- Bitcoin price prediction witnessed a competitive decrease after Bearish Expectations on the market for US shares.

- The drop under the mid-range support could stimulate a deeper BTC correction to $ 92k.

Bitcoin [BTC] Has dropped 5.88% in the last 24 hours. On January 20 on January 20, it was pushed $ 109,588 according to Binance’s trade data, but has since been in a malaise.

The fast losses in the past hours were probably not a sign of inherent BTC weakness.

The rise of the China’s Deepseek LLM model has started with the influence of the US stock market. The Nasdaq 100 Futures Were at the time of the press with 2.9% down and would reportedly sweep $ 1 trillion of the US stock market.

This in turn influenced this panic -sensitive sentiment crypto and bitcoin. The market could also be disconnect ahead FOMC meeting Later this week.

Bitcoin – Price forecast – Acquisition will have a playing role

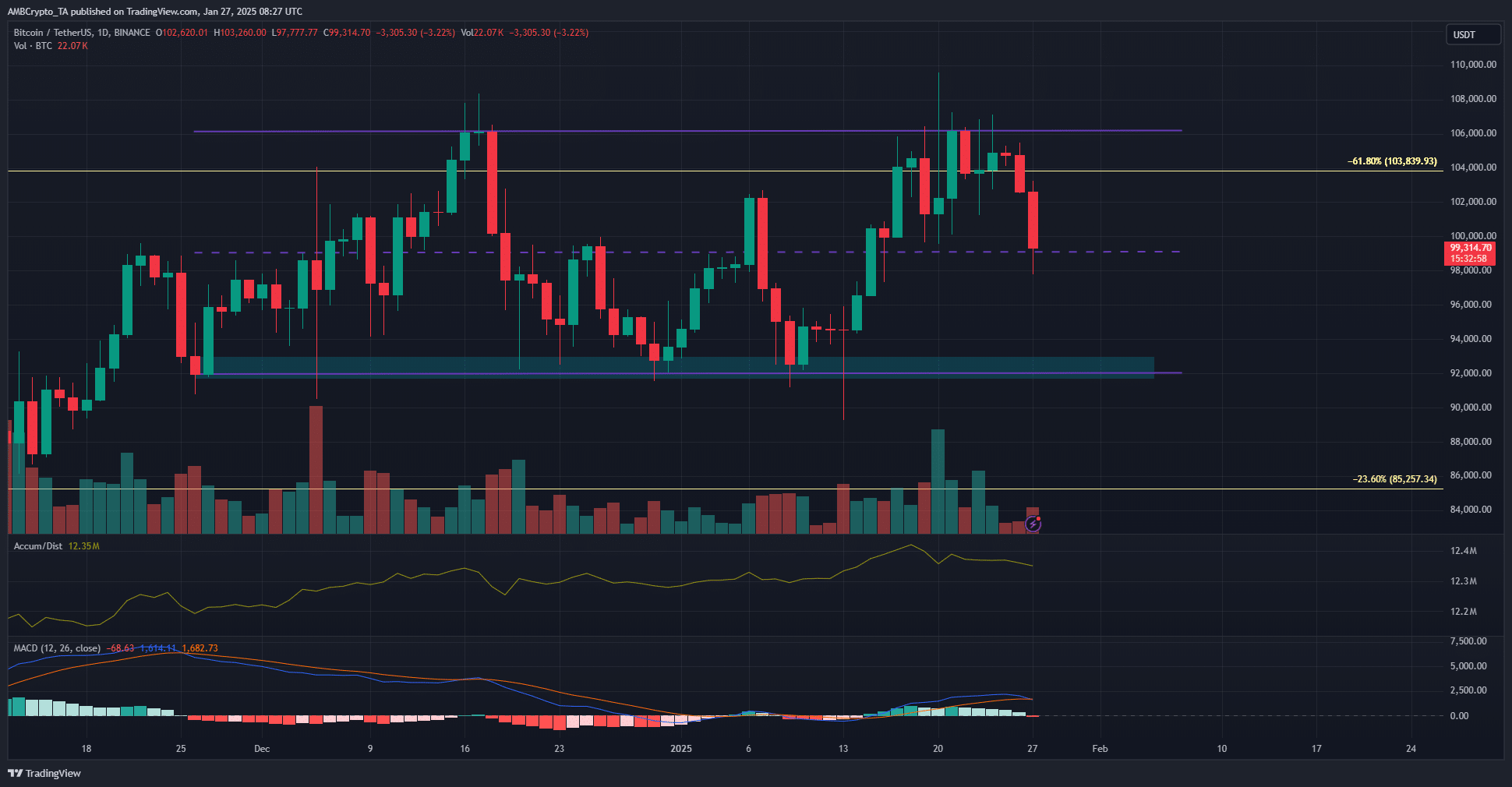

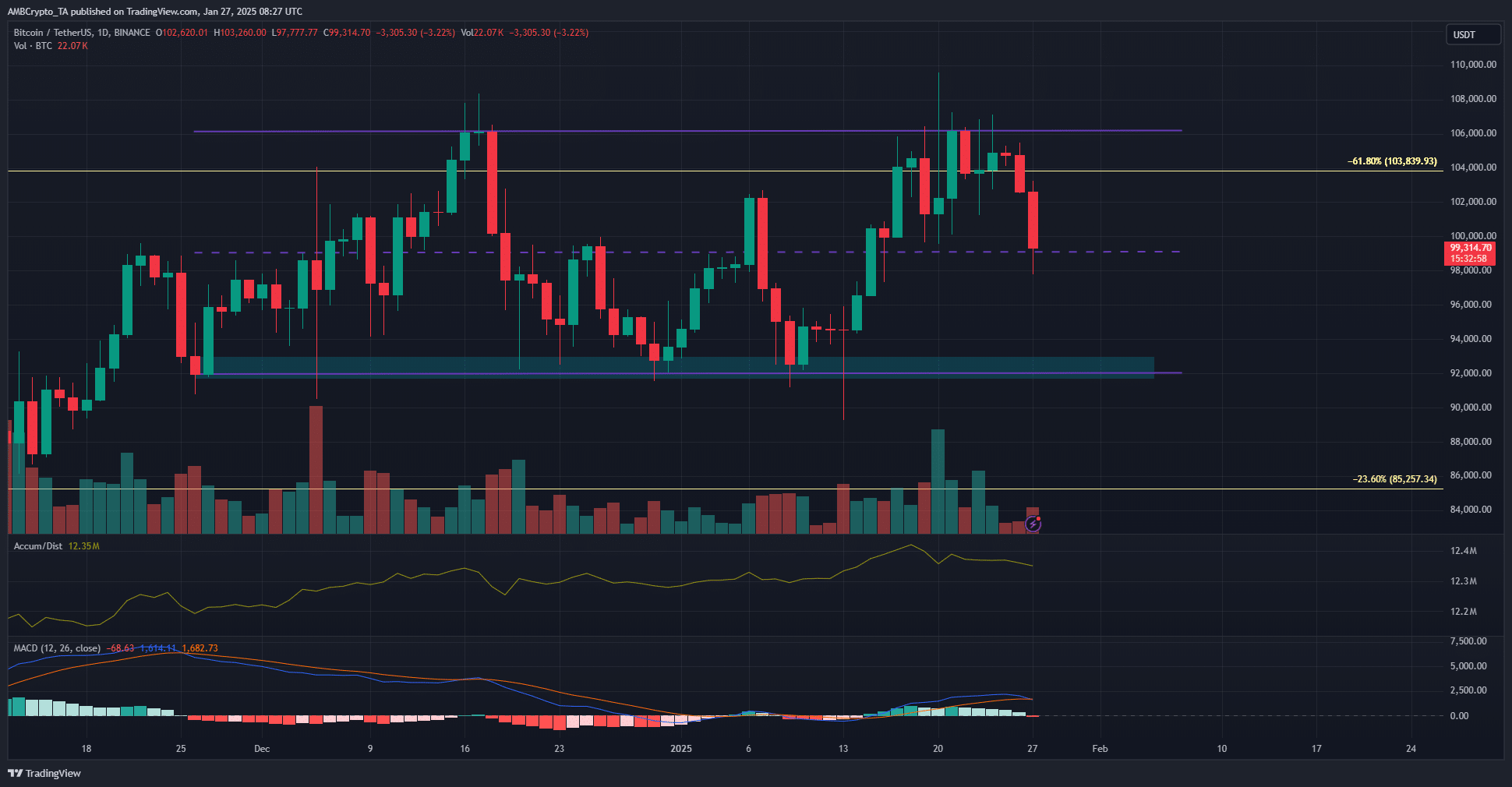

Source: BTC/USDT on TradingView

In the past two months, Bitcoin has traded in a range that extended from $ 92k to $ 106k. The middle reach level at $ 99K has been crucial in recent weeks as a support/resistance level.

The sales pressure in the past hours brought BTC to the mid-range support.

It should be noted that the trade volume remained muted, but this could change during the New York Trading Session open. That is why traders must remain careful in the short term.

A drop below the middle range would probably see a deeper price correction up to $ 92k.

That is why the Bitcoin price forecast Beerarish was in the short term. The MACD on the daily map had formed a bearish crossover to signal that bulls began to lose the power.

Conversely, the A/D indicator made higher lows. From the A/D indicator we can see that the sales pressure was a reaction to the expectations of the US stock market and not necessarily weakness of BTC.

Is your portfolio green? View the Bitcoin -Win Calculator

The coinalyze data showed that Beerarish sentiment had been strong in the last few hours. The financing percentage decreased in a negative area during the rapid price decrease, while open interest saw an increase when prices fell below $ 102k.

This implied an increased short -sold and bearish sentiment on the derivaten market. Crypto analyst Axel Adler noted in a post on X that Panic Was not going on, as shown on the profit loss in the short term for exchanges.

Disclaimer: The presented information does not form financial, investments, trade or other types of advice and is only the opinion of the writer