- The rally after the 2024 BTC halving has yet to begin, says Capriole Investments director.

- According to analysts, market dynamics are shifting to a possible upward trend later in 2024.

Bitcoin [BTC] is in its fourth month of range trading and stuck between $60,000 and $71,000. After the incredible performance of 68% gain in the first quarter of 2024, the cryptocurrency has not made any significant gains.

After the halving in the second quarter of 2024, the price has even fallen by 11% and has only recovered 6% so far.

Profits after BTC halving still likely?

Overall, BTC rose 9% since the April halving. However, the digital asset had yet to experience its parabolic rally, which is typical of post-halving events in the past.

This prospects was according to Charles Edwards, founder of crypto hedge fund Capriole Investments.

‘This Bitcoin Cycle Hasn’t Even Started Yet’

Source: X/Charles Edwards

In contrast to the current single-digit gains, BTC has registered a three-digit rally post-halving.

According to the attached chart from Capriole Investments, BTC is up 630% after the 2020 halving. In 2016 and 2012, assets increased by 1,400% and 5,500% respectively.

A similar and serious start to the 2024 parabolic run could begin in September, according to some analysts.

In fact, Coin base and JPMorgan analysts have warned that the recent rally above $67,000 may not be sustainable.

In short, the recent rally might not be the start of the long-awaited post-halving parabolic run.

Demand Whales for Bitcoin Rise

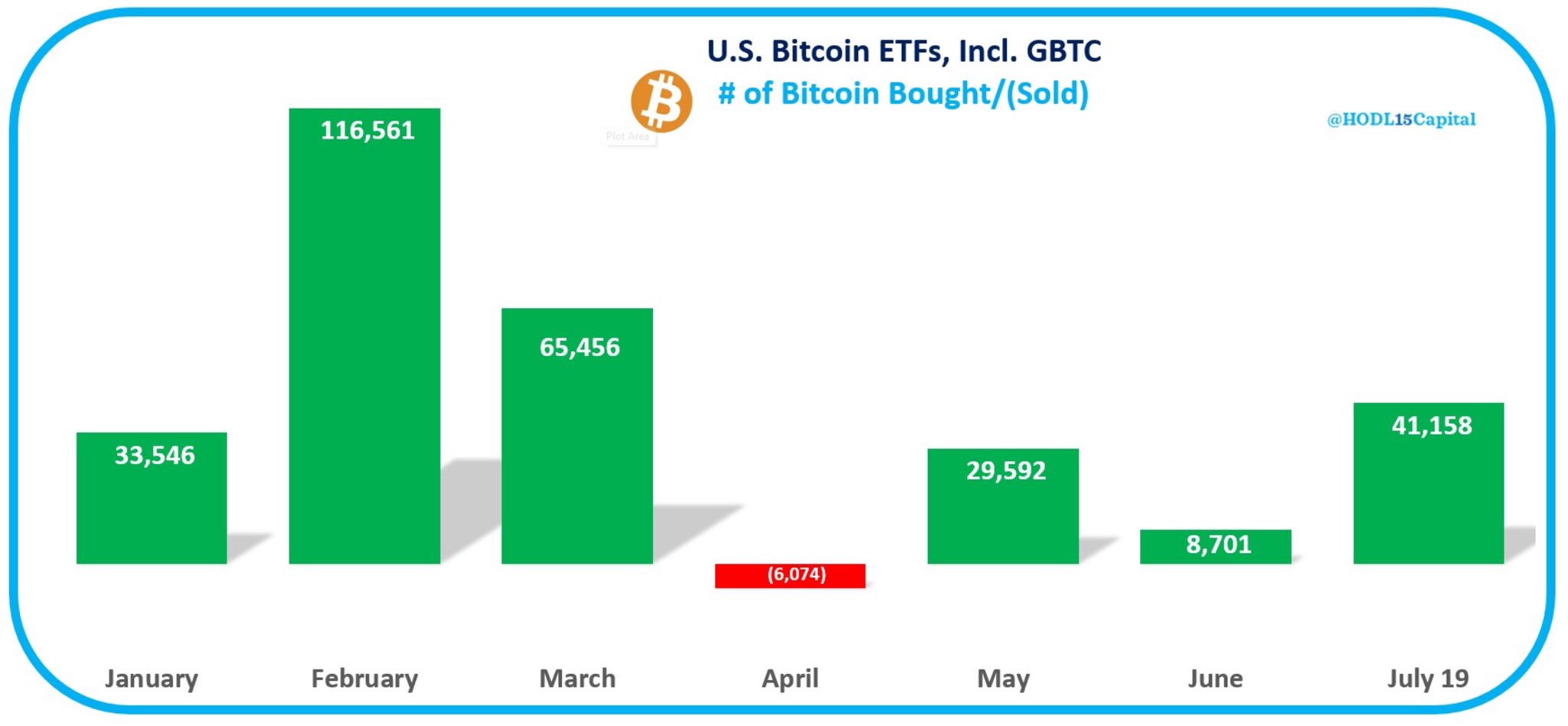

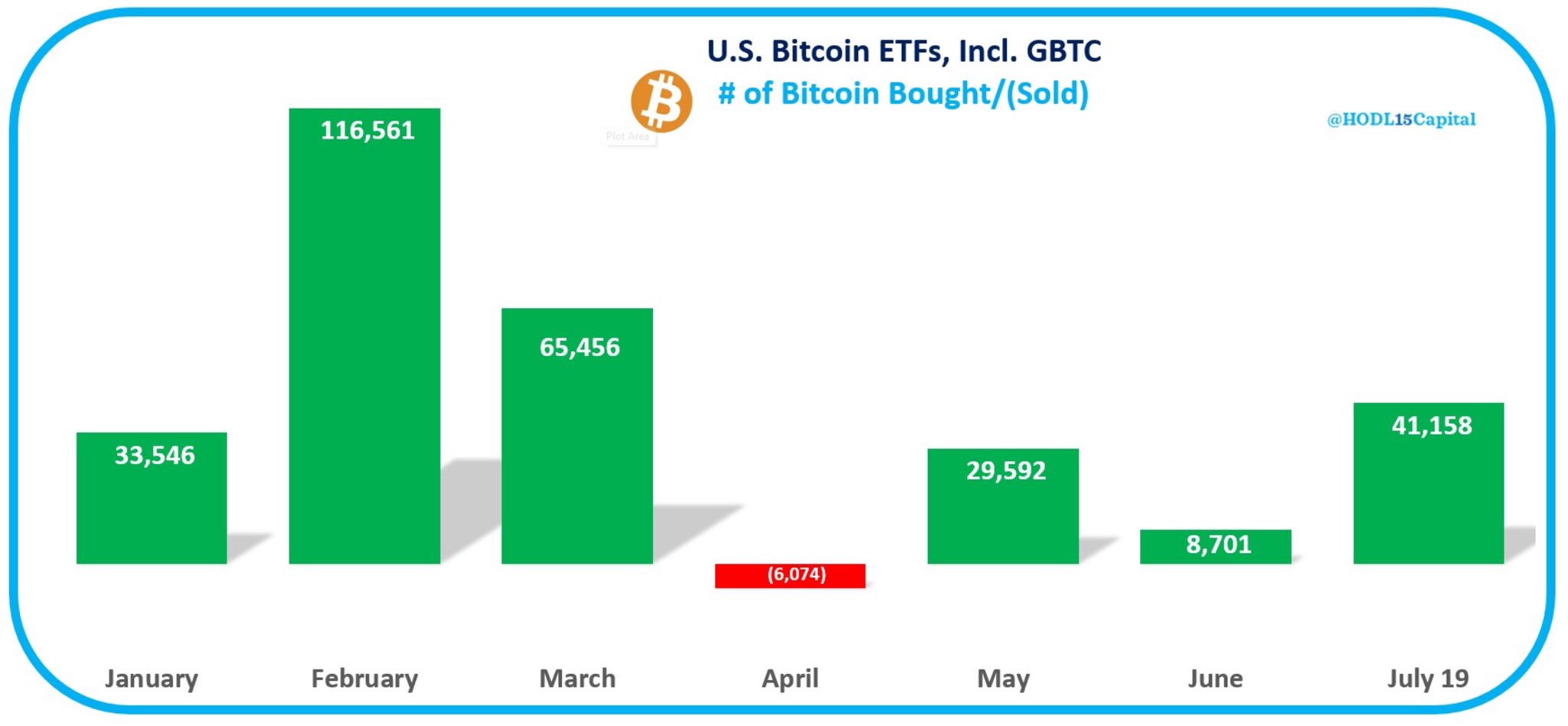

Meanwhile, demand for US spot BTC ETFs has increased. The products collected +41,000 BTC in the first three weeks of July. This accumulation wave, led by BlackRock, has since tipped the YTD (year-to-date). net flows of BTC ETFs will cross the $17 billion mark.

Source: X/HOLD15 Capital

This has also pushed Bitcoin whales to a two-year high. Additionally, BTC’s total short positions on the Chicago Mercantile Exchange (CME) have been significantly reduced.

Commenting on the decline in overall short positions in CME futures, CryptoQuant founder Ki Young Ju said said,

‘The open interest for both long and short positions has increased, but is negative on balance. We are now less negative, similar to the levels seen ten months ago when the BTC price was $27,000.”

This could be another setup for an explosive run for BTC, especially if the supply pressure from Mount Gox is lifted.

In such a likely bullish scenario, market analyst Stockmoney expects Lizards suggested that BTC could reach $90,000 by fall 2024.

Source: X/Stockmoney Lizards