This article is available in Spanish.

Bitcoin price has consolidated around $94,000 for most of the past seven days signs of a fracture on both sides. According to a crypto analyst, Bitcoin’s recent price movements have led to the creation of liquidity blocks ranging between $86,000 and $104,000, which carries an equally high chance of a jump towards $104,000 or $104,000. a setback up to $86,000 from current price.

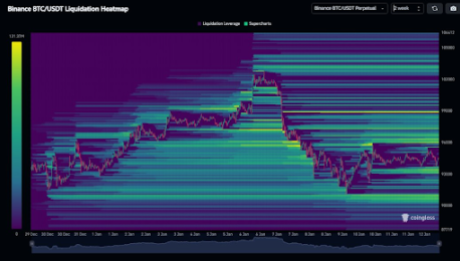

Huge blocks of liquidity in both directions

Bitcoin’s recent price consolidation has given little to no idea of what to expect from it, with the liquidation heatmap also showing the same trend. As highlighted by crypto analyst Kevin (@Kev_Capital_TA), reports Bitcoin’s liquidation heatmap huge liquidation blocks from $86,000 to $90,000, all the way to $104,000.

Related reading

According to the analyst, these huge liquidation blocks increase the possibility that Bitcoin price continues to fluctuate between these levels and create an up-and-down move between $86,000 and $104,000 until the end of the month. However, a break to $86,000 could have a devastating effect on the Bitcoin price. The Bitcoin UTXO Realized Price Distribution (URPD) ATH-partitioned shows a support gap of $12,000 below this price point. Therefore, a drop to $86,000 opens the possibility of a further crash to $75,000.

Bitcoin’s price action is likely to continue moving in the trading range of $86,000 to $104,000, and there will only be a bullish case if Bitcoin eventually breaks above $108,000. This level is important because it serves as Bitcoin’s current price peak. A breakout above $108,000 would translate into new all-time highs for the leading cryptocurrency and could pave the way for a more sustained bullish trend.

The analyst also emphasizes the importance of monitoring USDT dominance, which currently stands at 3.7%. Kevin argues that a clear breakdown of USDT dominance is a necessary signal for a more stable and bullish market environment. One consequence of USDT’s less dominance is that investors are converting their stablecoins into Bitcoin and other cryptocurrencies.

Logical approach to the liquidation blocks

Kevin noticed that the logical approach would be to keep an eye on the market during these predicted up and down choppy moves. This approach is even more practical for traders who are more involved in recent trades and current price action.

Related reading

On the other hand, traders who have been holding since the bottom of the bear market may find it easier to weather the current volatility given the broader bullish outlook predicts further price increases throughout 2025.

At the time of writing, Bitcoin is trading at $94,050 and is down 0.5% and 5.46% respectively over the past 24 hours.

Featured image created with Dall.E, chart from Tradingview.com