- Bitcoin’s cost basis revealed a stark contrast between long-term holders and recent buyers

- SOPR held the 1.04 level as whale addresses piled on the $105,000 test

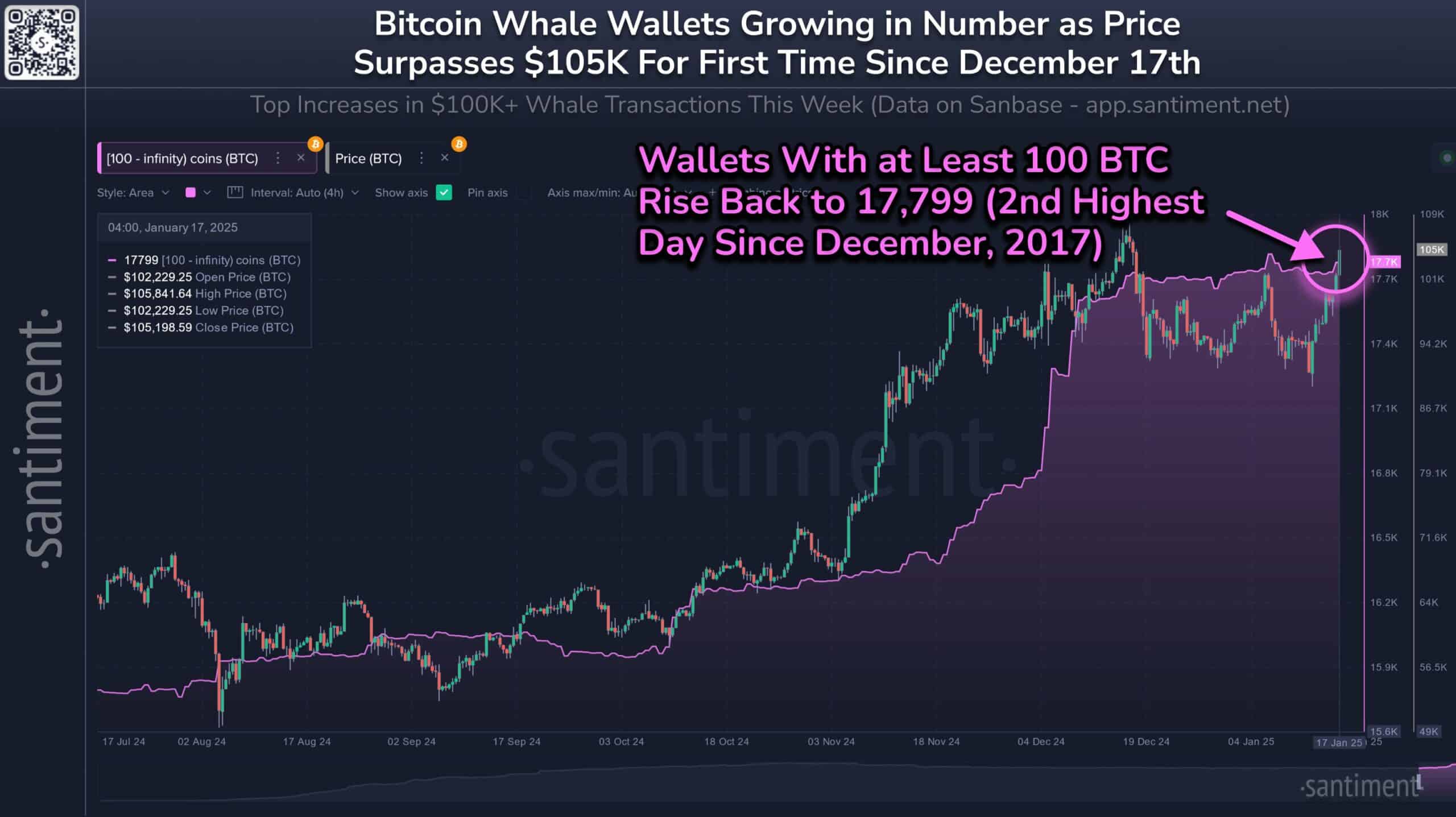

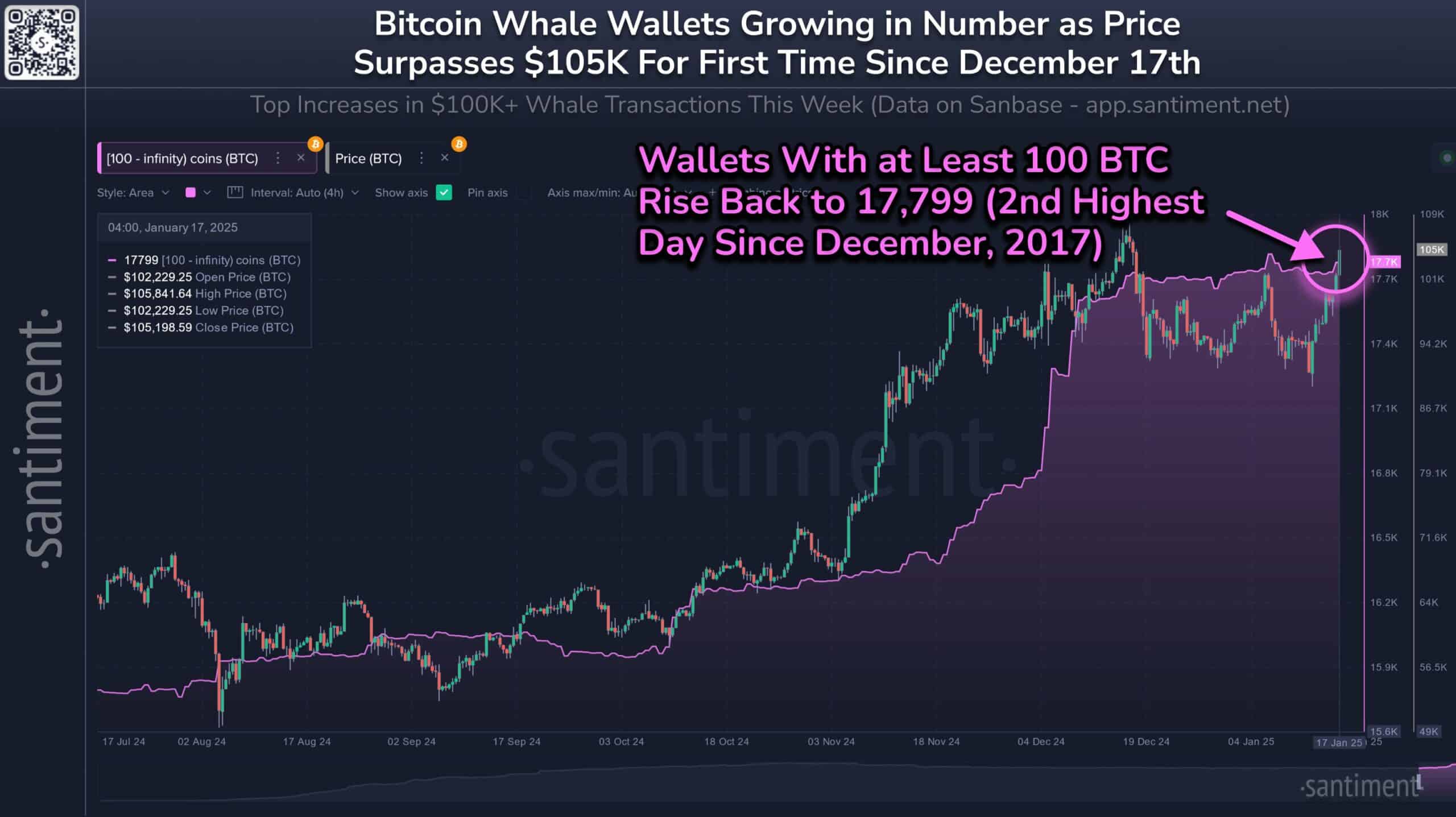

Bitcoin’s market structure has noticed a significant shift after whale addresses reached levels not seen since December 2017. The shift appears to be in line with the crypto’s price action testing the crucial resistance above $105,000.

This institutional positioning comes amid a clear divergence between long-term and short-term holder behavior. The trend also paints a compelling picture of the market’s maturity.

The strategic positioning of Bitcoin whales is intensifying

At the time of writing, the number of addresses Holdings of at least 100 Bitcoins had risen to 17,799 – marking the second highest level since December 2017. This milestone coincided with BTC’s latest rise to $105,841.64 – A sign of strategic accumulation by institutional players.

Source: Santiment

Particularly notable is the steep accumulation pattern that began in October 2024, when there were approximately 16,200 whale addresses – representing a nearly 10% increase in the concentration of large farmers in just three months.

Notably, the acceleration of whale accumulation during the November-December period corresponded with Bitcoin’s continued break above the $90,000 level.

Bitcoin’s market structure indicates maturity

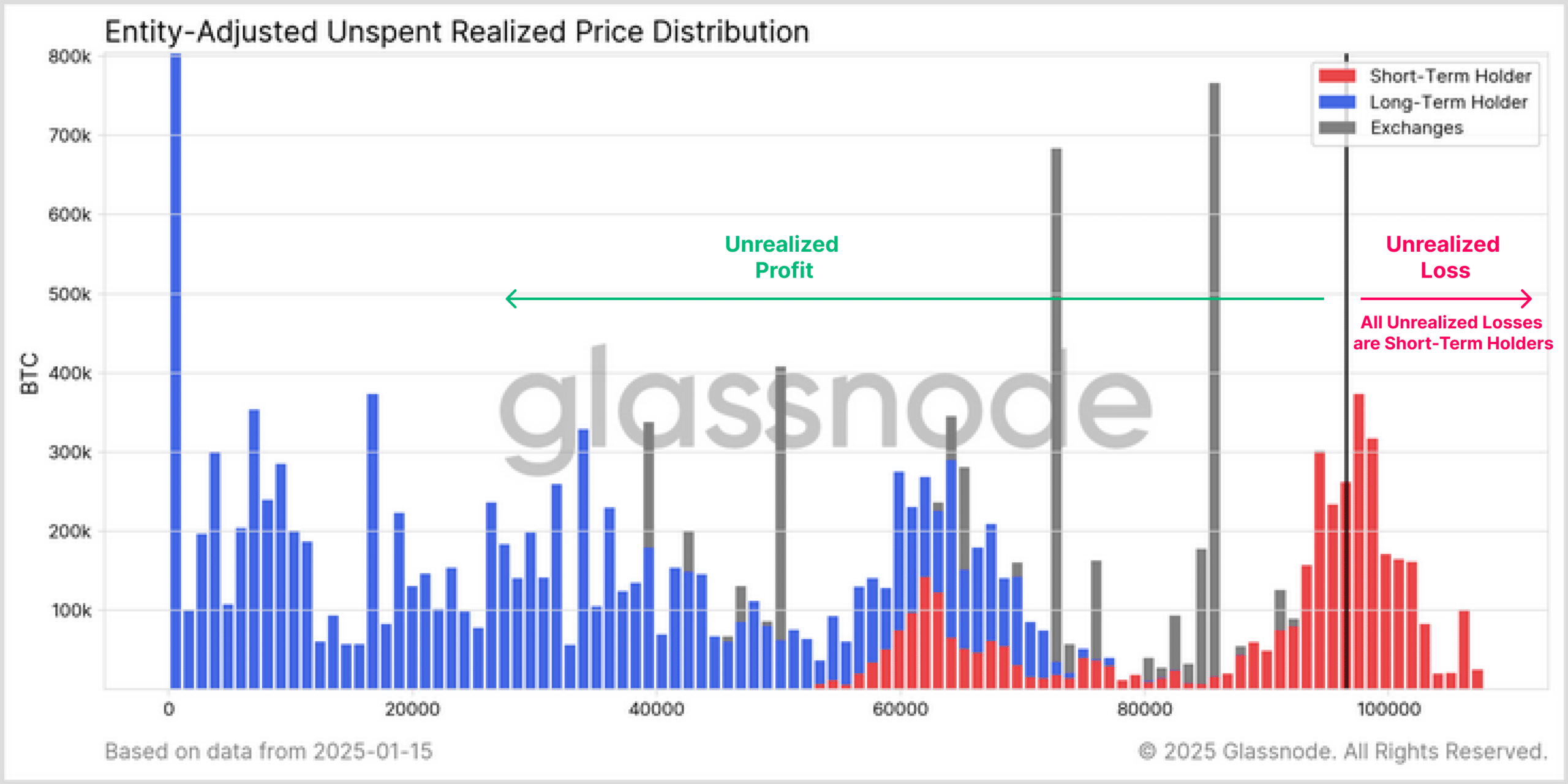

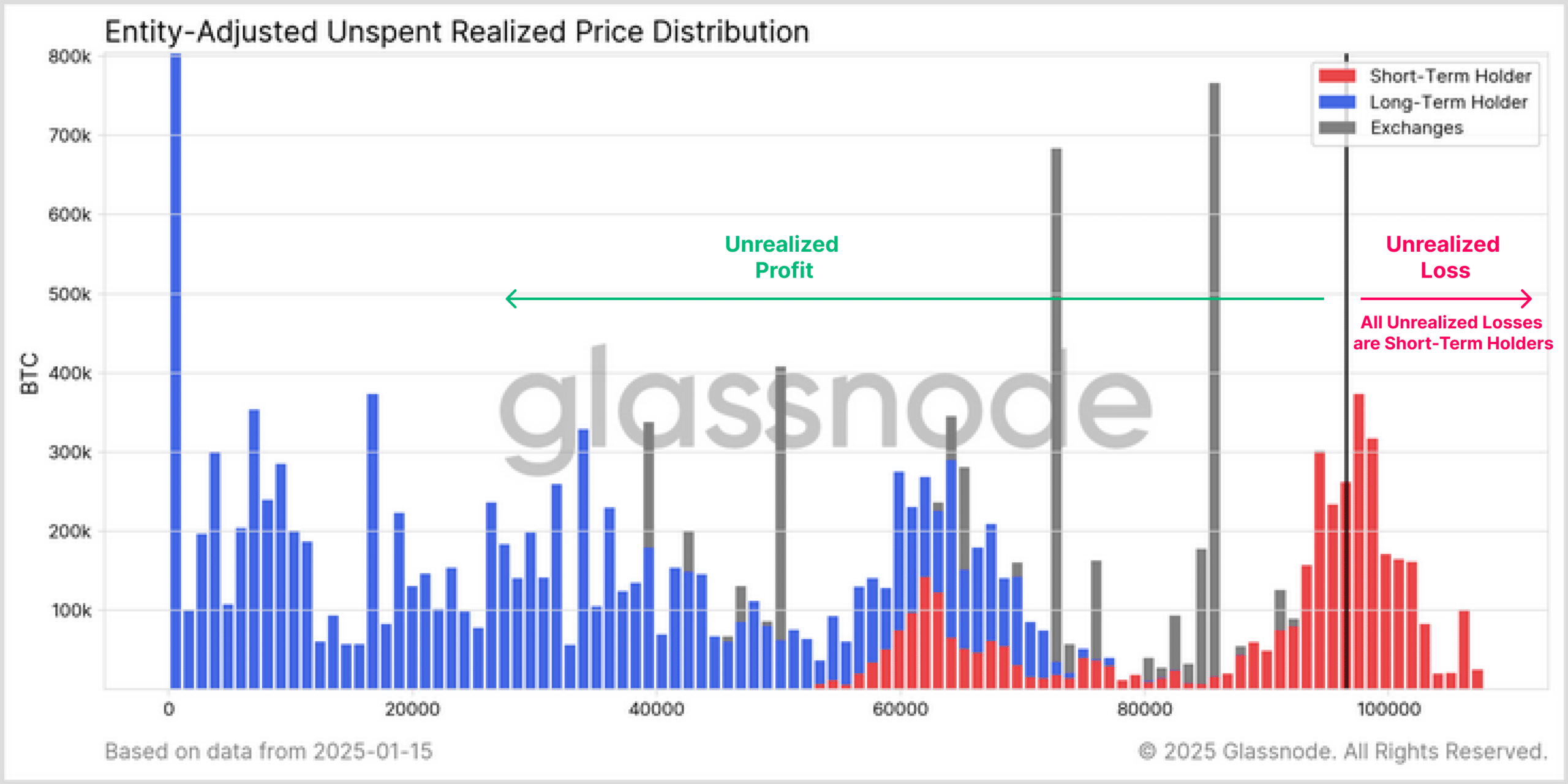

Bitcoin’s cost basis distribution further underscored this bullish narrative and highlighted telling market dynamics.

The facts showed that unrealized losses were concentrated exclusively among short-term holders who had entered positions within the last 155 days. Long-term holders retain significant unrealized gains, with substantial accumulation zones visible in the 20,000-40,000 BTC range.

Source: Glassnode

Most striking seemed to be the contrast between long-term holders’ behavior, as highlighted by the blue bars around lower price levels, and short-term positions highlighted in red at higher prices.

Stock market holdings, shown by gray bars, underlined periodic spikes above 600,000 BTC. This again indicated strategic institutional positioning rather than panic selling.

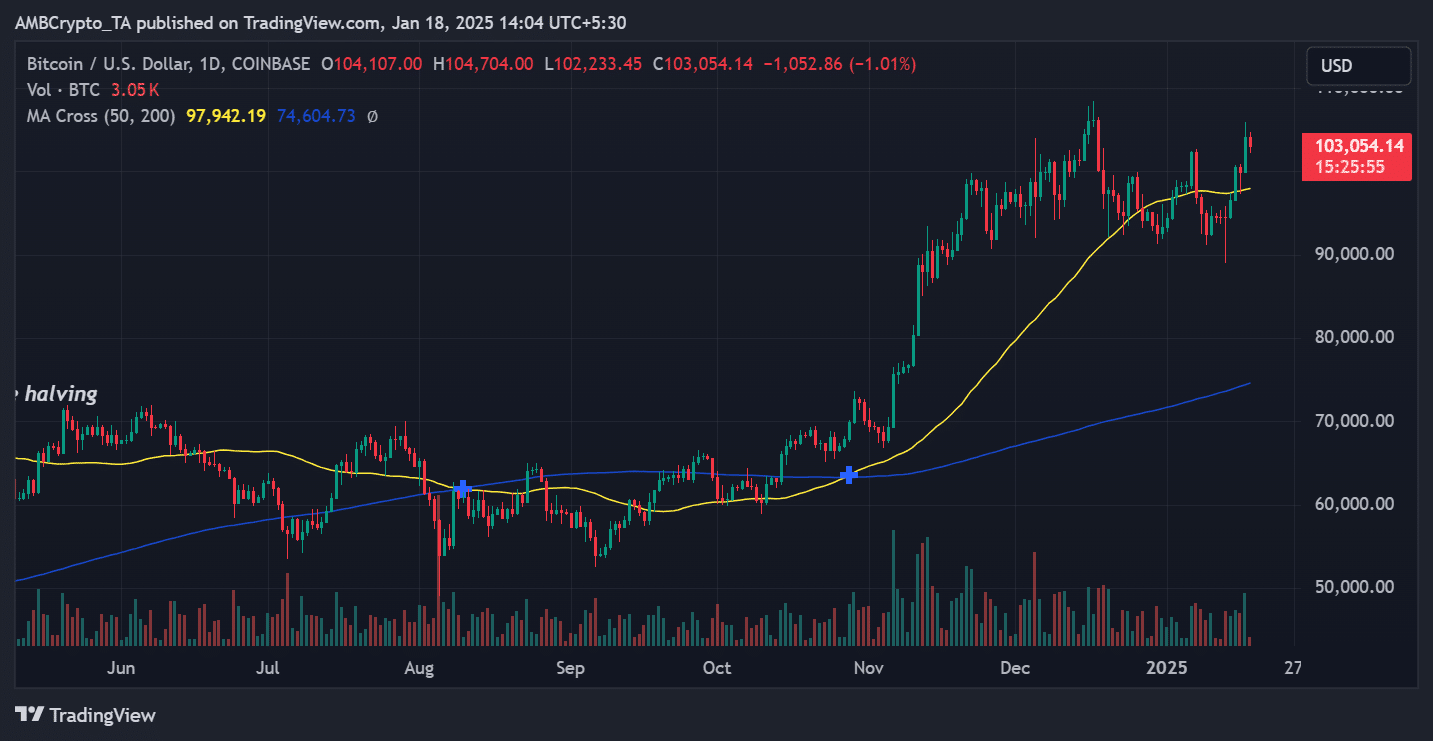

A strong technical foundation supports BTC’s uptrend

Supporting these on-chain metrics, Bitcoin’s price action maintained its bullish momentum on the charts, with the 50-day moving average at $97,942.19 providing dynamic support well above the 200-day MA at $74,604.73.

This significant gap between the moving averages, over $23,000, highlighted strong upside momentum.

Source: TradingView

Recent trading volume of 3,05,000 BTC at $103,054.14 showed continued institutional interest, while the series of higher lows since November provided a robust technical foundation.

The recent pullback from $105,841.64 to press time levels represented healthy consolidation rather than a trend reversal.

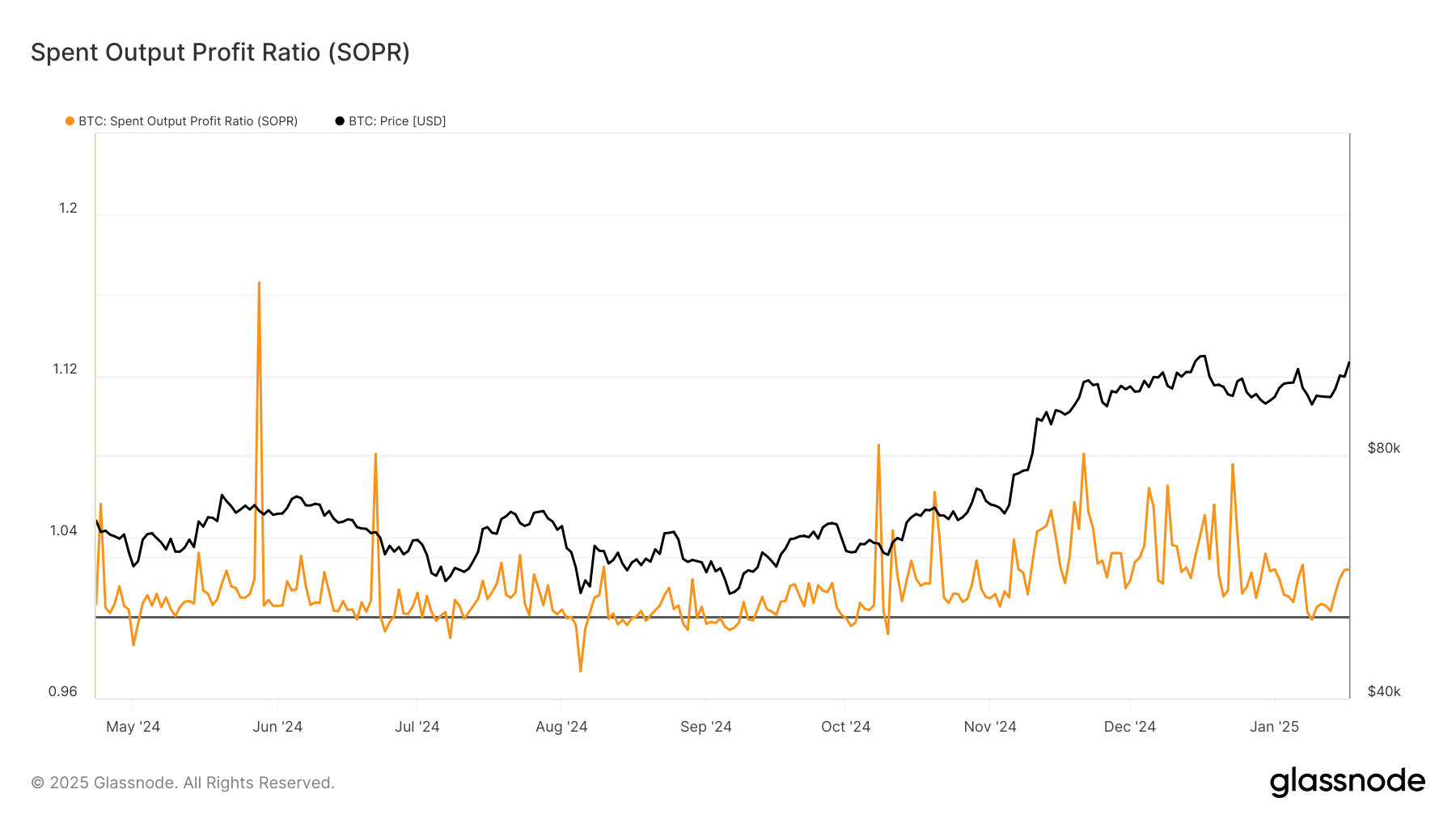

On-chain metrics confirm Bitcoin’s power

The Spend Output Profit Ratio (SOPR) added another layer of confidence and has remained consistently above 1.0 since the strong increase in November. This metric, which hovers around 1.04, indicates that most Bitcoin trades have realized modest gains without triggering massive selloffs.

Source: Glassnode

Finally, exchange mains current patterns showed a calculated distribution approach, where a positive inflow of 308.7 BTC indicated controlled accumulation rather than distribution.

Historical net flow peaks, especially those in December, have preceded significant price movements, indicating strategic positioning by major players.

– Read Bitcoin (BTC) price prediction 2024-25

Looking ahead, Bitcoin’s ability to hold above the psychological $100,000 level as institutional portfolios continue to grow could signal a strengthening of market fundamentals. The convergence of multiple positive indicators – record whale addresses, healthy SOPR levels, strong moving average support and strategic exchange rate flows – suggests that BTC’s market structure remains robust.

However, traders should keep a close eye on the $105,000 resistance level. A decisive break above this threshold could trigger the next important step.