0.54, which suggests that more traders have a profit than with losses. He observes a correlation of seven weeks with the S&P 500 at 0.25, which only indicates a moderate coupling between Bitcoin and the traditional stock market in that period.

Related lecture

The analyst then deals with the “Daily Trend”, indicating that he sees Bitcoin for the time being within a range of $ 90,000 to $ 110,000 oscillate. He is the 200-day simple advancing average at around $ 80,200 and emphasizes that this figure is up. Cryptto₿irb also explains that its own 200-day BPRO indicator is around $ 94,400, which he regards as a different sign of strengthening the momentum, despite a 50-day RSI at 42. A RSI under 50 often points At the cooled market momentum, but it is still noted that the volatility is currently crushing, with an average where there is $ 3,360 that suggests that price fluctuations are softened compared to previous periods.

Turning to his ‘trade arrangement’, Cryptto₿ IRB emphasizes that he sees certain bearish configurations on his 12-hour BPRO CTF and HTF trailer indicators. He describes market conditions as jerky, with resistance that appears around the range of $ 99,700 to $ 103,100. This means that if Bitcoin fails to break above that resistance level, the activities in the short term or lateral activity can continue until buyers regain control.

Regarding ‘Sentiment & Miners’, the analyst points to a lecture by Fear & Greed Index of 51, a level that is considered neutral. He notes that fear usually peaks just before the key outbreak, which implies that the absence of extreme fear can indicate a more persistent climb as soon as resistance zones have been erased. He also classifies the current market cycle phase as ‘faith’, which suggests that investors remain carefully optimistic without the euphoria that often signals large tops. Another crucial factor is the profitability of miners, of which he estimates that it remains healthy above $ 88,400, a threshold that can discourage excessive sale of miners and help strengthen the price floors.

Related lecture

His commentary on “seasonal” underlines the historical version of Bitcoin. He notes that February has seen an average profit of 15.85% with a positive return in seven out of ten years. In general, the first quarters tend to deliver approximately an average profit of 25%. From 2010 to 2024, the return of Bitcoin is approximately 145%on an annual basis, which reflects the impressive growth in the long term that has characterized its history. Crypto₿irb encourages traders to “BTFD February -March”, who is short for “buy the dip”, which implies that he expects attractive access points before the market might come together again.

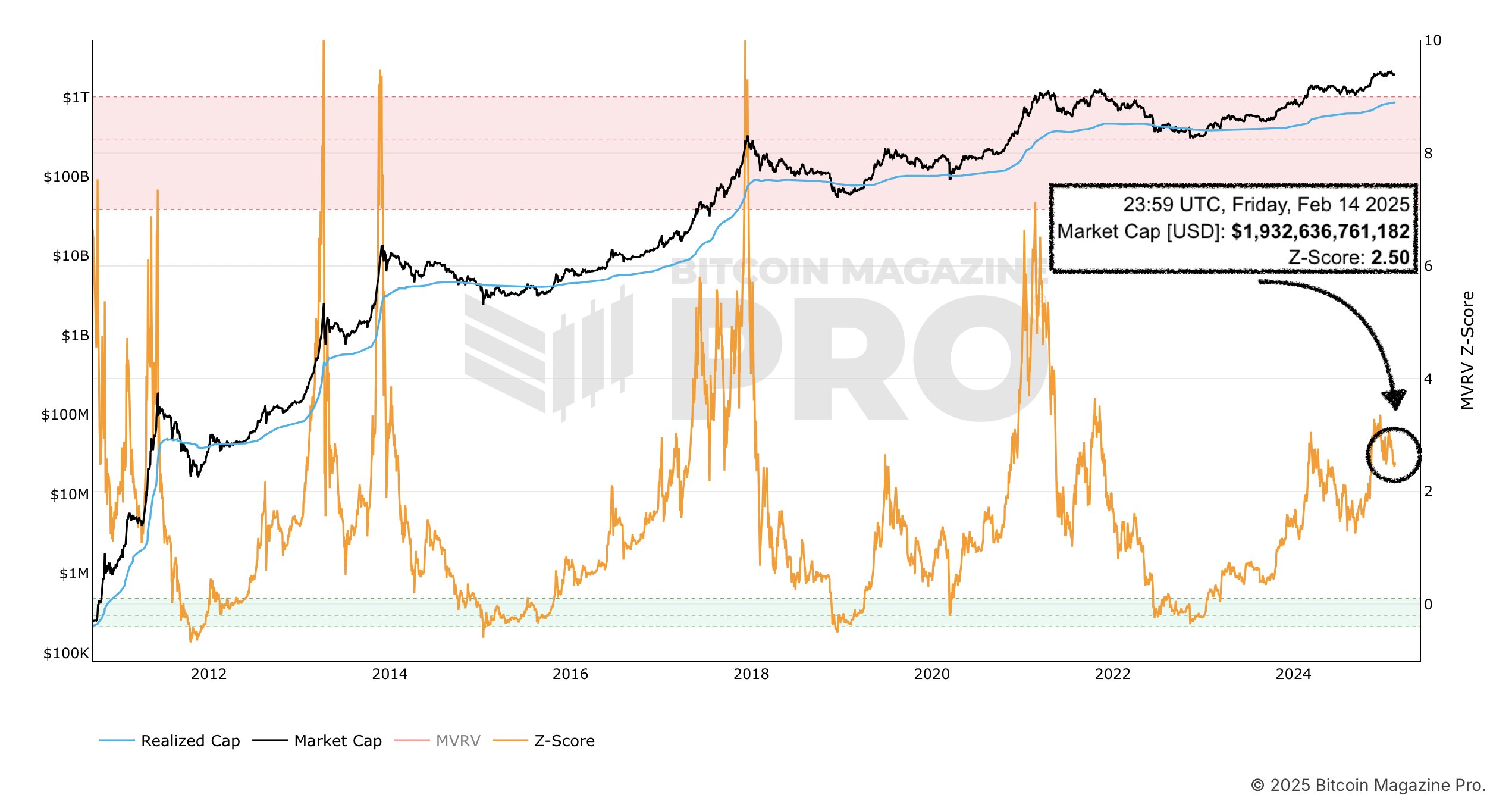

When explaining the ‘macro-top’ he looks at the MVRV Z-score, a metric that compares the market value with realized value. He warns that an MVRV Z-score above 7.0 traditionally indicates an overheated market. Currently at 2.43 the score remains far below that danger zone, which means that it projects a possible peak above $ 273,000 (2.88 times from $ 95.3k).

He explains: “Bitcoin will start forming more than $ 273k+. According to MVRV Z-score, the market only peaked when MVRV pushed and remained above 7.0 for weeks (2.8x from $ 97.5k). It is the pre-rich phase. “

At the time of the press, BTC traded at $ 95,553.

Featured image made with dall.e, graph of tradingview.com