- Bitcoin traders de-risk as a FOMC illness looms.

- Can the policy of 9% January feed Trump’s policy a new momentum for BTC?

January has traditionally been a slow month for Bitcoin [BTC]But 2025 is the trend with a win of 9%. Nevertheless, a record decrease in open interest and negative CME premiums signal that traders reduce their BTC exposure.

Is this just caution with the American economy as the most important trigger – or the start of a larger shift?

What happens in the US?

American investors are now the ones to look at. The Coinbase Premium Index (CPI) is in the red Seven days in a row, in accordance with the dip of BTC from $ 104k to $ 102k.

As de-risk continues, with more than $ 3 billion in futures positions closed, the purchasing pressure remains lukewarm.

With the FOMC meeting that pop up great, traders take a step back from risky leverage, so that every large increase in open positions of the table remains prolonged.

Although inflation seems to be under control and Trump is pink For lower oil prices, it is the implementation of this policy that the market has in a holding pattern. Until the clarity comes, traders remain on the sidelines.

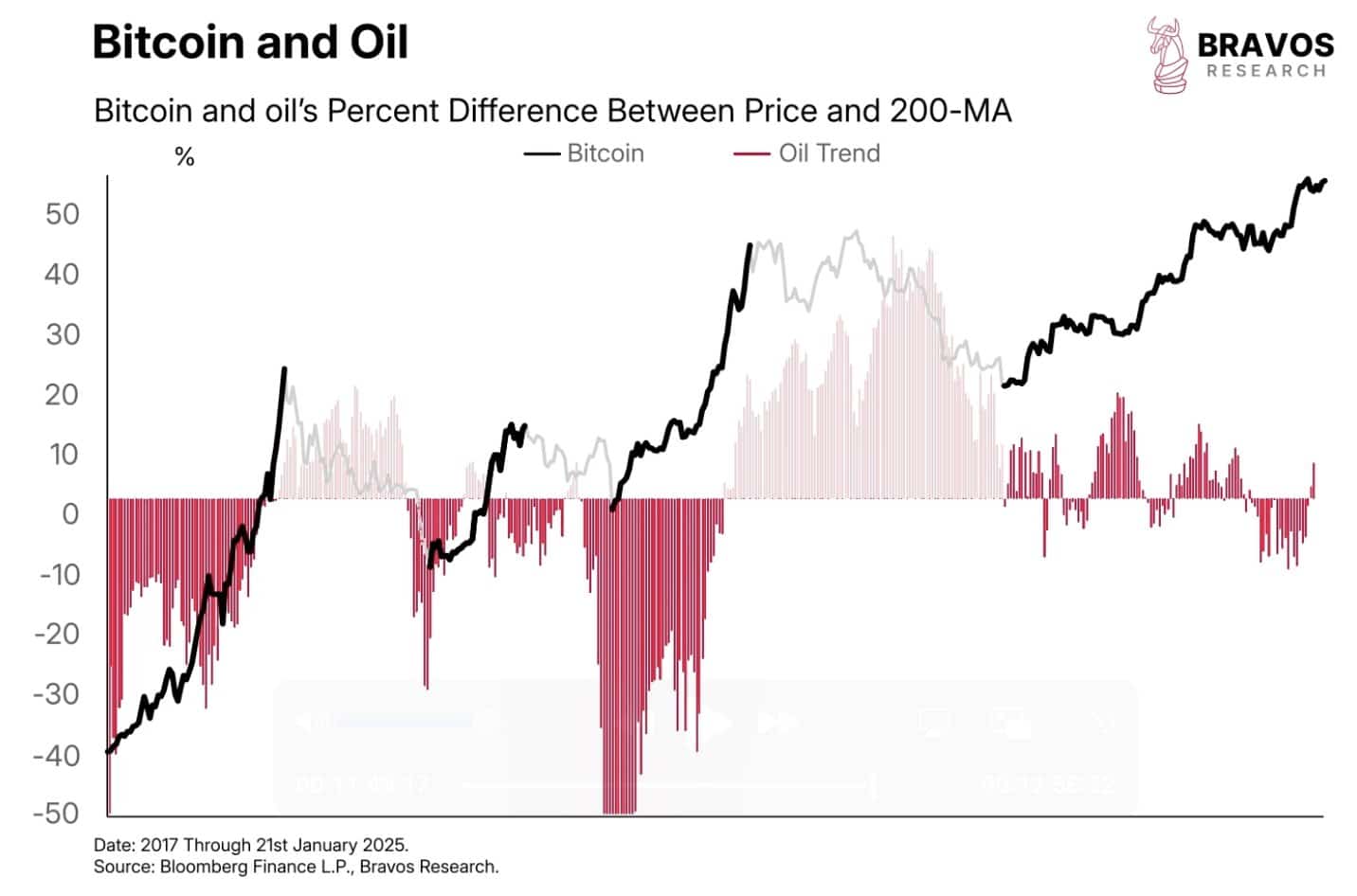

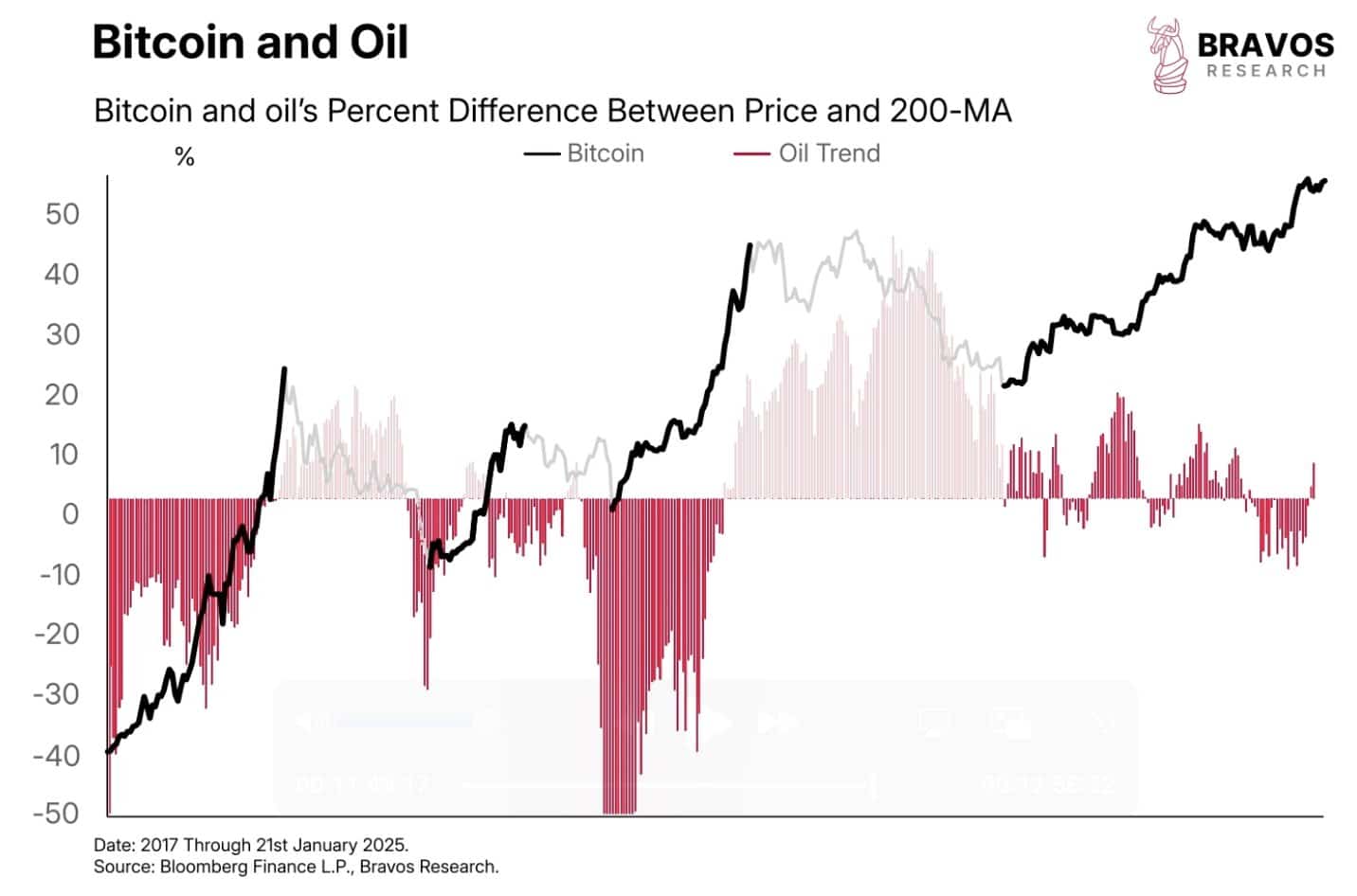

Bitcoin often performs well when oil prices are falling. If oil helps to cool inflation, the Fed can lower the rates. View this closely – it can be a key factor in the coming days.

Source: Bravos Research

Bitcoin in January

Between the inauguration of Trump, the constant large bitcoin accumulation of micro strategy, and a highest high in the ETF volume of 10 months, Bitcoin saw a solid jump of 9%in January.

These important drivers are the scene for a potential market shift. If bullish expectations falter, the range of $ 87k – $ 90k could arise as a strong support zone, where large players will probably intervene to buy BTC.

It is reminiscent of the price fall from December, when BTC dropped from $ 106k to $ 89k in just two weeks after inflation had checked 0.2%.

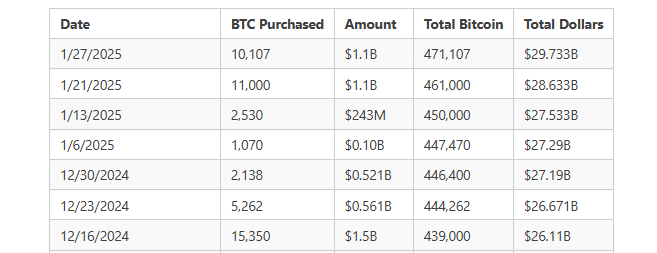

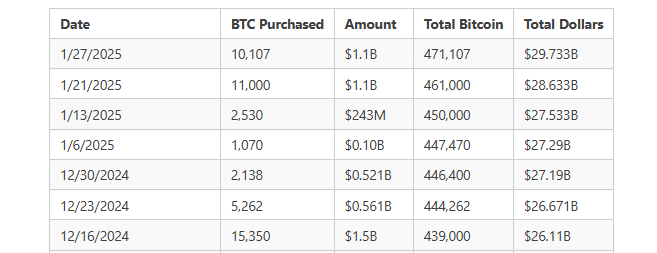

During that period, MicroSstratey made three huge Bitcoin purchases, each worth more than a billion dollars, double on their Bitcoin bet.

Source: Bitbo

Read Bitcoin’s [BTC] Price forecast 2025–2026

So, although the market runs carefully, a bitcoin ‘crash’ seems unlikely.

If there is something, a large shock can come if the Fed tart the expectations with Trump that penetrates lower rates, the market seems ready to endure a potential storm, making the much needed lighting in 2025.