- Short-term holders of Bitcoin realized losses, due to market uncertainty and potential turning points.

- A decline in Bitcoin’s STH SOPR suggested the risk of deeper corrections or long-term opportunities.

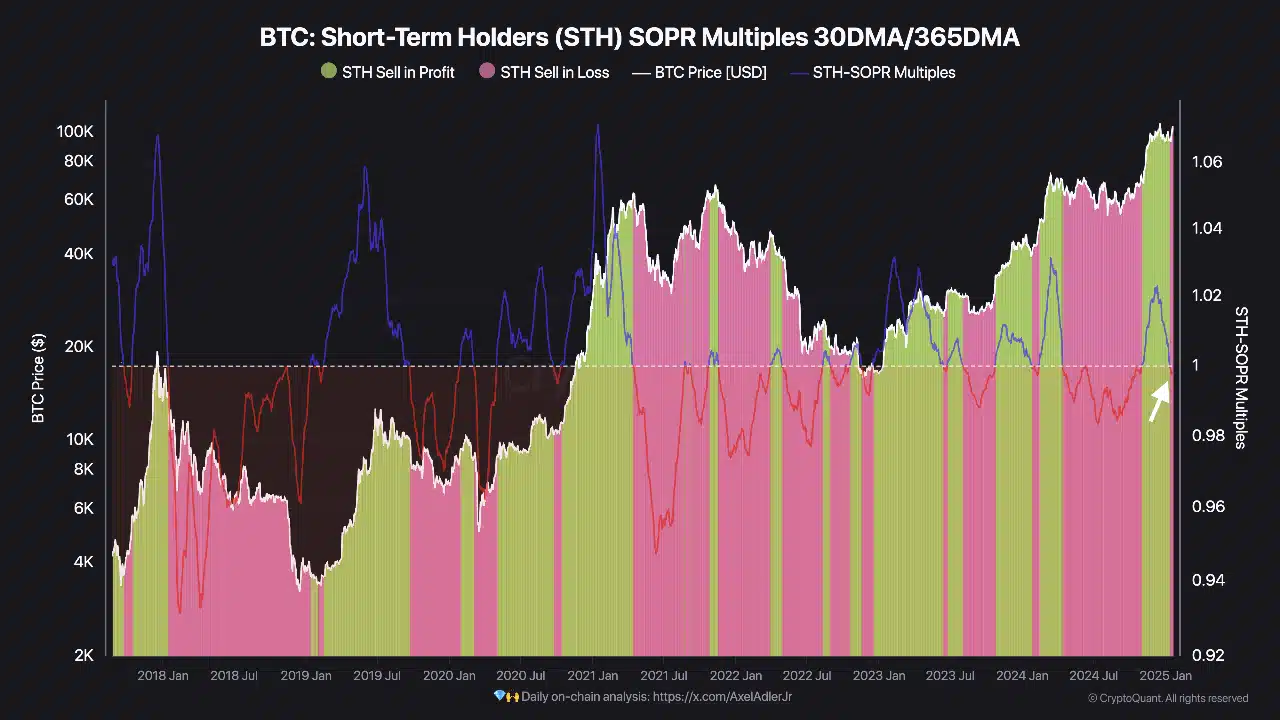

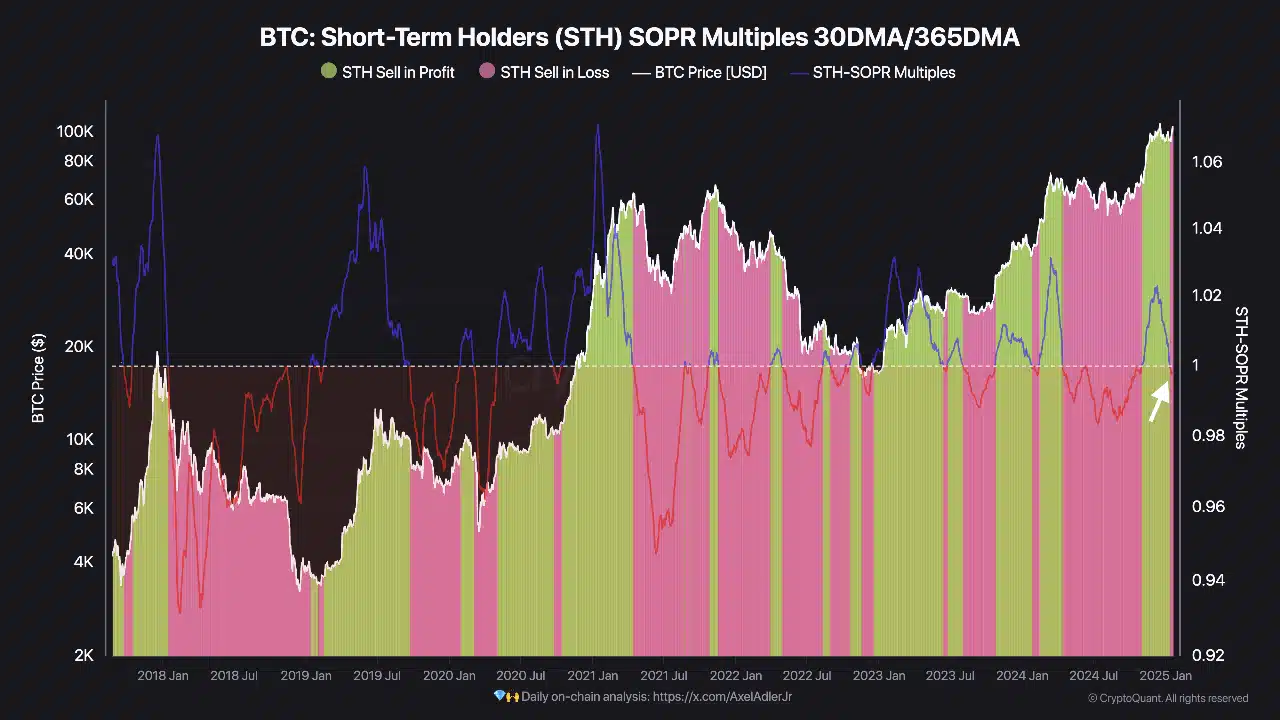

Bitcoin [BTC] short-term holders are now selling their holdings at a loss, with the Short-Term Holder Spent Output Profit Ratio (STH SOPR) becoming negative.

This metric, which compares the 30-day STH SOPR to the 365-day average, highlights a shift in STH profitability trends.

Historically, such moments coincide with major inflection points in the market, signaling attractive long-term entry opportunities or heightened short-term risks.

What the STH SOPR reveals about BTC

The STH SOPR measures whether Bitcoin holders are selling at a profit or loss in the short term. By comparing the 30-day STH SOPR to the 365-day average, this metric shows a clear trend of STH profitability.

Recent data has shown that the STH SOPR multiple has entered negative territory, indicating that STHs are selling at a loss.

Historically, such dips often reflect increasing market stress, but can also provide accumulation opportunities for long-term investors.

Source: Cryptoquant

The chart highlights this shift, with the recent drop below 1.0 indicating declining confidence among STHs.

As this trend continues to unfold, it raises questions about whether STHs will continue to sell off, deepening market corrections, or hold, creating a potential price floor.

Potential Market Outcomes Amid STH Losses

As Bitcoin holders begin to realize short-term losses, two possible scenarios could shape the market trajectory.

In the first scenario, STHs may choose to hold rather than sell at a loss, allowing their realized price to act as a strong support level. Such behavior could stabilize Bitcoin’s price and provide a basis for recovery.

Conversely, a wave of capitulation could occur if STHs continue to divest their assets. This could increase selling pressure and trigger a deeper market correction.

Historically, such capitulation events often coincide with increased volatility, but they can also signal attractive entry points for long-term investors.

The development of the trend will depend on broader market sentiment and the behavior of other market participants.

Historical context and long-term prospects

Historically, negative STH SOPR multiples have coincided with crucial turning points in the Bitcoin market.

For example, during the COVID-19 market crash of March 2020, the STH SOPR fell into negative territory, signaling that short-term holders were capitulating at a loss.

This period later proved to be one of the most lucrative entry points, as Bitcoin rose from $4,000 to over $60,000 the following year.

Similarly, in mid-2018, as Bitcoin retreated from its $20,000 peak, the STH SOPR showed persistently negative values.

Although it signaled capitulation at the time, it marked the accumulation phase before Bitcoin’s rally to new all-time highs in 2020.

Read Bitcoin’s [BTC] Price forecast 2025–2026

For long-term investors, these negative SOPR phases often precede a significant recovery as selling pressure subsides and accumulation begins.

While the current trend reflects near-term uncertainty, historical patterns indicate the potential for bullish outcomes over a longer horizon.