- Glassnode estimated a capital inflow of approximately $70 billion into a Bitcoin ETF.

- There would be less Bitcoin immediately available to new investors.

The crypto market pinned its hopes on the possible adoption of a Bitcoin [BTC] spot exchange-traded fund (ETF), which many analysts believe would be a turning point for the king of cryptocurrencies.

If ETFs get the green light from the US Securities and Exchange Commission (SEC), they would expose BTC to a large group of institutional investors in traditional financial markets.

These changes were to be expected

While expectations were high, a logical question to ask was how much of the Bitcoin market would be available for spot ETFs. How much new capital would it attract?

In a report, on-chain research firm Glassnode estimated capital inflows of approximately $70 billion into a Bitcoin ETF. Of this, almost $60.6 billion should come from the stock and bond market, while about $9 billion would come from the gold market.

The calculations were based on well-considered assumptions about capital flows from the regular financial markets.

The assumptions were made after taking into account the ongoing challenges to these investment vehicles and Bitcoin’s growing narrative of the ‘digital store of value’.

The $70 billion figure seemed conservative compared to estimates from some other analytics firms. Last month, CryptoQuant predicted a capital inflow of $155 billion in the Bitcoin market after approval of the ETFs.

The shortage of supply could spell trouble for new investors

Beyond the demand side, Glassnode drew attention to the exposure of Bitcoin’s available supply to spot ETFs.

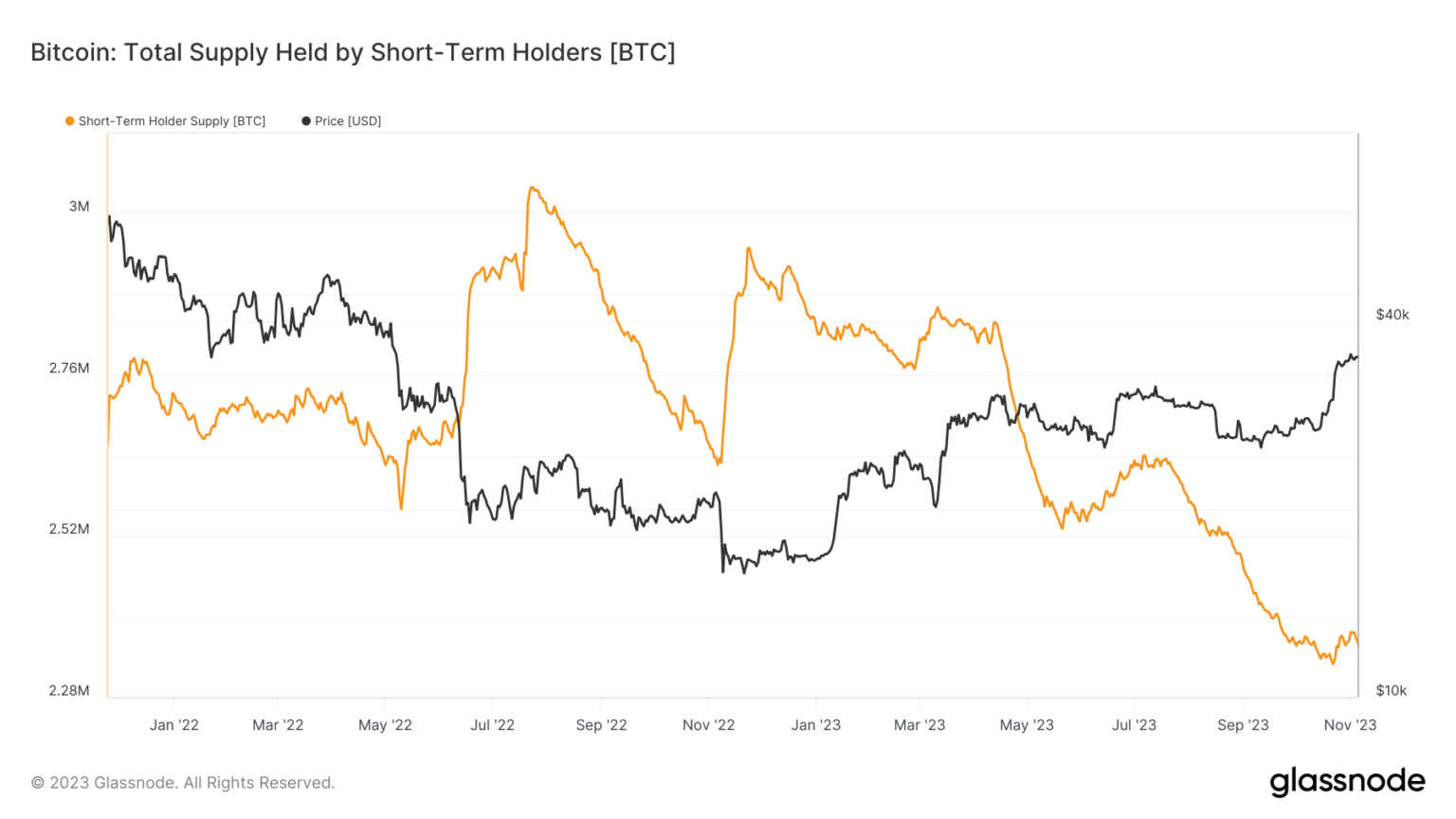

Short-term holders (STH), which are known to buy and sell frequently and are more sensitive to market fluctuations, are considered good indicators of liquid supply.

Short-term holders (STH) supply was at multi-year lows at the time of writing. This meant a marked reduction in the tradable supply of Bitcoin.

Another way to look at the supply squeeze was through the illiquid supply indicator. The illiquid supply consisted of nothing but BTCs locked in wallets with poor spending histories.

As the chart below shows, illiquid supply has been steadily increasing over the past two years.

In contrast, the supply of liquids, which is much more likely to be traded, fell significantly over the same time.

To cut the long story short, there would immediately be less Bitcoin available to new investors.

Furthermore, if limited supply cannot keep pace with new demand from spot ETFs, Bitcoin could face increased market volatility, according to Glassnode.

Bitcoin market becomes more sensitive to investments

It was also essential to study the sensitivity of the Bitcoin market to the inflow of new capital. The Realized Cap serves as a reliable instrument for this analysis.

Realized limit values an asset based on the price of each of his coins when they last moved, instead of their market value. You can see it as a measure of the capital invested.

When new capital enters the market and investors snap up Bitcoins at a higher price, the realized limit typically sees an increase.

It is clear that conventional market capitalization would rise faster than realized capitalization.

The sensitivity is therefore the ratio between the realized capital and the change in market capitalization. When the ratio is low, it means that the market is very sensitive.

Small amounts of invested capital would cause a significant change in market capitalization. Conversely, a higher ratio will require greater investments to increase Bitcoin’s market value

At the time of writing, the ratio was $0.085. This meant that it only took $0.085 in capital investment to bring about a $1 change in market capitalization, indicating a very sensitive market.

However, the real test would come in the wake of the spot ETF’s launch.

Is your portfolio green? look at the BTC profit calculator

Bitcoin climbed above $37,000 in the past 24 hours and shrugged it off Binance-related FUD. The coin was trading comfortably at $37,341 at the time of writing, up 2.27% from the same time last day, according to CoinMarketCap.

According to the latest market updates, market sentiment was trending towards greed Bitcoin fear and greed index. This meant that more purchases could be made in the coming days, potentially causing prices to rise.