Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

Due to this week’s market recovery, Bitcoin (BTC) has risen more than 10% to re -test an important barrier for the first time in weeks. In the midst of this performance, some analysts suggest that the flagship Crypto is about to restart Bullish Rally, while others believe that retaining important levels will determine the next step of BTC.

Related lecture

Bitcoin rearranges his ‘ultimate’ level to break

Bitcoin has recovered from the correction of the start of $ 80,000 early April after an increase of 11% in the past week. On Friday, the largest crypto has recovered the barrier of $ 85,000 through market capitalization, which has served as an important barrier since the end of March.

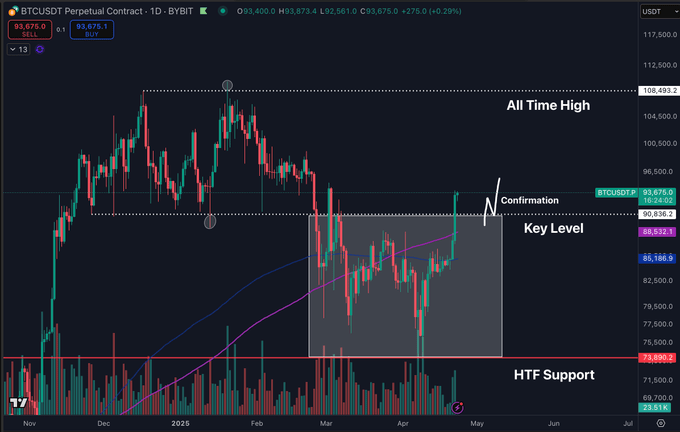

Since Friday, BTC has climbed various key levels, broken on Tuesday above the $ 90,000 resistance and held them in the last 24 hours. Analyst Daan Crypto Trades pointed out that Bitcoin has a “solid breakout back in the previous reach and above the daily 200ma/EMA”.

In particular, the cryptocurrency has been traded within a significant area in recent weeks, because it has tested its multi-months Downtrend line and the Daily 200 Exponential Moving Average (EMA) and Moving Average (MA).

After the Thursday pump that kicked the current recovery, Bitcoin broke out of his four -month downward trend. The Cryptocurrency bounced from daily 200ema to consolidate below daily 200 mA before he breaks above this level yesterday.

This sent the cryptocurrency to the “ultimate level of the bull to break”, the range of $ 90,000- $ 91,000. However, the analyst suggested that Bitcoin must be retained that region to confirm that the breakout is not “just a liquidity grip to fall back.”

Moreover, he also stated that the daily closures of BTC above these levels must remain “ideally” and that “some consolidation here to regain fuel and try to be higher” for a rally front forecast.

Ali Martinez too marked The price performance of BTC, which is traded near the annual opening of $ 93,500. The analyst claimed that this level was a strong support during the outbreak after the elections, but noted that “it could now turn in key resistance” if it is not recovered.

Analysts Eye BTC’s weekly close

Crypto Jelle called The resistance of $ 93,500 the ‘last line of defense’ of the bear, which states that as soon as BTC recovers that level, “all bets are eliminated.”

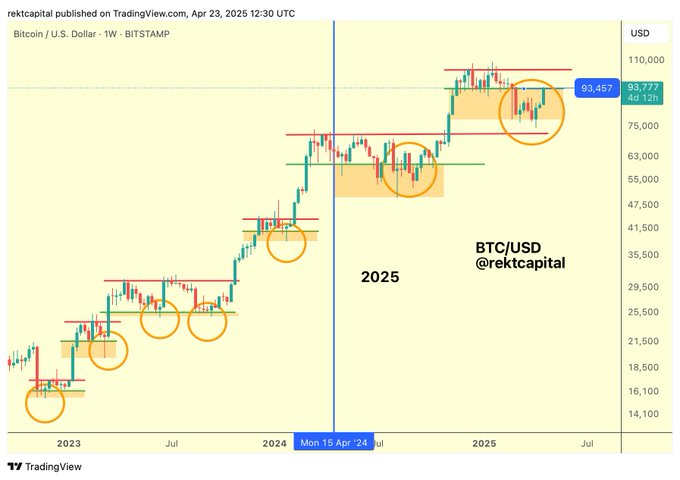

In the meantime, Capital noted that Bitcoin “has gathered in an attempt to again synchronize with his former travel car range and to confirm the end of his first price discovery correction.”

He emphasized that after yesterday’s performance, BTC is at the end of his downward deviation and confirms that the cryptocurrency should stabilize above the level of $ 93,500.

To achieve this, Bitcoin needs a weekly close one above this crucial level and the recovery as a new support. He also emphasized that it is repeatedly The price performance from the middle of the 2021 ‘Fantastic good’.

Related lecture

The analyst previously explained that Bitcoin consolidated in 2021 between the two largest bullmarkt exponential advanced averages (EMAs), the EMAs of 21 weeks and 50 weeks, before he broke out from the triangular structure and his rally resumes.

Now BTC breaks from the reach that is formed by the two Bullmarkt EMAs, which “was not only expected in mid -2021 as it happened, but also in this cycle.” Capital concluded that a weekly close to $ 87,000 “BTC will position for a confirmed outbreak.”

Bitcoin is currently acting at $ 93,459, an increase of 8.2% in the monthly period.

Featured image of unsplash.com, graph of TradingView.com