The majority of the last trade week presented an old price action on the Bitcoin (BTC) market that underwent continuing consolidation. While Prime Minister Cryptocurrency registered a price drop on 20 March to reclaim the price zone of $ 87,000, the sales pressure will soon forced a return to less than $ 84,700, which resumed a lateral movement. In the meantime, the Bitcoin price action has created a bullish pattern in recent months that hints on a substantial expansion of the price.

Bitcoin Falling Wedge signals a big rally- How high can BTC fly?

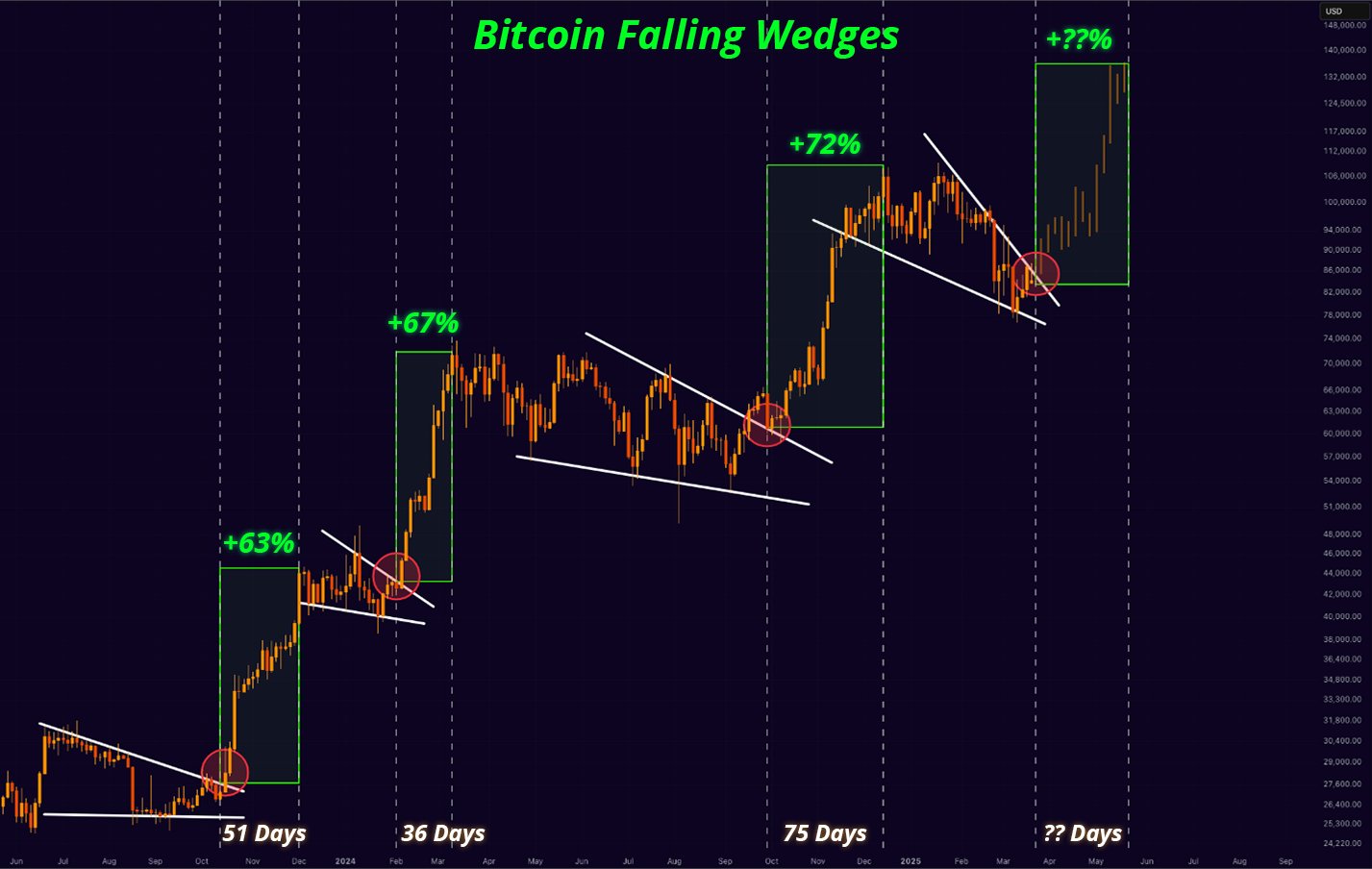

In one Recent Post On X, a digital asset market analyst offered some bullish insights into the Bitcoin market at the username Mister Crypto based on a continuation diagram pattern and historical price data. According to Mister Crypto, the price of Bitcoin seems to be a falling wedge that suggests that a possible price can occur in the event of outbreak. The falling WIG is a well -known bullish pattern in technical analysis formed by two converging trend lines as a result of price action that form lower highlights and lower lows. It usually indicates that Beerarish Momentum is weakened and Bitcoin can start a persistent upward trend after an outbreak of the upper trend line.

Interestingly, Mr. Crypto notes that Bitcoin has consistently experienced strong price collections after previous formations of a falling wedge as indicated in the graph above. In particular, there have been three different cases in the last two years in which the Prime Minister Cryptocurrency has risen on average 54 days, which produces an average profit of 67.5%. Looking at the previous periods and the gradual rise in rise, Bitcoin could rise with an estimated 77% in an confirmed outbreak of the current falling WIG that suggests a strong bullish market in most of the quarter of Q2 2025.

Investors move 10,000 BTC as market confidence rises

In other news, the renowned market analyst Ali Martinez report A continuous increase in Bitcoin Exchange outflows despite current market uncertainty. With the help of data from cryptoquant, Martinez notes that investors have transferred 10,000 BTC with a value of $ 842.9 million from crypto exchanges to personal decentralized portfolios.

This development is strong bullish because it indicates growing market confidence in price evaluation, while investors choose to keep their assets instead of selling.

At the time of trade, Bitcoin acts at $ 84,309, which reflects a price loss of 0.14% in the last 24 hours. In the meantime, the Crypto-Activum flagship drops by 0.39% on the 7-day graph as the consolidation continues. BTC has to break decisively above $ 84,700, avoiding any retirement to confirm any intention of an upward trend. Other immediate resistance, however, will be at $ 86,800 and $ 90,774.