- QCP Capital foresaw a positive outlook for BTC as the options market grew.

- Expected Fed rate cuts could be another positive catalyst, according to crypto exec.

After the recent carnage and massive sell-off, markets appear poised to continue their recovery. Based on options market data, crypto trading firm QCP Capital projects a positive outlook Bitcoin [BTC].

The company wrote this in its periodic update on Thursday declared it was bullish on the largest digital asset as major funds showed huge interest.

“We remain bullish on #BTC as we see significant call buying in the December and March expirations. Large funds also continue to roll over their long call positions in September.’

For those unfamiliar, a rise in long call positions meant that buying speculators expected the underlying asset, BTC, to rise by the expiration dates (September and December).

In short, it outlines bullish sentiment and a likely appreciation of BTC in the third and fourth quarters.

BTC: No more macro risk?

After the huge BTC drop to $49,000 on August 5, the market stagnated on August 6 and 7 after a slight recovery above $50,000.

According to Quinn Thompson, founder of crypto hedge fund Lekker Capital, BTC rose to $60,000 on August 8, as there were no sellers as the market expected.

“While many were looking to retest the lows, no sellers showed up willing to do so, and enough time passed where the broader market realized there were no sellers at those levels.”

The executive downplayed fears of a recession, claiming that upcoming Fed rate cuts would be the next positive market catalyst.

“The recession was a second-quarter event, and now the market is looking at the first rate cuts in four years next month as global central banks resume coordinating easier policy.”

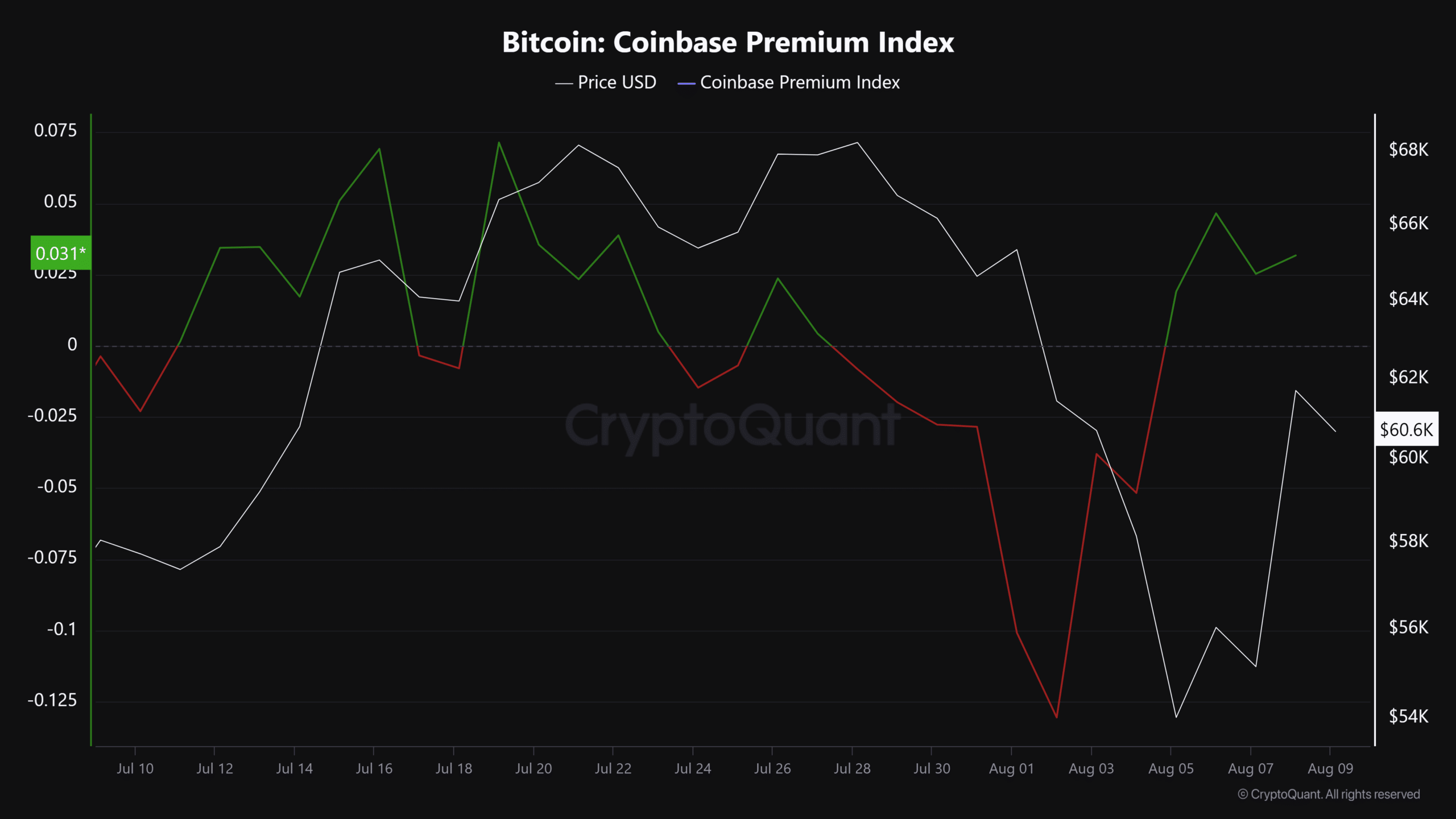

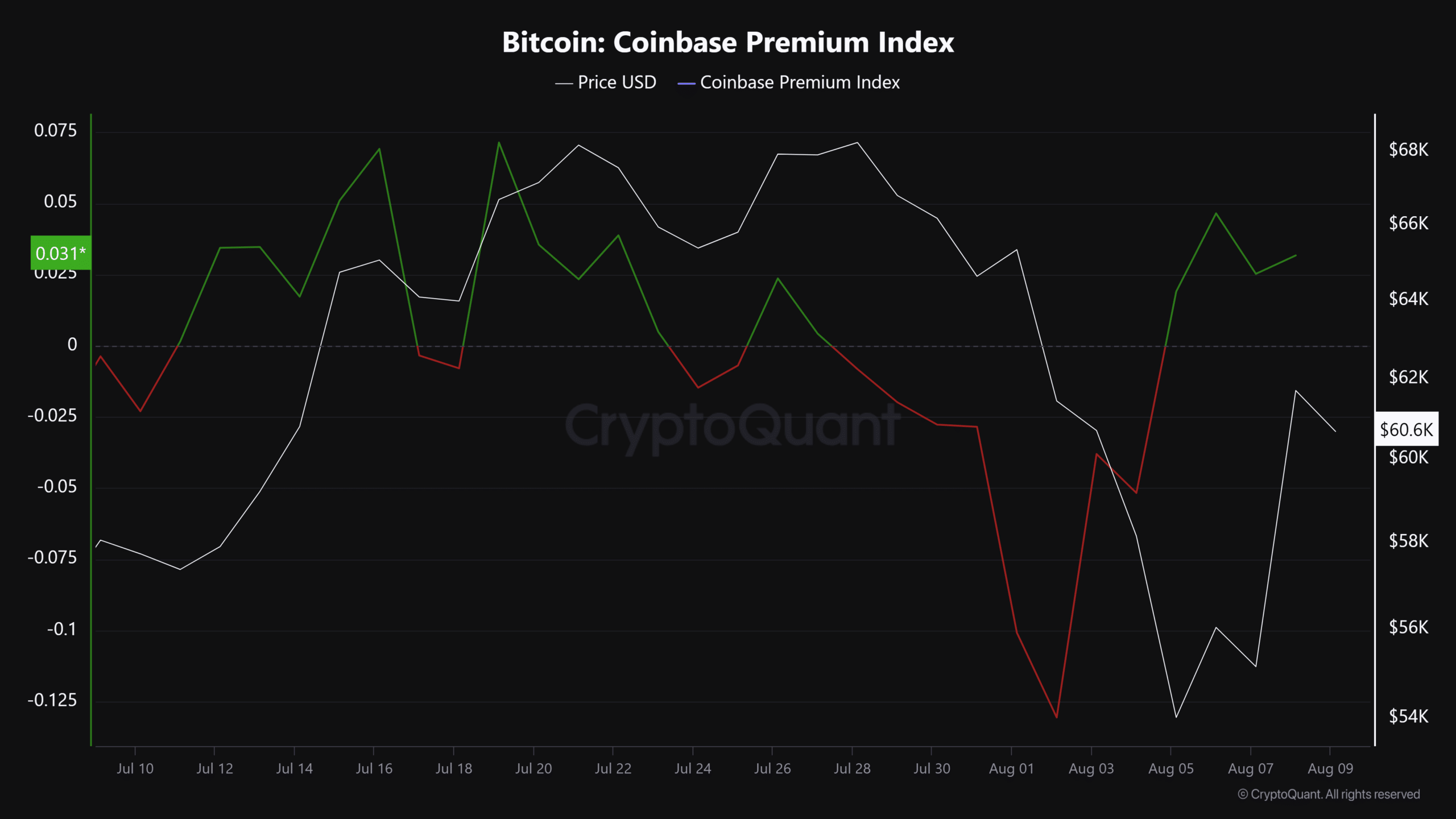

Meanwhile, demand for BTC has strengthened this week, especially from US investors, as evidenced by the Coinbase Premium Index, which rose from negative to positive.

Source: CryptoQuant

Low demand from US investors has generally coincided with price declines for the largest digital assets. Thus, at the time of writing, current strong demand allowed BTC’s appreciation and recovery to continue.

However, BTC has done that flashed some bearish signals, which could make some investors and traders nervous despite expectations of further recovery.