- BTC experiences a strong demand for all market participants.

- Whales on Binance do not sell Bitcoin, which is a reflection of growing market confidence.

Since he fell to a local low of $ 74ka, week ago, Bitcoin [BTC] has made a significant recovery and has a highlight of $ 86k.

These significant profits reflect the shift in market distributors of market participants, especially whales.

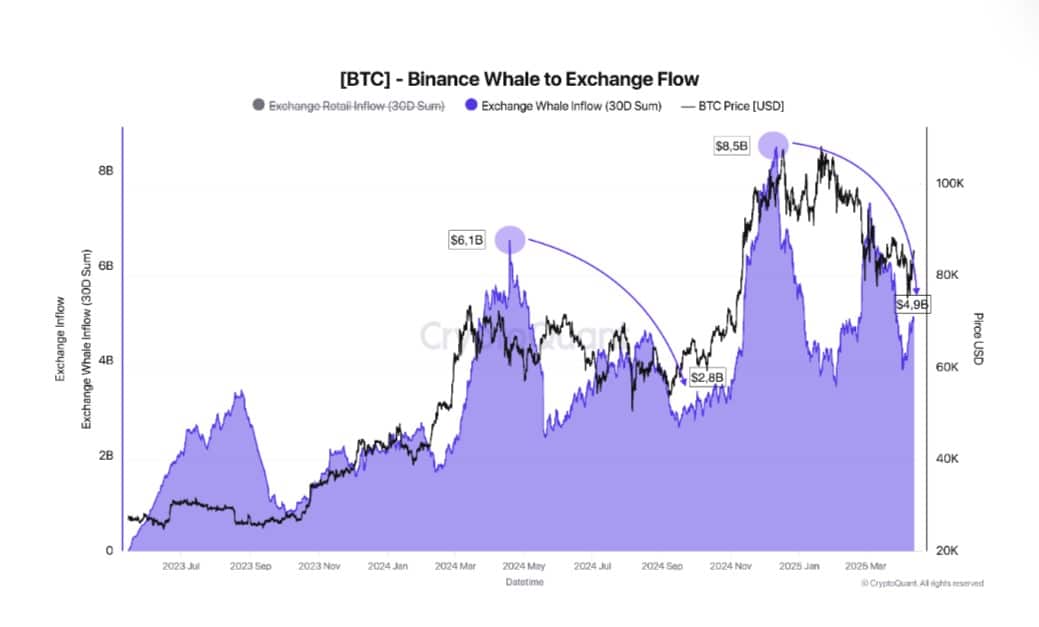

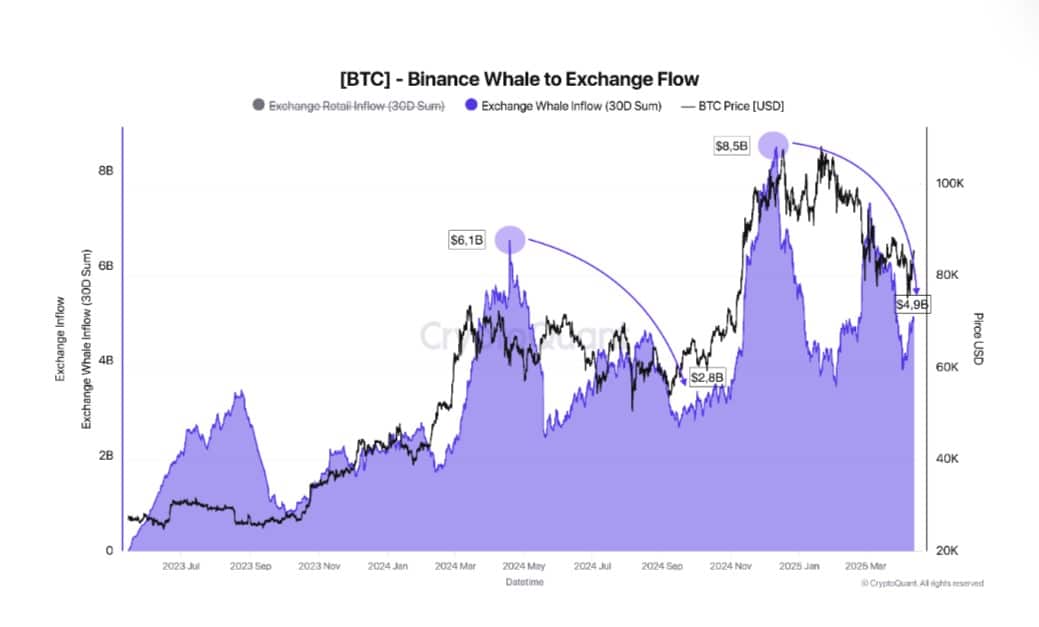

As such, whales have cooled down and they do not sell per Cryptoquant. This market behavior under large entities is more proven by whale activity on Binance.

Source: Cryptuquant

In the past thirty days, the whale inflow values have fallen considerably and fall by more than $ 3 billion – comparable to the earlier correction in 2024. This indicates that Binance whales retain calmness and do not show any signs of panic.

In addition, both the exchange rate and the flaw cream flow decrease on Binance. This change in whale behavior indicates a shift in market sentiment, with confidence in large holders who are steadily recovering.

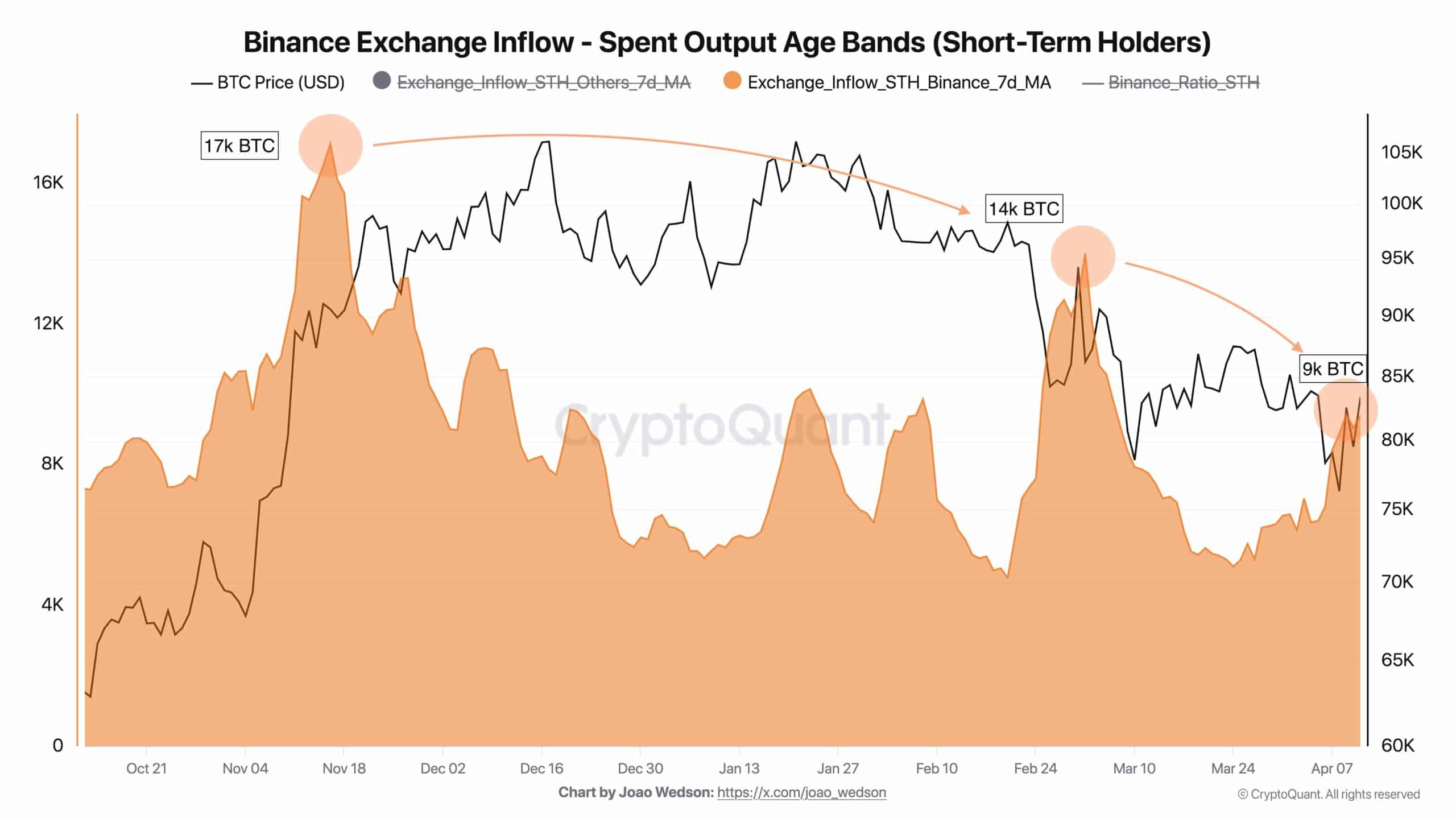

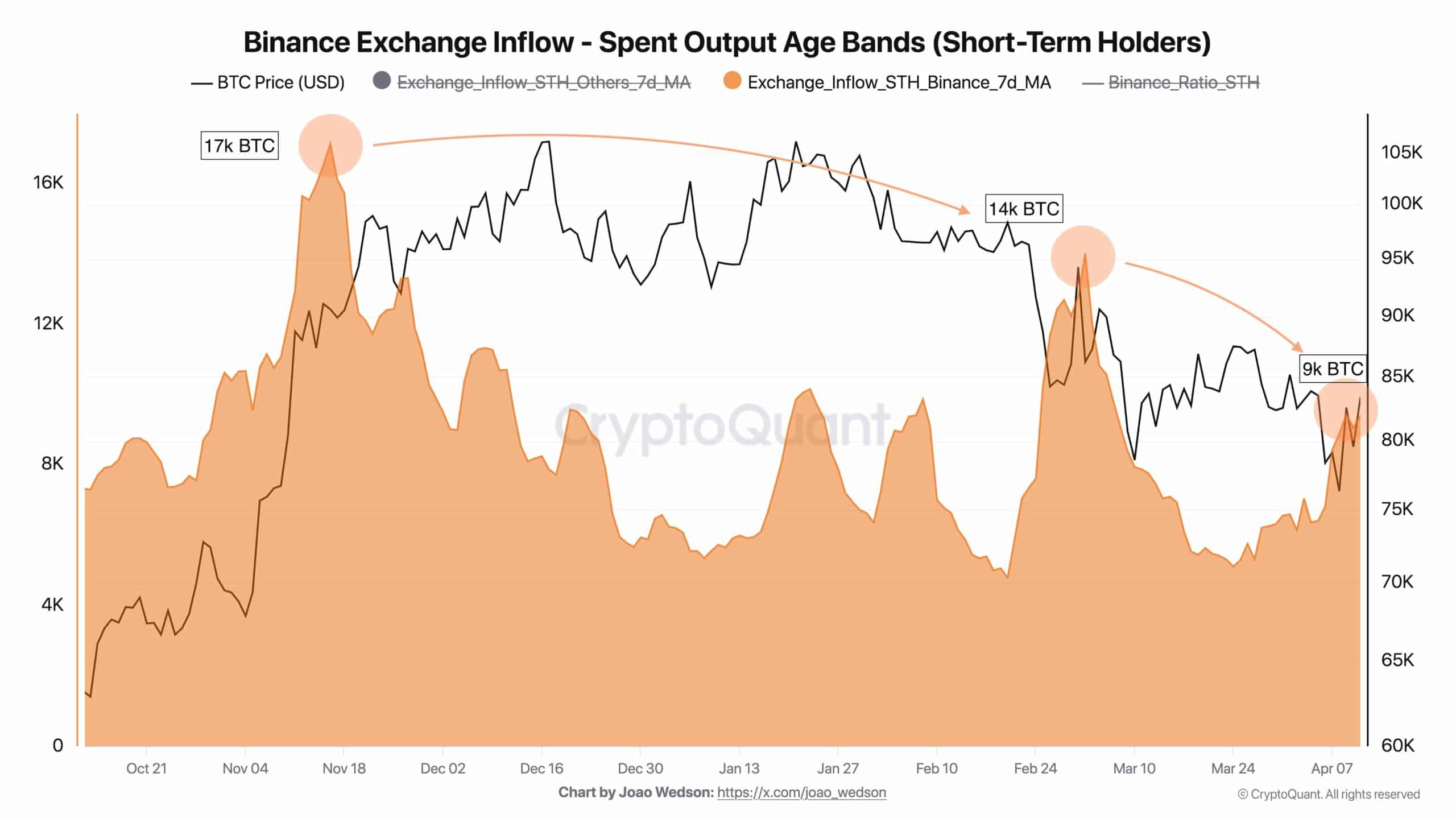

Source: Cryptuquant

This shift in market behavior is even more visible at holders in the short term. As such, STH sales pressure decreases on Binance. BTC inflow (7dma) from STHS to Binance has been steadily decreased.

They fell from around 17,000 BTC inflow on November 16 to 14,000 on March 3 and now floated around 9,000.

This indicates that the sales pressure of short -term investors is relaxed on Binance, which is a positive signal.

Source: Cryptuquant

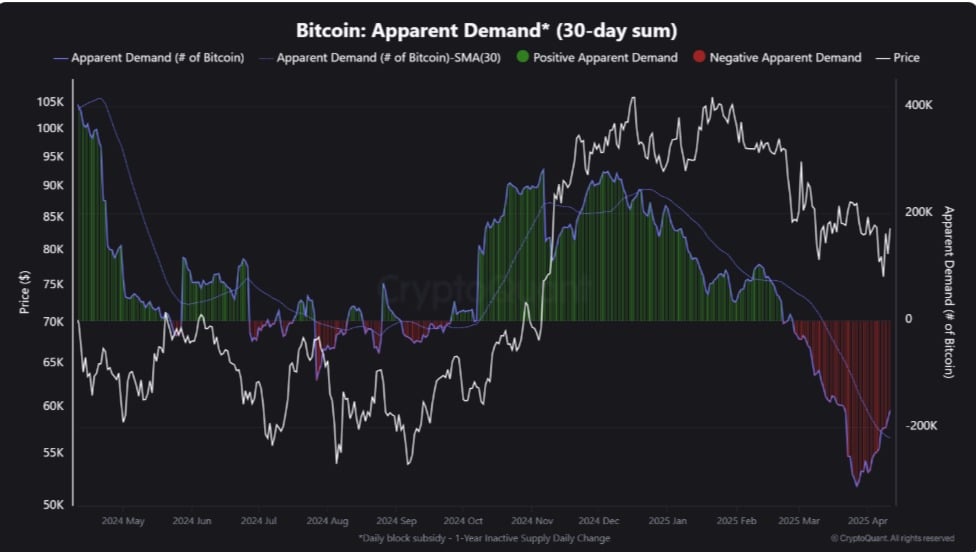

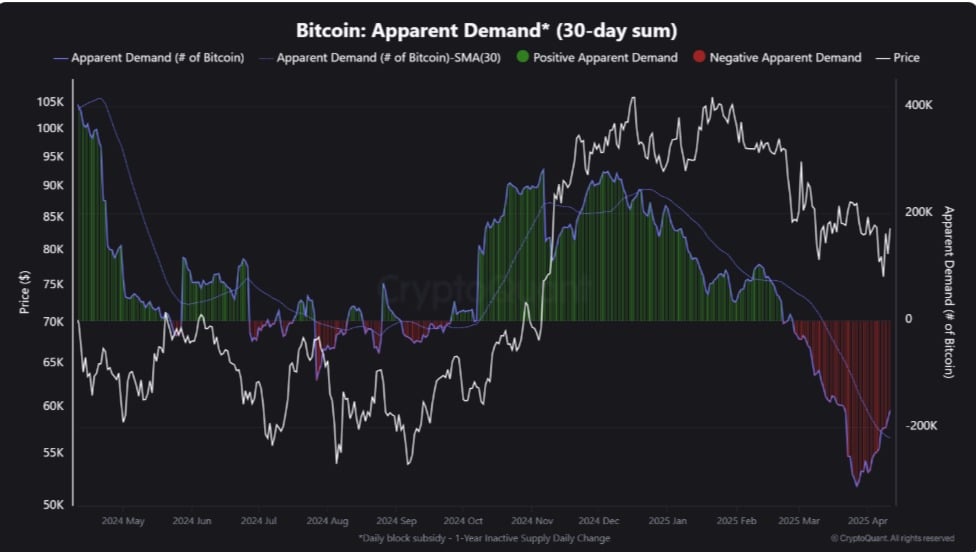

With whales and short -term holders on Binance that reduces sales activity, this reflects the increasing demand for Bitcoin.

As such, the apparent demand from Bitcoin (30-day sum) recently started bouncing deep negative territory, causing a possible shift in market behavior hintt.

Source: Cryptuquant

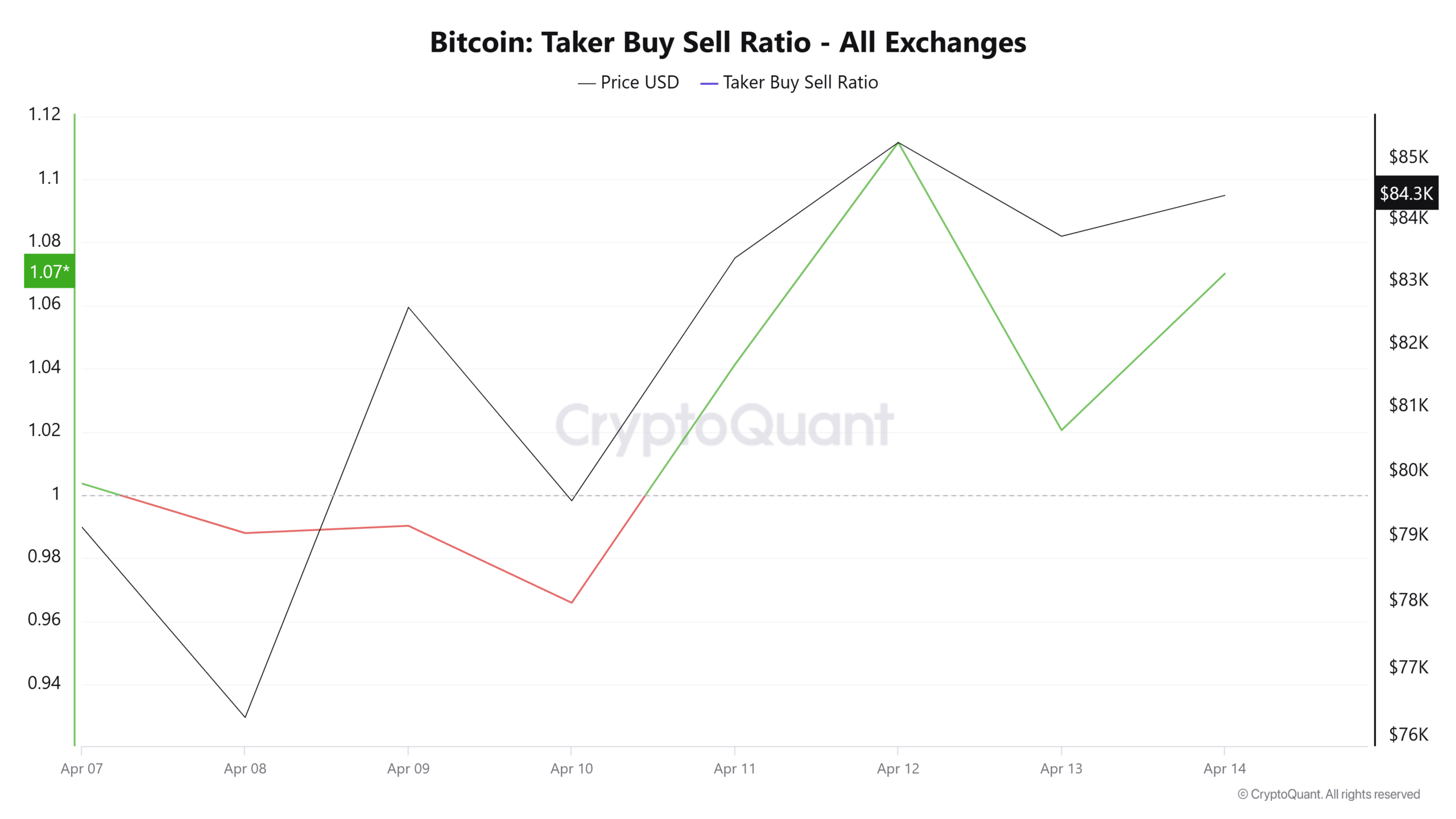

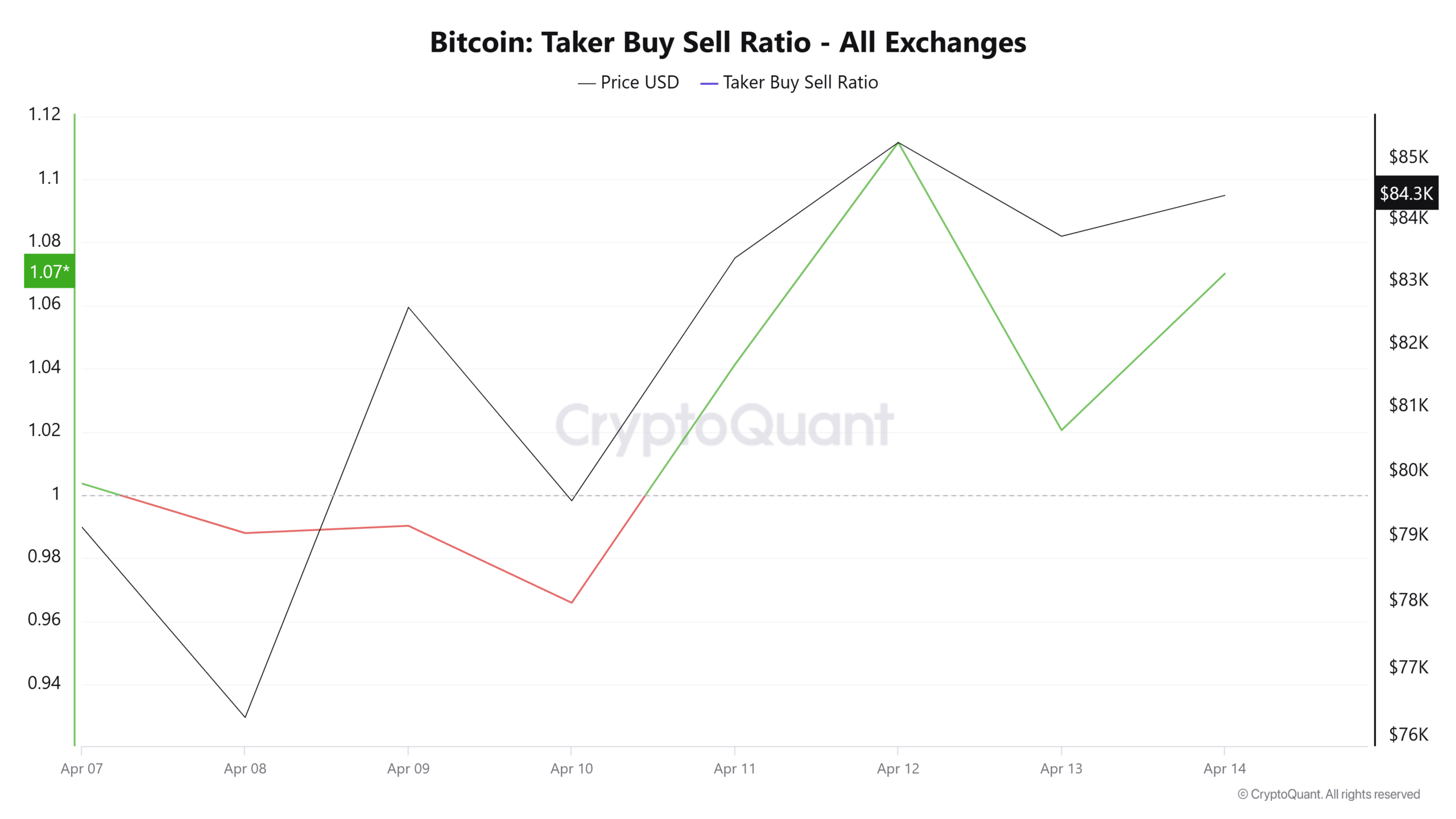

Ambcrypto saw this shift in demand because buyers took the market back. This change in dominance is proven by the recent peak in the Taker Buy Sell Ratio, which has reached 1.07.

When the Taker Buy Sell Ratio 1 surpasses, this suggests that buyers are now dominant in the market, which reflects a higher demand as investors accumulate. The increase in demand means a breaking pressure break, which suggests a possible shift in Momentum.

What it means for BTC

A reduction in the activity of the short -term holder and the sale of whales suggests a shift in market feature, in which bulls get control.

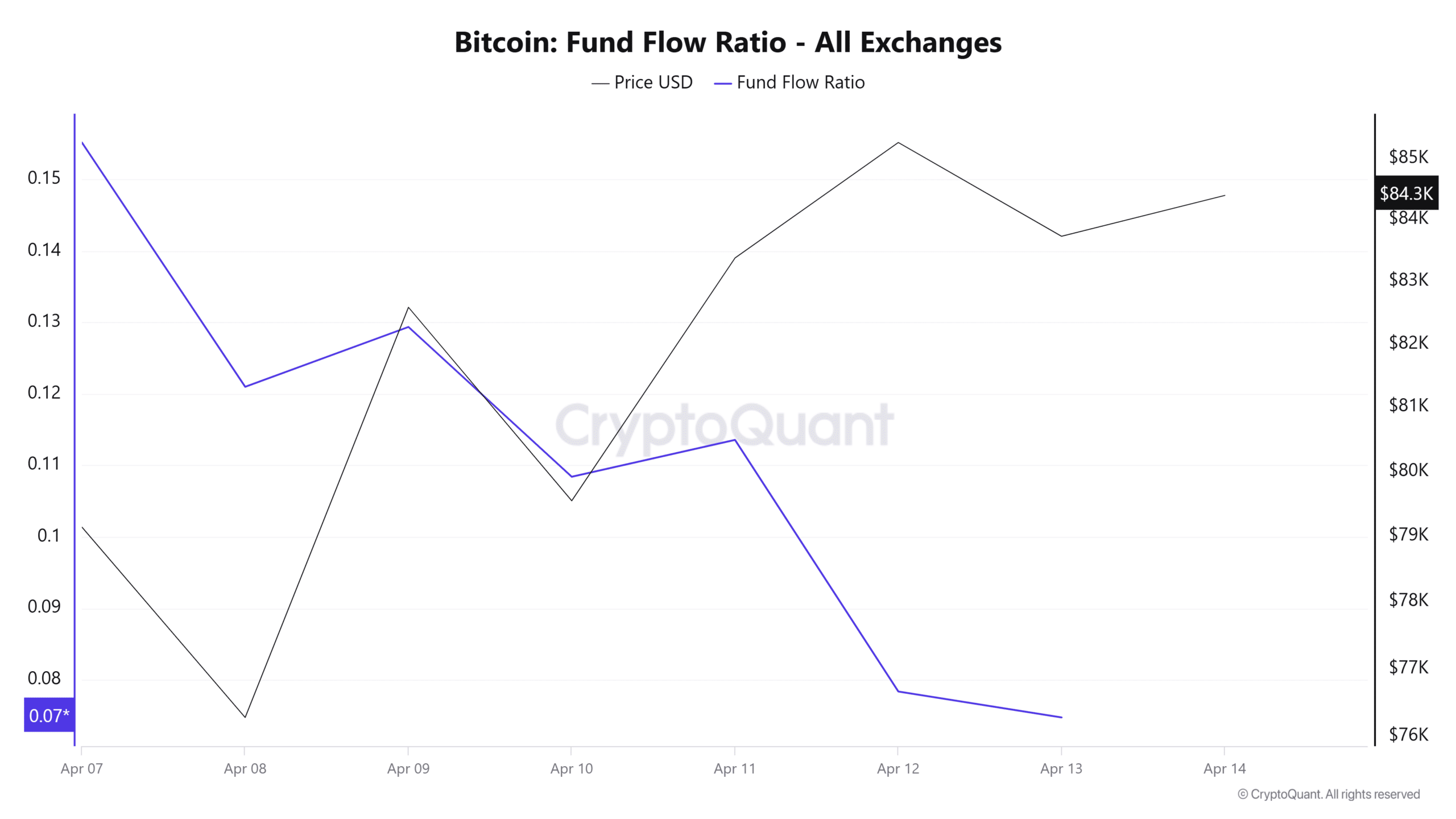

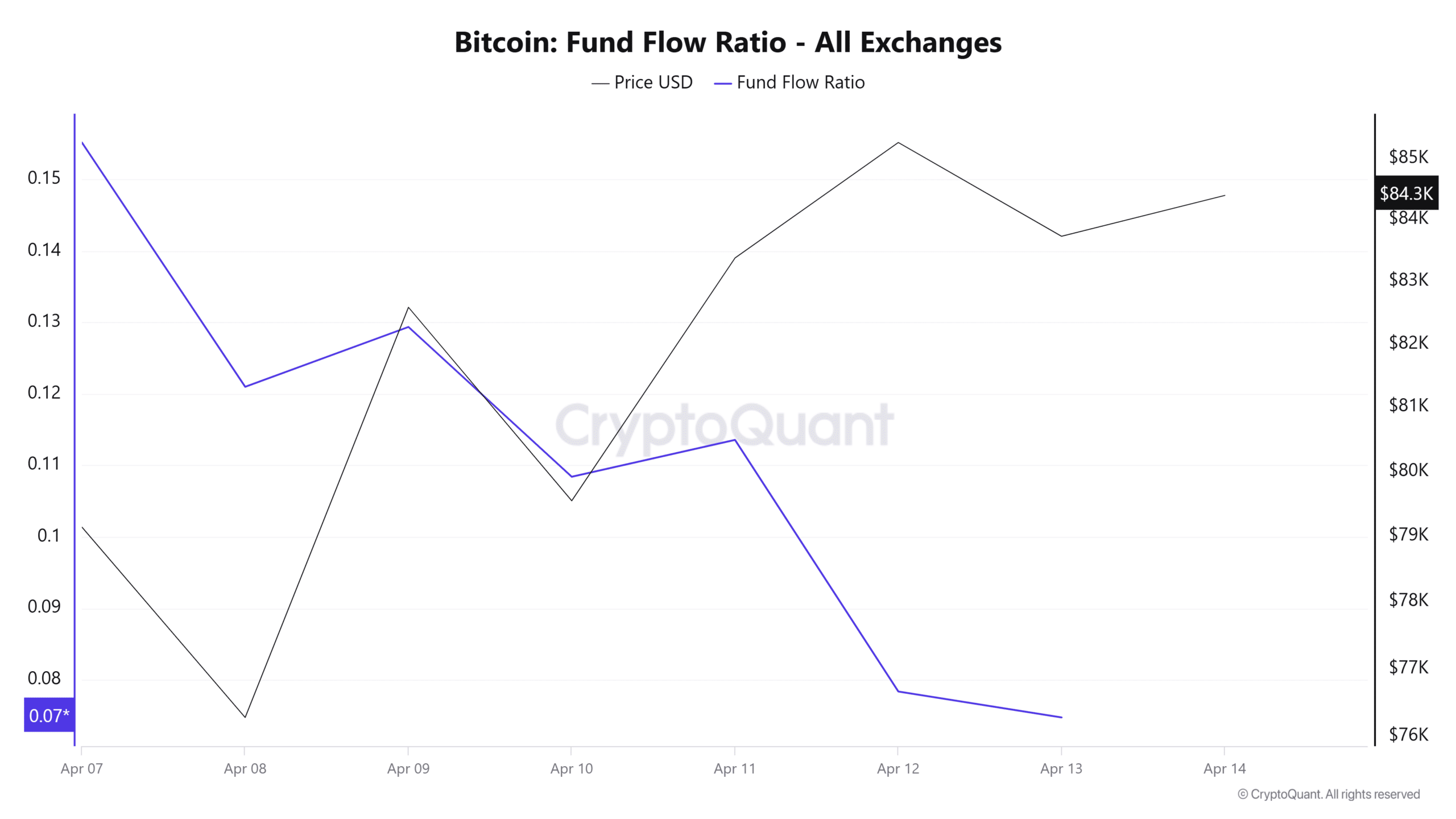

Bitcoin shows signs of a potential trend removal, making it a scene for persistent profits. The fund current ratio indicates limited involvement in trade fairs for sale.

In the past week, the fund current ratio has steadily reduced to 0.07, from which it is emphasized that holders abandon aggressive sale.

Source: Cryptuquant

With reduced sales activity and increased demand, the outlook for BTC seems promising, so that the cryptocurrency is placed for sustainable recovery. Historically, a low sales pressure has combined with rising demand often led to price increases.

If the current market conditions remain stable, BTC can reclaim the key resistance to $ 87,167 and possibly to $ 88,600 aim. However, if volatility increases and recovers sellers, BTC can be confronted with a correction, which drops to $ 82,460.