- BTC could rise to $67,269 in the first phase of the expected rebound

- Liquidation levels showed a bearish bias that may soon be reversed

Things may have changed for Bitcoin [BTC] after the completion of the 4th halving. However, when it comes to price, the more things change, the more they stay the same. AMBCrypto came to this conclusion after monitoring currency transfers to derivatives exchanges. According to data from CryptoQuant, the amount of BTC sent to derivatives exchanges has increased significantly.

Above all, we have seen that this is the handiwork of whales. Historically, if this happens at a rapid pace, it means whales are preparing to open long positions in Bitcoin.

Source: CryptoQuant

Big guns become aggressive

Also a pseudonymous on-chain analyst datascope commented on the activity. According to datascope sharing its thoughts on CryptoQuant,

“The increase in the transfer rate of Bitcoin from exchanges to derivatives exchanges is considered an important indicator. Recent data indicates that these types of transfers have been a major factor in the rise in Bitcoin prices.”

The price of Bitcoin at the time of writing was $63,572. It is worth noting that before the halving, AMBCrypto had argued that the number one cryptocurrency could already be priced in.

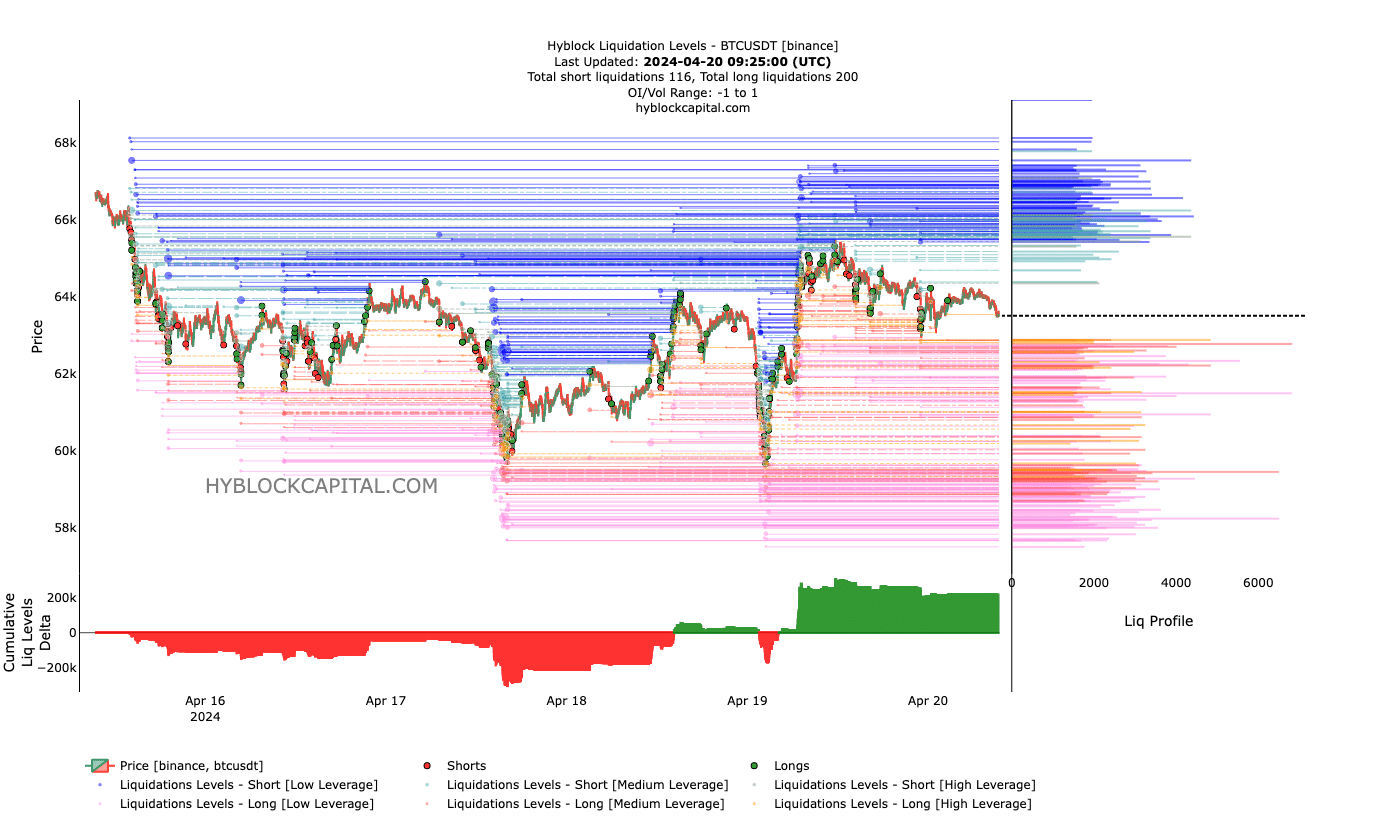

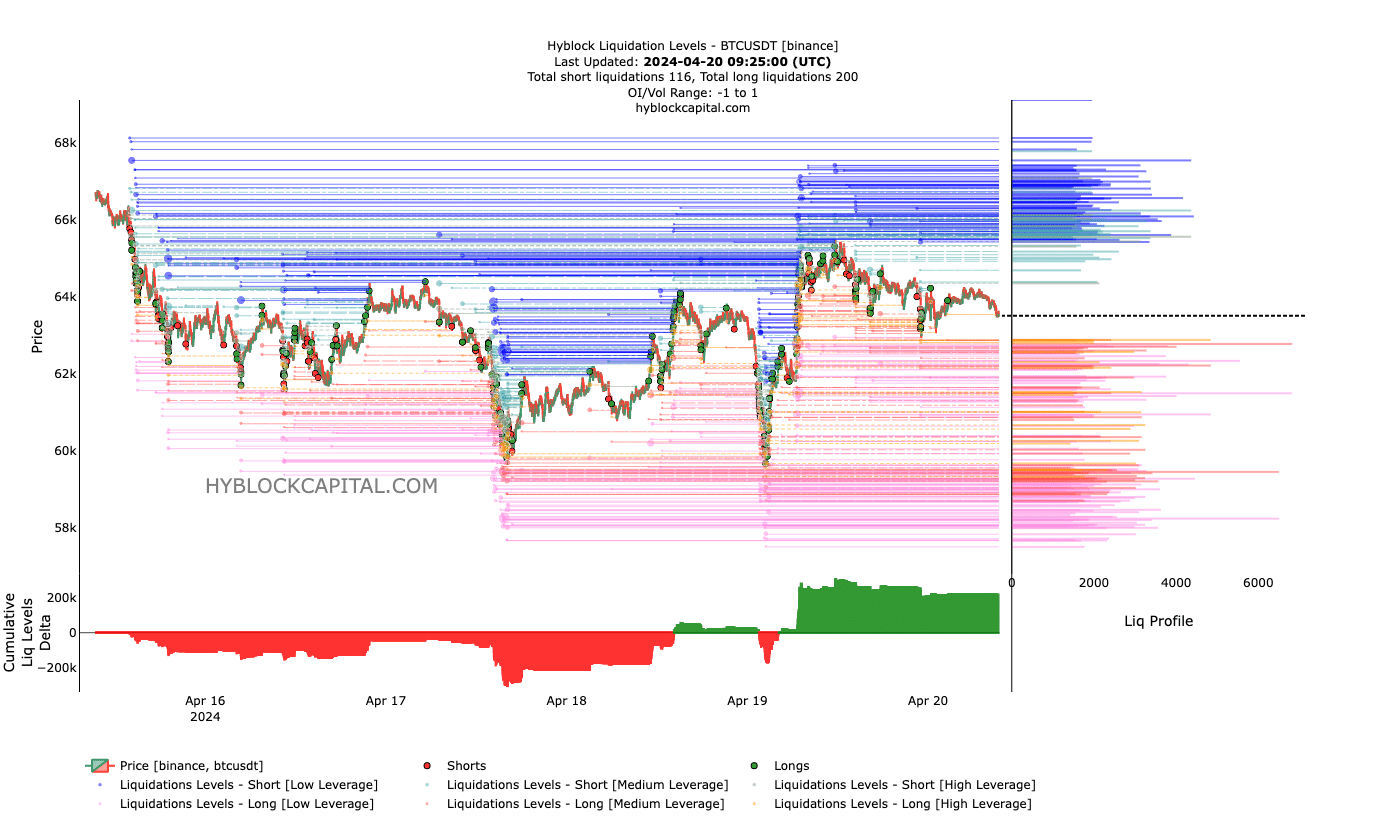

However, based on our latest analysis, the stalemate could turn to the positive side. Liquidation levels are one indicator fueling this prediction.

Liquidation levels revealed estimated price levels where a liquidation event could occur. For context, liquidation occurs when an exchange forcibly closes a trader’s position. This is either due to an insufficient margin balance, or a highly leveraged bet that went in the opposite direction.

At the time of writing, a liquidity cluster appeared from $65,434 to $67,269, suggesting that Bitcoin’s price could target these levels in the near term.

Another thing we noticed was that there has been some aggressive buying since the drop below $64,000. As buying pressure increases, long positions with low leverage could soon be rewarded.

Bears will not survive what is coming

Finally, we looked at the Cumulative Liquidation Levels Delta (CLLD). At the time of writing, the CLLD was positive. Negative values of the CLLD indicate more short liquidations.

On the contrary, a positive reading implies that more long-term liquidations have taken place. However, this indicator also has some effect on the price.

Source: Hyblock

From the above indications, the CLLD showed a bearish bias. However, if whales enter their orders with current liquidity, this signal could be reversed.

In this situation, the price may fall and cause some stop losses. And yet, once some of the liquidity is washed away, the price could go back up.

Read Bitcoin’s [BTC] Price forecast 2024-2025

Should this be the case in the future, Bitcoin could rise, and in the medium term, reaching $75,000 could be an option. However, in the short term, BTC could fall lower than $63,000 before the pump kicks in much later.