Este Artículo También Está Disponible and Español.

Ark Invest’s Cathie Wood is steadfast based on her estimate that Bitcoin can rise $ 1.5 million by 2030Despite a daring projection that causes a commotion about the crypto space.

Related lecture

Known for its elevated technical predictions, the financial guru described this situation during Ark’s Big Ideas 2025 ConferenceWhere she revealed that the chance of achieving this astronomical figure has actually increased.

The path to a Bitcoin of a million dollars

Wood’s forecast goes beyond the only one from the blue of figures. Given bitcoin’s Current market value From $ 95,500, Ark’s prediction would be a surprising increase of 1,470% in the next five years.

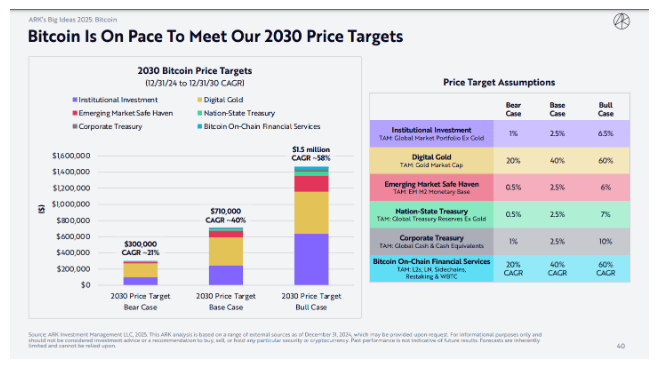

The company has outlined three possible routes: a middle land objective of $ 710,000, a conservative estimate of $ 300,000 and the Headline-Grabbing Bull scenario of $ 1.5 million. These scenarios correspond to compound annual growth rates of 21%, 40%and 58%respectively.

Institutional money floods the crypto -markets

Research by Ark indicates that the area of Bitcoin investments is changing considerably. According to the most hopeful scenario, their studies show that institutional investors can bind up to 6.5% of their global market portfolio to Bitcoin.

Large financial companies already see the Crypto flagship as a portfolio diversifier, drawn by its special risk-preview profile, which is why this is not just theoretical thinking. The possibility that the digital assets is up to 60% of the bill Gold’s market capitalization Borrows another degree of legitimacy to these daring predictions.

Cathie Wood: BTC could reach $ 600k by 2030, and even $ 1.5 million in Bull Market

Ark Invest CEO Cathie Wood stated in an interview with CNBC that Bitcoin (BTC) is expected to reach $ 600,000 in the company’s basic scenario by 2030 and could even hit $ 1.5 million in a bull’s suitcase, …

– coinness Global (@coinnessgl) December 31, 2024

Stablecoins dominate conventional payment stabs

Perhaps the most eye-opening unveiling of Ark’s research problems stablecoinsThose quietly brought about a revolution in the payment landscape.

In 2024, the transaction values of Stablecoin reached no less than $ 15.6 trillion, which surpassed both Mastercard and Visa. Compared to 119% of Visa and Double Mastercard, Stablecoin volumes were compared to 119%.

Although conventional payment systems are currently managing more individual transactions, Stablecoins reveals a fascinating picture of the direction of digital financing.

Multiple growth catalysts point to the north

Wood’s positive prediction is not based on an element. Instead, Ark sees a confluence of growth factors, including the acceptance of Bitcoin as a safe haven through emerging economies, the integration of the digital currency in Treasury Holdings by Nations, the growing use of financial services on chains to diversify their money reserves, and more.

Related lecture

This wide range of application strategies can make it easy to rise the price of Bitcoin. When cryptocurrencies Becoming more popular as an option for digital gold, and as their share of institutional portfolios grows, it seems that the market may not give them enough credit for their long -term potential.

Now that the digital revolution is currently taking place in traditional finances, the big goals of Wood may not be out of reach.

Featured image of Pexels, Graph of TradingView