- Bitcoin bulls have proven strong lately, pushing the price closest to its ATH.

- The bullish optimism remains especially as the American elections approach.

October may have been a good month for Bitcoin [BTC] and for more than one reason. Accumulation has been gaining momentum throughout the month, contributing to a major pattern break.

A result that could set the pace for some interesting price action and new highs in the coming months.

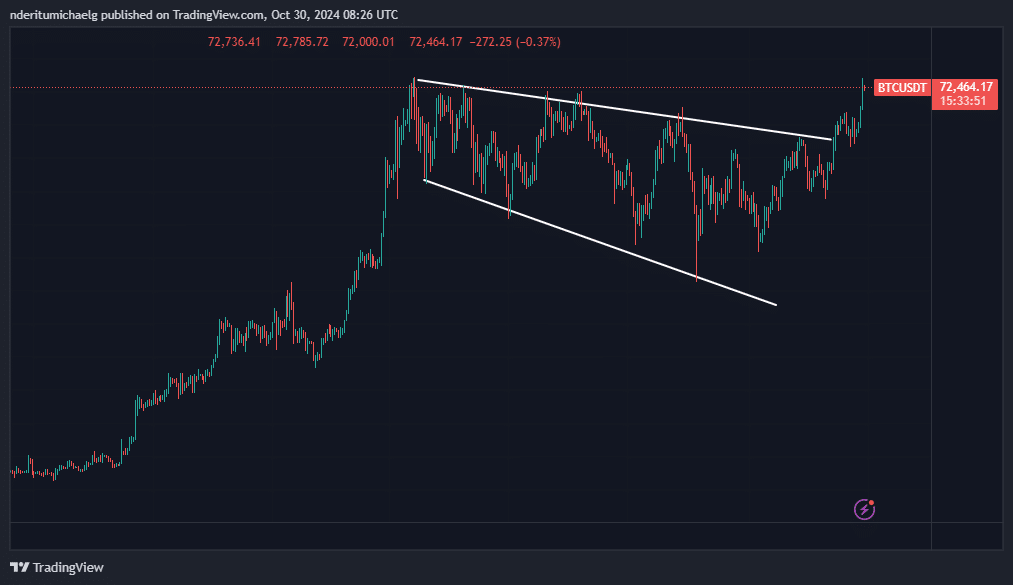

Bitcoin formed a long-term bullish flag after its impressive rally in the first three months of 2024. This pattern has been playing out since March and is characterized by descending support and resistance bands.

BTC’s final move above the resistance line yielded success at $66,000 and continued to show strength above that level.

The bullish momentum over the past five days confirmed the breakout and allowed Bitcoin to rise close to its historic ATH of $73,777. The recent increase peaked at 73,620.

Source: TradingView

The breakout of the bullish flag pattern has finally occurred for the first time in almost seven months. This also suggests that the price could be on the verge of another big move in favor of the bulls. In other words, Bitcoin is on the verge of price discovery and new all-time highs.

The next big Bitcoin catalyst

The US elections are just around the corner and the outcome is expected to have a significant impact on Bitcoin’s price action. This became evident in July when BTC sentiment around presidential candidates was quite high, based on whether they support crypto.

Trump is currently considered the most pro-crypto candidate, meaning a win for him would likely have a positive outcome on Bitcoin’s price action. On the other hand, a win for Harris may not yield a similar result for BTC.

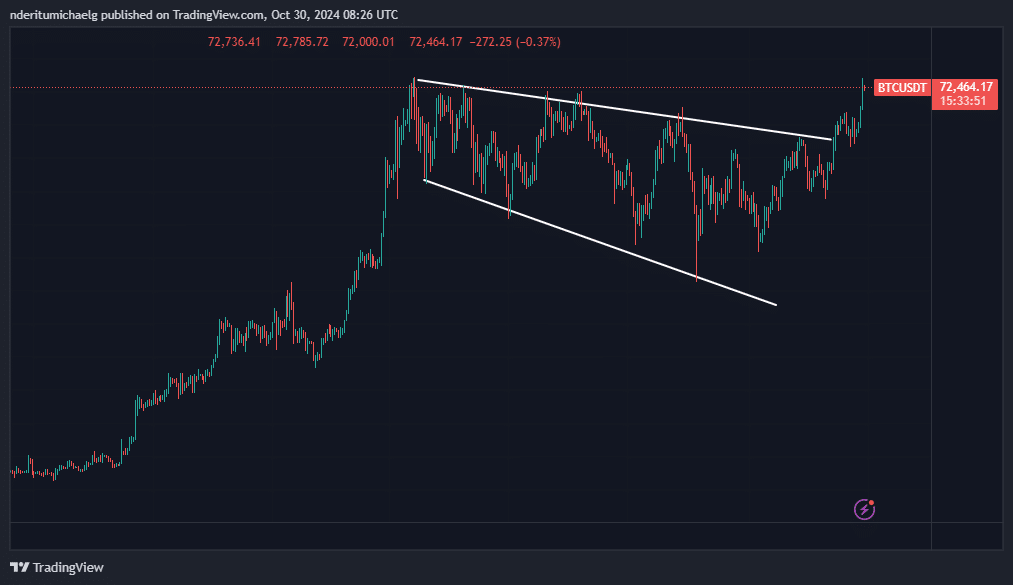

Uncertainty has also returned after the last rally. Price has shown resistance within the previous high range. More remarkably, data on the chain suggests that large companies have made profits.

There was recently a big spike in the amount of Bitcoin flowing out of large accounts. The outflow grew from 0 BTC to 3,990 BTC between October 26 and October 30. Meanwhile, inflows from large holders peaked at 2,020 BTC in the past 24 hours.

Source: IntoTheBlock

Read Bitcoin’s [BTC] Price forecast 2024–2025

Despite this observation, current sentiment suggests more bullish expectations in the future. This was evident from the fact that the latest upturn was not immediately followed by a sharp increase in selling pressure.

However, higher levels of volatility are likely to emerge in the future.