Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

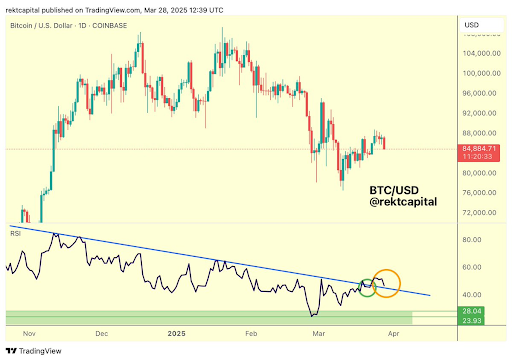

Crypto analyst Stretching capital Recently discussed the Bitcoin price campaign and provided insights into the future process of the Crypto flagship. In particular, he referred to BTC’s RSI, which shows a similar pattern as last year, just before the rally to new highlights.

Bitcoin’s RSI -oriented on daily retest that was activated in 2024 price rally

In one XCapital revealed that Bitcoin’s RSI focuses on a daily retest that the price of 2024 has activated. He called it last week, the Daily RSI Successfully a retest after the collapse of the RSI-Down Trend, which dates from November 2024, to confirm the outbreak. He added that the RSI is now going a new retest of the same falling trend.

Related lecture

The Bitcoin -price collected up to $ 100,000 During this period of November 2024 after the victory of Donald Trump in the US presidential election. The corresponding graph of stretching Capital showed that the RSI re -test the 40 zone, with a break below this level that will probably cause another downward trend for the flagship Crypto. On the other hand, holding up above this RSI level can cause another uptrend for BTC, which means that the price is sent to new highlights.

However, the Bitcoin price is currently more likely to be confronted with another large correction, which has fallen from the weekly high from around $ 88,500 to less than $ 84,000 on Friday. Macro factors such as Donald Trump’s rates And the quantitative tightening policy of the US Federal Reserve weakens the bullish momentum of the flagship Crypto.

Handelsbureau QCP Capital was of the opinion that every upward upward upward for the Bitcoin prize will be tucked off while the markets are waiting for clarity of Trump’s next movement in the escalating trade war. The PCE inflation data, which were released on Friday, also led to a bearish prospect for BTC, because the core index rose above expectations.

BTC can form a local soil at the current price level

Crypto analyst Titan from Crypto suggested that the Bitcoin price could be Form a local soil At its current price level. He noted that BTC still retains a strong confluence of supports, including the monthly Tenkan and the centerline of the monthly real value Gap. The analyst added that the last twice BTC kept these supports, it has marked a local soil.

Related lecture

In an earlier post, Titan of Crypto had increased the possibility that the Bitcoin price will soon come to $ 91,000. He stated that a bullish pennant had formed on the 4-hour graph. According to him, if this pattern breaks upside down, the BTC goal is around $ 91,400. In the meantime, Legendary trader Peter Brandt Looks bearish because he recently predicted that BTC could fall to $ 65,635.

At the time of writing, the Bitcoin price acts at around $ 83,900, according to more than 2% in the last 24 hours, according to facts Van Coinmarketcap.

Featured image of Unsplash, graph of TradingView.com