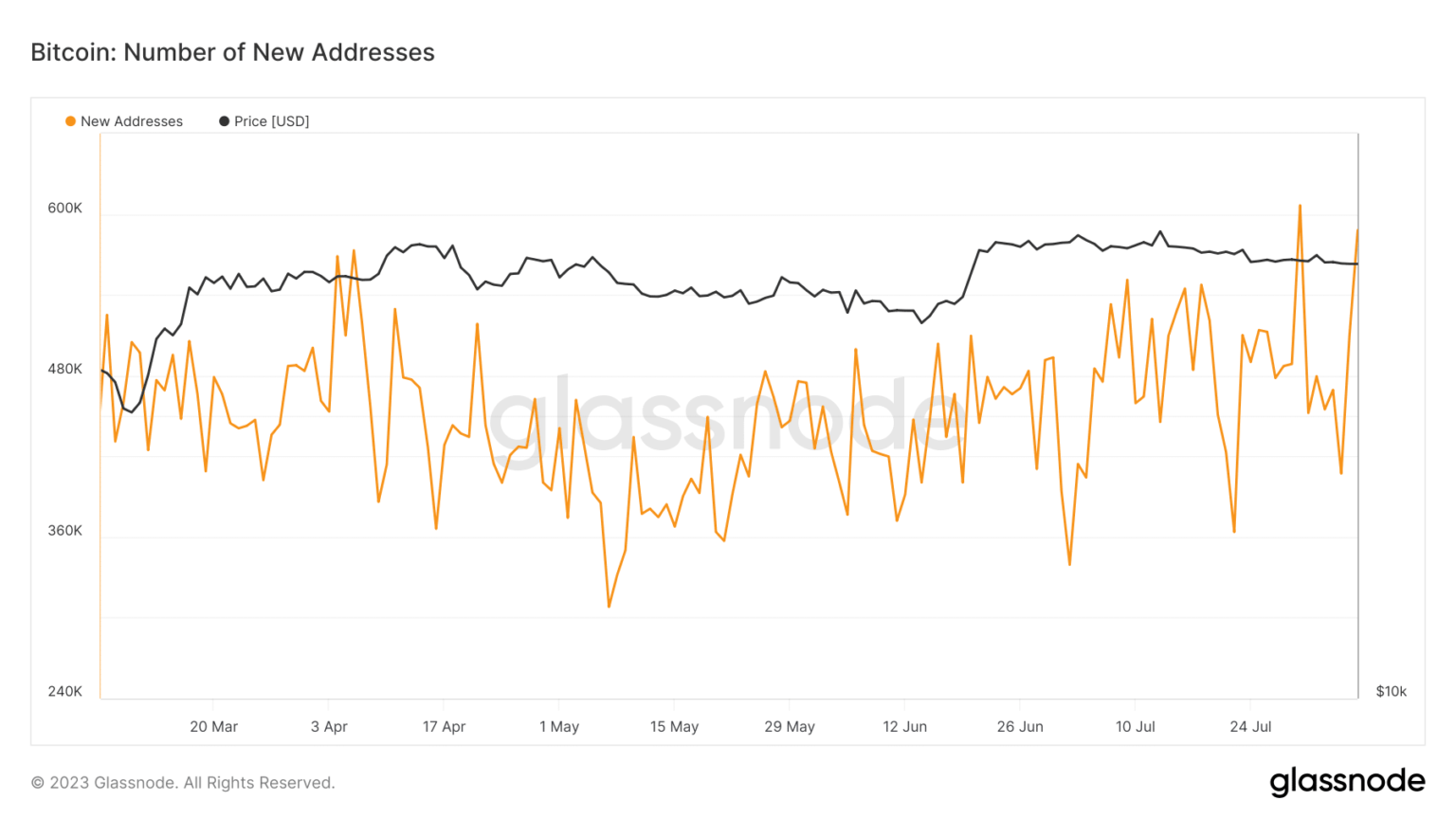

- New Bitcoin addresses have reached nearly 600,000 as new accounts peak.

- BTC was on its third day of decline and it remained below USD 30,000.

The Bitcoin [BTC] price has struggled in recent weeks. However, during this battle, new addresses have consistently appeared on the platform. This raises the question of what implications this phenomenon could have for BTC, despite its slow price development.

How much are 1,10,100 BTC worth today

New users join the Bitcoin network

Recently, Bitcoin has seen a remarkable upward trend in new addresses. Based on from Glassnode new address statistics, there has been significant growth in August. Analysis of the chart revealed an increase that started around August 4.

At the time of writing, the number of new addresses exceeded 588,000. This was the second-highest influx of new addresses in nearly five months, with over 600,000 on July 30 being the highest.

Source: Glassnode

The data pointed to a notable divergence between Bitcoin price and network growth. However, this difference was judged positive as it suggested the possibility of a strong price increase due to the increased demand from the newly created addresses.

This trend could include a potential increase in Bitcoin’s value as more users enter the network, indicating a growing interest in the cryptocurrency.

Bitcoin active addresses are showing positive signs

The analysis of Bitcoin’s 30-day active addresses indicated a stable level of activity. The chart showed a small upward trend around June, reaching about 18 million active addresses. Since then, the number has been maintained consistently, with approximately 18.2 million registered active addresses at the time of writing.

Source: Sentiment

In addition, the daily active addresses for Bitcoin show promising numbers. The average number of active addresses per day is around 900,000; at the time of writing, there were more than 400,000.

The data suggested that Bitcoin user activity was stable and relatively robust. This consistent level of engagement can be viewed as a positive as it reflected continued interest in and use of the cryptocurrency.

BTC continues negative trends

On a daily time frame chart, Bitcoin has been in a negative trend for three consecutive days. It is worth noting, however, that the decline on each of these days was relatively modest, staying below 1%. At the time of writing, Bitcoin’s trading price has hovered around $29,400, with a drop of less than 1%.

Source: TradingView

Is your wallet green? Check out the Bitcoin Profit Calculator

In addition, the ongoing downtrend has resulted in a significant shift in the short moving average (yellow line) from supporting to acting as resistance at around USD 30,000.

This shift signals a change in market sentiment as the previous support level has become a major barrier to upward price movements.