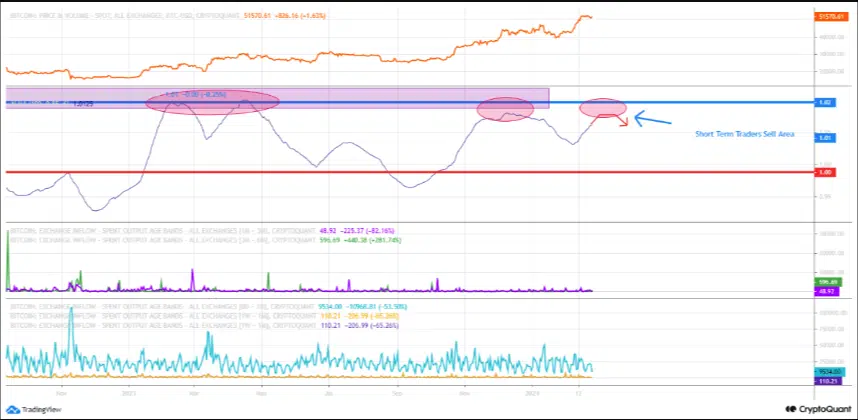

- The STH-SOPR surpassed a reading of 1, indicating potential short-term profit-taking.

- One analyst noted that Bitcoin could reach $58,000, but the retracement could be shocking.

Whether it’s good or bad news for you, Bitcoin’s [BTC] The correction is getting closer than you think. However, there is one major problem with the forecast that pits market players against each other.

Will the rapture take place before the having or after?

Interestingly, AMBCrypto came across the view that BTC would correct the pre-halving. Around the same time period, we noticed another analyst saying Bitcoin would surpass its annual high before the event.

One side takes the preliminary round

CryptoOnchain, a pseudonymous author on CryptoQuant, Posted that Bitcoin could fall to $48,000 in the coming days.

The author drew his conclusion based on the Short Term Holder (STH) Spent Output Profit Ratio (SOPR).

The STH-SOPR assesses the behavior of short-term investors by considering output less than 155 days. Values of the STH-SOPR above 1 suggest that investors are selling at a profit.

But when the value is less than 1, it means investors are cashing out at a loss.

However, the above graph showed that the value had risen above 1. This also showed that the SOPR was at a point where the price of Bitcoin has been correcting in recent months.

In addition to the on-chain analysis, CryptoQuant has also investigated the technical angle. Regarding this part, the analyst wrote:

“Bitcoin is approaching sales territory for short-term investors. Examining the technical chart also confirms this problem. Bitcoin is in the area below resistance on the technical chart.”

The other remains with history

Michaël van de Poppe, however, did not share a similar opinion. According to him, Bitcoin’s correction would happen, but not before prices rise to $54,000 or $58,000.

In his point, the analyst also mentioned that the decline could be more difficult, noting that BTC could fall as much as 40,000 after the halving.

Historically, Bitcoin’s price has risen before the halving. After the event, the coin shreds a significant portion of its value before heading to a new high.

AMBCrypto continued to analyze the price action before the last two halvings.

The second halving took place on July 9, 2016. From our observation, BTC climbed to $617 before the event. Later the price dropped.

A similar event occurred during the third halving, when Bitcoin’s price rose to $9,619. Weeks after the event, the price dropped significantly.

Is your portfolio green? Check out the BTC profit calculator

AMBCrypto believes Bitcoin could go either way this time, depending on where capital rotates. If market participants decided to inject liquidity into BTC, the price could rise to $54,000.

However, the rotation towards altcoins could shrink BTC’s value. But at the same time, the presence of institutional money, which was not present in the last two halvings, could change things.