Bitcoin price took a downward turn this weekend and appears poised to retest critical support levels. The downward price action was caused by a spike in selling pressure following the approval of Bitcoin spot exchange traded funds (ETFs) in the US.

At the time of writing, Bitcoin price is trading at $40,900, having lost 2% in the last 24 hours. Over the past week, these losses have doubled, with other assets in the market’s top 10 cryptos underperforming, except Dogecoin (DOGE), which is still posting a 4% gain over the same period.

Bitcoin Price Is Losing Steam, How Low Can BTC Go?

Via the social media platform X, the founder and former CEO of crypto exchange BitMEX, Arthur Hayes, shared a prediction for the Bitcoin price. According to Hayes, BTC appears to be on the verge of losing its current levels.

The crypto founder and trader claims that the low time frame price action is likely to push Bitcoin below $40,000 and possibly below $35,000 if the bulls fail to defend the higher territory around these levels.

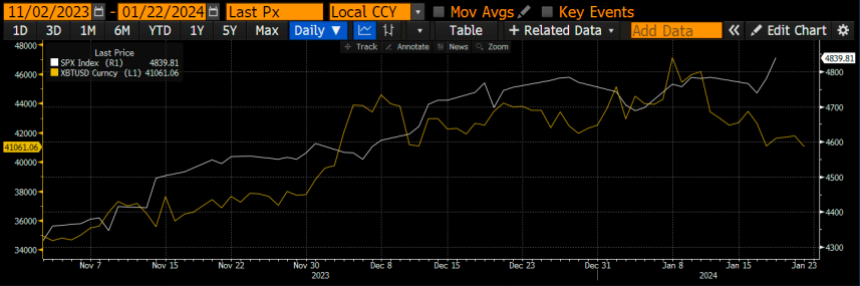

The main issue regarding the current market structure rests on the liquidity in the Bitcoin market. As seen in the chart below and as noted by Hayes, liquidity in the BTC market has been on a downward trend since the Bitcoin spot ETF was approved.

As a result, and due to the constant selling pressure from the Grayscale Bitcoin Trust (GBTC), the market is trending down and could be sustained until the next major macroeconomic event.

About the above, the founder of BitMEX declared:

Why didn’t $SPX and $BTC rise together after the launch of the US BTC ETF? Both are love more $liq, which one is right about the future? $BTC tells us there is trouble for the $liq, the next signpost is the annc (announcement) of the US Treasury refund on January 31st.

If Bitcoin Heads South, What Levels Can Hold the Line?

A pseudonymous crypto analyst showed a cluster of buy orders stacked from $38,819 to $40,000 in a separate report. In other words, these levels should provide resistance and appear to be the biggest opportunity for BTC to bounce back, at least in the short term.

In this sense, anticipating a possible short-term recovery, the analyst stated the following and showed the picture below:

Some major zones are starting to build around 41K and 42K. I’m pretty sure we’ll remove that top part sometime next week. See if the price holds up after that.

Cover image from Unsplash, chart from Tradingview

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.