- BlackRock expects approval for its proposed Bitcoin spot ETF on January 10.

- According to one analyst, the chance of rejection of the ETFs fell from 10% to 5%.

The coming week could prove to be historic for cryptocurrencies as the US Securities and Exchange Commission (SEC) would make a decision on the spot. [BTC] applications for Exchange Traded Funds (ETFs).

BlackRock expects approval on this day

Amid the hype and anticipation, BlackRock, the world’s largest asset manager, remained optimistic about its chances. According to a report from Fox Business, the TradFi giant expected an approval on January 10.

BlackRock filed with the SEC last June for an ETF tied to Bitcoin’s spot price, encouraging other TradFi firms to drop their hats as well.

The filing by a company, with more than $9 trillion in assets under management (AUM), is widely seen as the best indication of the growing institutional interest in Bitcoin and cryptos in general.

Indeed, the market erupted with cheers when Bitcoin rose 25% in a week following BlackRock’s entry at the time, AMBCrypto noted using CoinMarketCaps facts.

The countdown begins

At the time of writing, most formalities related to ETF applications have been completed. After this, the SEC is expected to officially begin clearing the ETFs.

Meanwhile, the odds of rejection for the ETFs fell from 10% to 5%, according to Bloomberg ETF analyst Eric Balchunas.

The likely reasons for the rejection, including President Biden’s intervention and the SEC coming up with new reasons, were considered unlikely.

Read Bitcoin’s [BTC] Price forecast 2023-24

Bitcoin peaks above $44,000

These developments continued to give BTC a bullish boost. The king coin rose above 44,000 in the past 24 hours.

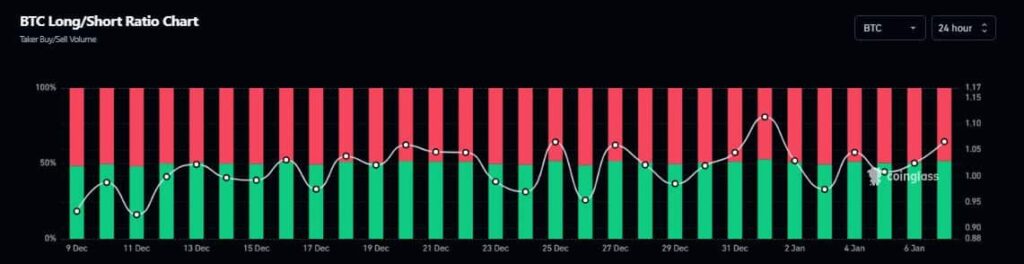

Moreover, the number of long positions for the world’s largest digital currency has increased, according to AMBCrypto’s analysis of Coinglass data. The higher number of bullish leveraged bets compared to bearish bets reflected confidence in Bitcoin.

Source: Coinglass