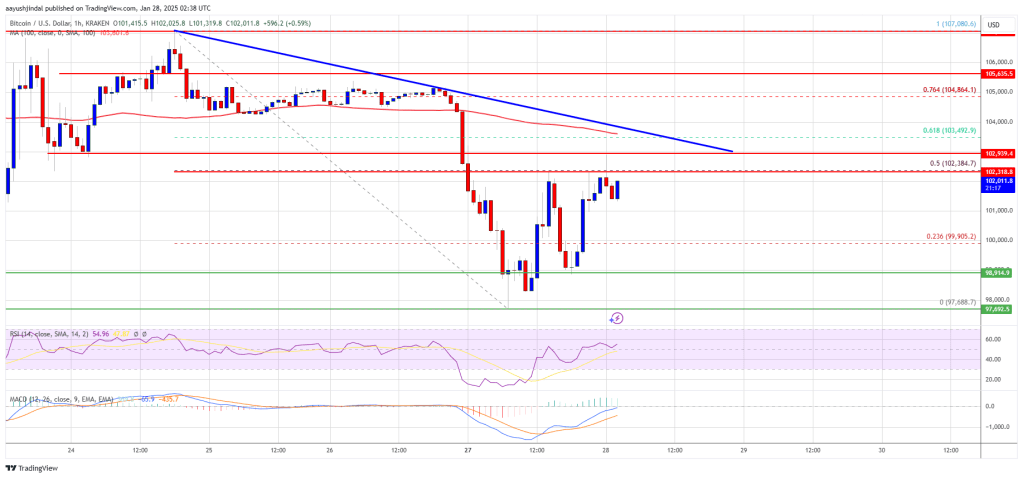

Bitcoin price extended losses and tested the $ 97,650 zone. BTC now corrects losses and can be confronted with obstacles near the level of $ 103,000.

- Bitcoin started a narrow correction under the $ 103,000 zone.

- The price is traded under $ 103,200 and the simple simple advancing average of 100 hours.

- There is a connecting Bearish trend line that forms with resistance to $ 103,000 on the hour table of the BTC/USD pair (data feed from Kraken).

- The couple can start a new decline if it remains below $ 103,500 zone.

Bitcoin -price drops further

Bitcoin price started a new decrease under the levels of $ 105,000 and $ 103,500. BTC even dropped below the $ 100.00 level before the bulls appeared. A low point was formed at $ 97,688 and the price now corrects losses.

There was a movement above the levels of $ 99,500 and $ 100,000. The Bulls pushed the price above the 23.6% FIB retracement level of the downward movement of the $ 107,080 Swing high to $ 97,688 low. However, De Beren are active near the $ 102,000 zone.

Bitcoin price is now traded under $ 103,200 and the 100 simple advancing average per hour. At the top is immediate resistance near the $ 102,350 level or the 50% FIB retracement level of the downward movement of the $ 107,080 Swing high to $ 97,688 low.

The first key resistance is near the level of $ 103,000. There is also a connecting Bearish trend line that forms with resistance to $ 103,000 on the hour table of the BTC/USD pair.

The next key resistance can be $ 104,200. A close -up resistance of $ 104,200 can further send the price. In the case mentioned, the price could rise and the resistance level of $ 105,500 tests. More profits can send the price to the $ 107,000 level.

More losses in BTC?

If Bitcoin does not rise above the $ 103,000 resistance zone, this can start a new decline. Immediate support on the disadvantage is near the level of $ 100,500. The first major support is close to the $ 100,000 level.

The next support is now near the $ 88,500 zone. More losses can send the price to the support of $ 86,500 in the short term.

Technical indicators:

MACD per hour – the MACD now loses pace in the Bearish zone.

Picly RSI (Relative strength -Index) -The RSI for BTC/USD is now above 50 -level.

Important support levels – $ 100,500, followed by $ 100,000.

Important resistance levels – $ 102,200 and $ 103,000.