- Whales have accumulated significant amounts of BTC in recent days.

- Private interest was great, but open interest also increased.

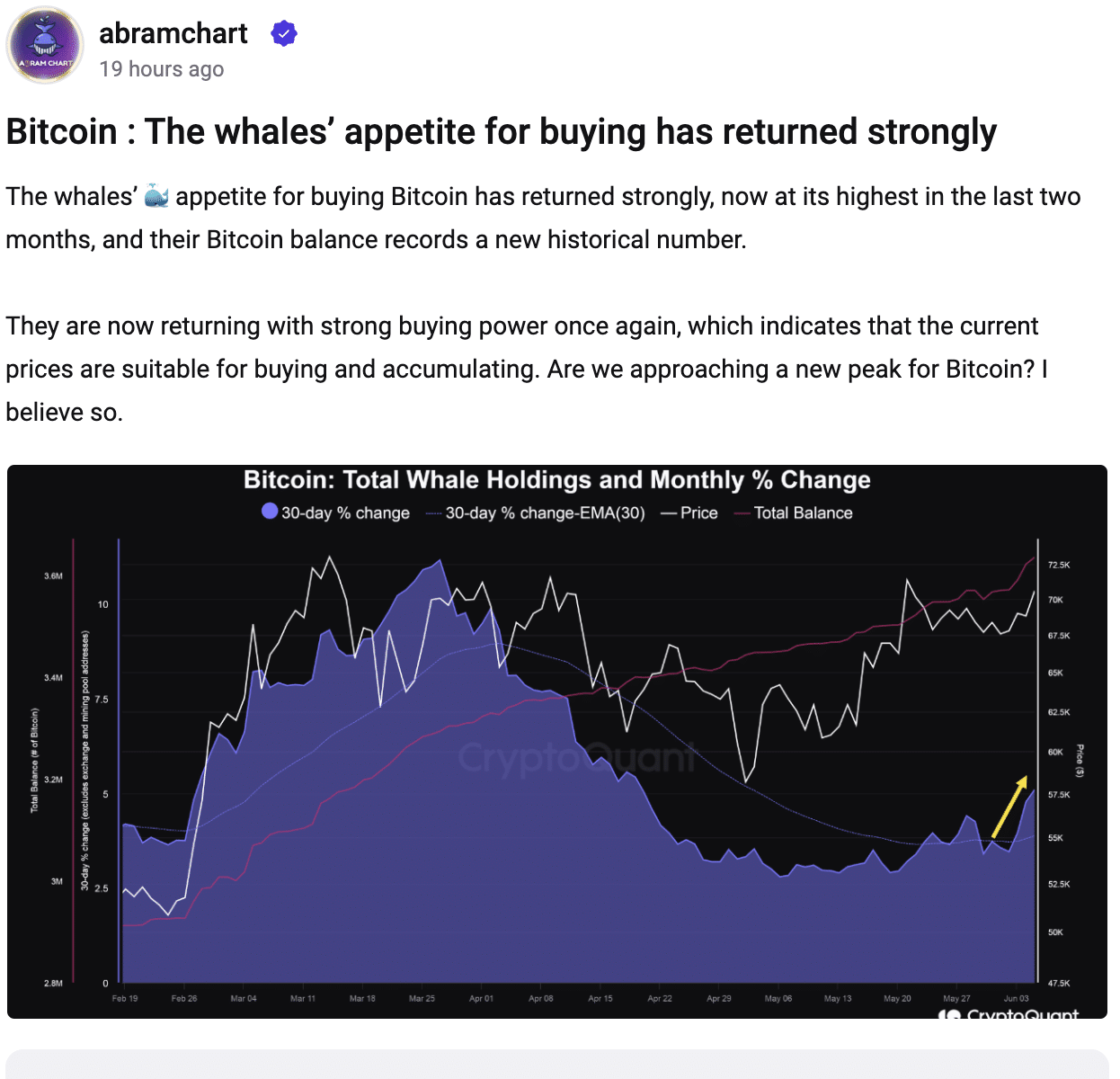

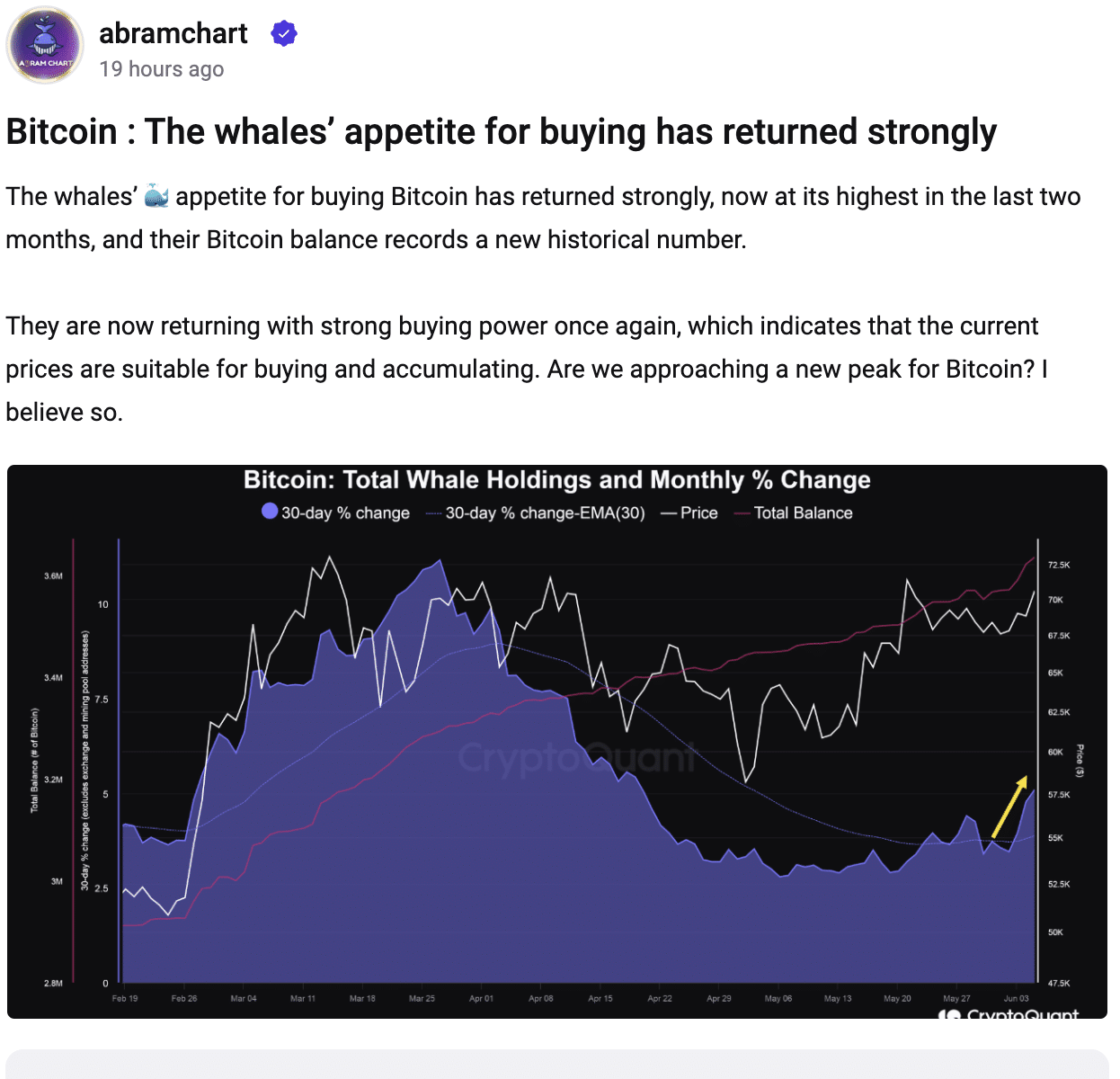

Whales collected a large amount of Bitcoin [BTC] the past weeks. Data suggested a renewed surge in Bitcoin purchases by whales, which hit a two-month high.

Their Bitcoin holdings have also reached a record peak. This renewed buying frenzy means that major investors are seeing current prices, which are already extremely high, as an attractive entry point for accumulating Bitcoin.

While past performance is not necessarily indicative of future results, whales’ historical influence on the market suggests that their buying activity could be a bullish indicator for Bitcoin.

Source: CryptoQuant

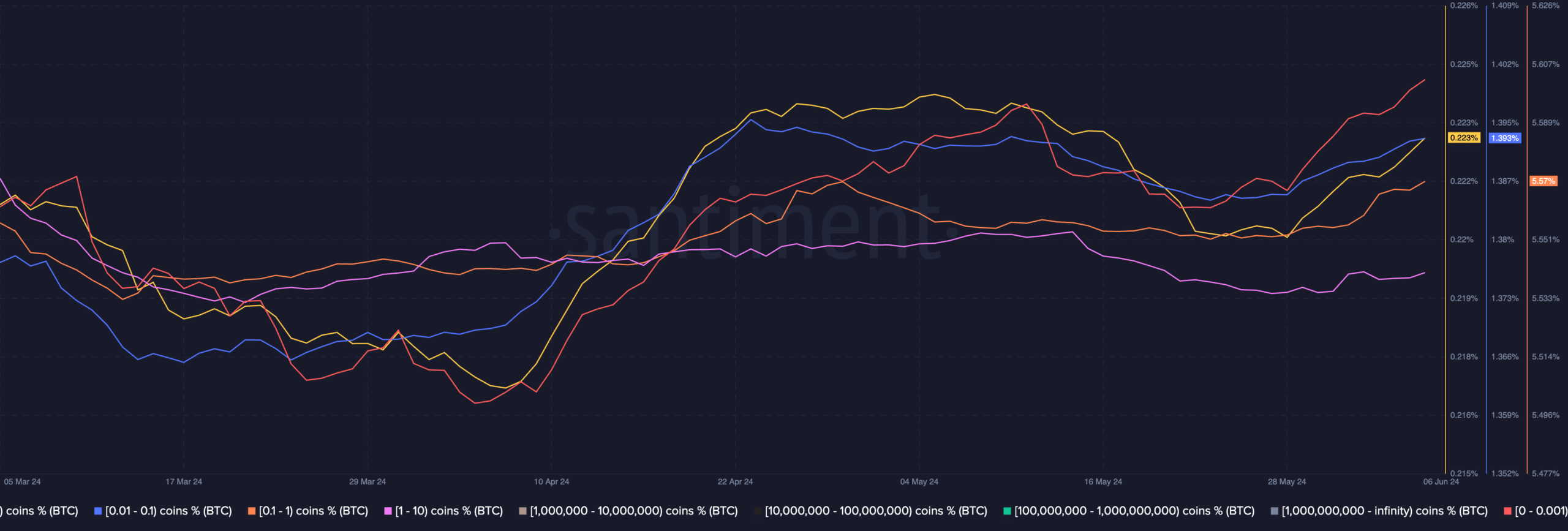

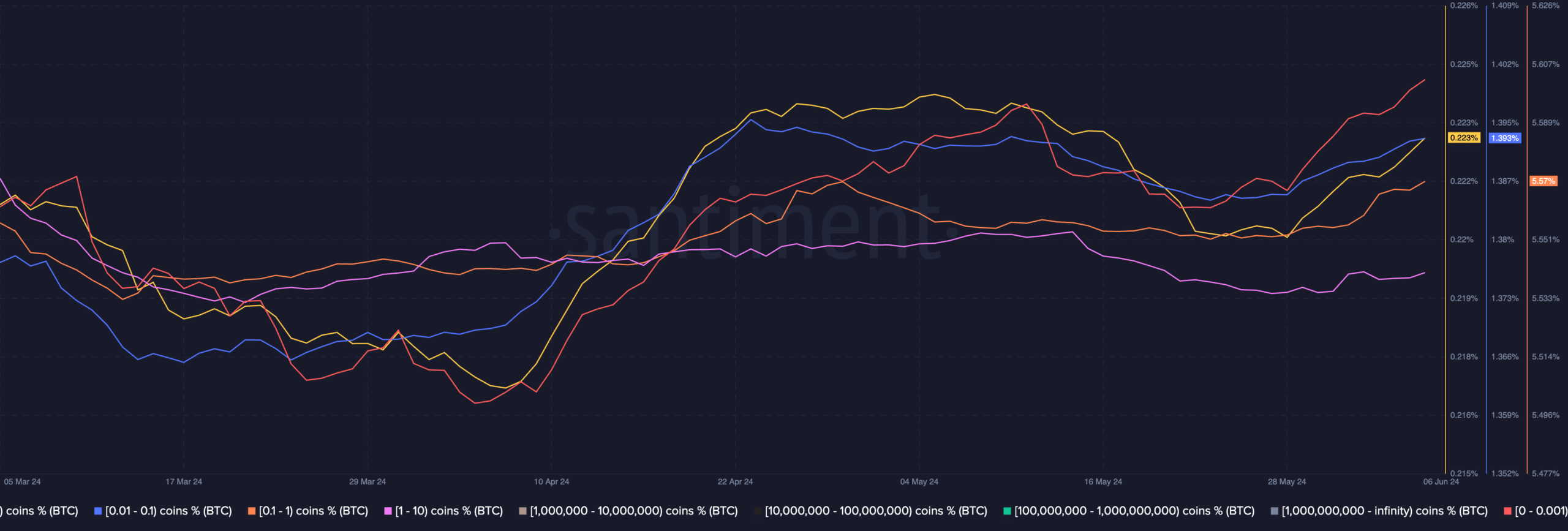

Private investors also showed interest in BTC. AMBCrypto’s analysis of Santiment’s data revealed that the cohort of addresses ranging from 0.1 to 10 had shown interest in BTC.

Source: Santiment

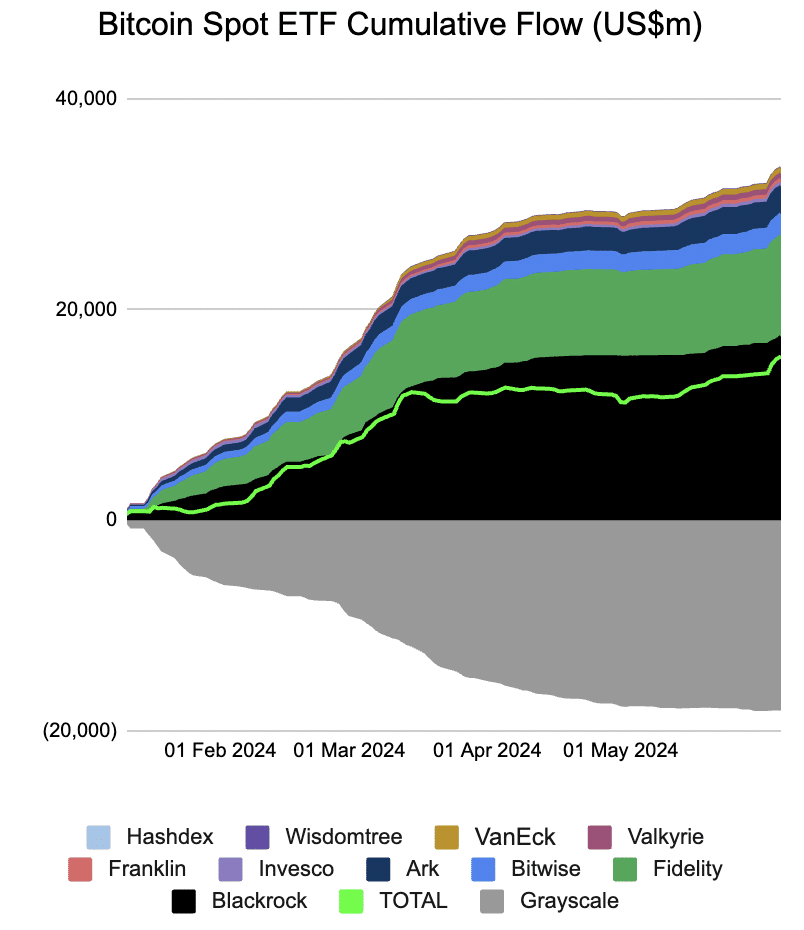

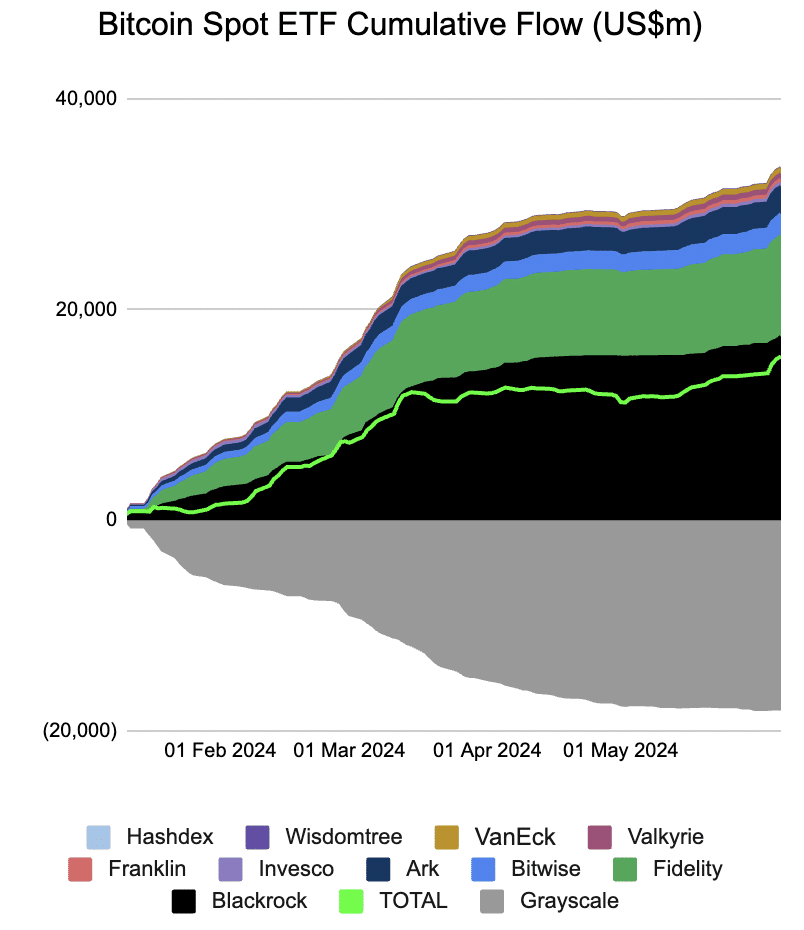

Interest in BTC ETFs also grew

Despite a surge in interest in Bitcoin ETFs, with a record 19-day inflow into US spot Bitcoin ETFs, there was no sign of a change in BTC prices.

While positions in spot Bitcoin ETFs have reached significant levels globally, with approximately 1.3 million Bitcoin or 5.2% of the circulating supply as of June 6, and much of it concentrated in US-listed ETFs, the price has not reacted as dramatically as some others. could expect.

Farside data shows that inflows amounted to $217.7 million on June 6 alone. Total inflows since launch have exceeded $15.5 billion, but some traders believe this amount is still insufficient to significantly move the price needle until other markets open up.

Source: Farside

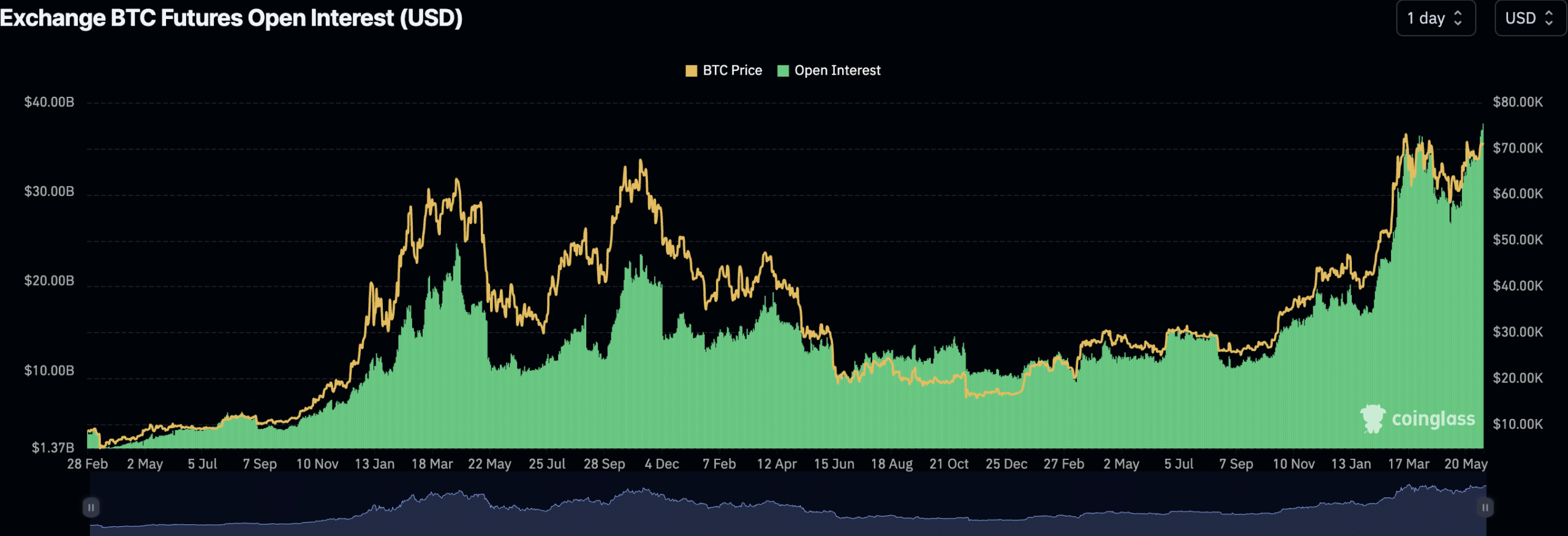

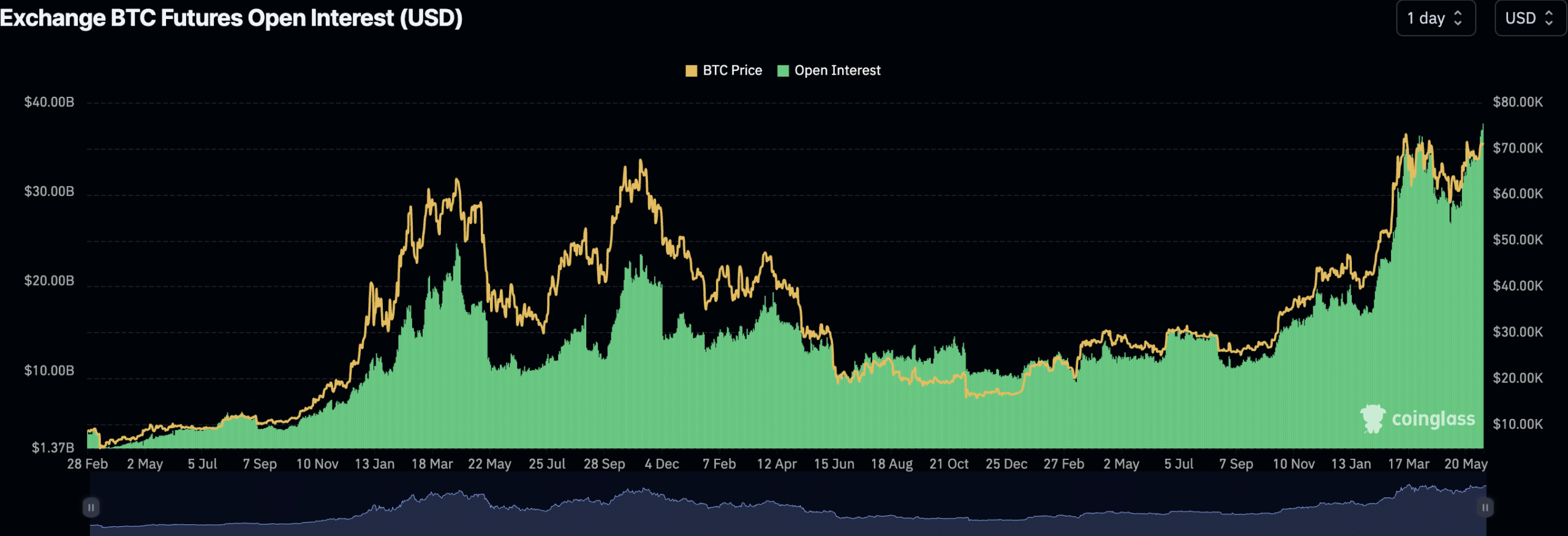

Open interest is rising

In addition, the Open Interest (OI) in BTC also grew.

Historically, high OI has been characterized by excessive debt burden, and speculation often precedes a price correction. However, at the time of writing this did not appear to be the case.

While funding rates, which reflect the willingness of long and short positions to pay each other, remained slightly positive, they were significantly lower compared to March highs.

Read Bitcoin’s [BTC] Price forecast 2024-25

This indicated that bullish long positions were dominant and that bulls were willing to pay bears to maintain their short positions. However, the market was not as heated as in March.

At the time of writing, BTC was trading at $71,138.10 and in the last 24 hours it had grown by 1.09%.

Source: Coinglass