- Transaction fees paid for using the Bitcoin network increased by double digits.

- This is due to a spike in daily registrations on the network.

Bitcoins [BTC] Network fees have risen 38% in the past week to an average of $0.000086 per transaction, data from IntoThe Block shows.

Bitcoin network fees rose 38% this week as Ordinals inscriptions hit their second-highest daily amount pic.twitter.com/rjQ7aYLNSU

— IntoTheBlock (@intotheblock) September 8, 2023

How much is 1.10.100 BTC worth today?

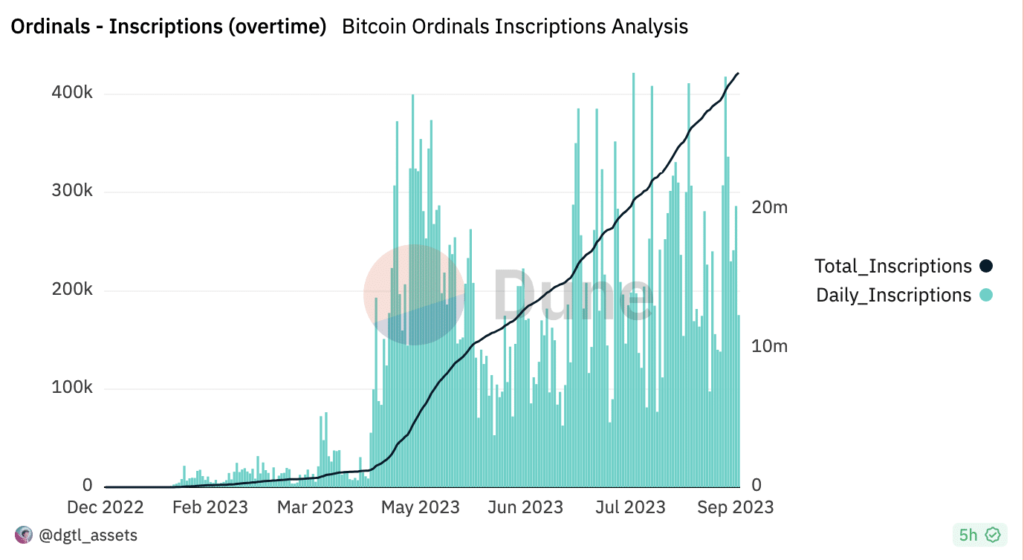

The increase in network costs is attributed to a revival in Ordinals Inscriptions activity. Dates of Dune Analytics revealed that the month so far has been marked by an increase in registrations on the Bitcoin network.

On September 3, these inscriptions recorded their second highest daily count of 418,000.

Source: Dune Analytics

While the number of text inscriptions fell around 150,000 on September 8, the number of daily inscriptions still remained at the highest level last observed in August.

Bitcoin miners responded briefly

While network fees rose due to a surge in network activity on September 3, miners increasingly let go of some of their BTC holdings between September 4 and 5.

A review of BTC’s Miner to Exchange Flow revealed a 364% increase in this metric between when daily entries rose to their second highest amount and the two days that followed.

The Miner to Exchange Flow metric measures the amount of BTC flowing from miners to exchanges. When this statistic increases, miners are selling more BTC than they are mining.

For context, on September 3, BTC’s Miner to Exchange Flow was 81.57 coins. According to data from September 5, this had increased to 376.78 BTC CryptoQuant.

Source: CryptoQuant

Furthermore, BTC’s Miner Reserve – which measures the amount of coins held in member miners’ wallets – confirmed the outflow of coins from miners’ wallets within the period examined.

Between September 3 and 5, this metric trended downward, indicating miners rallied to book profits as network costs spiked.

Source: CryptoQuant

At the time of writing, the BTC Miner Reserve held 1.84 million BTC, data from CryptoQuant showed.

Daily demand increases, but the price continues to say no

While the price of BTC remains stuck in a tight price range, new demand for the leading coin appears to have returned.

Rated based on a seven-day moving average, data from Glass junction revealed that the daily number of new addresses created to trade BTC fluctuated between 450,000 and 530,000. On September 8, BTC saw a total of 527,908 new addresses completing transactions with the king coin.

Source: Glassnode

An increase in new demand for an asset indicates renewed interest in the asset and is often a precursor to a price increase. While BTC was still facing the $26,000 price barrier at the time of writing, the Chaikin Money Flow (CMF) started an uptrend as it was above the midline.

Source: BTC/USD, TradingView

An asset’s CMF measures the flow of funds into and out of that asset. When this indicator rises, it indicates that money is flowing into the asset. Conversely, a falling CMF indicates that money is flowing out of the asset.

Read Bitcoin’s [BTC] Price Forecast 2023-24

When the CMF spikes while the price fluctuates within a narrow range, it indicates that even though more liquidity is flowing into an asset, market sentiment is not positive enough to increase the asset’s value.

It remains important to note that a spiking CMF in a narrow price range is a sign that there is a lot of volatility in the market, and this could be a good time to trade.