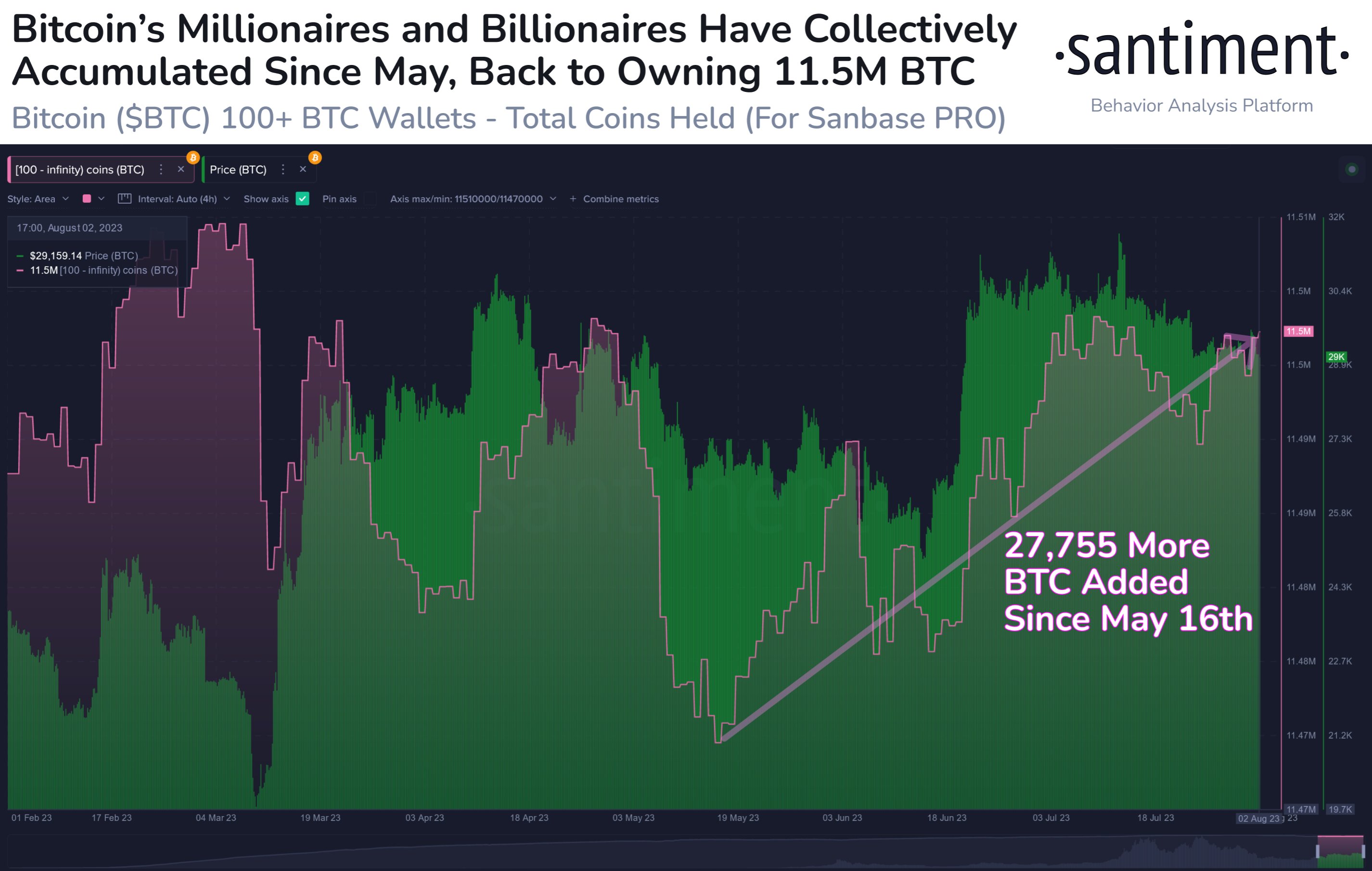

New data from market research firm Santiment reveals that Bitcoin (BTC) investors with big pockets have spent more than $750 million on the king crypto in the past three months.

According to Santiment, Bitcoin millionaires and billionaires have prepped their activity since May, building the largest crypto asset by market capitalization at a rapid pace, bringing their total amount of BTC owned to 11.5 million, which is more than half of the total supply of BTC.

“There are currently 15,870 Bitcoin addresses that hold at least 100 BTC. Collectively, these whales own 11.5 million BTC, representing more than half of the total existing supply (59.2%). In the past 12 weeks, their combined share has increased by 27,755 BTC.”

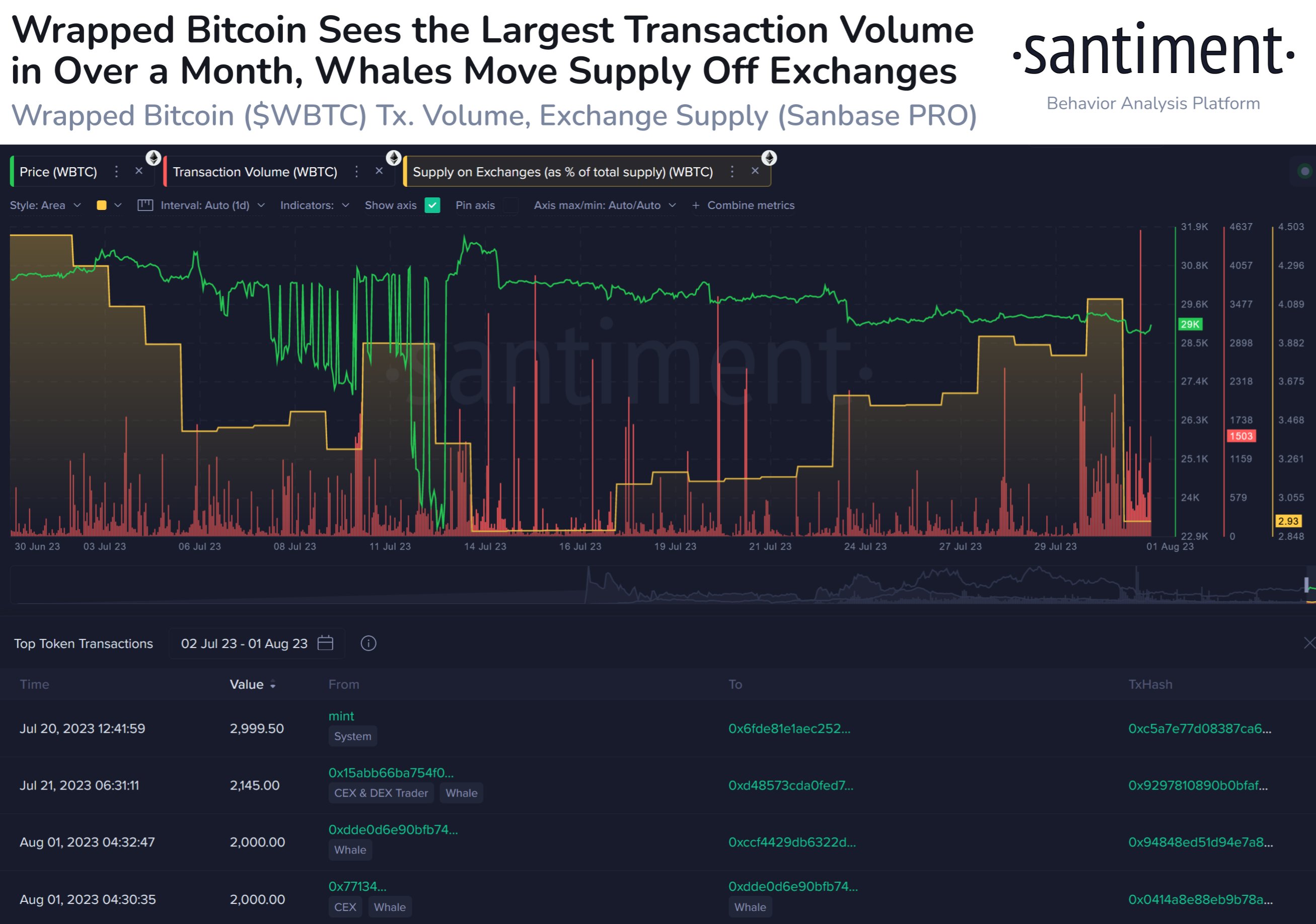

Furthermore, the crypto analysis platform notes that whale activity around Wrapped Bitcoin (wBTC) has also seen a major spike in activity.

According to the data, wBTC’s on-chain transaction volume is at its highest in more than a month as high net worth traders move the digital asset from crypto exchange platforms.

“Wrapped Bitcoin is seeing a lot of activity today after a few 2,000 wBTC moves that resulted in a drop in exchange supply. On-chain transaction volume is at its highest level in more than a month. This is especially relevant to how BTC can be influenced.”

Bitcoin is trading at $29,280 at the time of writing, a fractional drop over the past 24 hours.

Don’t Miss Out – Subscribe to receive email alerts delivered straight to your inbox

Check price action

follow us on Twitter, Facebook And Telegram

Surf the Daily Hodl mix

Featured image: Shutterstock/StockStyle/Roman3dArt