Bitcoin has shown impressive strength above the $34,000 mark despite a lot of profit-taking from short-term holders.

Short-term Bitcoin holders are selling, while long-term holders are still quiet

As explained by analyst James V. Straten in a new after on X, short-term holders are currently participating in some of the strongest profit-taking in recent years.

The ‘short-term holders’ (STHs) here refer to all those Bitcoin investors who have been holding their coins since less than 155 days ago. This group includes one of the two main divisions of the BTC market, with the other being called the ‘long-term holders’ (LTHs).

Statistically, the longer an investor leaves their coins idle, the less likely they are to sell them at any time. For this reason, STHs tend to be the weak hands of the sector, while LTHs are the strong, persistent holders.

Whenever the industry experiences significant FUD or FOMO, STHs swerve and participate in at least some of the selling. The LTHs, on the other hand, generally show little response.

Since the Bitcoin price has seen a sharp rally lately that has pushed the price above the $34,000 level, the STHs would naturally sell off now. One way to keep track of whether this Bitcoin group is selling their coins is to track the volume they transfer to exchanges.

In the context of the current discussion, Straten has decided to choose the version of this indicator that specifically tracks the trades of investors who make profits, since profit taking is generally the focal behavior during rallies. In contrast, loss transactions play a greater role in price declines.

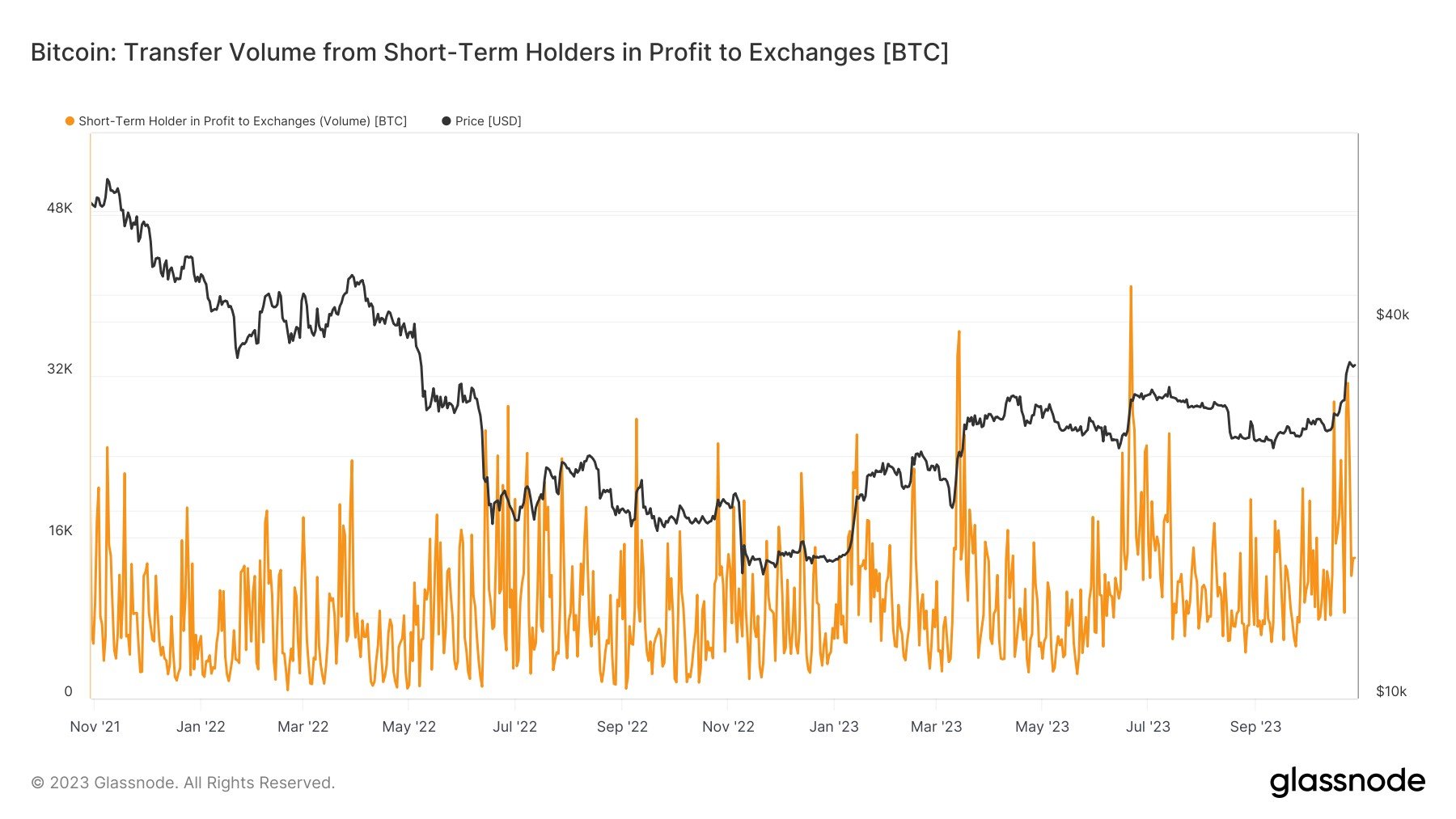

Here is a chart showing the trend in the metric for the Bitcoin STHs over the past two years:

Looks like the value of the metric has been quite high in recent days | Source: @jimmyvs24 on X

As the chart above shows, profitable Bitcoin STHs have been sending large amounts of money to these centralized platforms since the last rally in the asset.

This confirms that these weak hands have sold recently. As previously mentioned, it’s not unusual for something like this to happen, but the magnitude of the profit-taking this time is particularly significant.

The chart shows that there have only been a few instances in recent years of profitable STHs transferring similar or higher volumes to exchanges. Considering this sell-off, it is impressive that Bitcoin has been able to stay above the $34,000 level in recent days.

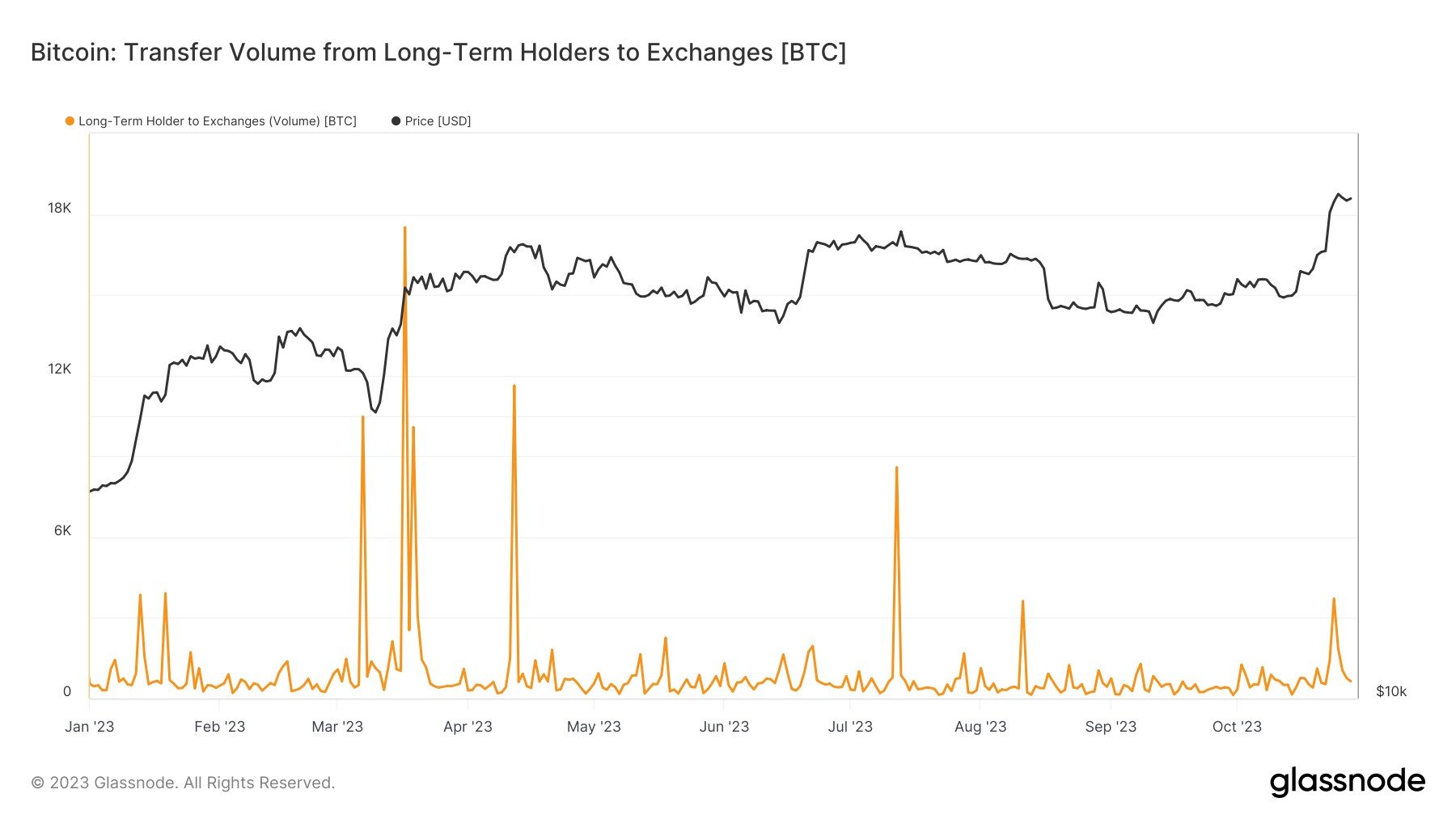

As expected of LTHs, they have not sold much despite the rally.

The metric has seen a small spike recently | Source: @jimmyvs24 on X

The metric currently sits at the sixth highest value for the year, but as is clear from the chart above, the size of this sell-off is still not that large in pure terms.

BTC price

At the time of writing, Bitcoin is trading around $34,700, up 13% in the past week.

BTC has slowed down a bit since its sharp rally | Source: BTCUSD on TradingView

Featured image of Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com