- Bitcoin is down almost 3% after climbing to a local high of $69.4k.

- The Bitcoin dominance and liquidity charts contain clues about the next price movement.

Bitcoin [BTC] reached the $69k resistance zone. An earlier report highlighted that the liquidity pool at this level was likely to pick up prices before a potential bearish reversal occurred.

In the last 24 trading hours, BTC reached $69.4k and fell 2.7% to trade at $67.5k at the time of writing. The metrics were short-term bearish earlier this week. Monday’s trading session could set the trend for the following week.

Potential scenarios for Bitcoin this week

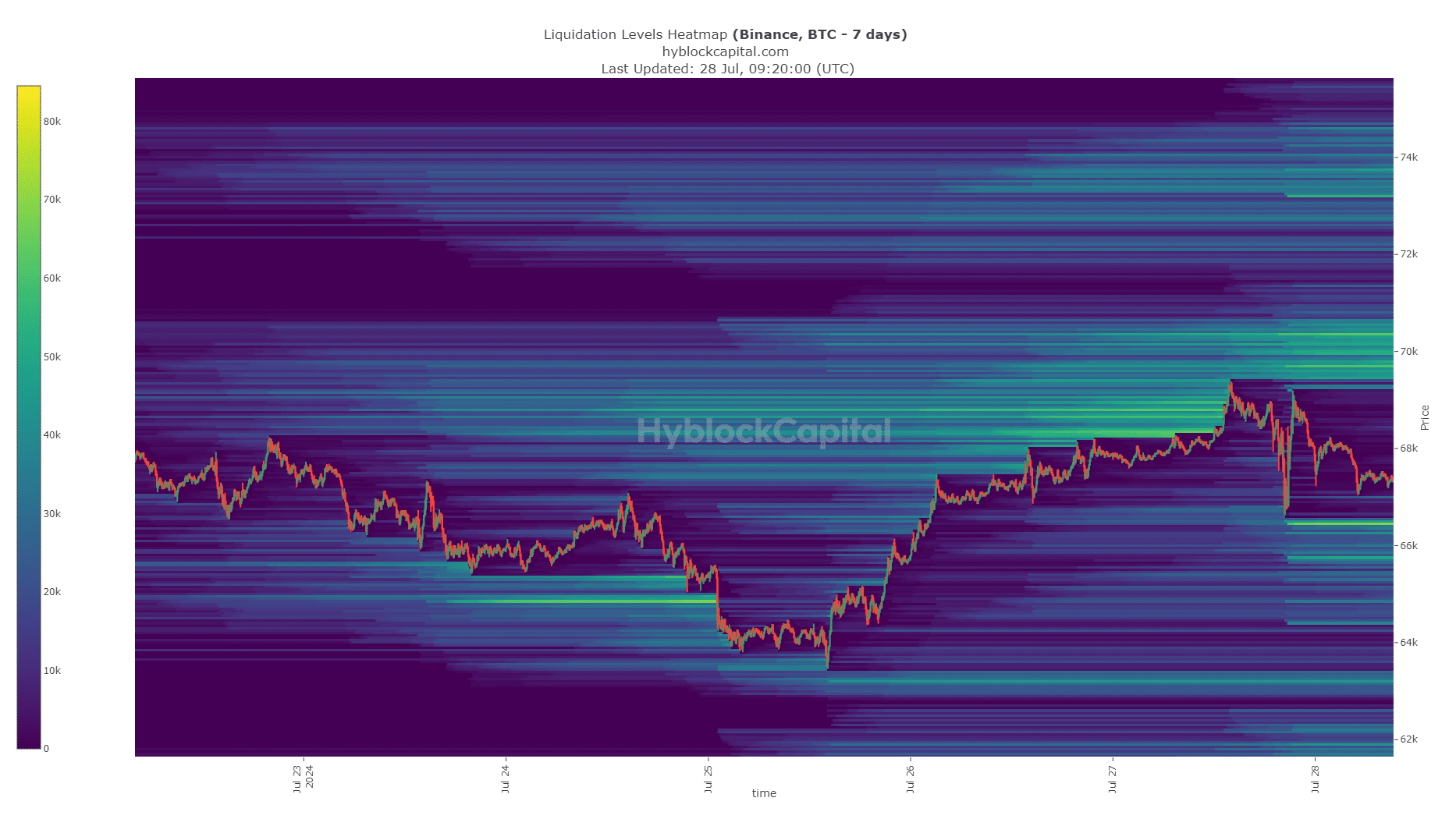

AMBCrypto analyzed the 7-day lookback period on the liquidation heatmap. A cluster of liquidation levels was present around the $70k level and at the $66.4k level.

In the last few hours, the price reversal from the $69,000 zone has added to the liquidity pool of around $70,000.

This makes it an interesting price target for Bitcoin on Monday. A move towards the $70,000 area to clear liquidity and create hope among the bulls before a reversal could occur.

This price increase could precede a dip to the $66.4k level. A move past either level would likely signal whether this week would be bullish or bearish.

Clues from the Dominance Chart

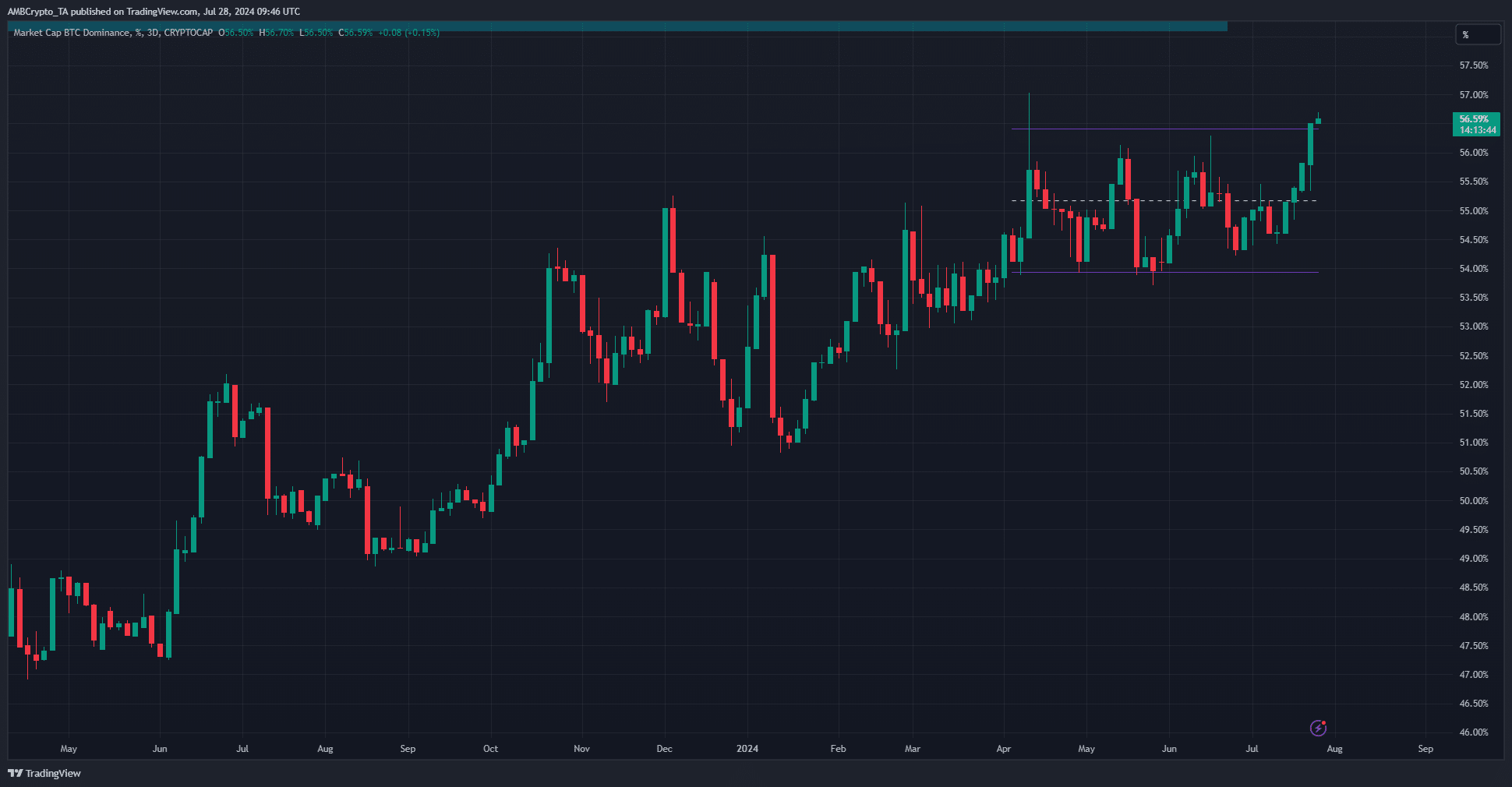

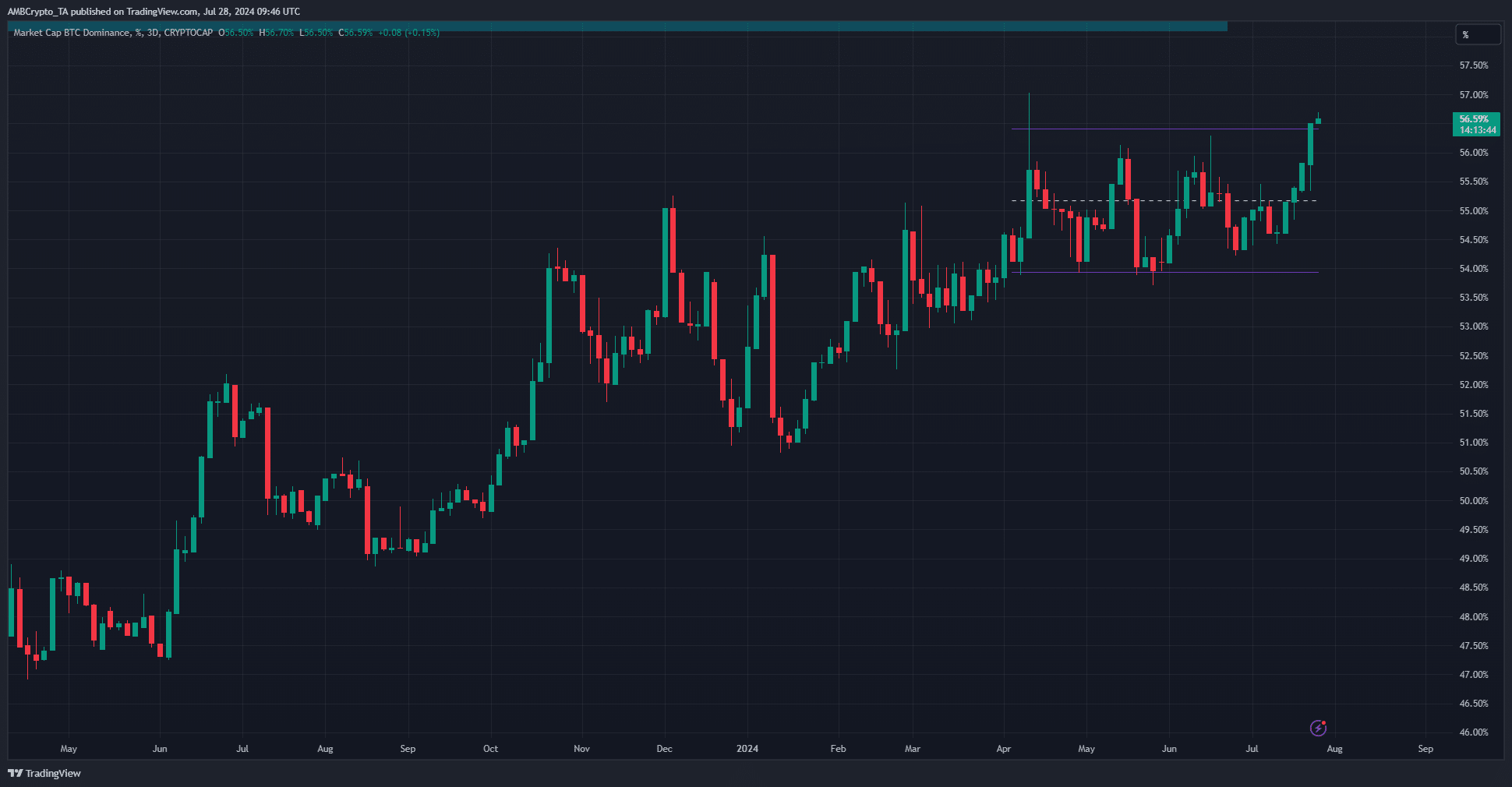

Source: BTC.D on TradingView

The Bitcoin Dominance chart showed a break above the range highs. This meant that Bitcoin outperformed the major altcoins. In the event of a market-wide downturn, altcoins would suffer disproportionately.

Traders can use this information to decide which assets to trade, based on Monday’s guidance.

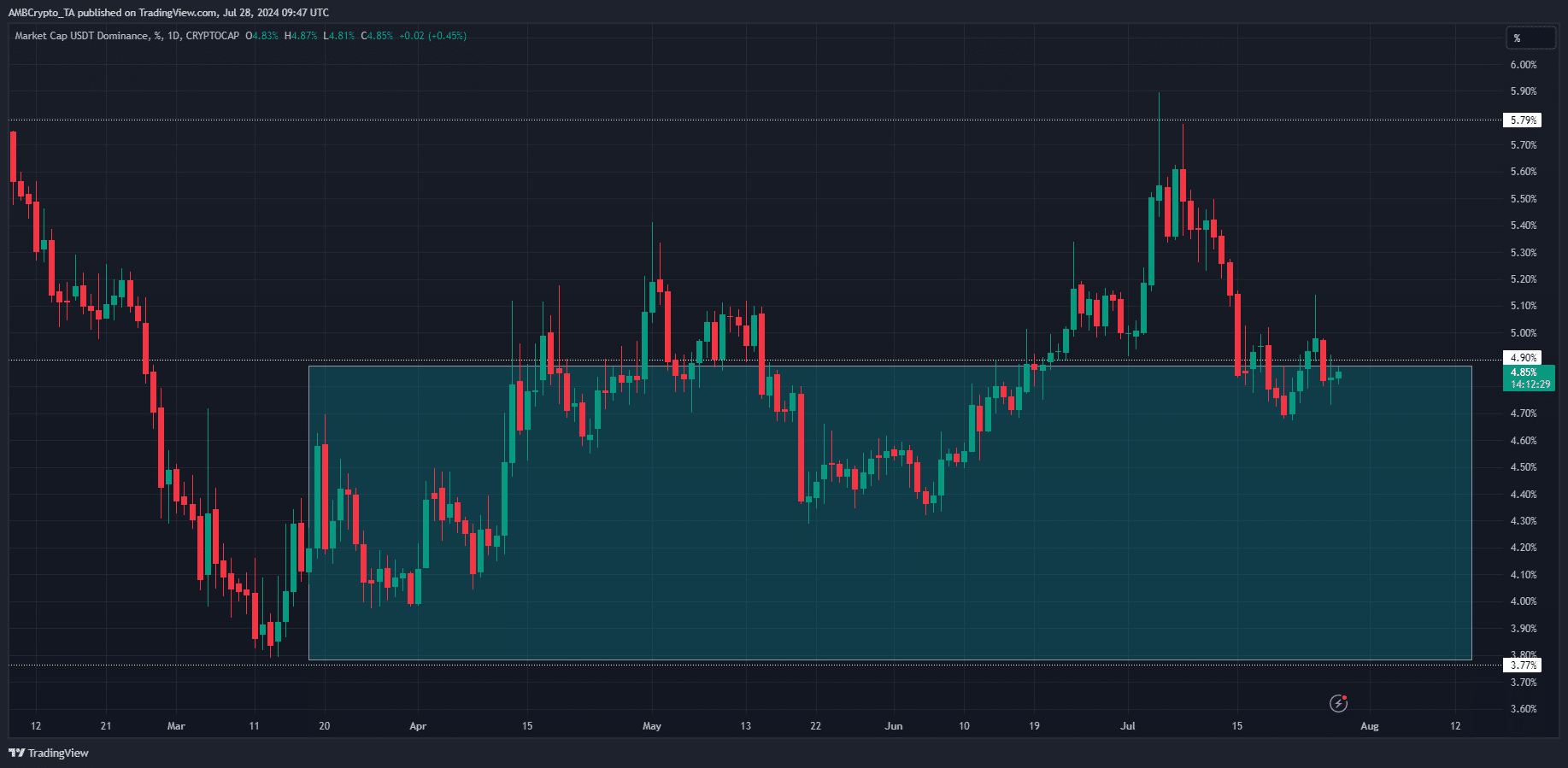

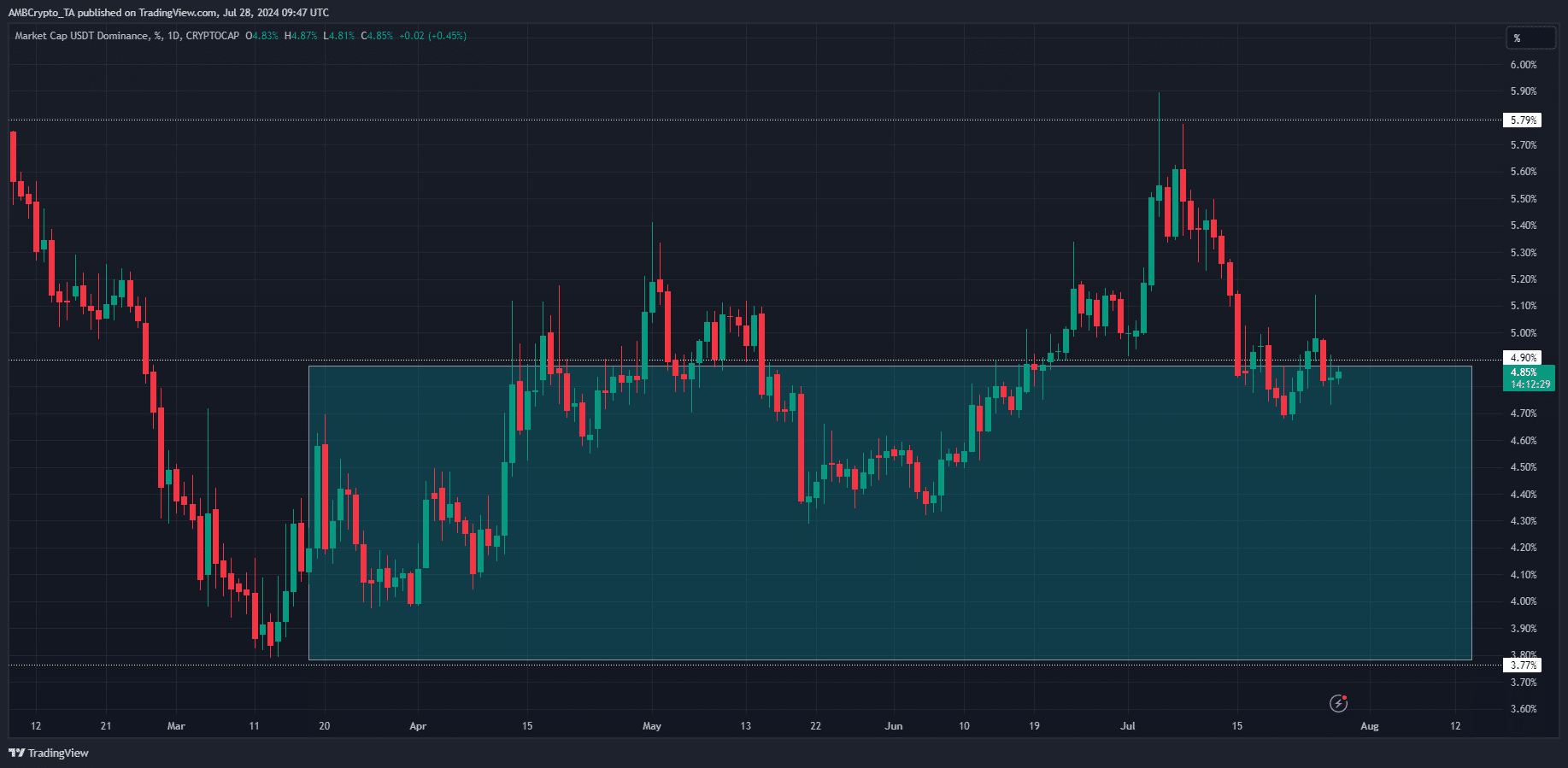

Source: USDT.D on TradingView

The Tether Dominance chart is inversely related to the price movements in the crypto market. When USDT.D rises, it is a sign that investors are switching to stablecoins and selling their crypto.

Read Bitcoin’s [BTC] Price forecast 2024-25

Based on the Tether Dominance trend, there could be a downward move this week. Traders can keep a close eye on Monday’s performance and structure their directional preference accordingly.

Over the past month, the USDT.D move on Monday has generally set the tone for the week ahead.