- Bitcoin has risen to a 20-week high above $71,000 amid positive market sentiment.

- With 98% of holders in profits, FOMO could push BTC to a new ATH before the end of Uptober.

Bitcoin [BTC] is on the rise this month, recently hitting a 20-week high above $71,500. At the time of writing, BTC was trading at $70,900 and was only 3.7% below its all-time high.

Several bullish indicators currently suggest that Bitcoin could form a new ATH before the end of “Uptober” amid positive market sentiment.

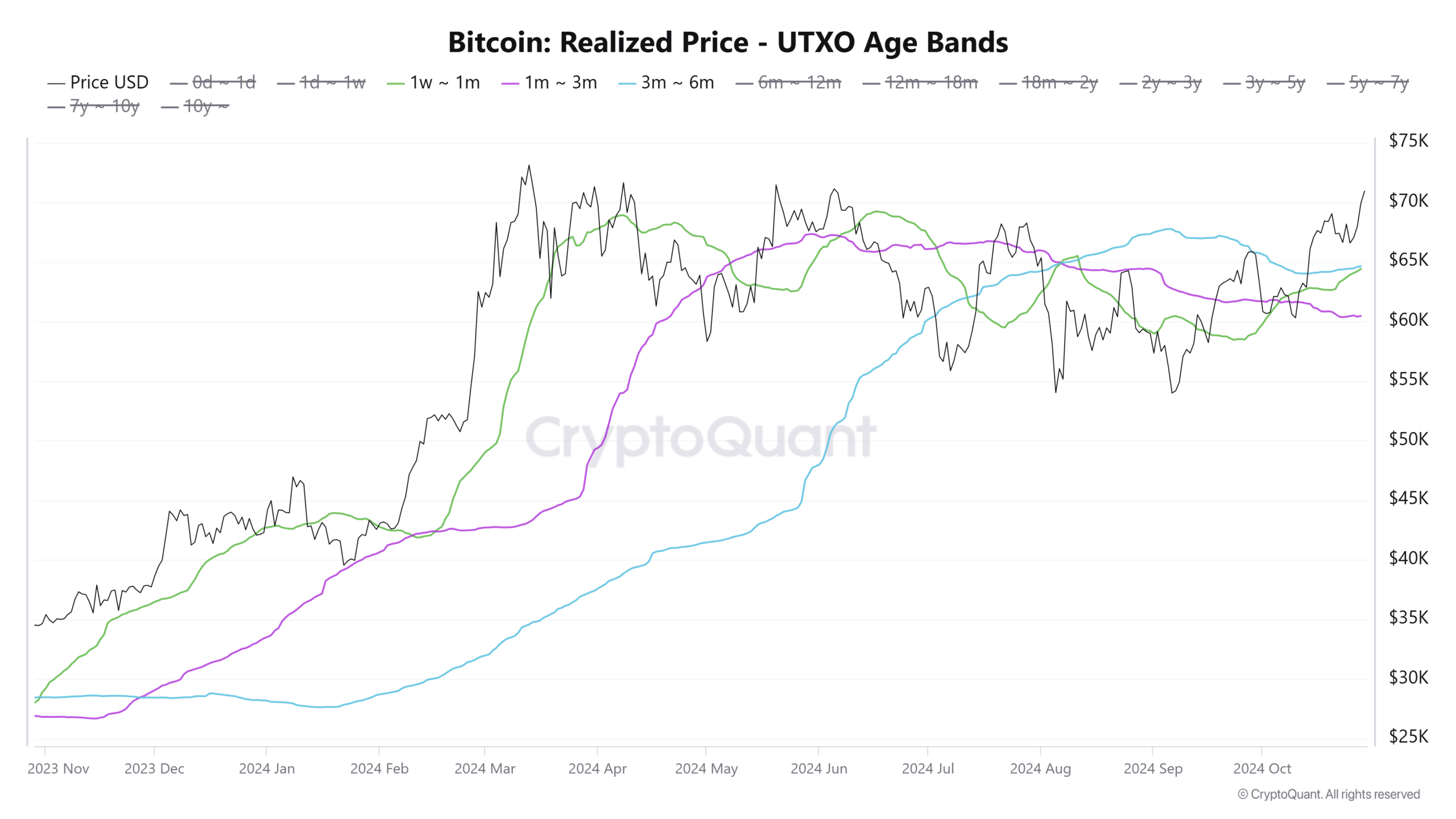

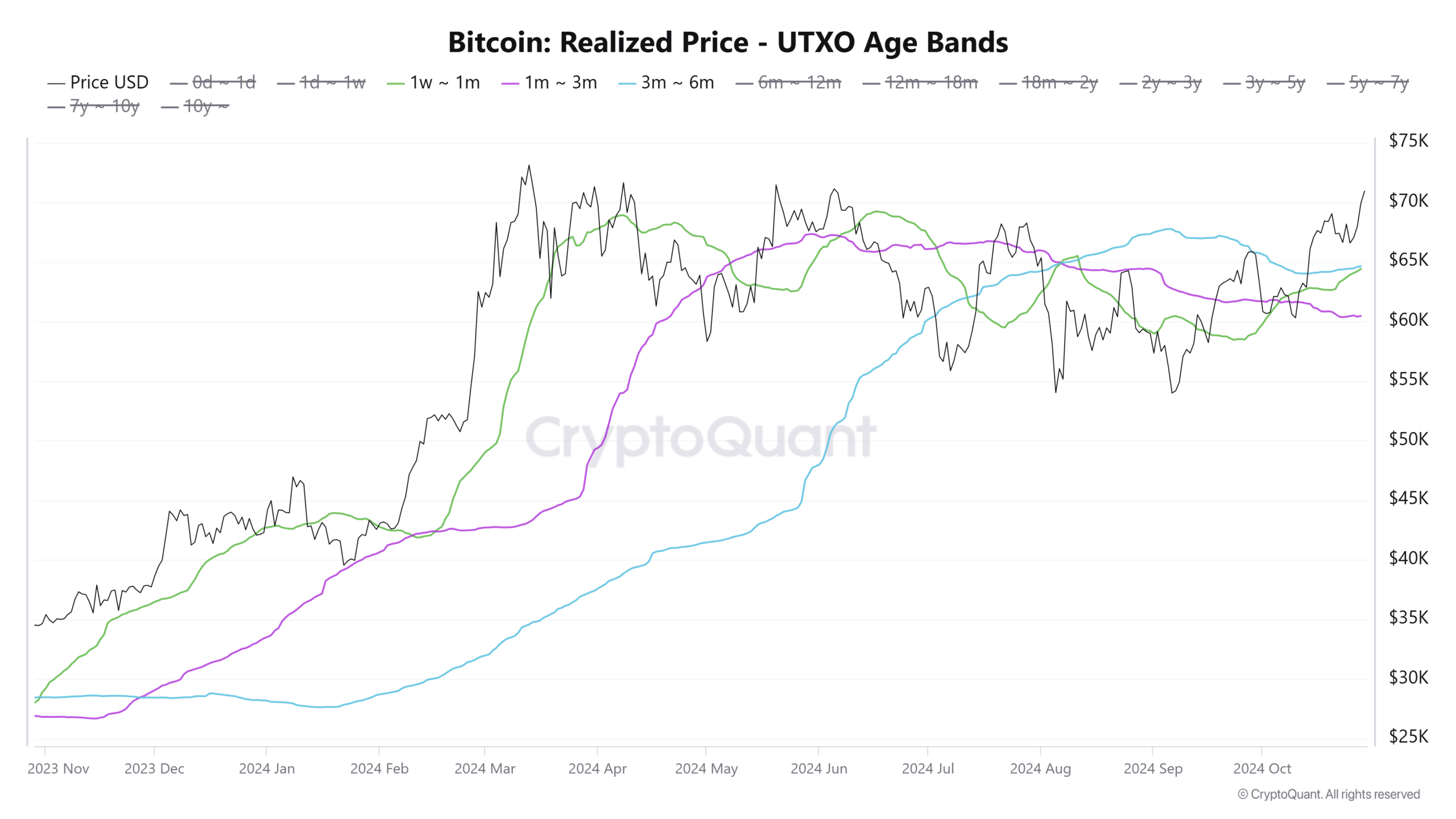

Bitcoin UTXO Realized price

A look at the Bitcoin UTXO realized price for short-term holders suggests that prices could continue to rise in the short term.

Per CryptoQuantthe UTXO realized price for wallets that have held BTC for less than a month nearly surpasses that of wallets that have held Bitcoin for three to six months.

Past crossovers have often been preceded by significant price increases. A similar crossover is about to happen, which could reinforce the bullish narrative surrounding BTC.

Source: CryptoQuant

Short-term bonds generally determine the sustainability of a rally. If new trades occur at higher prices, this will boost market sentiment and pave the way for an ATH.

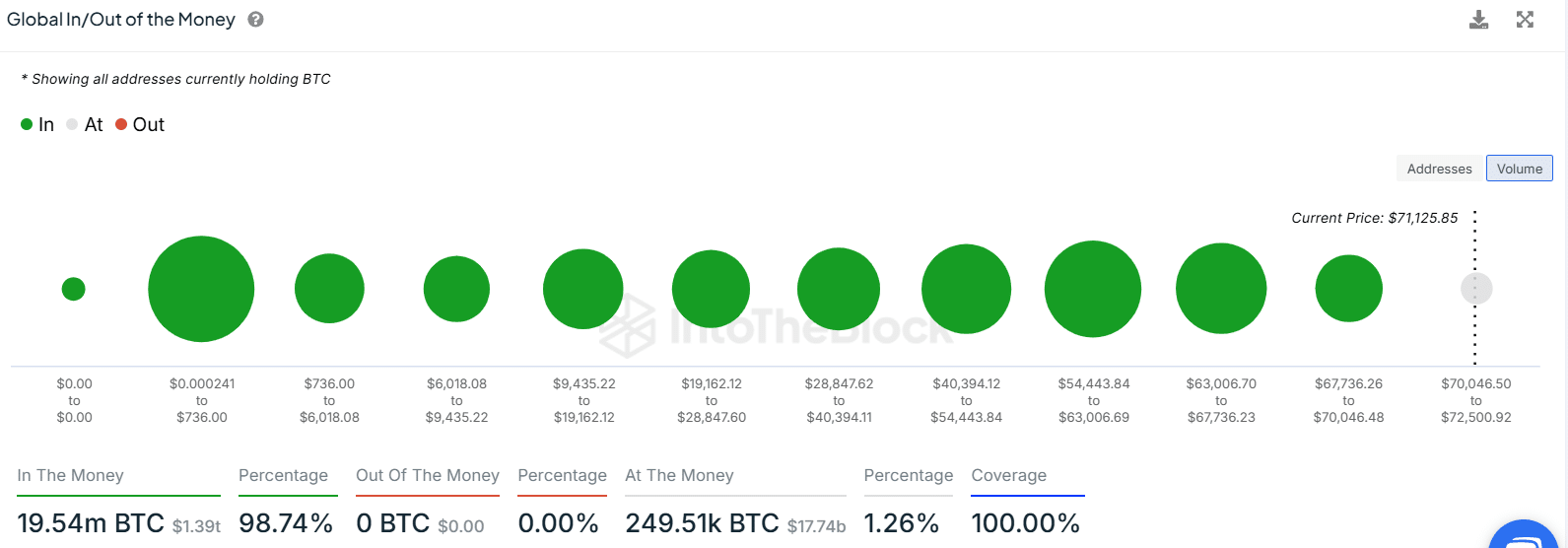

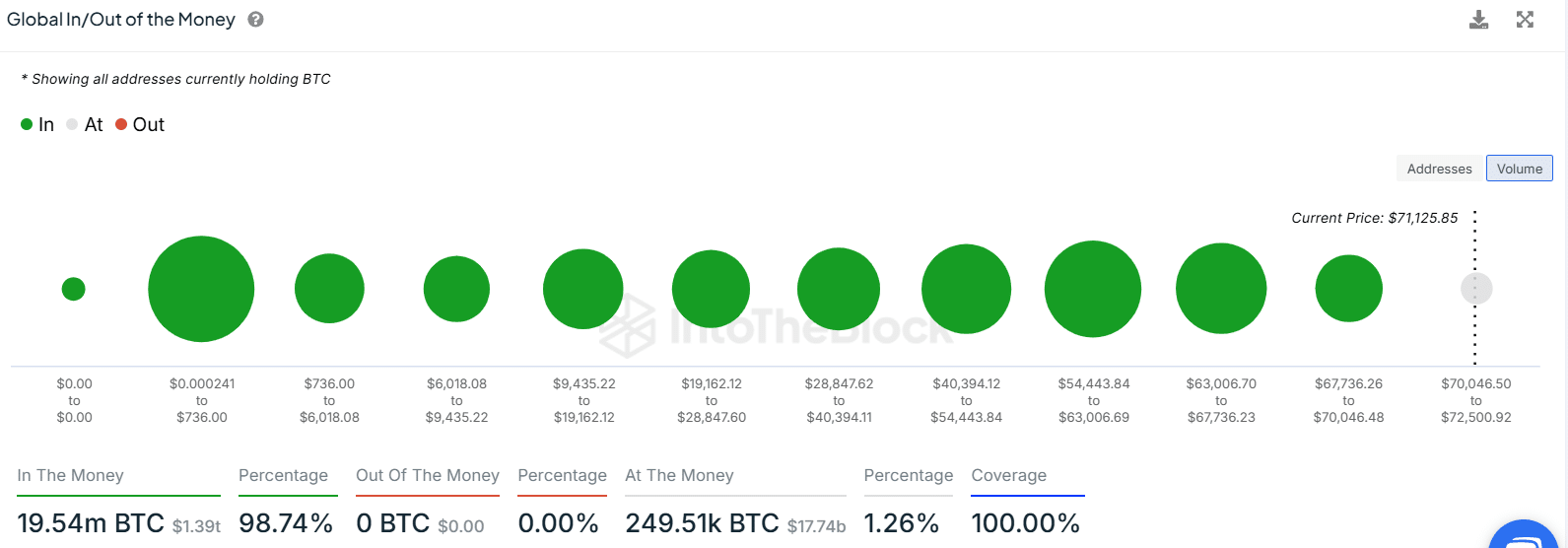

98% of holders make a profit

Data from IntoTheBlock shows that 98% of BTC holders are making a profit, while 1.26% are at a breakeven point.

Source: IntoTheBlock

When wallet profitability increases, it increases investor confidence as holders are more willing to hold their assets rather than sell them. This scenario can also fuel fear of missing out (FOMO). As a result, new buyers could enter the market, reinforcing the upward trend.

FOMO is already evident as the Fear and Greed Index is at 72. This shows that the market is in a state of greed.

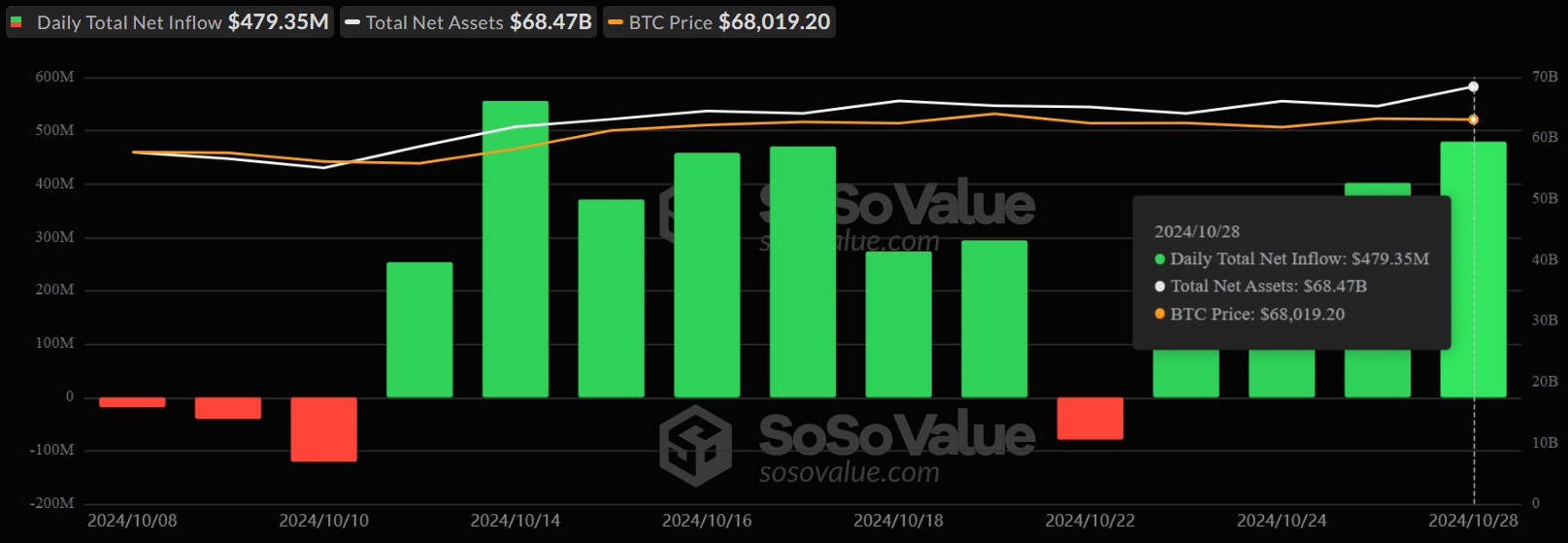

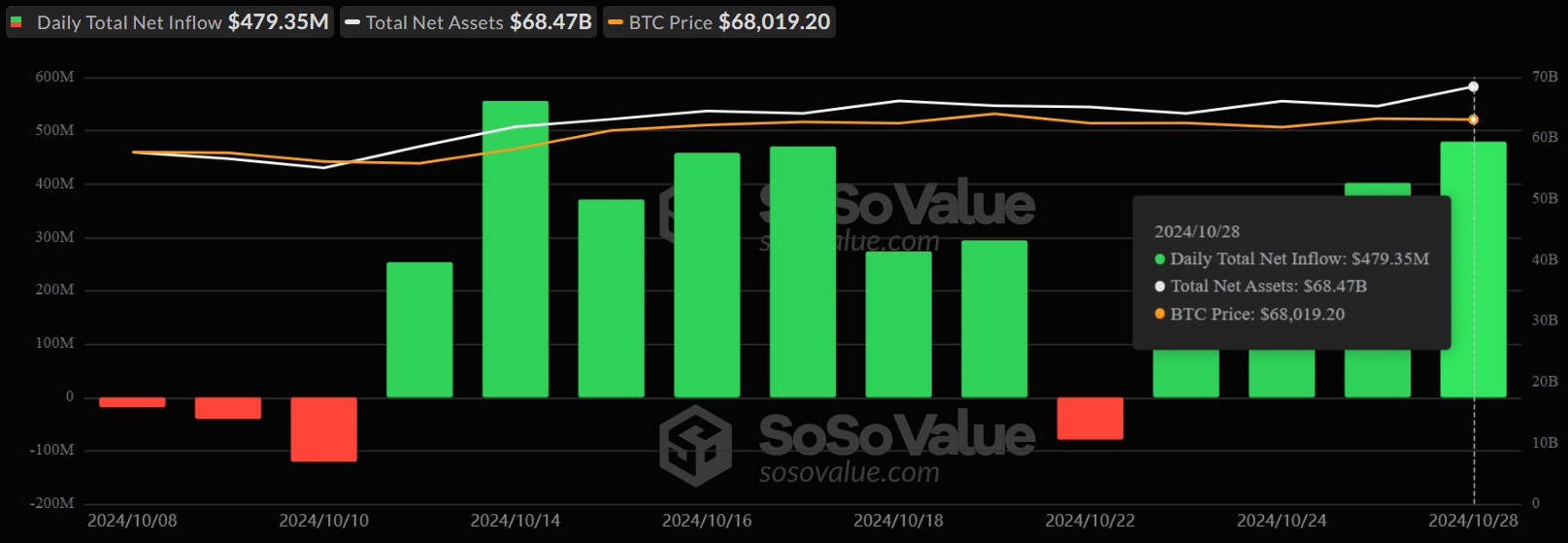

Rising demand for BTC ETFs

On October 28, US Bitcoin Exchange-Traded Funds (ETFs) recorded their highest inflows in two weeks. According to SoSoValue, intraday inflows totaled $479 million, with Blackrock taking the largest share with an inflow of $315 million.

Source: SoSoValue

As AMBCrypto reported, BlackRock’s BTC holdings have surpassed 400,000 coins, with the asset manager on track to flip Satoshi and become the largest Bitcoin holder.

Read Bitcoin’s [BTC] Price forecast 2024–2025

US spot Bitcoin ETFs collectively hold $68.47 billion in assets, which is 4.9% of the Bitcoin supply. In just two weeks, these ETFs have recorded net flows of $3 billion.

With Bitcoin attracting new interest from both retail and institutional investors, market dominance over altcoins has continued to rise. At the time of writing, Bitcoin’s dominance stood at 60%, while the altcoin seasonal index had dropped to 27.