- Bitcoin mining problems have reached an all-time high due to a surge in the network.

- BTC has remained above the $67,000 price range.

Bitcoin [BTC] Mining problems have reached an all-time high, driven by a sharp increase in the network’s hashrate. This increase occurs as the price of Bitcoin rises, prompting miners to expand their operations to take advantage of the potential rewards.

The higher mining difficulty is a reflection of the growing security of the network, but also poses challenges for miners as they face rising costs.

Rising hashrate indicates difficulties in mining Bitcoin

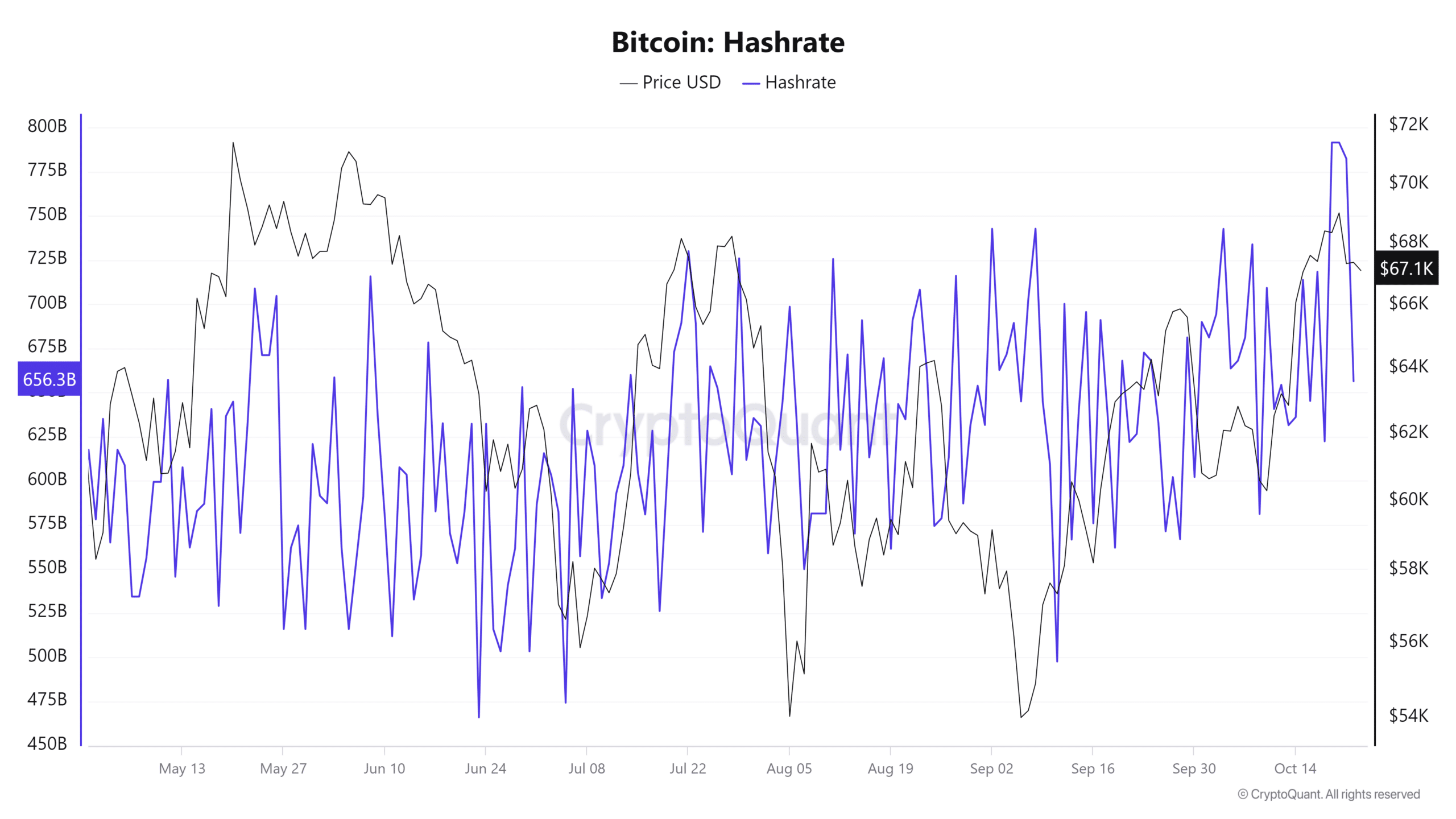

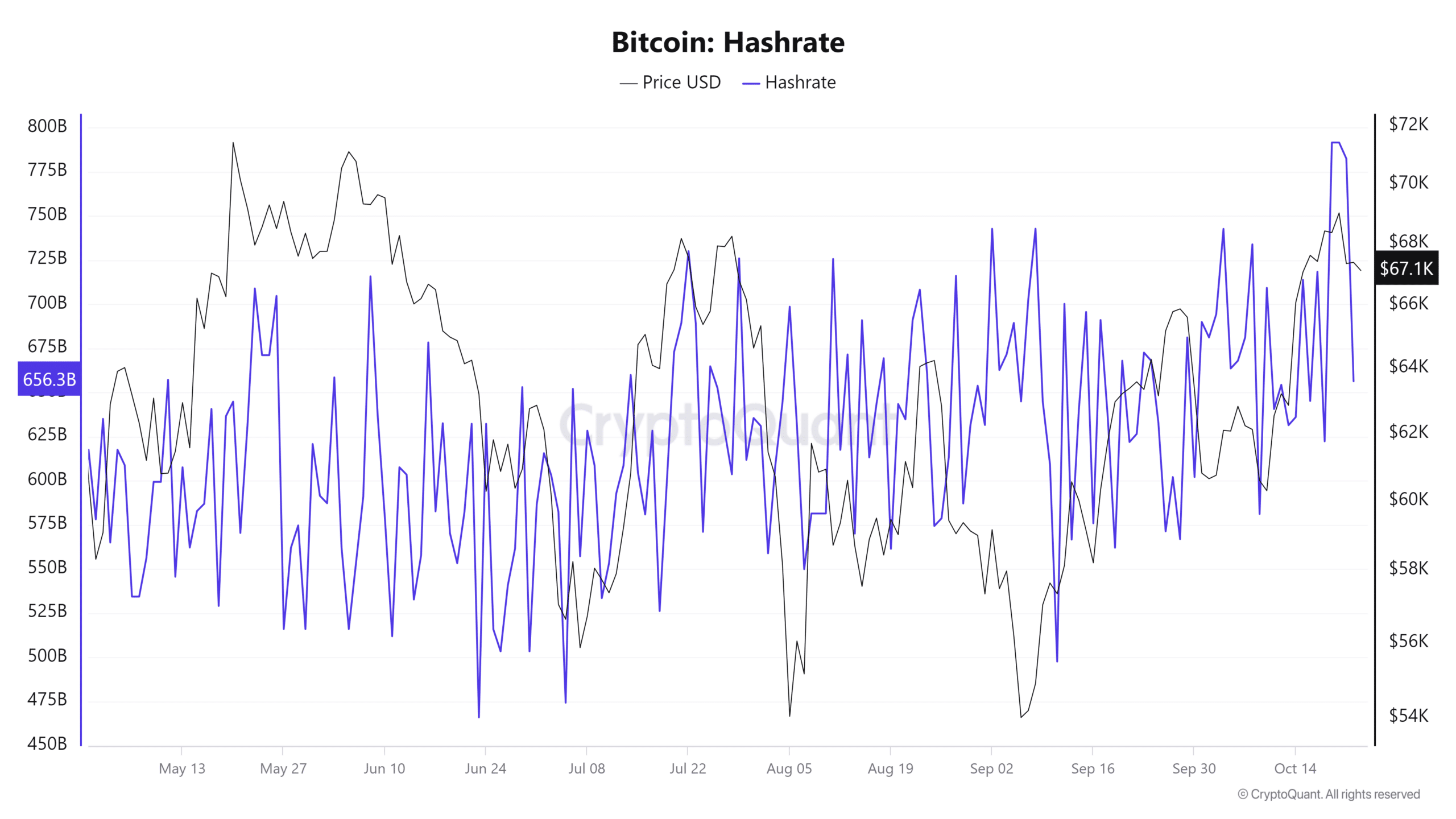

During 2024, Bitcoin’s hashrate has steadily increased. In mid-October it peaked at 656.3 billion, indicating increased mining activity on the network.

A higher hashrate means more miners join the Bitcoin network and compete for blocks.

Source: CryptoQuant

The main motivation for miners is the continued rise in BTC prices, which has encouraged them to ramp up their computing power.

With BTC trading around $67,193, the incentive to secure new blocks has increased. However, this has also led to an automatic adjustment of the network’s mining problems.

The difficulty of Bitcoin mining is reaching new heights

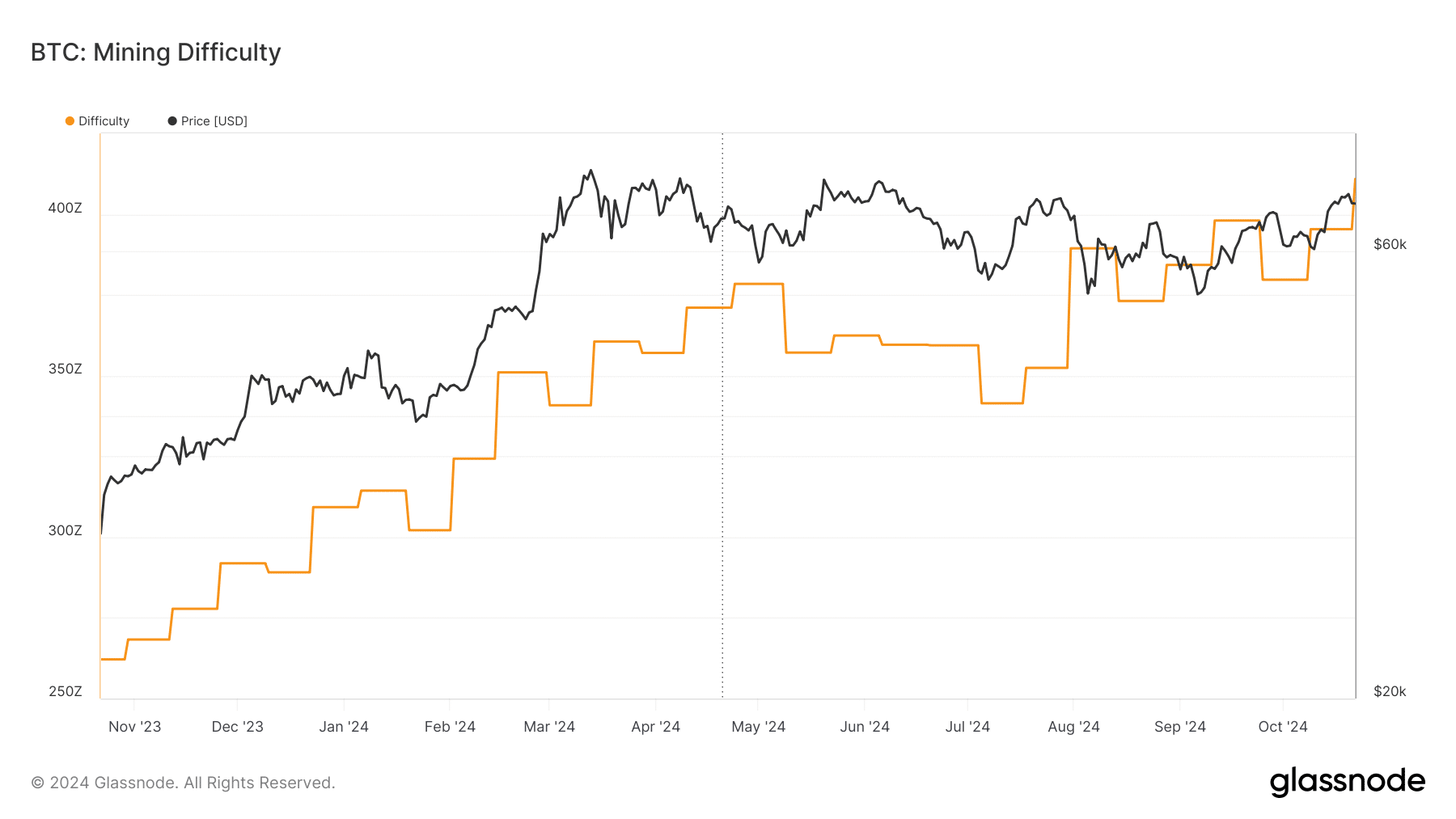

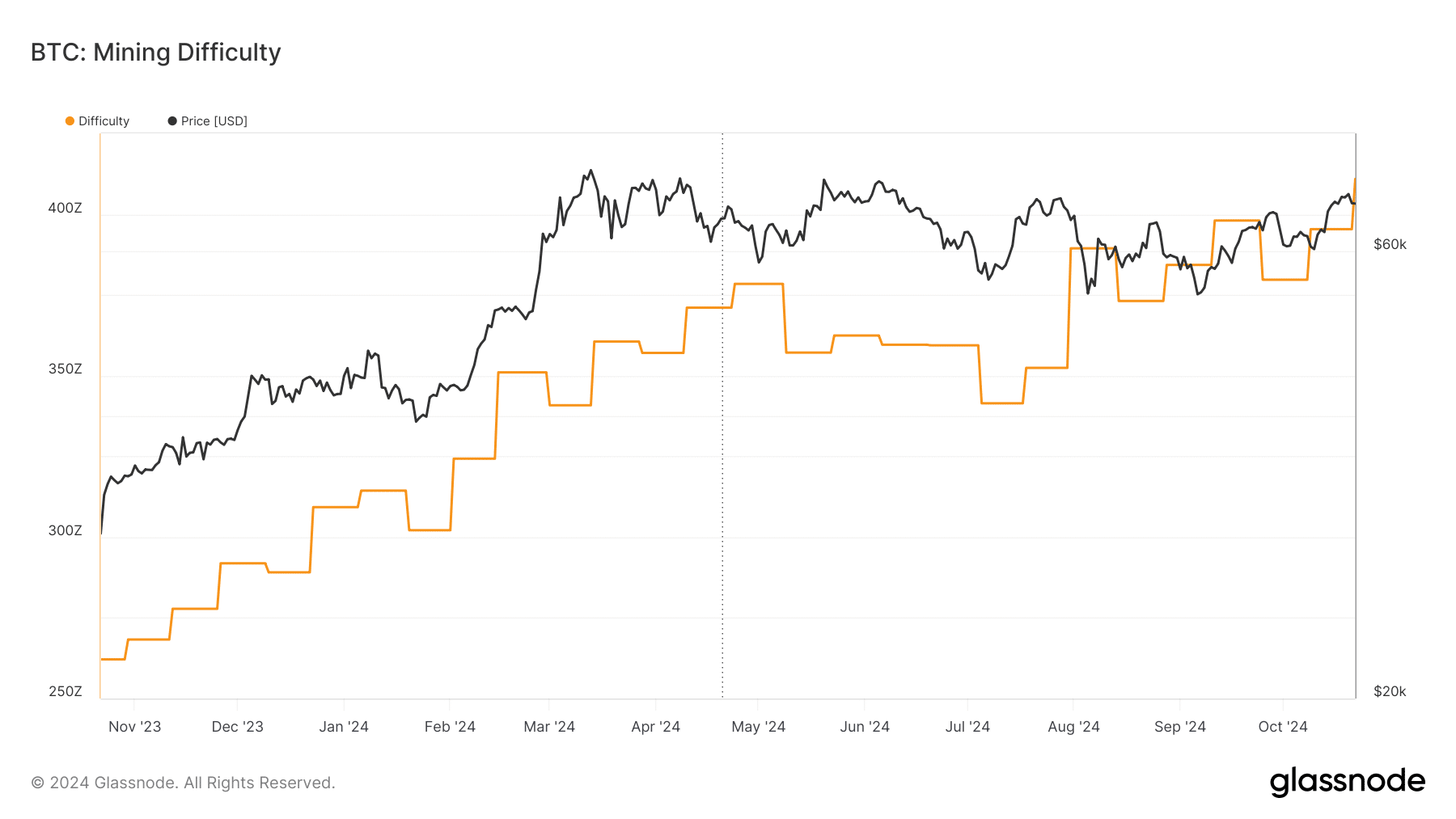

Bitcoin mining difficulty has risen to all-time highs following the hashrate increase. The network automatically adjusts the mining difficulty every two weeks to ensure blocks are mined approximately every 10 minutes.

As more miners join the network, competition becomes fiercer, increasing the difficulty and costs associated with mining.

Source: Glassnode

For miners, this increasing difficulty means they need more computing power and higher energy costs to maintain profitability. While the rising price of BTC brings potential rewards, it also increases the cost of securing those rewards, squeezing profit margins for many miners.

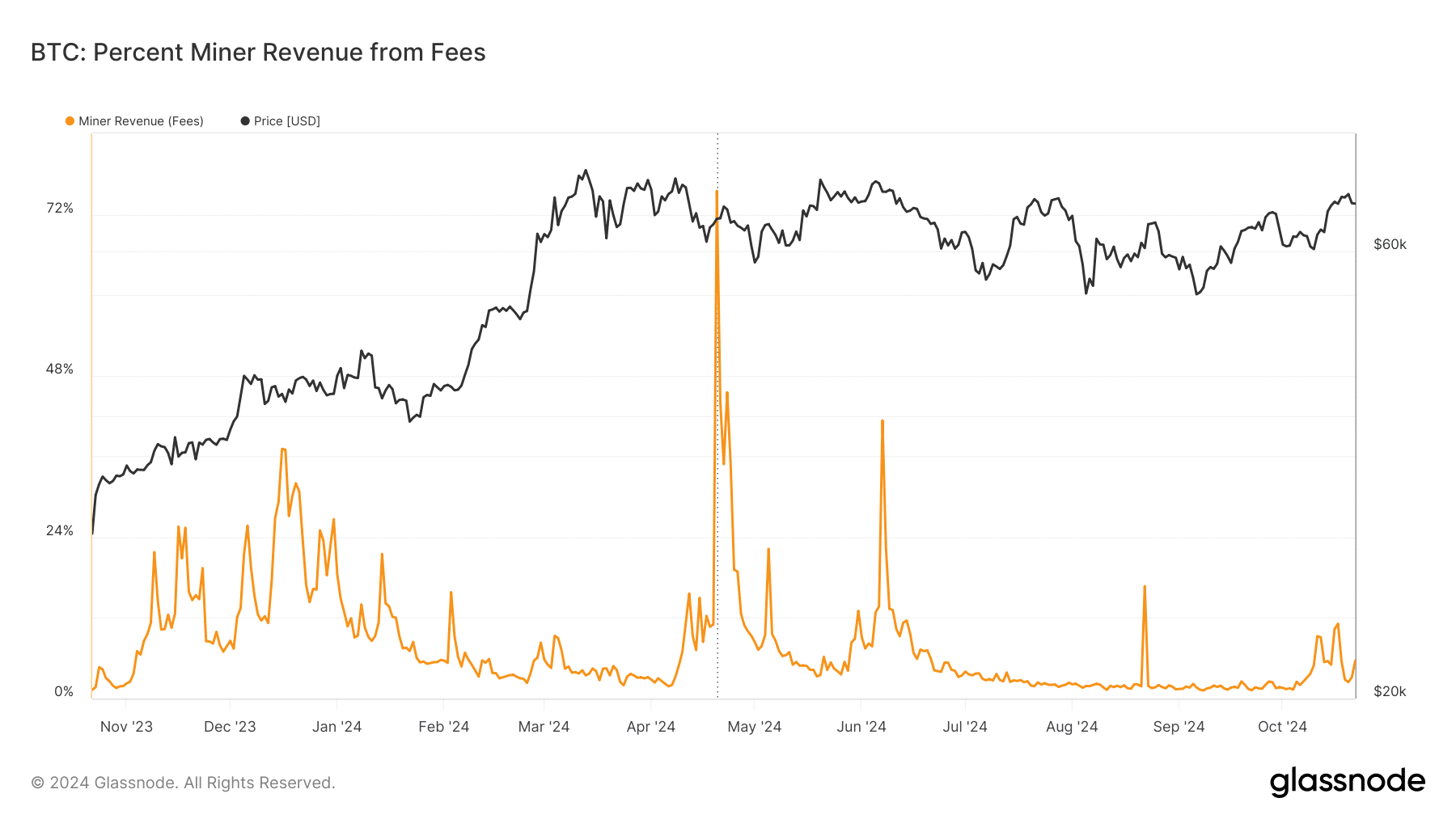

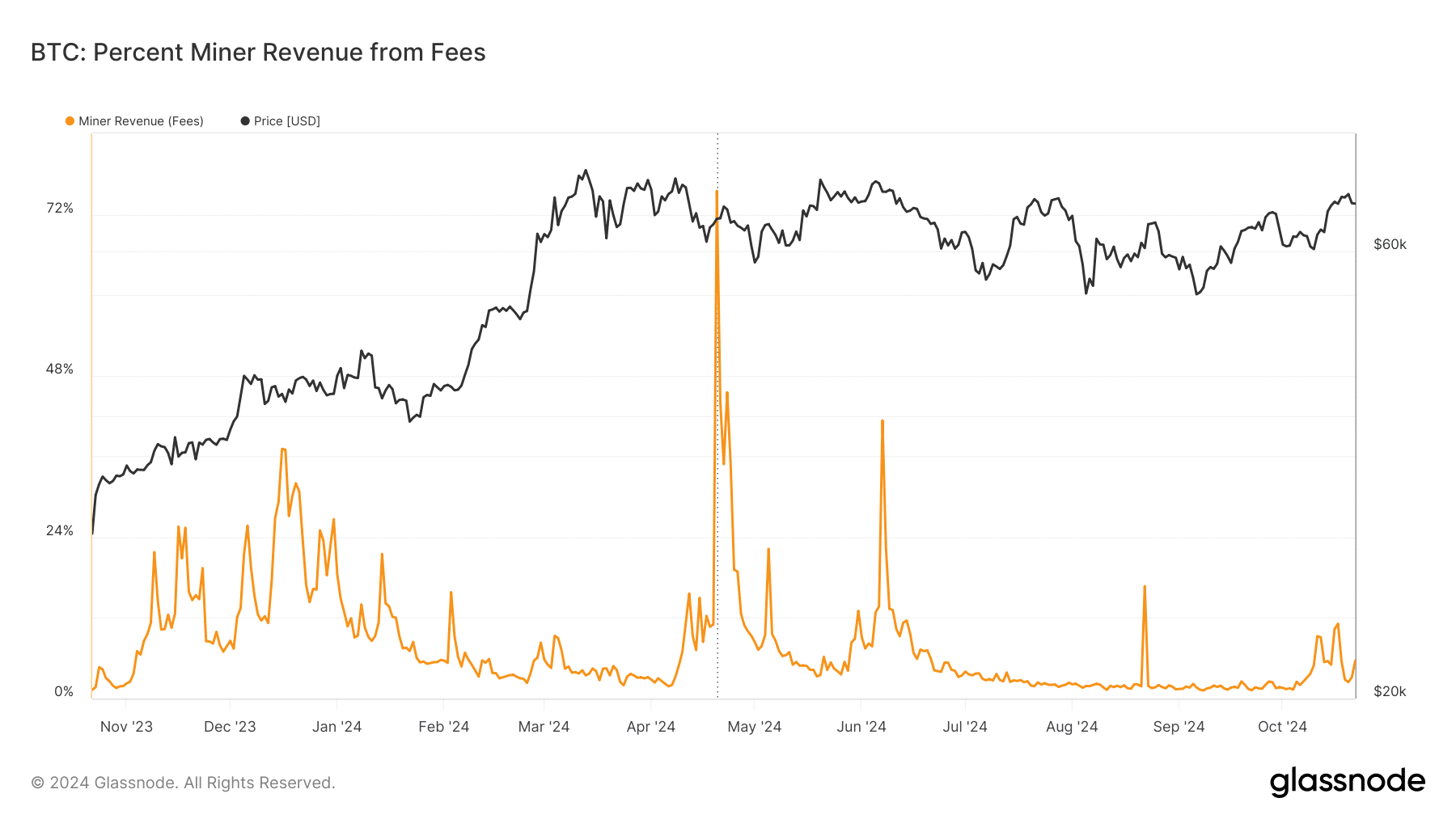

Costs for miners are rising slightly, while the price of Bitcoin remains stable

In addition to the rise in Bitcoin mining problems and hashrate, miners compensation have shown a moderate increase. Fees typically rise as network activity increases, with miners prioritizing transactions that yield higher rewards.

Although miner fees have increased during the 2024 network congestion, block rewards continue to make up the majority of miners’ income.

Source: Glassnode

Despite these network adjustments, Bitcoin’s price has remained relatively stable and is currently trading at $67,193, down 0.28%.

Read Bitcoin (BTC) price prediction 2024-25

The Average True Range (ATR) indicator highlights potential short-term volatility, suggesting that the price of BTC could see fluctuations as the mining ecosystem adapts to increased difficulty and network activity.

As the difficulty and hashrate of Bitcoin mining continue to rise, the interplay between miner profitability, fees, and the price of BTC will be essential to monitor.