- Bitcoin must remain above $100,000 for the uptrend to continue.

- BTC has experienced a slight pullback over the past day, down 2.55%.

After experiencing a sustained uptrend that reached $106K in the past day, Bitcoin has risen [BTC] has found. In fact, at the time of writing, BTC was trading around $102,000. This marked a decline of 2.55% on the daily charts.

Prior to this decline, Bitcoin was in an uptrend, rising 8.85% on the weekly charts. To this extent, CryptoQuant analyst Crazyyblock suggested that Bitcoin should maintain a support level above $100,000, and here is the reason.

Why $100,000 is Crucial for Bitcoin

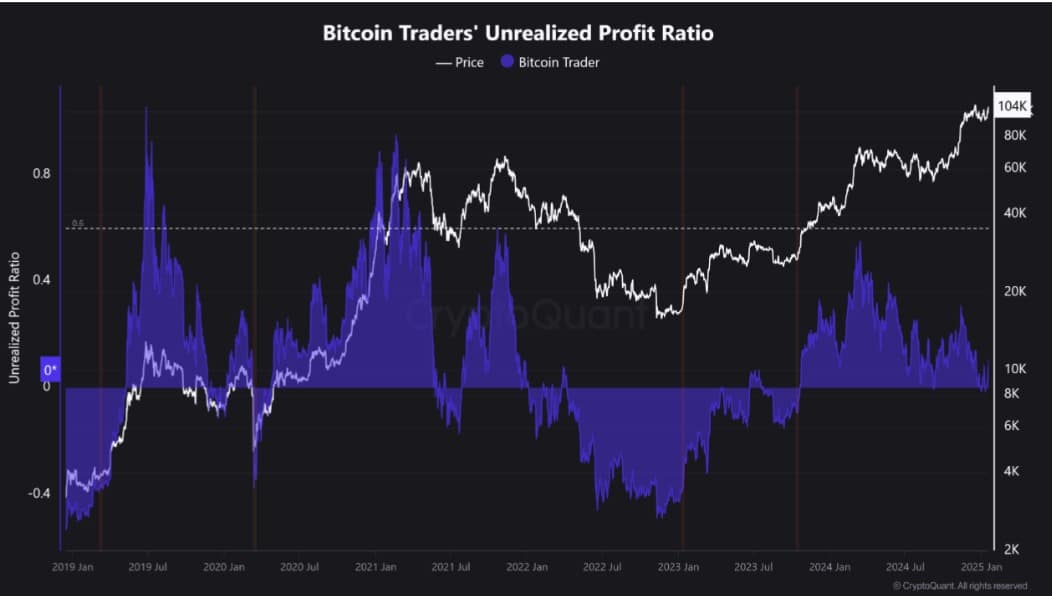

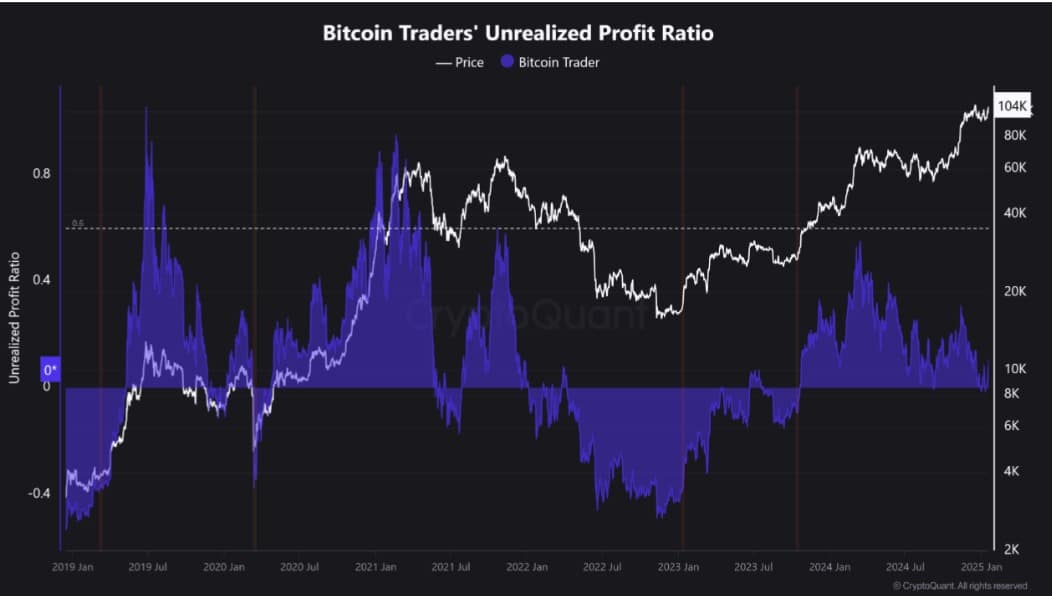

According to Crazy blockBitcoin needs to stay above $100,000 simply because the profitability of current holders now depends on maintaining this level.

Source: CryptoQuant

Failure to maintain this critical psychological level could lead to panic selling or loss-induced liquidations among market participants.

This is because Bitcoin investors in this category are holders within an age range of 1 to 3 months. The group is known for its emotional selling, as they react quickly to market changes and thus engage in short-term strategies.

Therefore, if Bitcoin fails to maintain a $100,000 support level, many of these participants could choose to sell even at a loss, creating potential selling pressure.

Thus, the king coin’s ability to defend this level will determine the direction of the market, making it a crucial point for both an up and down trend.

Can BTC maintain the uptrend?

According to AMBCrypto’s analysis, Bitcoin remained in a bullish phase despite the recently observed pullback. In particular, market conditions at the time of writing pointed to a new upward move.

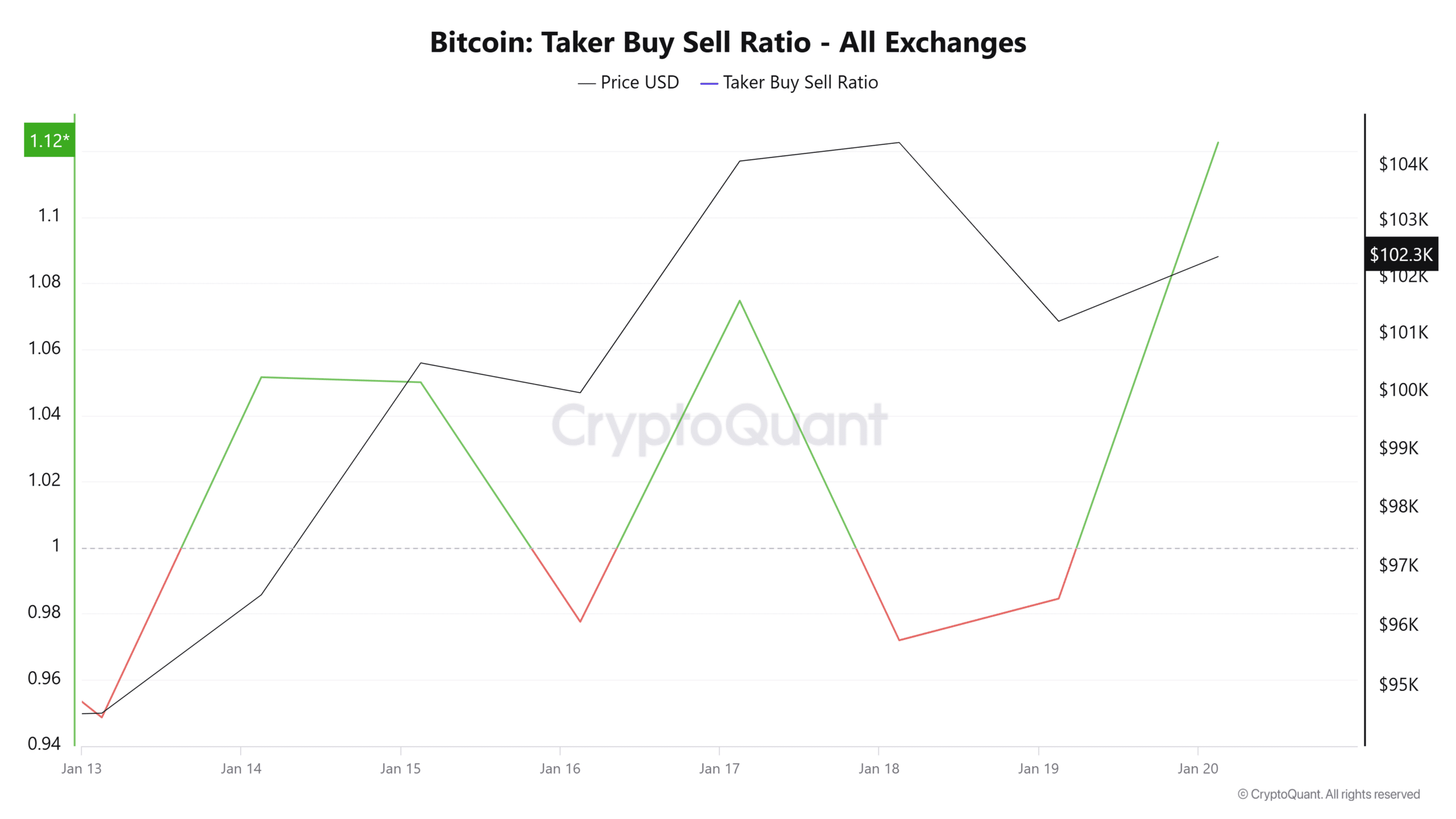

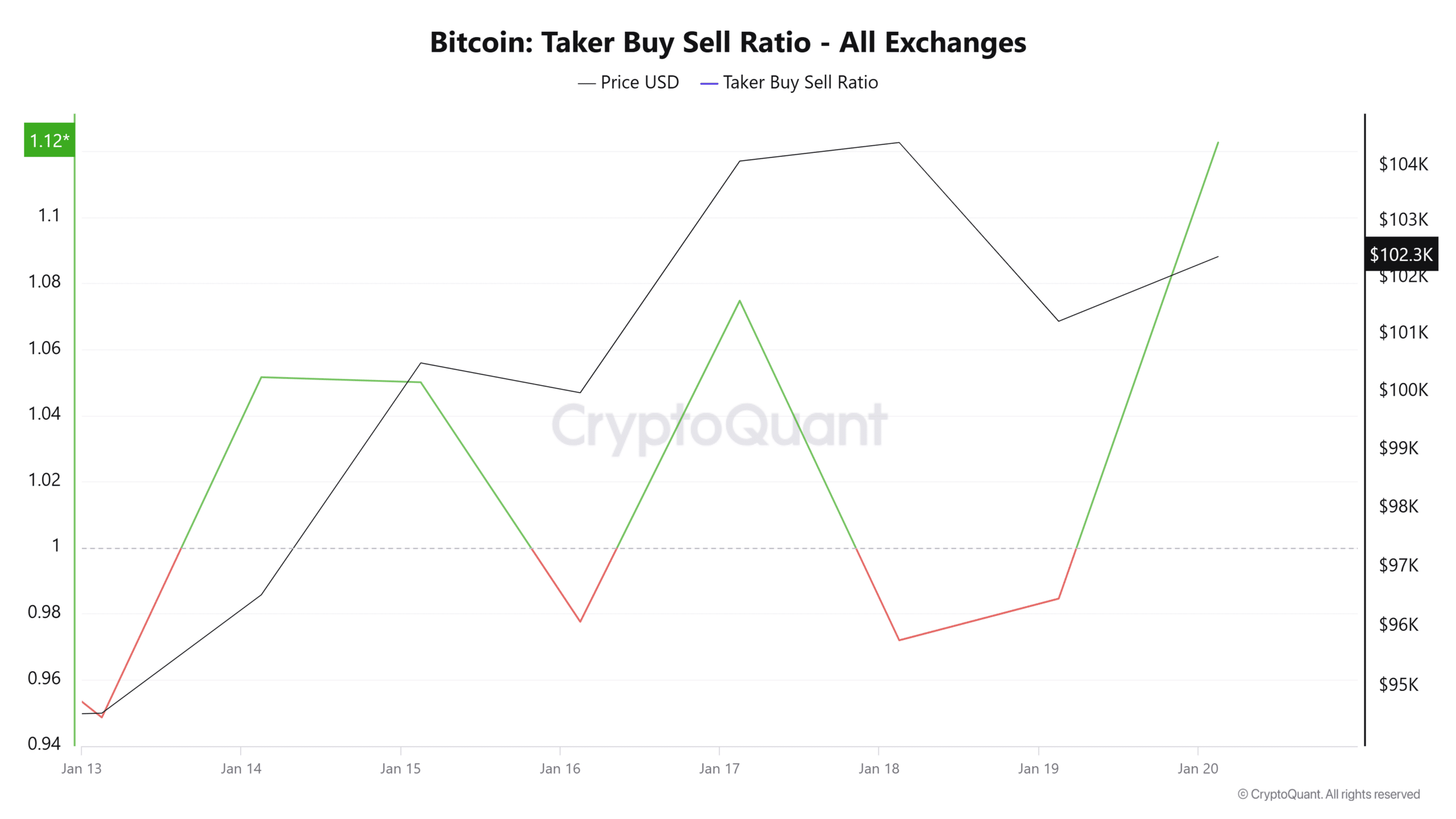

Source: CryptoQuant

For example, Bitcoin’s Taker Buy Sell Ratio remained at 1.12, indicating that buyers dominated the market. So there was higher purchasing pressure.

This reflected bullish sentiments as investors accumulated BTC in anticipation of further gains.

Source: TradingView

At the same time, Bitcoin began to experience strong upward momentum, as evidenced by the rising RVGI and ADR. At the time of writing, RVGI was up after making a bullish crossover four days ago.

This indicated strong upside momentum as the bears seemed to lose the spark. Likewise, Bitcoin’s ADR suggested that BTC posted more gains than losses.

Simply put, the recent decline appears to be just a market correction before a new uptrend is initiated. This is because most market participants remain optimistic and expect prices to rise.

Read Bitcoin’s [BTC] Price forecast 2025–2026

Therefore, if current sentiment holds, BTC will reclaim $105,000 and attempt to break out above $106,000 where it faced multiple rejections.

However, if the correction continues, it could fall below $100,000, resulting in a further decline to $98,000.