The Bitcoin market has witnessed a significant downturn with prices falling below $66,000. This abrupt -5.6% price move can be attributed to four major factors: a prolonged liquidation event, a rising US Dollar Index (DXY), profit-taking by investors, and Bitcoin ETF outflows.

#1 Long liquidations

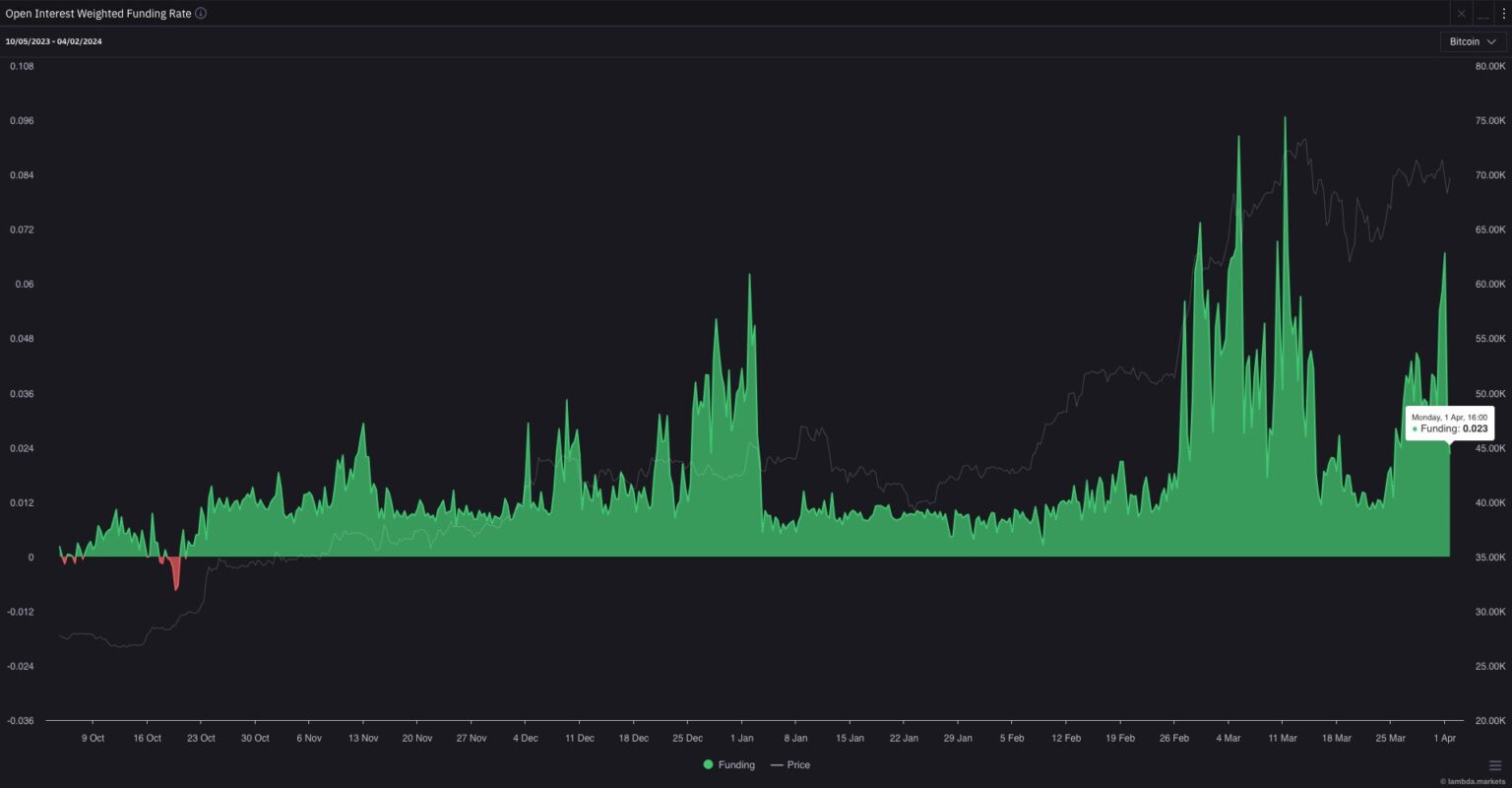

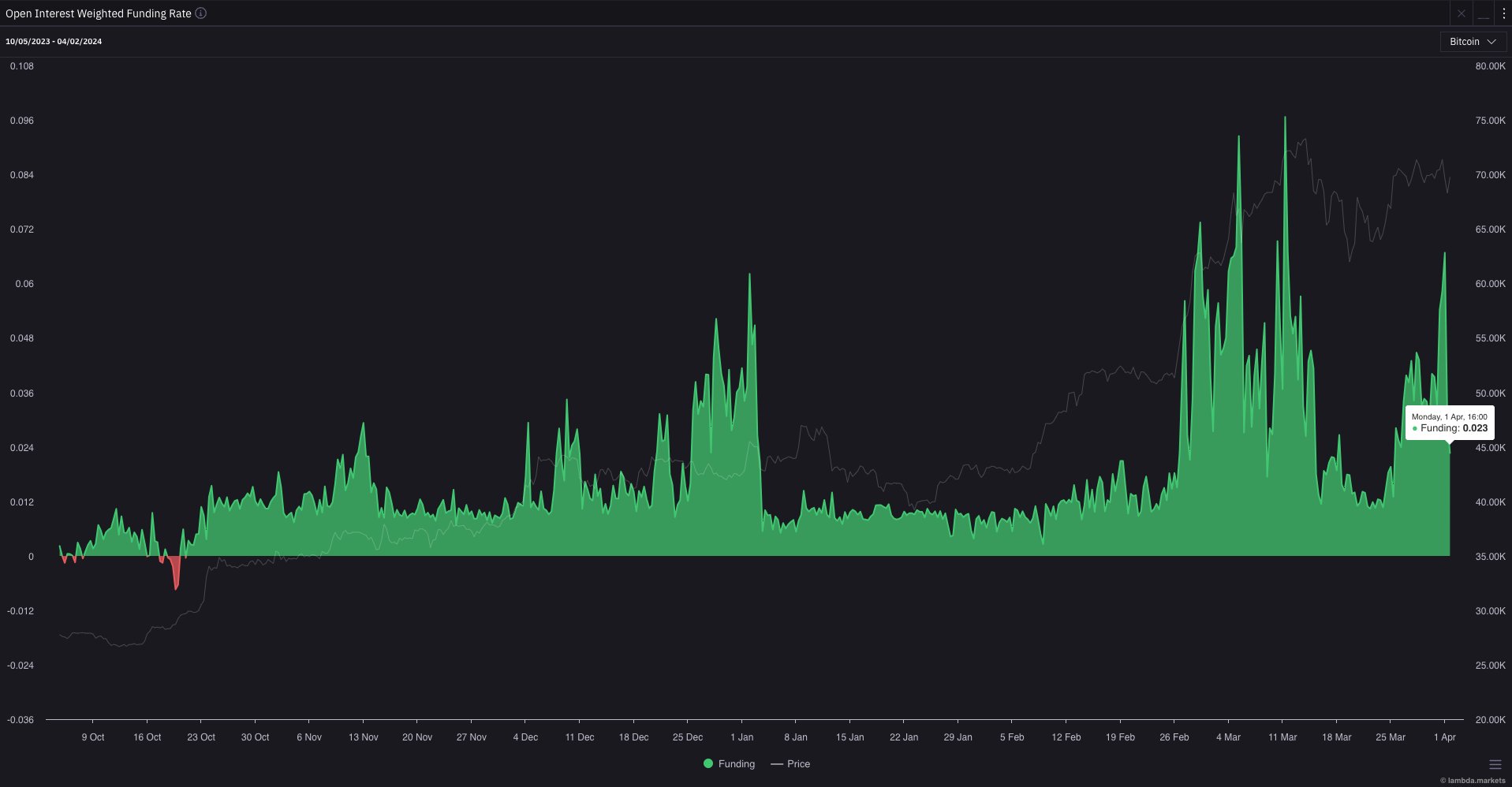

The main reason that led to Bitcoin’s price decline today was significant deleveraging characterized by an unusually high level of prolonged liquidations. Before the recession, Bitcoin’s Open Interest (OI) Weighted Funding Rate was unusually high, indicating that leveraged traders were paying premiums to hold long positions in anticipation of future price increases. However, this optimism made the market vulnerable to sudden corrections.

Crypto analyst Ted, known as @tedtalksmacro on X (formerly Twitter), noticed, “Today was the largest long liquidation event since March 19.” He further elaborated on the effects of this correction by noting: “Nice reset in overall positioning today, even with a drop of just 5% lower for Bitcoin… The next leg higher is loading I think.” This comment highlights the severity of the liquidations and suggests a possible recovery or restructuring within the market as it stabilizes.

Coinglass data shows that 120,569 traders were liquidated in the last 24 hours, totaling $395.53 million in liquidations, of which $311.97 million are long positions. Bitcoin-specific long liquidations amounted to $87.42 million.

#2 DXY puts pressure on Bitcoin

At 105.037, the DXY closed at its highest level since November yesterday, evidence of a strengthening US dollar. Given Bitcoin’s inverse correlation with the DXY, the stronger dollar may have shifted investors’ preference towards safer assets, driving them away from riskier investments like Bitcoin.

This correlation stems from risk sentiment in the global market, with a rising DXY often signaling a shift towards safer investments, detracting from riskier assets such as Bitcoin. However, analyst Coosh Alemzadeh offered an opposing perspective, suggesting via a Wyckoff rebalancing scheme that despite the DXY’s recent rebound, the next move could favor risky assets, which could include Bitcoin.

#DXY ⬆️4 weeks in a row/broke out of the downtrend, so the consensus is that a new uptrend is starting, but risky assets are consolidating at ATH

Next step ⬆️in risky assets on deck IMO pic.twitter.com/u6ORa76vkj

— “Coosh” Alemzadeh (@AlemzadehC) April 2, 2024

#3 Profit taking by investors

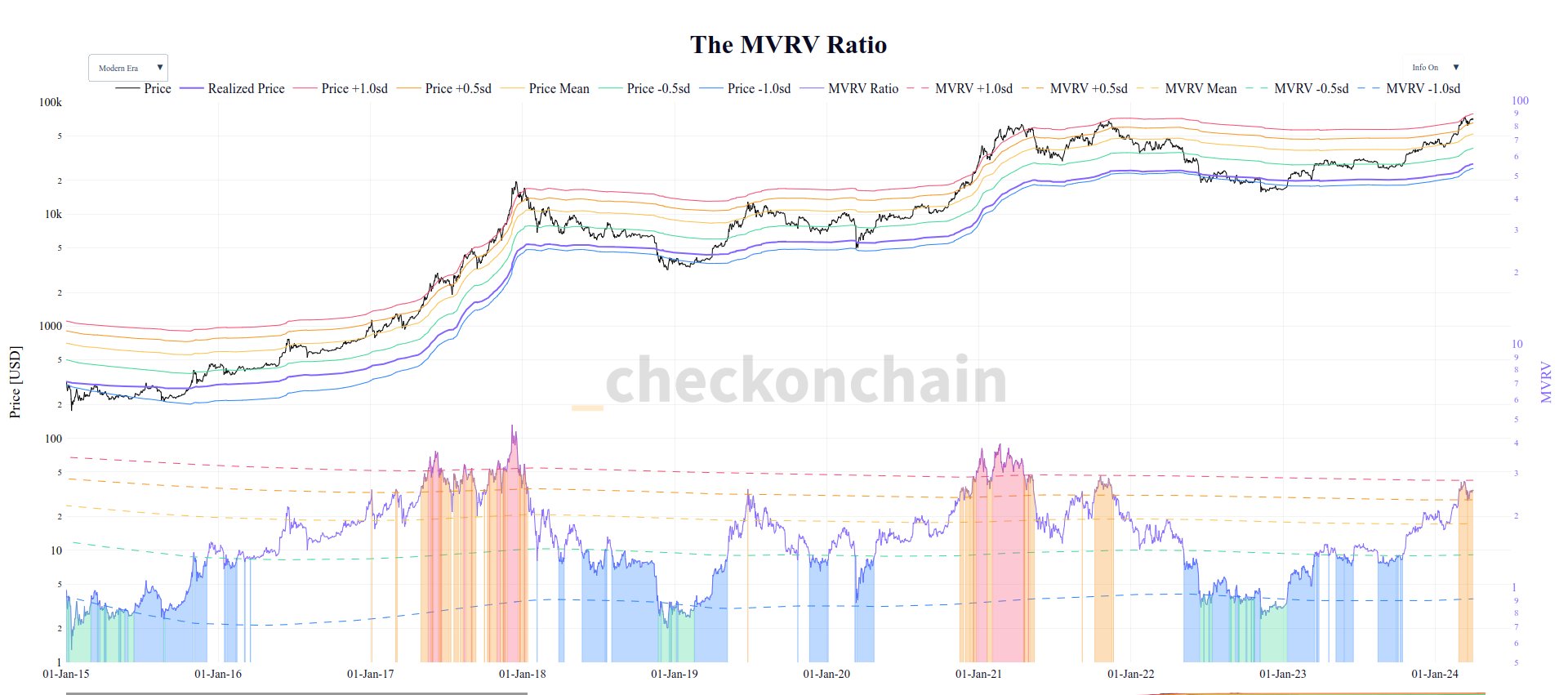

Profit-taking by investors has also played an important role in the recent price adjustments. The Bitcoin on-chain analysis platform Checkonchain reported a spike in profit-taking activity.

Glassnode’s lead on-chain analyst, Checkmatey, shared insights via MVRV = above +0.5sd but below +1sd. This indicates that the average BTC holder is sitting on a significant unrealized gain, leading to an increase in spending.”

The profit taking coincided with Bitcoin peaking at $73,000, marking a cycle of high profit realization with over 352,000 BTC sold for profit. This selling behavior is typical of bull markets, but plays a crucial role in creating resistance levels at local price levels.

#4 Bitcoin ETF Outflows

Finally, the market witnessed notable outflows from Bitcoin ETFs, marking a reversal from last week’s substantial inflows. Total outflows in one day were $85.7 million, with Grayscale’s GBTC seeing the most significant withdrawal of $302 million.

Meanwhile, Blackrock’s IBIT and Fidelity’s FBTC reported positive inflows of $165.9 million and $44 million respectively. In response, WhalePanda noticed, “Overall a negative day, but not as negative as the price suggested. Closing Q1, so taking profits here makes sense. What a mess in the neighborhood [the] A new quarter and a halving are expected.”

At the time of writing, BTC was trading at $66,647.

Featured image created with DALL·E, chart from TradingView.com

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.