- The CEO of Into The Cryptoverse predicts Bitcoin’s future price movements.

- Increasing greed warrants caution.

As the highly anticipated month of ‘Uptober’ comes to an end, everyone has only one question: what’s next Bitcoin [BTC]?

Well, Benjamin Cowen, CEO and founder of Into The Cryptoverse, seems to have the answer. In his last videothe director emphasized the importance of the last week of the month and stated:

“This week that we’re entering, I think, will be the decision week for Bitcoin’s path for the remainder of the fourth quarter.”

Down or Up: Where Is Bitcoin Going?

Cowen explained that the king coin is at a crossroads between the cyclical view and the monetary policy view.

Historically, BTC has performed strongly in the fourth quarter of its half-lives.

Barring unfavorable macroeconomic factors, the former trend could push prices higher in the fourth quarter of 2024. Therefore, if the coin can break the $70,000 barrier with continued momentum, the cyclical outlook will become stronger.

Conversely, if Bitcoin falls near $70,000 and falls back to $64,000, the monetary policy outlook could prevail.

This perspective is consistent with previous patterns where BTC fell after reaching peaks in April and August. This scenario therefore points to a temporary pullback, with the next significant rally likely to be postponed until early 2025.

Upcoming labor market report: a decisive factor?

But what will determine the fate of the king’s coin? The answer is quite simple. The CEO underlined that labor market data could likely determine short-term direction.

Interestingly enough, AMBCrypto noted that in the past, weaker jobs reports – indicating fewer jobs added – have often led to Bitcoin rallies.

For example, after the April jobs report in early May, it saw a 6% increase as the labor market deteriorated. Conversely, stronger jobs reports in June and July correlated with BTC price declines. So if this pattern holds true, the upcoming report would prove crucial for BTC’s prospects.

In addition to price action, Cowen highlighted that Bitcoin’s market dominance was approaching a critical 60% threshold. This milestone in dominance was a sign of its growing influence and could lead to market-wide adjustments.

BTC’s greed is increasing

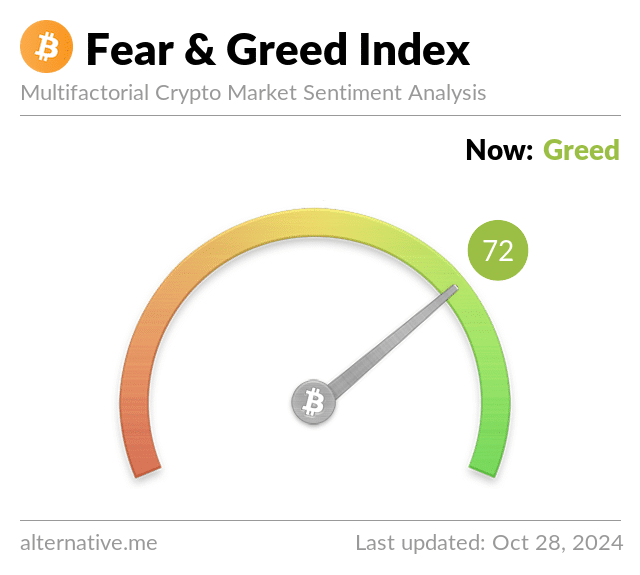

Complementing the heightened anticipation, Bitcoin’s Fear and Greed Index was recorded at 72, at the time of writing.

Source: Alternative.me

It’s worth noting that elevated greed levels often indicate that many investors expect continued price gains, reinforcing bullish sentiment.

Yet this also raises concerns about a potential overheating of the market, especially if external factors such as regulatory developments or economic data shift sentiment and lead to a sell-off.

What does the liquidation heatmap say?

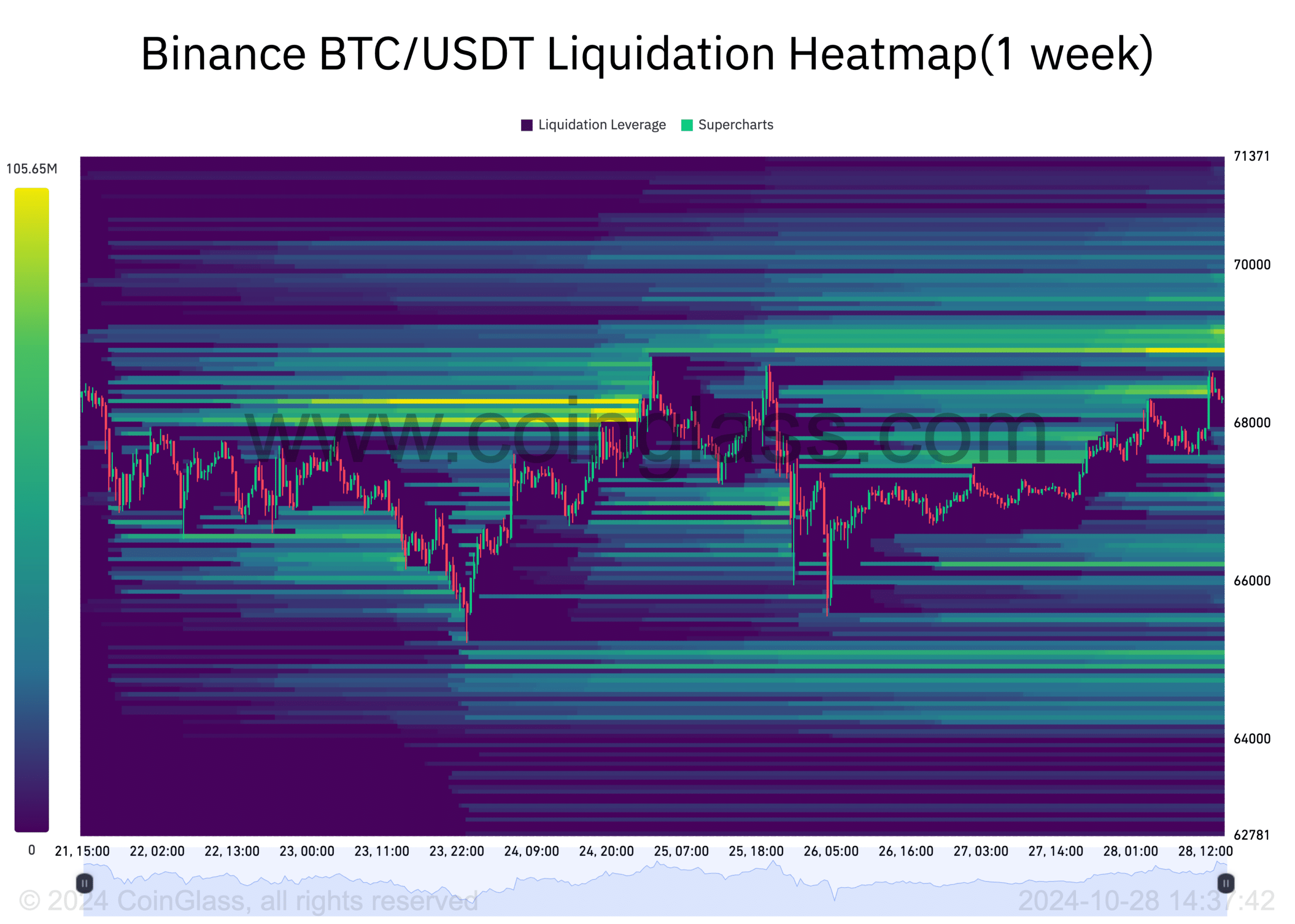

To further investigate BTC’s potential short-term path, AMBCrypto analyzed the one-week period liquidation heatmap from Coinglass.

The heatmap revealed a strong liquidity cluster around $68,900. In the short term, there may therefore probably be a movement towards this magnetic zone.

Source: Coinglass

At this level, the coin faces the possibility of a rejection or a breakout, all of which will impact the broader market.

Read Bitcoin’s [BTC] Price forecast 2024–2025

Furthermore, AMBCrypto’s observations indicated an impending supply shock. This could set the stage for significant upward price movement, favoring the latter possibility.