- Popular analysts believe that BTC’s potential to reach a new peak is based on historical data

- The expected rally depends on how well the crypto holds the $54,000 support level

Over the past week, Bitcoin’s market performance has been sluggish, with a 4.53% decline on the charts. At the time of writing, the price was $58,371.56, with the market cap also declining marginally. That said, its valuation was still above a trillion dollars.

However, there is still a cautious sentiment in the BTC market, with many still hesitant to buy.

Is Bitcoin going to hit a new all-time high?

Crypto analyst Mustache claims that Bitcoin is currently at a major inflection point, which could potentially lead to a break above the $70,000 threshold.

His analysis is based on a comparison of BTC’s current price action following the Japanese stock crash, which caused a crypto plunge in August, with the COVID-19-induced crash.

Source:

According to his chart, the COVID-19-induced crash caused BTC to rise significantly, reaching a high of around $11,892.92. In this case this could potentially be duplicated.

The analysts claimed that, based on BTC’s historical trends, the current price consolidation could be temporary and set the stage for a potential upward move.

“If $BTC continues to copy 2020, the current range is the next best bet as it is just a retest for now.“

That said, he cautioned that stability at the $54,000 level is necessary for this upward trajectory to materialize. He added,

“$54,000 must be set aside for this purpose [rally to a new high] to happen.“

What this means is that a dip below $54,000 could tip the market into a bearish situation dominated by selling pressure.

With the spotlight now on the $54,000 level, AMBCrypto has dug further to determine whether this level is likely to hold and what the sentiment surrounding BTC actually is.

Market Sentiment – Will the $54,000 Level Hold?

This is evident from data from IntoTheBlock 80% of BTC holders are currently profitable. This suggested that overall market sentiment remains optimistic.

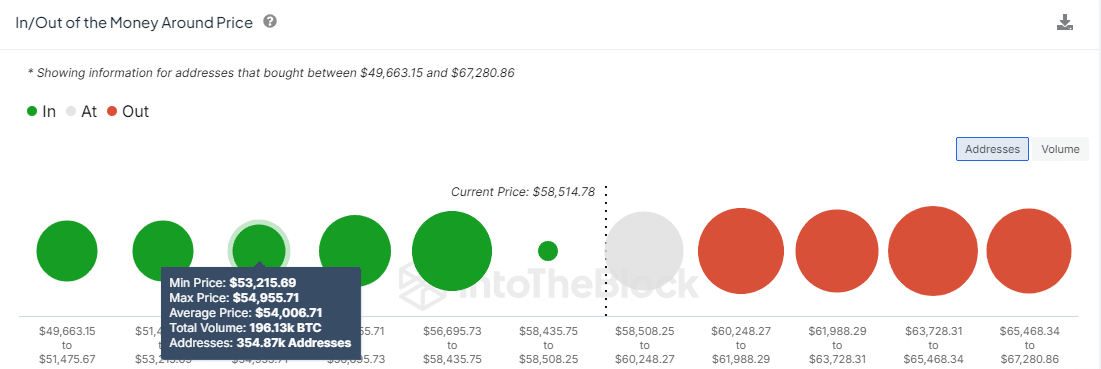

After analyzing the In/Out of the Money Around Price (IOMAP) metric, AMBCrypto found that $54,018.30 is a strong support level, with over 355,000 addresses having a combined trading volume of over $1 billion.

Source: IntoTheBlock

The IOMAP tool illustrates support levels where a majority of holders are profitable (“in the money”), and which could prevent prices from falling further. Conversely, it also identifies resistance levels, many of which are unprofitable (“out of the money”), potentially triggering a sell-off as prices rise, capping further gains.

With Bitcoin priced where it is today – a figure close to the $54,000 mark set by analysts – it appears well-positioned to act as a buffer against further declines. This finding could trigger another surge on the price charts.

Finally, Mint glass reported significant negative net flows of $738.06 million from three major exchanges, Binance, OKX and Bybit, in the past week – a sign that more BTC is being withdrawn than deposited.

This trend generally implies that market participants prefer to hold or safeguard their assets offline. This will potentially reduce supply on the exchanges and push up the price of BTC if demand remains the same or grows.