This article is available in Spanish.

Bitcoin price is recovering higher above the USD 95,000 level. BTC is showing positive signs and is aiming for another surge above the USD 98,000 level.

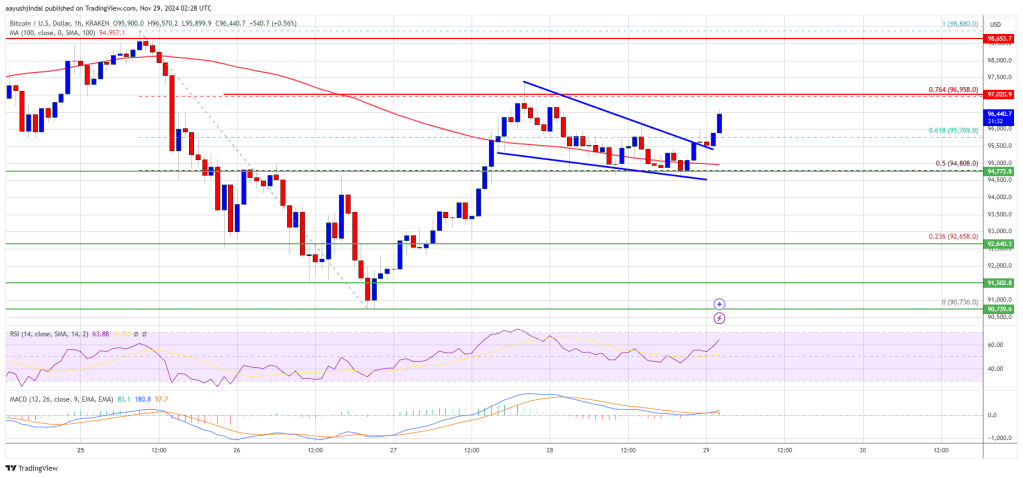

- Bitcoin started a new rise above the $95,000 zone.

- The price is trading above $95,500 and the 100 hourly Simple Moving Average.

- There was a break above a short-term contractual triangle at resistance at $95,500 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could gain bullish momentum if it breaks the $97,000 resistance zone.

Bitcoin price has more advantages

Bitcoin price remained steady above the $93,500 zone. BTC formed a base and started a new rise above the USD 94,500 resistance zone. The bulls were able to push the price above the USD 95,500 resistance zone.

There was a break above a short-term contractual triangle with resistance at $95,500 on the hourly chart of the BTC/USD pair. The pair climbed above the 61.8% Fib retracement level of the downwave from the $98,880 swing high to the $90,735 low.

Bitcoin price is now trading above $95,500 and the 100 hourly Simple Moving Average. On the upside, the price could encounter resistance near the USD 97,000 level. It is close to the 76.4% Fib retracement level of the downward wave from the $98,880 swing high to the $90,735 low.

The first major resistance is around the $98,500 level. A clear move above the USD 98,500 resistance could push the price higher. The next major resistance could be at USD 98,800. A close above the resistance at $98,800 could lead to more gains. In the said case, the price could rise and test the USD 100,000 resistance level. Any further gains could send the price towards the $102,000 level.

Another drop in BTC?

If Bitcoin fails to rise above the $97,000 resistance zone, it could trigger another downside correction. The immediate downside support is near the USD 95,500 level.

The first major support is near the $94,500 level. The next support is now near the $93,200 zone. Any further losses could send the price towards the USD 91,500 support in the short term.

Technical indicators:

Hourly MACD – The MACD is now gaining speed in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major support levels – USD 95,500, followed by USD 94,500.

Major resistance levels – $97,000 and $98,800.