Este Artículo También Está Disponible and Español.

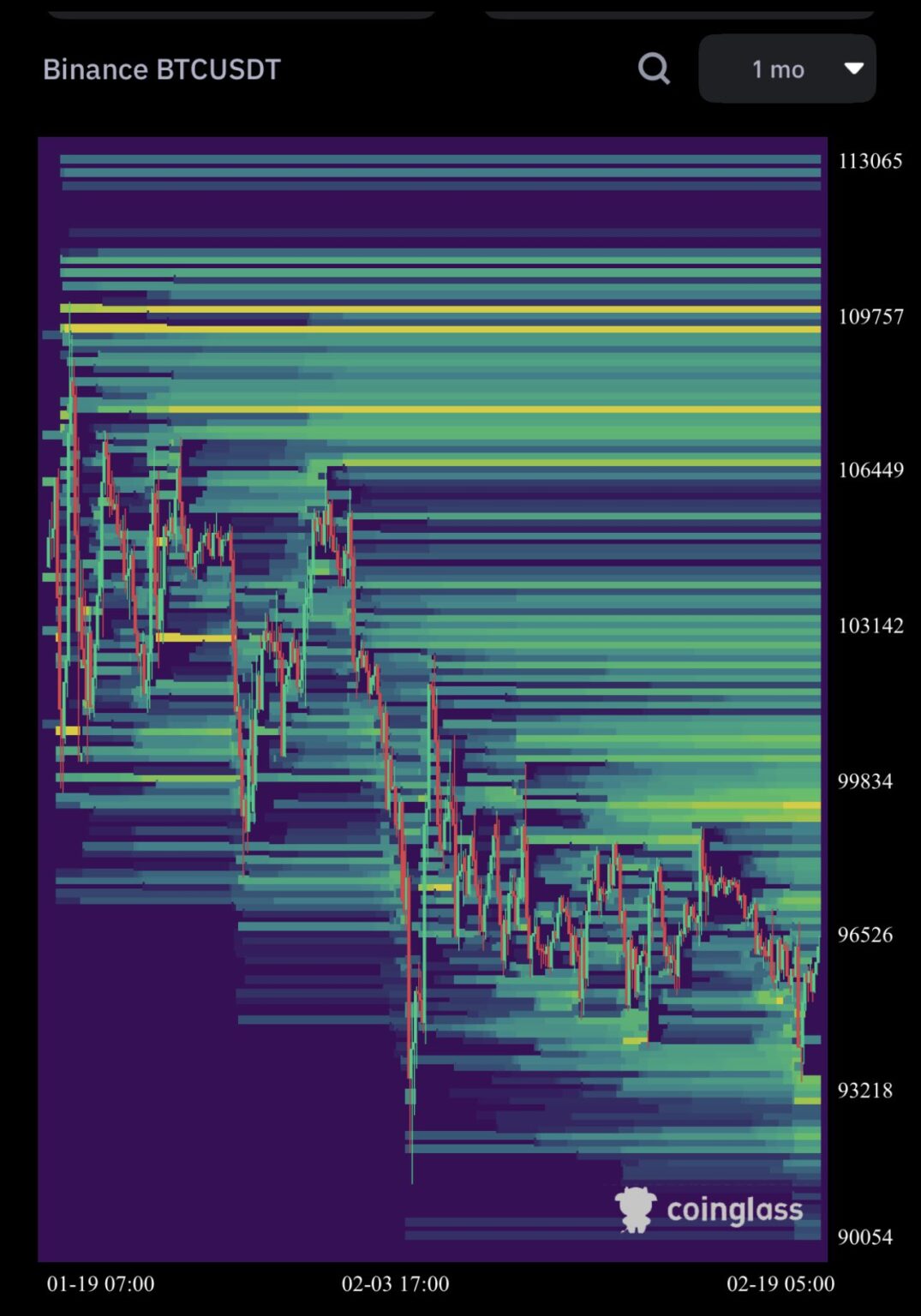

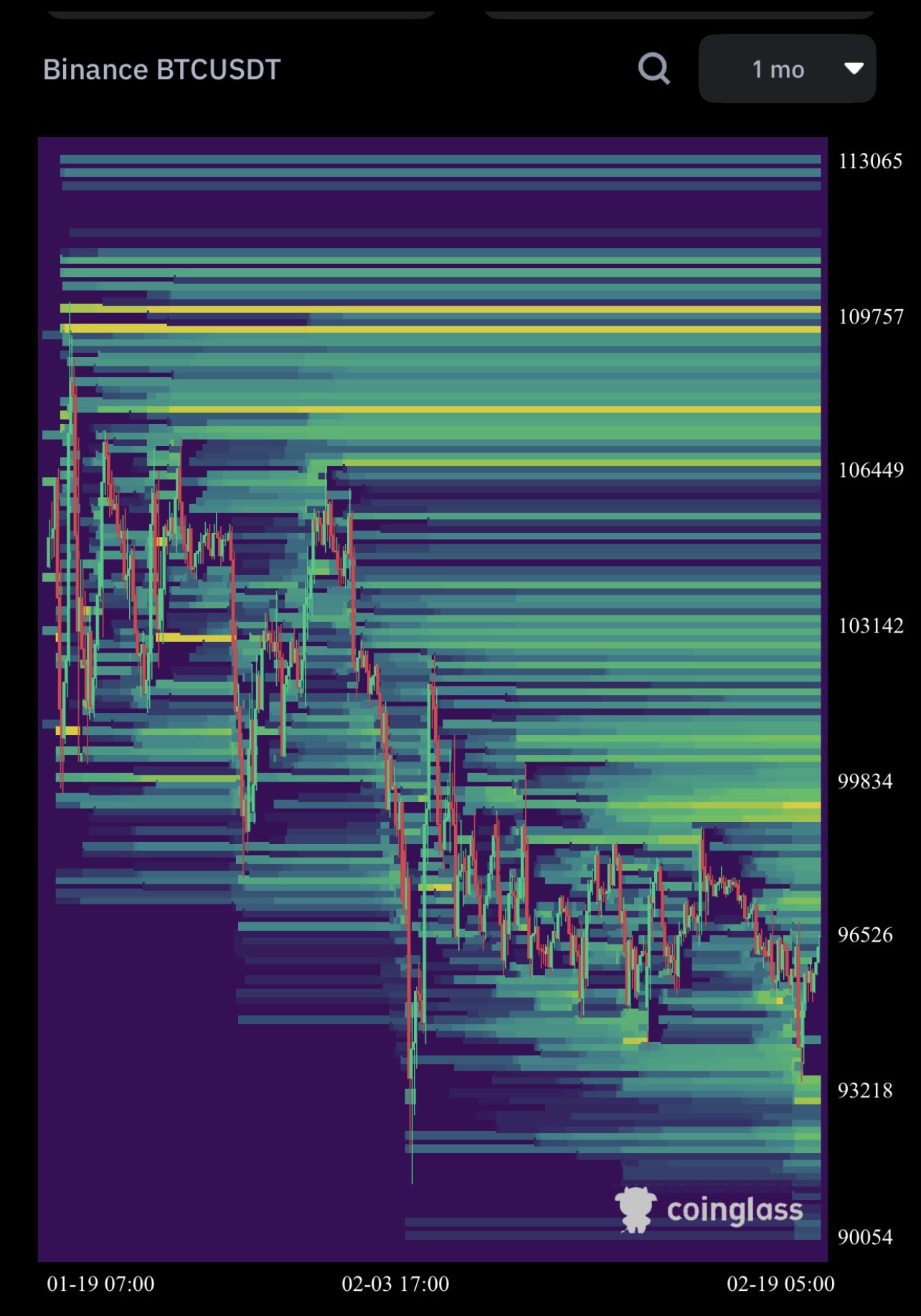

While the Bitcoin price below the crucial resistance fluctuates at $ 96,500, the liquidation heat folder sends on the BTC/USDT pair of Binance powerful signals from a potential short squeeze upwards. Analyst Kevin (@kev_capital_ta) shared His insights in addition to the attached Liquidation Heat Map and notes signs of significant liquidity pools that form both above and below Bitcoin’s current trade range.

“What we see in recent days is perfect in line with what I said,” explained Kevin, referring to his earlier market calls. “Wipe the liquidity to 91K, which we did yesterday. Maybe we may not take more, but in general I have never seen so much liquidity in the benefit on the monthly period on #BTC. “

According to Kevin, the data strongly suggests that great liquidity – where the positions of traders would be forced to liquidate – is now stacked around the 91K region and, more importantly, near the 111k marking. Although the lower zone may still occasionally see sweeps, it is the enormous cluster of liquidity around 111k that encouraged him to predict a possible switch to that level.

Related lecture

“There are more emotions in this market, I have ever seen,” he continued. “Guru’s stopping X, you no longer stream or make content, the comments are hateful and offensive every day […] In the meantime we remain measured and calculated here. “

Kevin emphasizes that many market participants are fixed on altcoins instead of monitoring the liquidity structure of Bitcoin, the general market capitalization and USDT -Dominance. He claims that the scary focus of traders on individual altcoins, instead of these broader statistics, causes them to miss critical signals.

“The problem is that everyone is hyper focused on the wrong one and that is #altcoins,” he said. ‘I literally give you the playbook. Follow it. “

What the Bitcoin Liquidatie Heatmap tells us

A liquidation heat illustrates where large parties are most likely to be closed if the leverage positions-such as futures or margin transactions are closed when the price reaches certain levels. When many traders place stop loss or heavily marinated transactions enforce around similar price points, these zones often accumulate as “hotspots” on the Hittemap. If price promotion is approaching this clusters, this can cause a chain reaction: forced liquidations stimulate further price movement, which can then flow into a faster pinch or sale.

Related lecture

According to Kevin, Bitcoin’s HeatMap currently shows billions of dollars in potential liquidations concentrated on higher levels (111k) and a significant liquidity block below (approximately 91k). Kevin’s presence of this deep liquidity has led Kevin to anticipate a “larger reliefally” that could force itself en masse.

‘As we can see […] We have billions of liquidity on the benefit at 111K. More than I have ever seen in the time frame of 1 million, “he noticed, and emphasized how unusually he finds this month -long concentration. “It would be totally good and the preference if we sweep [the 91K area] First to build even more liquidity and then start the real assistance. “

In addition to liquidity data, Kevin also quotes sentiment indicators such as the Fear & Greed Index, which currently reflects a “fear” lecture. From its point of view, this environment suggests that the emotional extremes of the market – coupled with heavy positioning – can be the scene for a fast momentum shift higher, because negative sentiment is often accompanied by local soils.

“You can see that this help that Rally wants to work, but it’s just not quite there yet […] I see no reason to be overly bearish on this market. You must calm down and stop being so angry. Stop being so soft. “

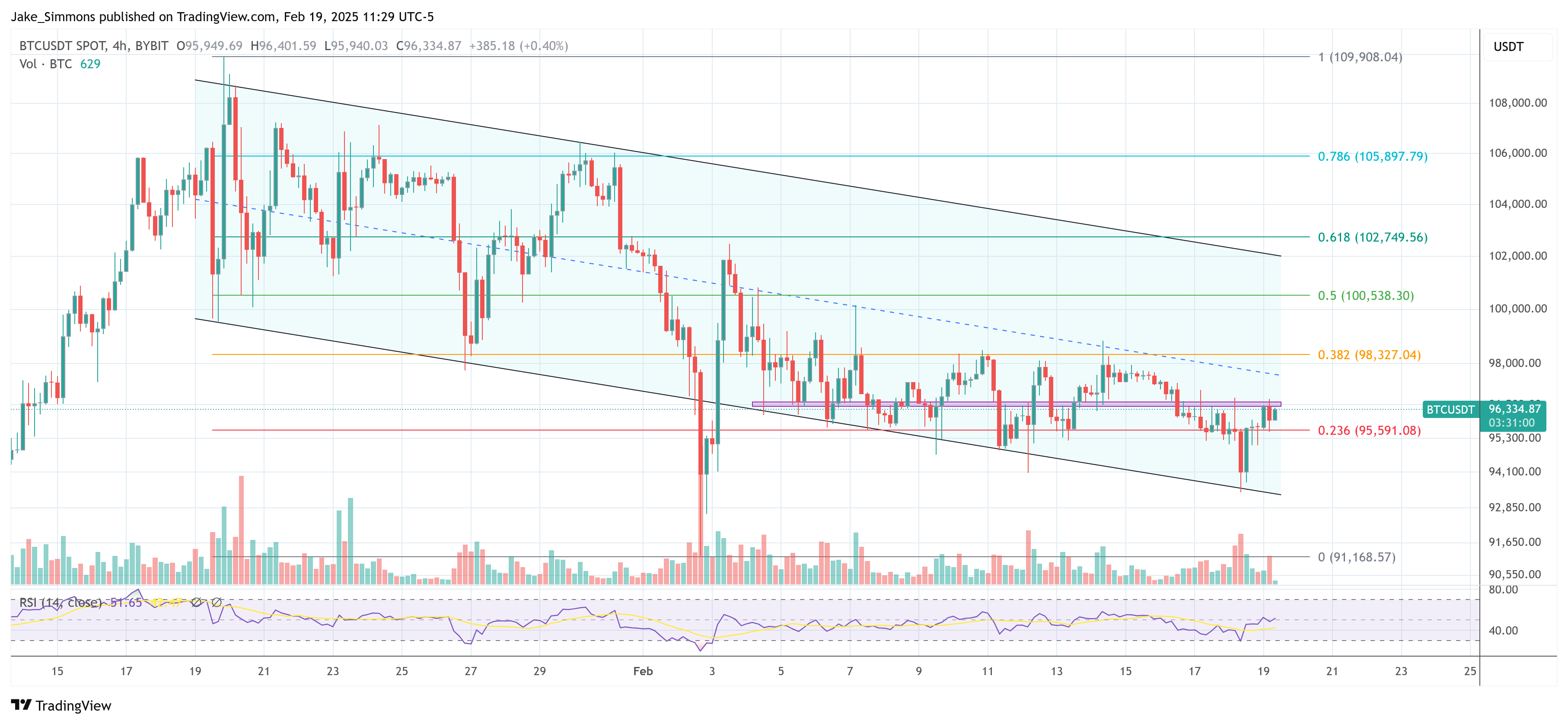

At the time of the press, BTC traded at $ 96,334.

Featured image made with dall.e, graph of tradingview.com