After the last trading window, the US Bitcoin spot ETFs have registered for another week of overwhelming net outflows with investors who get more than $ 900 million from the market. This development marks the fifth consecutive week of repayments that indicate weak market confidence at institutional investors of the first cryptocurrency.

Bitcoin Institutional Investors withdraws for the fifth consecutive week

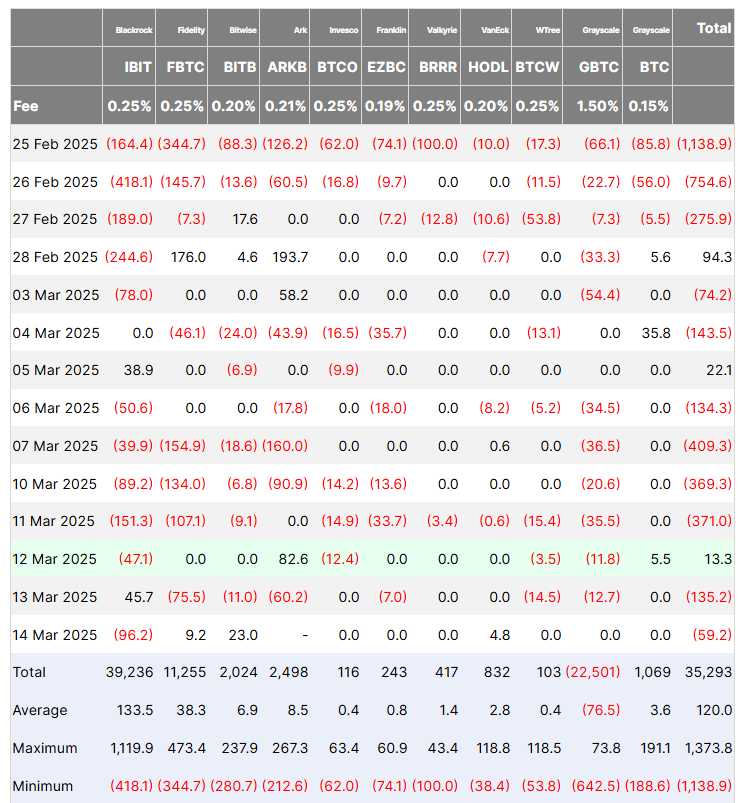

After a strong start of the year in which the Bitcoin ETFs attract more than $ 5 billion in investments, institutional investors have shown a lot of caution in recent weeks by mass recording. According to Data from FINES -INVESTERDERSThe Bitcoin Spot ETFs recorded $ 921.4 million in net outflows in an estimated total of $ 5.4 billion in the last five weeks last week.

The majority of last week’s recordings were taken from the IBIT of BlackRock, which registered $ 338.1 million in net outflows. The FBTC from Fidelity closely followed with investors with fund repayments that surpass deposits with $ 307.4 million. Other Bitcoin ETFs such as Ark’s Arkb, Invesco’s BTCO, Franklin Templeton’s EZBC, BTCW from Wisdomtree, and GBTC from Grayscale all saw moderate net outflow between $ 33 million and $ 81 million.

In the meantime, Bitwise’s Bitb, Valkyrie’s Brrr and Vaneck’s Hodl all recorded small net outflows, no greater than $ 4 million. The BTC from Grayscale emerged as the only fund that has a positive show with a net intake of $ 5.5 million.

The consistent high levels of recordings of the Bitcoin ETFs can be associated with the recent BTC market price correction. In the past month, the Maiden Cryptocurrency experienced a price decrease of 11.95% that reaches levels, as low as $ 77,000. During this period, institutional investors have shown a lot of caution, with the total net assets of the Bitcoin spot ETFs that, according to 21.70%, fall to $ 89.89 billion according to Data from Sosovalue.

Ethereum ETFs lose $ 190 million in recordings

In the midst of the struggles of the Bitcoin ETFs, the Ethereum Spot ETFS market experiences a similar investor sentiment after net outflows of $ 189.9 million in the past week. This development marks the third consecutive week of recordings, so that the total net outflows are $ 645.08 million within this period. Just like with his Bitcoin opposite, BlackRock’s Etha experienced the biggest recordings of the past week worth $ 63.3 million. At the time of writing, the total cumulative inflow into the ETHEEM ETF market is appreciated at $ 2.52 billion with a total net activa at $ 6.72 billion ie 2.90% of ETH market capitalization. In the meantime, Ethereum continues to act at $ 1,924 as a result of a profit of 0.73% in the last 24 hours. On the other hand, Bitcoin is appreciated at $ 84.009 without significant price change in his daily graph.