Bitcoin price managed to overcome the key resistance at $35,000. BTC is showing positive signs and could rise towards the USD 36,200 and USD 37,000 levels in the near term.

- Bitcoin is gaining pace above the USD 35,000 resistance.

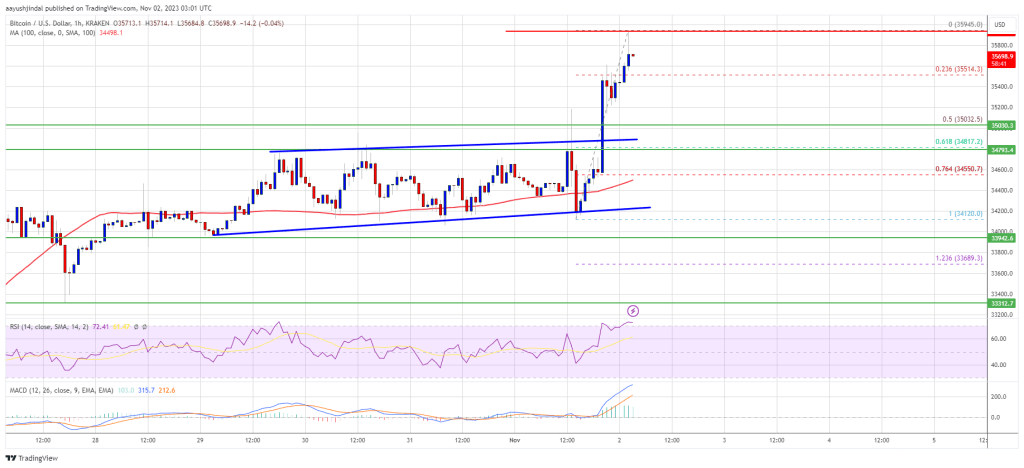

- The price is trading above $35,000 and the 100 hourly Simple Moving Average.

- There was a break above an ascending channel with resistance at $34,850 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair is showing positive signs and could rise towards the $37,000 resistance in the near term.

Bitcoin Price Breaks Barrier

Bitcoin price remained well above the $34,000 support zone. BTC formed a base, completed a consolidation phase and recently started a decent rise above the USD 34,750 resistance.

There was a break above a rising channel with resistance at $34,850 on the hourly chart. The bulls were able to pump the price above the last swing high and $35,500. It traded to a new multi-week high at $35,945 and continues to show positive signs.

Bitcoin is now trading above $34,260 and the 100 hourly Simple Moving Average. It is also well above the 23.6% Fib retracement level of the recent rise from the $34,120 swing low to the $35,945 high.

On the upside, immediate resistance is around the $35,950 level. The next major resistance could be near USD 36,200. A clear move above the USD 36,200 resistance could open the doors for a decent 5% upside towards the USD 37,000 resistance.

Source: BTCUSD on TradingView.com

The next major resistance could be at USD 37,500, above which the price could rise towards USD 38,000. Any further gains could send BTC towards the $38,800 level.

Are dips limited in BTC?

If Bitcoin fails to rise above the USD 35,950 resistance zone, a downward correction could occur. The immediate downside support is near the USD 35,500 level.

The next major support is near the $35,000 level or the 50% Fib retracement level of the recent rise from the $34,120 swing low to the $35,945 high. If there is a move below $35,000, there is a risk of more downside. In the mentioned case, the price could fall towards the $34,500 level or the 100 hourly Simple Moving Average.

Technical indicators:

Hourly MACD – The MACD is now gaining speed in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now in the overbought zone.

Major support levels – USD 35,500, followed by USD 35,000.

Major resistance levels – $35,950, $36,200 and $37,000.