- There is a growing consensus among analysts that BTC’s recovery could reach $70,000.

- However, BTC’s recent rebound was preceded by excessive leverage – a potential price risk.

According to Glassnode founders Jan Happel and Yann Allemann, Bitcoin [BTC] was in a great position to retest $70,000. The duo, called Negentropic on X, warned that speculators looking to short the $68,000 or $69,000 cryptocurrency could face serious liquidation.

“Shorts watching this long-term #Bitcoin compression range will be liquidated when the $68,000 to $69,000 level is breached….”

Source: X/Negentropic

The highlighted compression channel was part of the megaphone pattern that emerged as BTC continued to consolidate after the new March high.

Why BTC Could Rise to $70,000

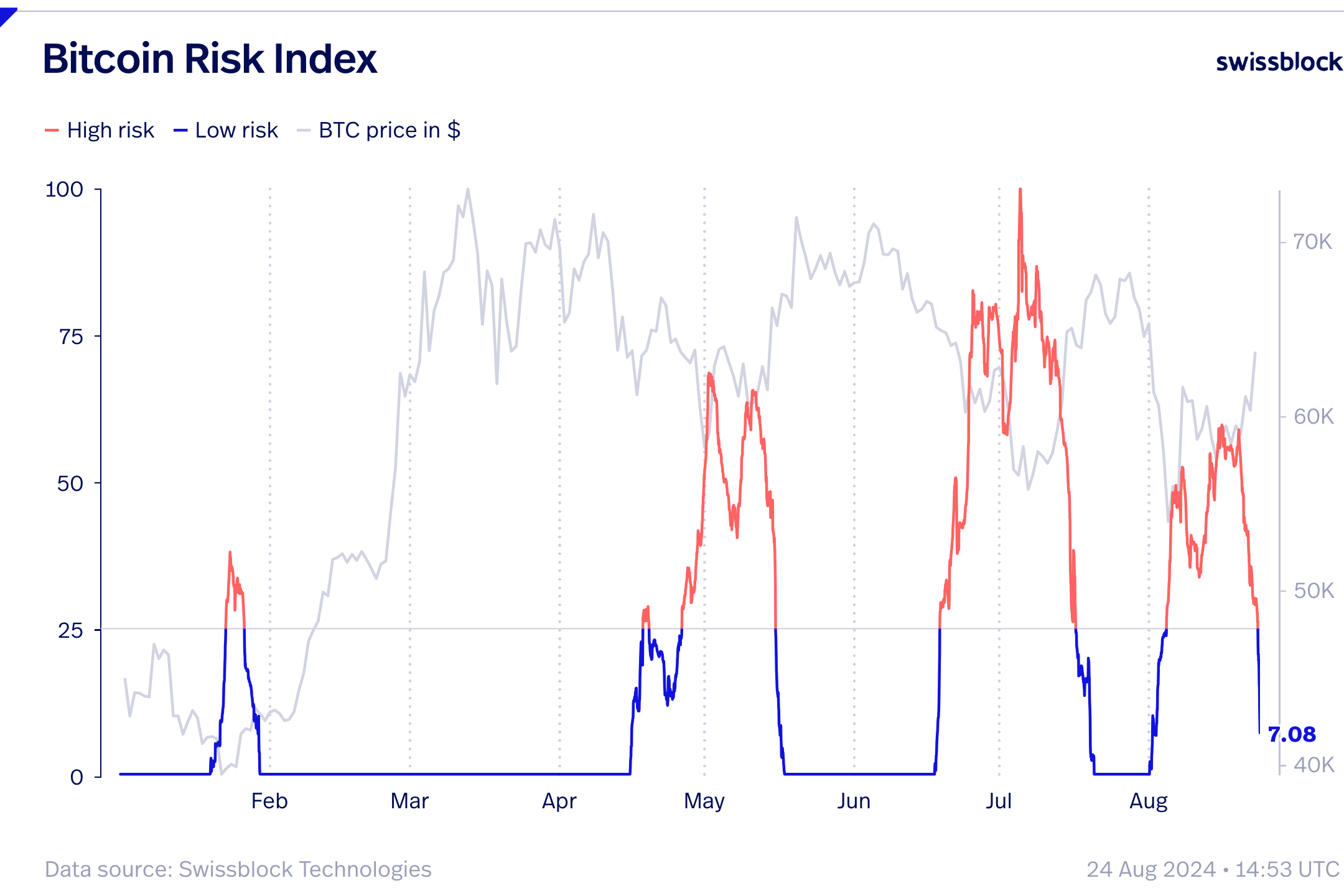

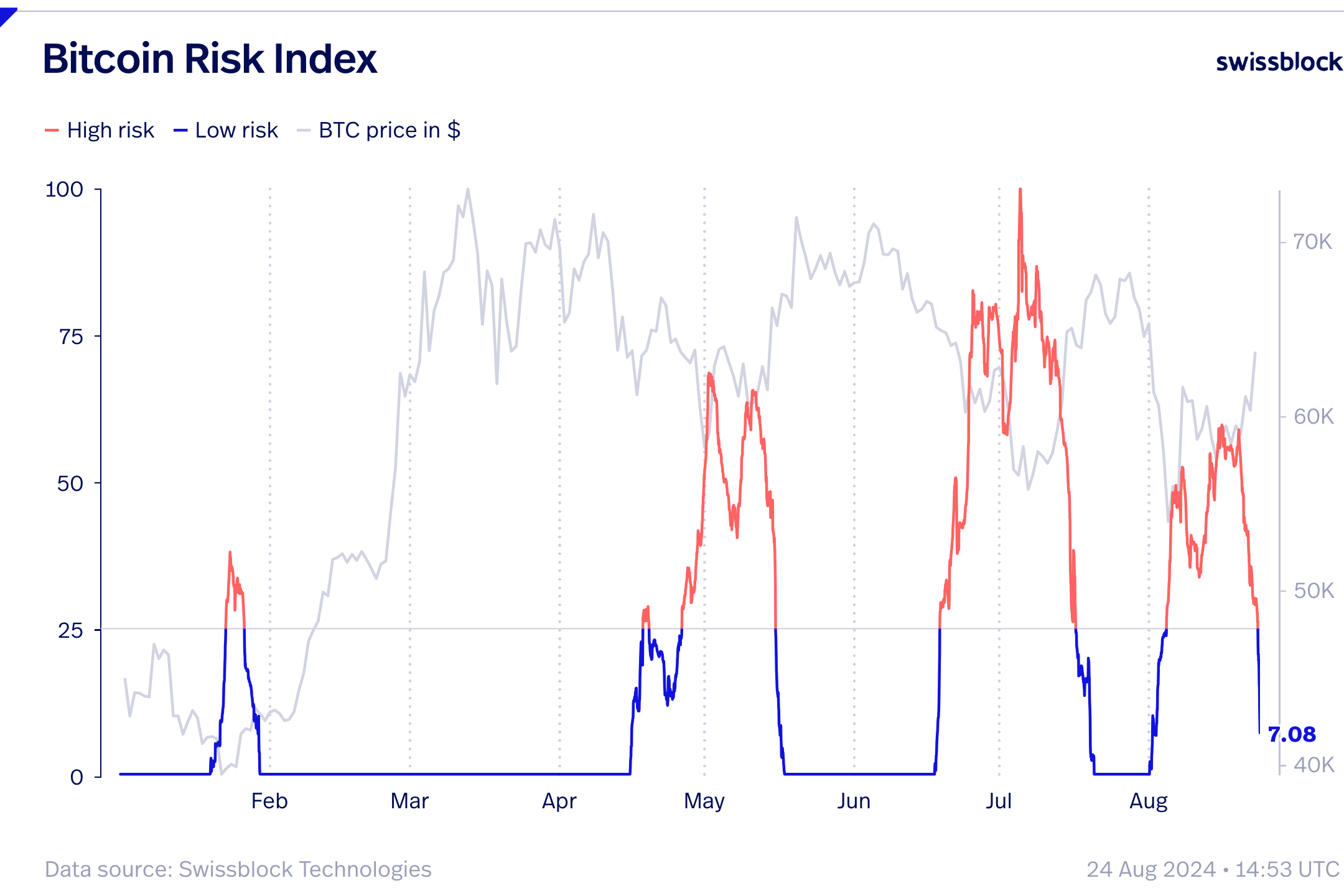

According to the founders of Glassnode, through their crypto insights platform Swiss blocBTC could reach $70,000 due to current low risk levels and an increase in network activity.

The founders also noted that BTC’s rally to $64,000 changed the asset’s risk profile from high to low.

Source: Swissblock

Interestingly, the recovery occurred in May, June and July after the asset showed a low risk profile. Therefore, the trend could repeat and tip the crypto towards $70,000.

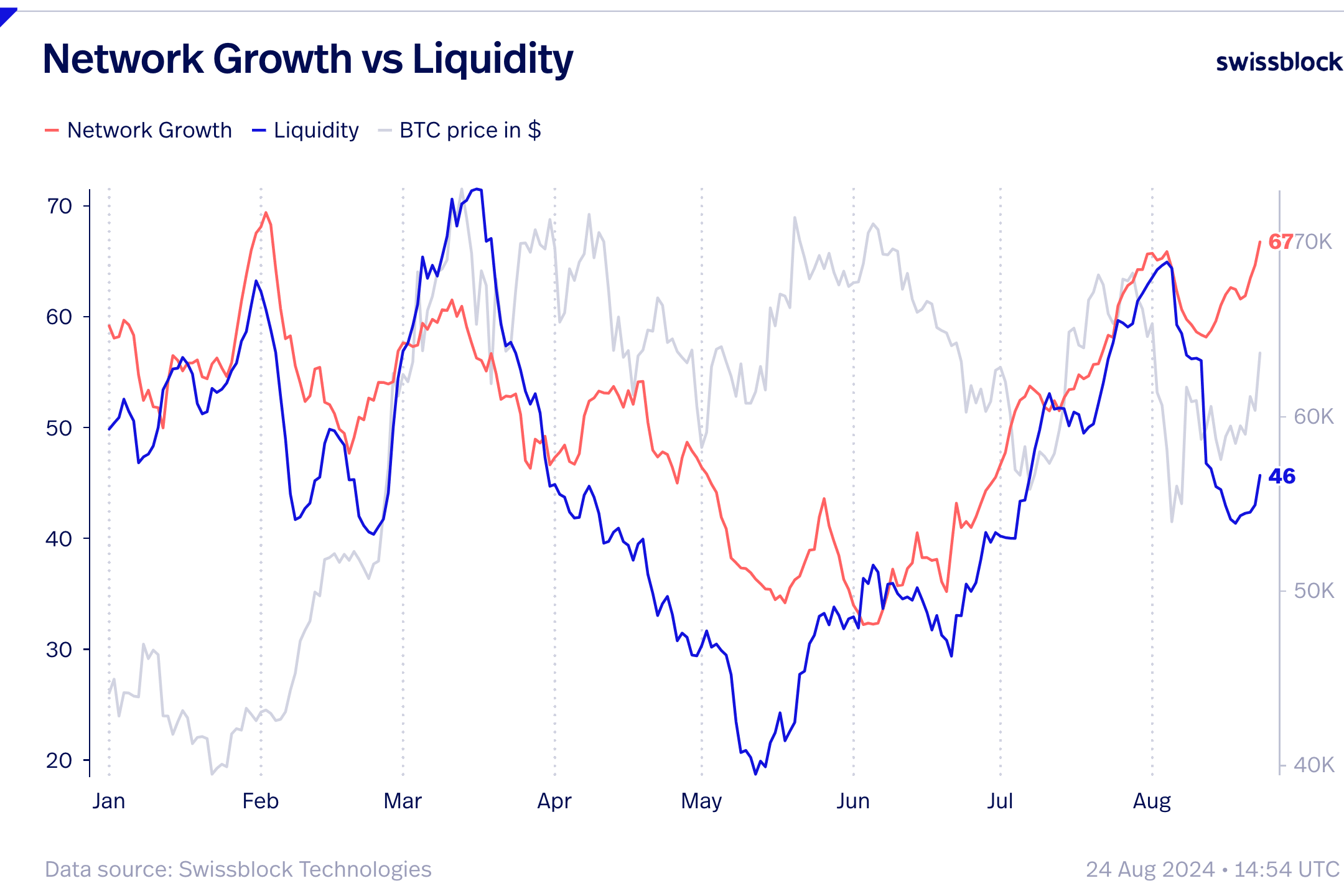

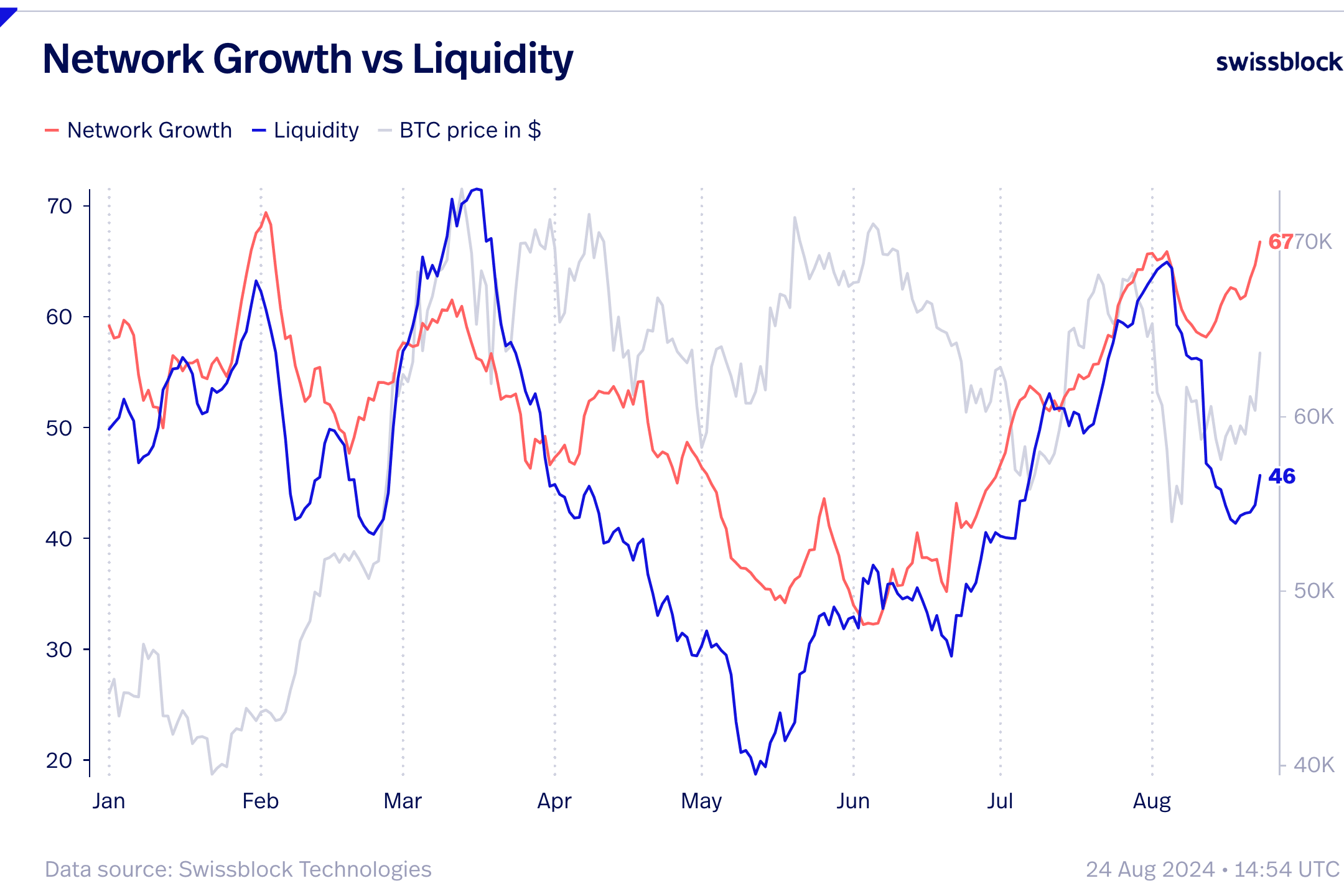

Additionally, Swissblock cited improved Bitcoin network growth that could confirm the sustainability of the uptrend.

“Network growth is resuming its upward trajectory, even challenging the highs of July, where we not only witnessed remarkable growth but also a break from a downward move that had occurred after the halving.”

Source: Swissblock

Network liquidity lagged behind growth, but the analytical platform revealed signs of a slow improvement that could boost BTC.

Furthermore, negative funding rates in the perpetual BTC markets could accelerate the recovery, per Swissblock.

“Funding rates on perpetual futures have not only remained negative since our last reading, but have also increased in magnitude: highly unusual in times of bullishness. This positioning is such that it could trigger an even stronger rise in the event of their liquidations.”

BTC’s low funding rates were related to the dominance of US spot BTC ETFs, which have a greater price impact than derivatives markets.

Furthermore, Swissblock speculated that the recent stake of BTC in the Babylon staking platform could have led to the negative funding rates.

VanEck recently shared same recovery prospects, citing a similar risk appetite for BTC as in previous market recoveries.

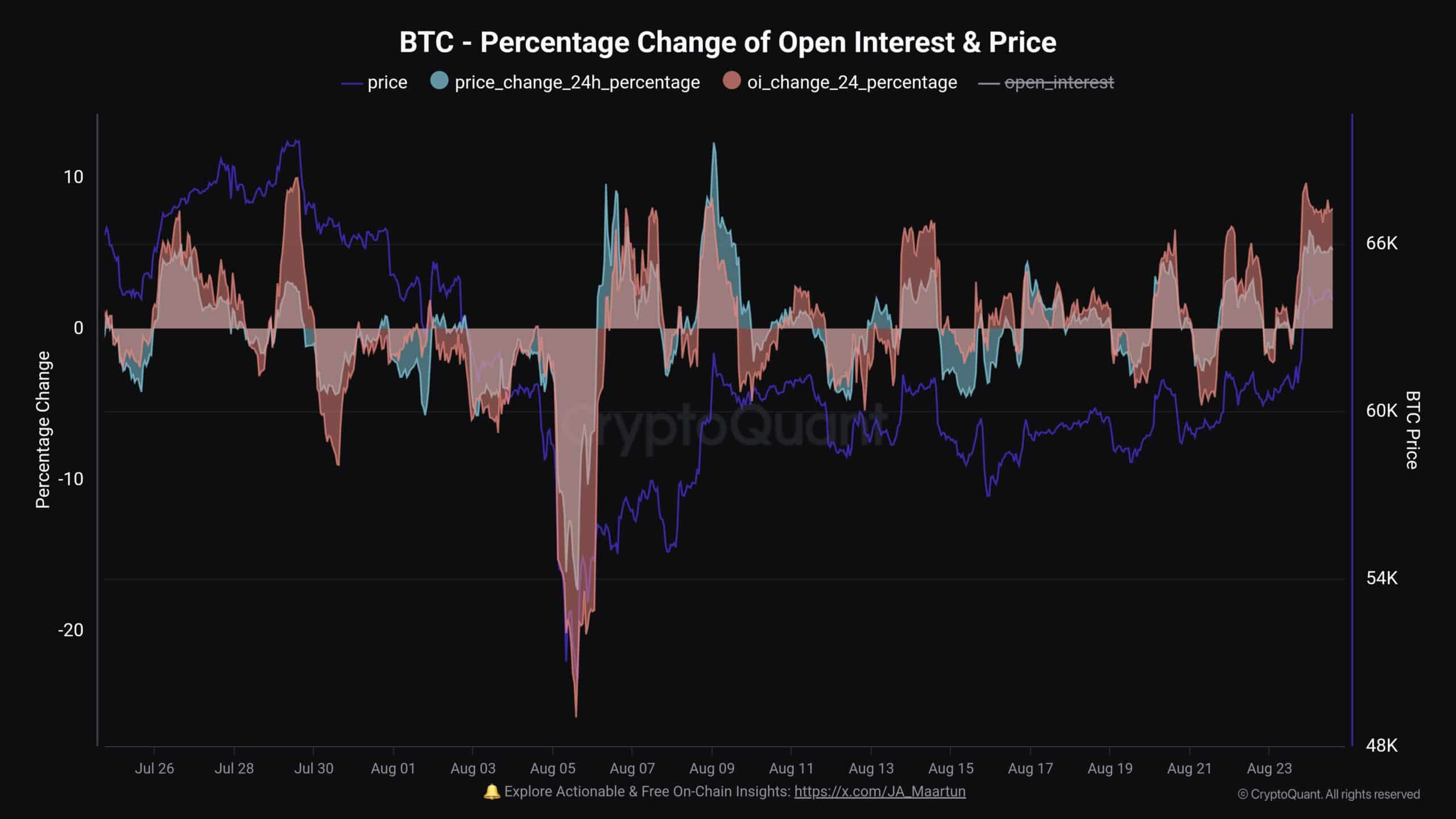

However, a CryptoQuant analyst warned that excessive leverage (open interest rates) drove up the price of BTC, which could cause a price reversal as seen in previous trends.

‘Same setup again? Open Interest rose faster than the Bitcoin price. The last two times it was a quick victory.’

Source: CryptoQuant