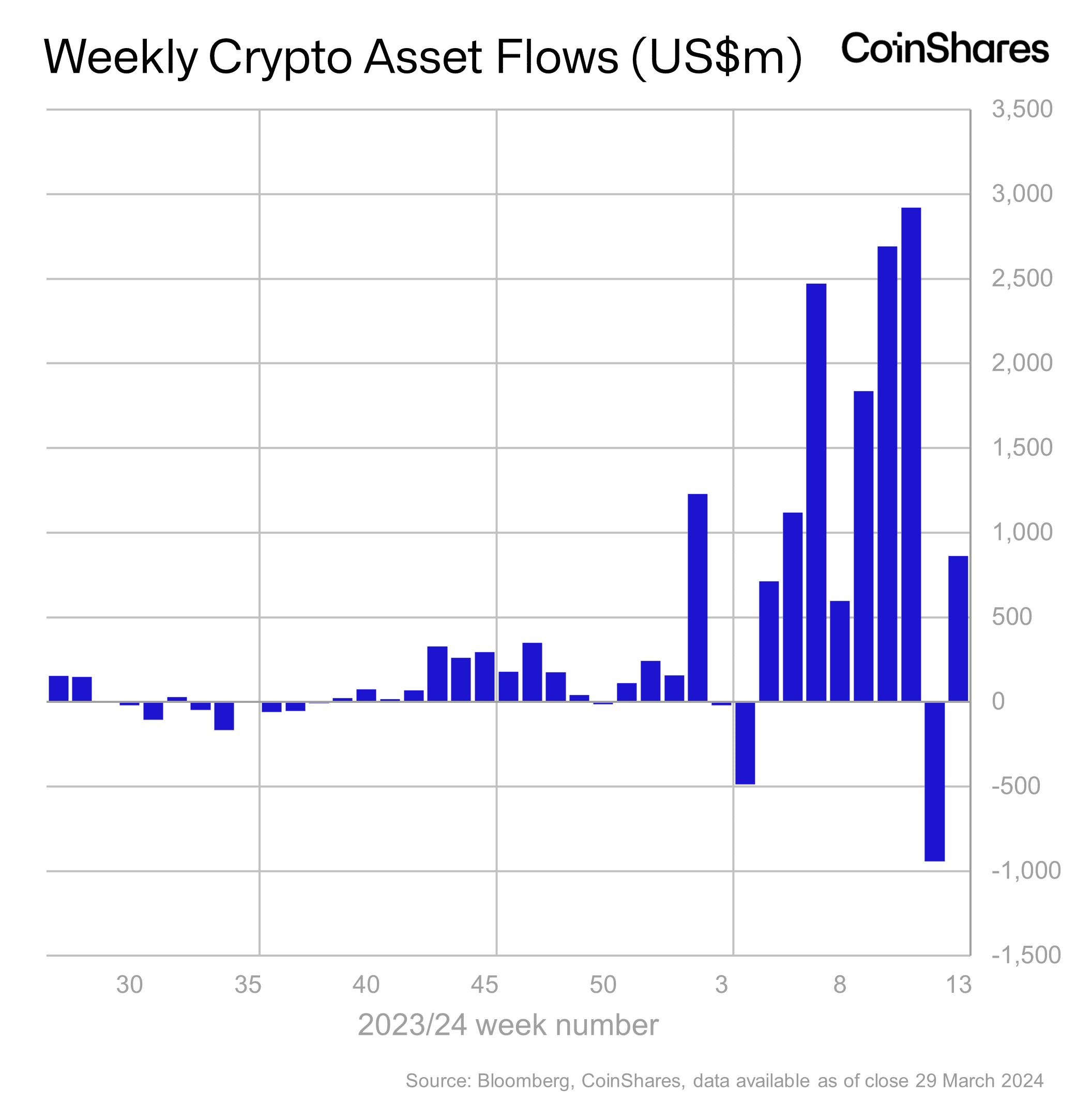

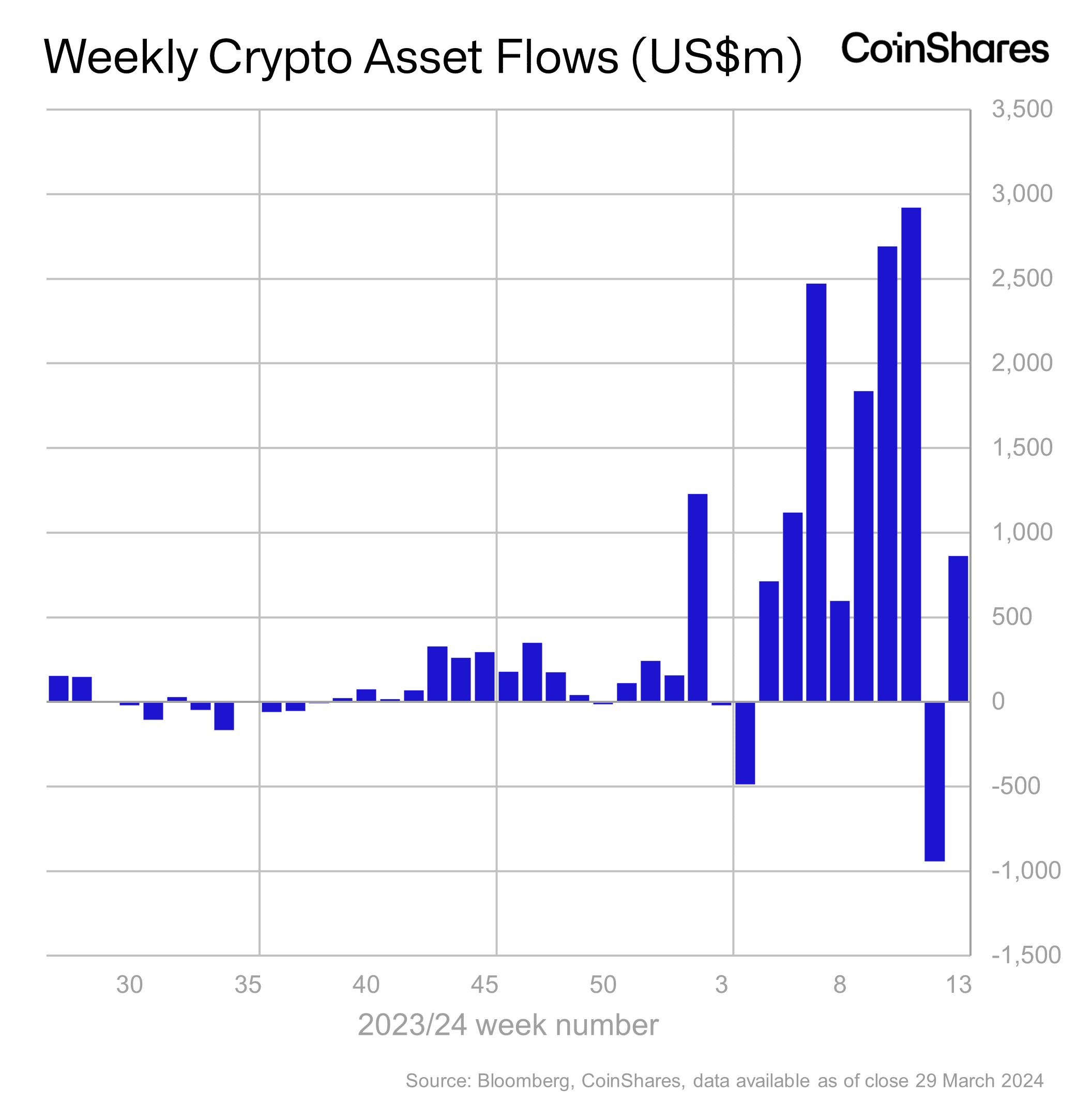

- Year-to-date, inflows into digital asset funds amounted to $13.13 billion.

- Bitcoin and Solana were in high demand, while Ethereum saw outflows.

Digital asset funds were back on track last week, boosted by strong investment in the newly launched Bitcoin [BTC] spot ETFs in the US

Strong recovery

According to data shared by James Butterfillhead of research at crypto asset management firm CoinShares, approximately $862 million in net inflows were recorded through institutional crypto products

This was a sharp recovery from the $942 million outflow a week earlier.

The latest capital injection took year-to-date (YTD) inflows to $13.13 billion. For context, this was almost 25% higher than the total inflows in 2021 – the year of the last bull run in the crypto market.

Source: CoinShares

During the week, total assets under management (AuM) rose to $98 billion, an increase of 11% from the previous week.

AUM is an important performance gradient of a fund. The higher the value of the assets under management, the more investments it usually attracts. AUM depends on the inflow and the market value of the underlying asset.

Last month, AUM reached $100 billion for the first time in history, as Bitcoin reached its all-time high (ATH) of $73,000. However, the subsequent price correction caused assets under management to fall to their current level.

Bitcoin remains the favorite of institutions

As expected, Bitcoin-linked funds led the charge, bringing in $865 million in inflows last week. This increased total inflows since the beginning of the year to an impressive $12.8 billion.

The increase could be attributed to strong demand for US-based spot Bitcoin ETFs, which attracted $860 million in inflows last week.

Robust inflows into new ETFs led by BlackRock’s IBIT helped offset outflows from incumbent issuer Grayscale’s GBTC, which has been hemorrhaging since switching to an ETF.

Ethereum loses, Solana wins

On the other hand, funds are linked to the second largest cryptocurrency Ethereum [ETH] saw an outflow worth $19 million last week. The bearish sentiment likely stemmed from lower odds of an ETH ETF approval.

Solana-based investment products saw $6 million inflows last week, boosted by impressive numbers price performance of the original assets SOL.